In the world of decentralized finance (DeFi), gas fees have become a major concern for users. Gas fees are the transaction fees paid by users to miners on the Ethereum network to process and validate their transactions. As the popularity of DeFi grows, so does the demand for transactions, leading to congestion and high gas fees. This has created a barrier for many users, especially those with smaller transactions, who find it uneconomical to pay high fees.

1inch, a decentralized exchange aggregator, has emerged as a solution to this problem. By leveraging multiple decentralized exchanges and liquidity pools, 1inch is able to find the most efficient and cost-effective routes for users to execute their trades. This results in lower gas fees compared to executing trades directly on a single decentralized exchange.

1inch achieves this by splitting trades across multiple decentralized exchanges, optimizing for the lowest gas fees. It takes advantage of the different liquidity pools and available tokens on each exchange to find the most cost-effective route. This not only reduces gas fees but also minimizes slippage and maximizes the user’s trading profit.

Furthermore, 1inch offers a gas optimization feature called GasToken. GasToken is a special type of token that allows users to store and reuse gas when Ethereum network fees are low. By using GasToken, users can effectively reduce their gas costs and optimize their transactions, further lowering the barriers to entry for DeFi users.

In conclusion, 1inch plays a crucial role in reducing gas fees in DeFi transactions. Its decentralized exchange aggregator not only optimizes trades for the lowest gas fees but also offers additional features like GasToken to further reduce costs. This makes DeFi more accessible and affordable for users, allowing them to participate in the growing ecosystem without being hindered by high gas fees.

Challenges Faced by Users due to High Gas Fees

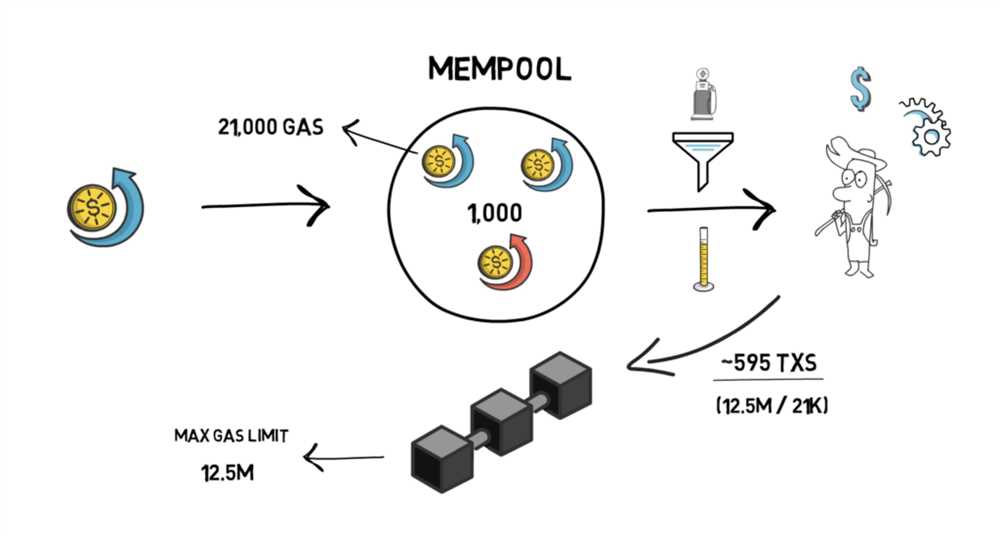

High gas fees have become a significant challenge for users in the decentralized finance (DeFi) ecosystem. Gas fees refer to the transaction fees paid in the form of cryptocurrency, usually Ethereum (ETH), to execute transactions on the blockchain network.

One of the challenges faced by users due to high gas fees is the increased cost of executing transactions. The high gas fees make it expensive for users to interact with DeFi dapps, especially for small transactions. This can discourage users from participating in certain DeFi protocols or conducting frequent transactions on the network.

Additionally, high gas fees can lead to delays in transaction confirmation. When the network experiences high congestion, users may have to wait for their transactions to be included in a block. This delay can be frustrating for users who need to interact with DeFi protocols in a timely manner, such as participating in token sales or providing liquidity to decentralized exchanges.

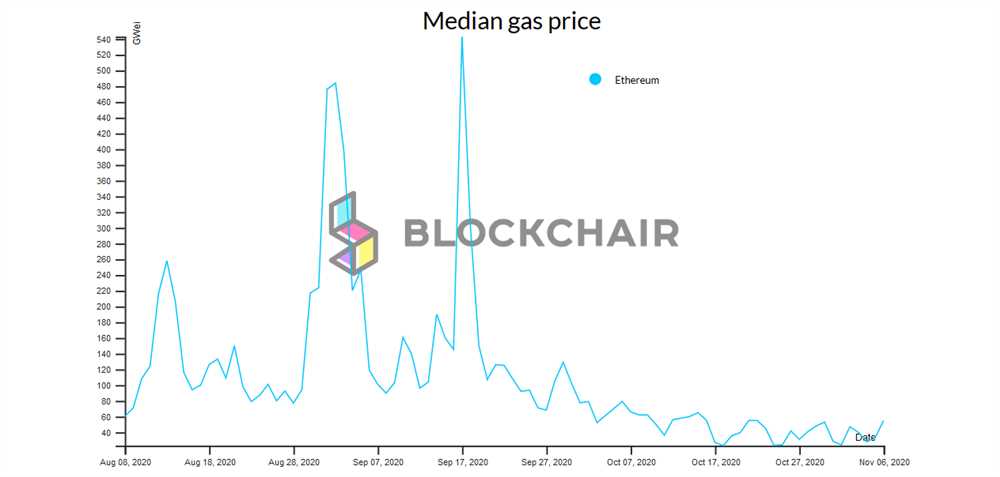

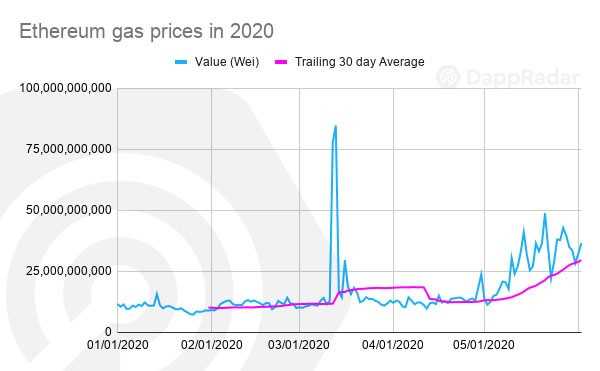

Moreover, the unpredictability of gas fees can pose a challenge for users. Gas fees are determined by market demand and network congestion, which can vary greatly. Users may face difficulty estimating the gas fees required for their transactions, leading to unexpected costs. This lack of transparency and predictability can make it challenging for users to plan their transactions effectively.

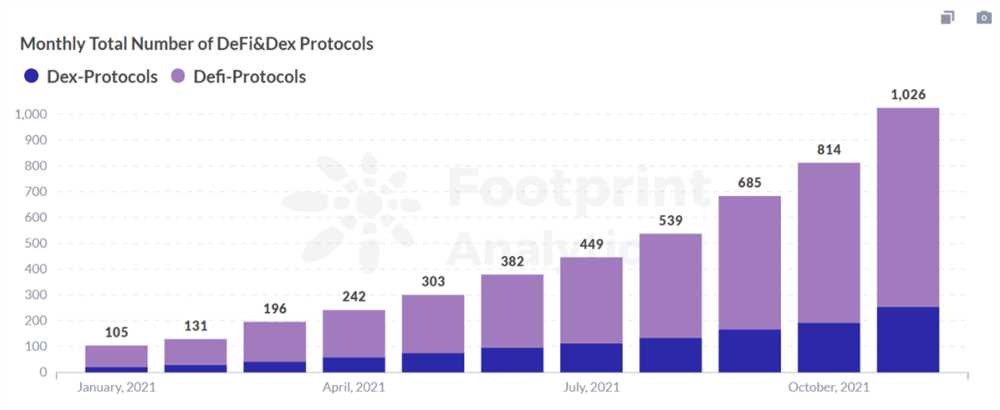

High gas fees also contribute to the overall scalability issues of the Ethereum network. As more users engage with DeFi protocols, the demand for transaction processing increases, resulting in higher gas fees and network congestion. This scalability challenge limits the accessibility and usability of DeFi applications for users, especially those with limited financial resources.

In conclusion, high gas fees present several challenges for users in the DeFi ecosystem. These challenges include increased transaction costs, delays in transaction confirmation, difficulty in estimating gas fees, and scalability issues. Addressing these challenges is crucial for enhancing the user experience and wider adoption of DeFi applications. Solutions like 1inch’s gas optimization technology can play a vital role in reducing gas fees and mitigating these challenges.

The Solution: How 1inch Reduces Gas Fees in DeFi Transactions

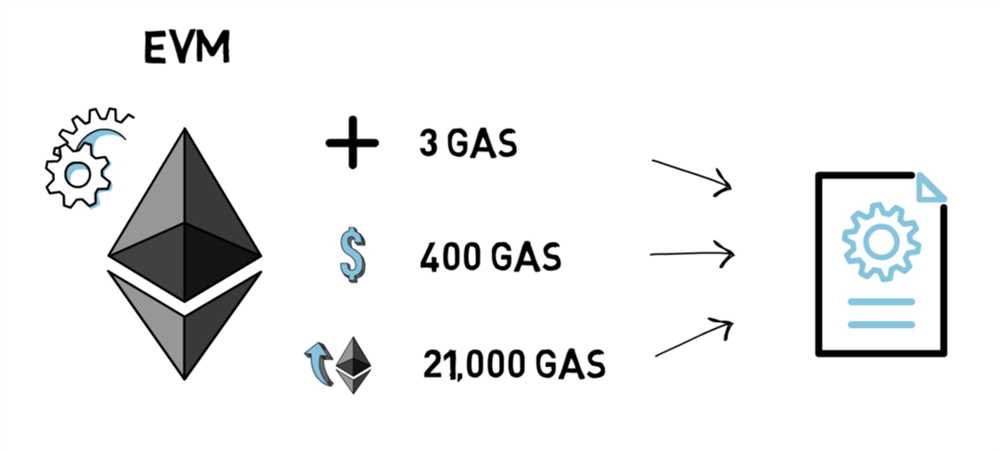

In the world of decentralized finance (DeFi), gas fees have been a major concern for users. Gas fees refer to the cost of computational resources required to perform a transaction on the Ethereum blockchain. These fees can fluctuate greatly based on network congestion and demand.

1inch, an aggregator for decentralized exchanges, has come up with several innovative techniques to reduce gas fees in DeFi transactions. These techniques are as follows:

Aggregation

1inch routes transactions through multiple liquidity sources to find the most optimal and cost-effective route. By aggregating liquidity from various decentralized exchanges, 1inch can minimize gas fees by finding the most efficient path for a trade.

Gas Token

1inch has introduced the concept of a gas token called CHI. With CHI, users can pre-purchase gas at a discount and use it to execute transactions in the future. This allows users to save on gas fees when the network is congested and gas prices are high.

Gas Optimization

1inch leverages various gas optimization techniques to minimize the gas consumption of transactions. This includes using smart contract features like batch processing and flash loans to reduce the number of interactions with the blockchain, thereby lowering gas fees.

Beyond these specific techniques, 1inch continues to explore new solutions and improvements to further reduce gas fees in DeFi transactions. Through constant innovation, 1inch aims to make DeFi more accessible and affordable for all users.

Benefits of Using 1inch to Reduce Gas Fees in DeFi Transactions

When it comes to conducting transactions in DeFi protocols, one of the biggest concerns for users is the high gas fees associated with these transactions. Gas fees are the amount of Ethereum network resources required to execute a smart contract or a transaction. These fees can be quite steep, especially during periods of high network congestion.

However, by utilizing 1inch, users can significantly reduce their gas fees and enjoy several benefits:

1. Aggregated Liquidity

1inch is a decentralized exchange aggregator that sources liquidity from various DEXes, such as Uniswap, SushiSwap, Balancer, and many more. By aggregating the liquidity from different DEXes, 1inch provides users with the best possible exchange rates and reduces the number of transactions necessary to complete a trade. This ultimately leads to lower gas fees compared to using a single DEX.

2. Gas Optimization

1inch utilizes advanced algorithms to optimize gas usage and reduce the number of transactions needed to execute a trade. This ensures that users pay the lowest possible gas fees for their transactions. The algorithms analyze the available liquidity across different DEXes and determine the most cost-effective routing strategy, resulting in significant gas savings.

3. Lower Slippage

Slippage occurs when the price of an asset changes between the time a transaction is submitted and the time it is executed. By aggregating liquidity from multiple DEXes, 1inch reduces slippage for users, allowing them to execute trades at more favorable prices. This not only improves the overall trading experience but can also save users money by reducing the impact of slippage on their transactions.

Overall, 1inch provides users with a cost-effective solution for reducing gas fees in DeFi transactions. By aggregating liquidity, optimizing gas usage, and reducing slippage, 1inch helps users save money while enjoying the benefits of decentralized finance.

Question-answer:

How does 1inch reduce gas fees in DeFi transactions?

1inch reduces gas fees in DeFi transactions by splitting a single transaction across multiple Ethereum blockchains. This allows users to find the best rates and liquidity across different decentralized exchanges, reducing the overall gas fees incurred.

Can you explain the concept of gas fees in DeFi transactions?

In DeFi transactions, gas fees refer to the cost required to execute a transaction on the Ethereum blockchain. Gas fees are paid in Ether and are used to compensate the miners for including the transaction in a block. The higher the gas fee, the faster the transaction will be processed.

How does 1inch find the best rates and liquidity across different decentralized exchanges?

1inch utilizes a smart contract and an algorithm called Pathfinder to discover the most efficient paths across various decentralized exchanges. By aggregating liquidity from different sources, users can find the best rates and reduce slippage, ultimately minimizing gas fees in their transactions.

Is it possible to use 1inch for reducing gas fees on other blockchains besides Ethereum?

Currently, 1inch primarily focuses on reducing gas fees within the Ethereum ecosystem. However, the platform has plans to expand to other blockchains in the future, which would enable users to leverage 1inch for reducing gas fees in transactions on those networks as well.