Exploring Synergies

Understanding DeFi

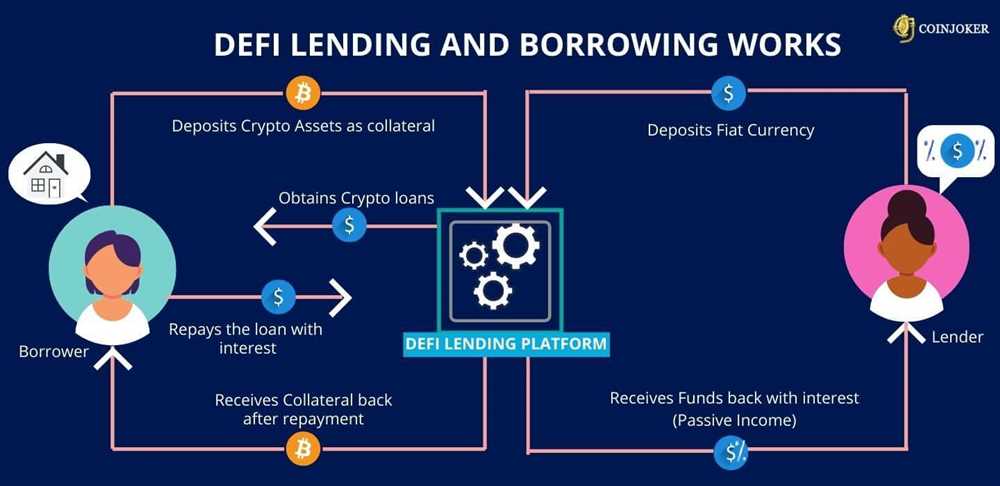

DeFi, short for Decentralized Finance, is an innovative financial system that operates on the blockchain. It aims to provide financial services and products without the need for traditional intermediaries such as banks or brokers. DeFi applications use smart contracts, which are self-executing contracts with the terms of the agreement directly written into code.

One of the key features of DeFi is the ability to leverage blockchain technology to create transparent and trustless systems. With DeFi, users have full control over their funds and can access a wide range of financial services, including lending, borrowing, trading, and asset management, directly through decentralized applications (dApps).

DeFi has gained significant traction in recent years due to its potential to democratize access to financial services. It eliminates the need for trust in a centralized authority and reduces the barriers to entry for individuals without access to traditional financial services. This opens up a world of opportunities for individuals around the globe.

However, it’s important to note that DeFi is not without its risks. The most common risk associated with DeFi is smart contract vulnerabilities, which can lead to financial loss or exploitation. It’s crucial for users to do their due diligence and review the code and security measures in place before interacting with any DeFi application or investing funds.

Overall, DeFi offers a decentralized and open alternative to traditional financial systems. It empowers individuals by providing them with greater control over their finances and enabling access to a wide range of financial services. As the DeFi ecosystem continues to evolve, it’s an exciting space to watch and explore for both enthusiasts and traditional finance professionals.

Exploring the Synergies

As the decentralized finance (DeFi) market continues to evolve, it’s important to examine the potential synergies that can be created through partnerships and collaborations. One such collaboration that holds immense promise is the partnership between 1inch and DeFi staking.

Maximizing Yield through Staking

1inch, a leading decentralized exchange aggregator, offers users the ability to access the best possible trade rates across various liquidity sources. By leveraging its advanced algorithm, 1inch ensures that users always get the most favorable rates for their transactions.

Combining this functionality with staking introduces an additional layer of benefits for users. By staking their tokens, users can earn passive income by providing liquidity to decentralized protocols. This not only helps to strengthen the overall liquidity of the DeFi ecosystem but also allows users to maximize their yield potential.

Enhancing Accessibility and Security

By exploring the synergies between DeFi and 1inch staking, we aim to enhance accessibility and security in the world of decentralized finance. Through our collaboration, users will not only have access to the best trade rates but also have the opportunity to earn passive income by staking their tokens.

Moreover, by providing liquidity to decentralized protocols, users contribute to the overall stability and security of the DeFi ecosystem. This helps to mitigate the risk of market manipulation and ensures that the DeFi market remains robust and reliable for all participants.

Overall, the intersection of DeFi and 1inch staking presents a unique opportunity to harness the power of decentralized finance and create a more accessible, secure, and profitable ecosystem for all participants. By exploring and capitalizing on the synergies between these two innovations, we can pave the way for the future of finance.

Join us today and be a part of the revolution!

Question-answer:

What is “The Intersection of DeFi and 1inch Staking: Exploring Synergies”?

“The Intersection of DeFi and 1inch Staking: Exploring Synergies” is an article or publication that explores the relationship between the decentralized finance (DeFi) industry and the 1inch staking platform. It discusses the potential synergies and benefits that can be derived from the intersection of these two sectors.

How does DeFi interact with 1inch Staking?

DeFi interacts with 1inch Staking by providing various decentralized financial services and applications that can be utilized through the 1inch protocol. This includes lending, borrowing, trading, and other financial activities that are facilitated by smart contracts and blockchain technology.

What are the benefits of the intersection of DeFi and 1inch Staking?

The intersection of DeFi and 1inch Staking brings several benefits. It allows users to earn passive income through staking their assets on the 1inch platform, while also accessing the multitude of DeFi applications and services offered through the 1inch protocol. This creates a seamless integration of decentralized finance and staking, providing users with financial opportunities and incentives.

How secure is the intersection of DeFi and 1inch Staking?

The intersection of DeFi and 1inch Staking is built on blockchain technology, which provides a high level of security. The smart contracts used in DeFi applications and the staking infrastructure of 1inch are designed to be secure and resistant to hacking or manipulation. However, it is important for users to exercise caution and conduct their own research before participating in any decentralized finance or staking activities.