In the decentralized finance (DeFi) space, liquidity mining has emerged as a popular strategy for users to earn passive income by providing liquidity to various protocols. One platform that has gained significant attention is the 1inch App, a decentralized exchange aggregator that allows users to find the best prices across multiple liquidity sources.

Liquidity mining plays a crucial role on the 1inch App by incentivizing users to contribute their assets to the platform’s liquidity pools. These pools are essential for facilitating trades and ensuring sufficient liquidity for users on the platform. Liquidity providers are rewarded with tokens for their participation, which can be staked, sold, or used for voting on governance decisions.

By participating in liquidity mining on the 1inch App, users not only earn passive income, but also contribute to the efficiency and stability of the platform. The more liquidity provided, the better the trading experience for all users, as it allows for tighter spreads and lower slippage. This attracts more users to the platform, creating a virtuous cycle of increased liquidity and trading volume.

In this comprehensive guide, we will explore the various aspects of liquidity mining on the 1inch App, including how it works, the incentives involved, and the potential risks and rewards. Whether you are a beginner looking to start your journey in DeFi or an experienced user seeking to maximize your returns, this guide will provide you with all the information you need to get started with liquidity mining on the 1inch App.

What is Liquidity Mining and How Does It Work?

Liquidity mining is a process that incentivizes individuals to provide liquidity to decentralized exchanges (DEX) by offering them token rewards. It is a way to bootstrap liquidity for new protocols and attract traders to these platforms. Liquidity mining also plays a pivotal role in creating a balanced and efficient market environment.

How Does Liquidity Mining Work?

Liquidity mining works by rewarding users with tokens for contributing to the liquidity pool of a DEX. In simple terms, users deposit their tokens into a liquidity pool, and by doing so, they increase its liquidity and trading volume. The more value they add to the pool, the more they can earn in rewards.

To participate in liquidity mining, users typically need to provide an equal value of two tokens, usually a base token and a quote token. For example, in a Uniswap liquidity pool for trading Ethereum and a stablecoin like USDC, users would need to provide an equivalent value of each token.

Once the tokens are deposited, the user receives liquidity pool tokens representing their share of the pool. These tokens can be staked or held in a wallet to earn rewards. The rewards are typically distributed proportionally to the user’s contribution to the pool’s liquidity.

The Impact of Liquidity Mining

Liquidity mining has several positive effects on decentralized exchanges and the broader cryptocurrency ecosystem:

| Benefits | Description |

|---|---|

| Increased Liquidity | Liquidity mining incentivizes users to provide liquidity to DEX platforms, thereby increasing the pool of available assets for trading. |

| Traction and User Adoption | By offering rewards, liquidity mining attracts traders and users to decentralized exchanges, boosting their adoption and overall trading volume. |

| Market Efficiency | Liquidity mining helps create a more efficient market by ensuring that there are enough buyers and sellers for each token, minimizing slippage, and reducing the impact of large trades. |

| Protocol Growth | Liquidity mining allows new protocols to bootstrap their liquidity and grow their user base by incentivizing users to provide liquidity and participate in the ecosystem. |

Overall, liquidity mining plays a crucial role in encouraging participation and growth within the decentralized finance (DeFi) sector. It rewards users for providing liquidity, promoting a healthy market environment, and expanding the reach of decentralized exchanges.

The Benefits of Liquidity Mining on the 1inch App

Liquidity mining on the 1inch App offers several benefits for users. By participating in liquidity mining, users can earn rewards for providing liquidity to various pools on the platform.

1. Increased Earnings

One of the main advantages of liquidity mining on the 1inch App is the potential for increased earnings. Users can earn additional tokens as rewards for providing liquidity, which can significantly boost their overall returns.

2. Diversification of Portfolio

Participating in liquidity mining allows users to diversify their portfolio by allocating funds to different pools. This helps to spread the risk and can lead to more stable and consistent returns in the long run.

Moreover, liquidity mining provides access to a wide range of tokens and pairs, allowing users to take advantage of various trading opportunities and potentially profit from market inefficiencies.

3. Building a Strong DeFi Community

Liquidity mining plays a vital role in building a strong DeFi community. By providing liquidity to pools on the 1inch App, users contribute to the overall liquidity and stability of the platform.

Additionally, by participating in liquidity mining, users become more engaged in the platform and have a vested interest in its success. This fosters a sense of community and encourages collaboration among users.

Overall, liquidity mining on the 1inch App offers users the opportunity to earn increased rewards, diversify their portfolio, and contribute to the growth of the DeFi ecosystem. With its user-friendly interface and wide range of available pools, the 1inch App is an excellent platform for liquidity mining.

Disclaimer: Liquidity mining involves risks, and users should carefully consider their investment objectives and risk tolerance before participating.

How to Participate in Liquidity Mining on the 1inch App

Liquidity mining on the 1inch App allows users to earn rewards for providing liquidity to the decentralized exchange (DEX) protocol. By participating in liquidity mining, users can contribute to the liquidity pool and earn a share of the trading fees generated on the platform.

Step 1: Connect Your Wallet

To participate in liquidity mining on the 1inch App, you need to connect your wallet to the platform. The 1inch App supports various wallets, including MetaMask, WalletConnect, and others. Simply select your preferred wallet and follow the on-screen instructions to connect it to the 1inch App.

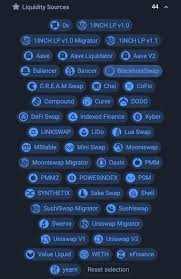

Step 2: Choose a Liquidity Pool

After connecting your wallet, navigate to the liquidity mining section on the 1inch App. Here, you will find a list of available liquidity pools to choose from. Each liquidity pool represents a different pair of tokens that you can provide liquidity for. Select a liquidity pool that suits your preferences and click on it to proceed.

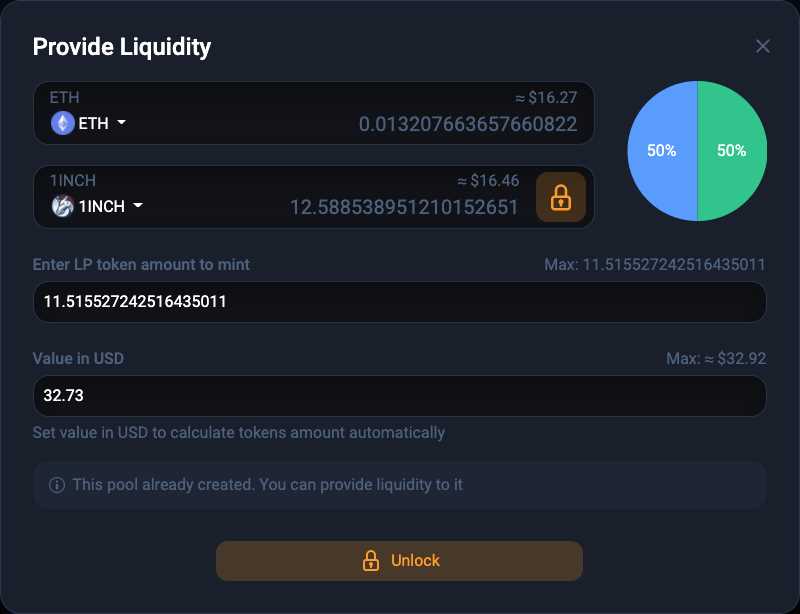

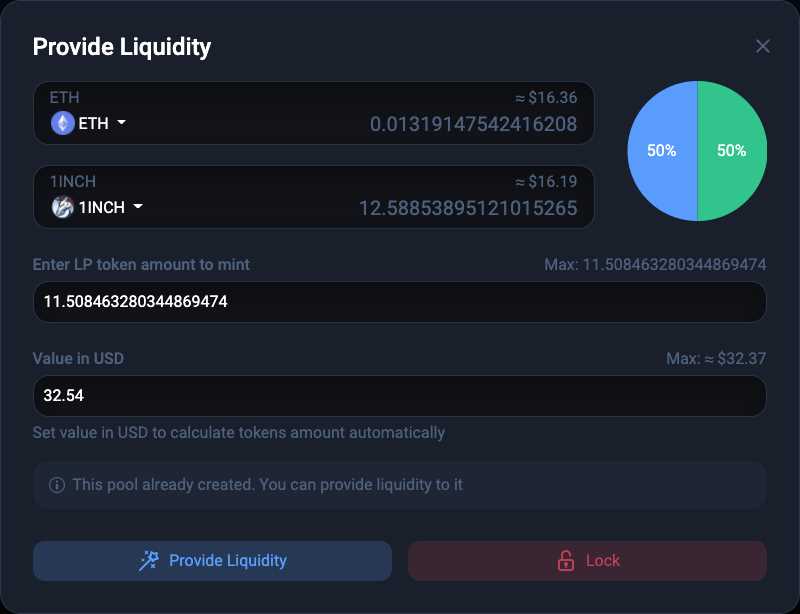

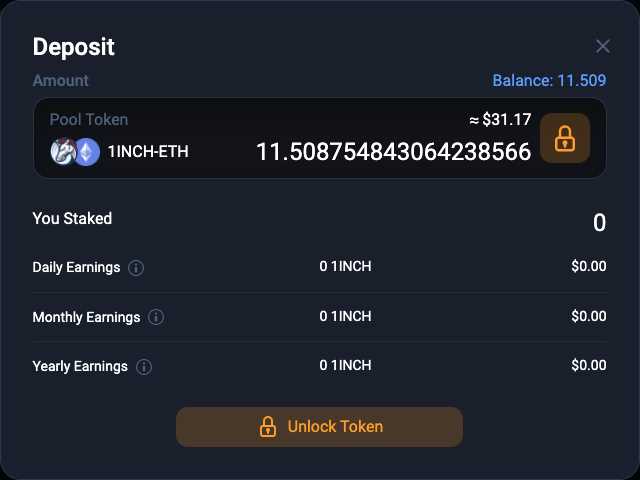

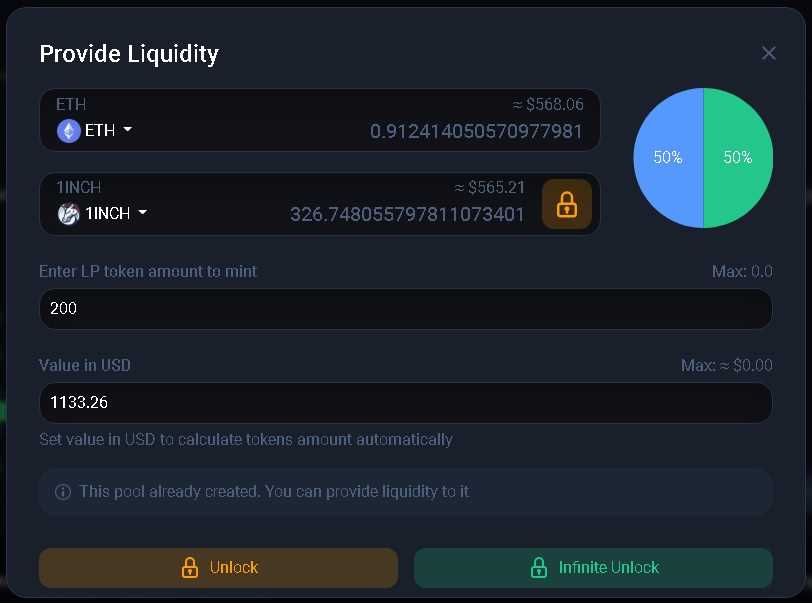

Step 3: Add Liquidity

Once you have selected a liquidity pool, you can proceed to add liquidity to the pool. To add liquidity, you need to provide an equal value of both tokens in the pair. For example, if you want to add liquidity to the ETH/USDC pool, you would need to provide an equal value of ETH and USDC. Enter the desired amount of tokens you want to provide and click on the “Add Liquidity” button.

Step 4: Confirm Transaction

After clicking on the “Add Liquidity” button, your wallet will prompt you to confirm the transaction. Review the transaction details, including the gas fee, and click on the “Confirm” button to proceed. Once the transaction is confirmed, the liquidity will be added to the pool and you will start earning rewards.

Note: Make sure you have enough funds in your wallet to cover the transaction fees.

It is important to note that liquidity mining involves risks, including impermanent loss and potential smart contract vulnerabilities. Make sure to do your own research and understand the risks involved before participating in liquidity mining on the 1inch App.

By following these steps, you can actively participate in liquidity mining on the 1inch App and earn rewards for providing liquidity to the decentralized exchange protocol.

Tips and Strategies for Successful Liquidity Mining on the 1inch App

Participating in liquidity mining on the 1inch app can be a profitable venture if approached strategically. Here are some tips and strategies to help you maximize your returns:

1. Choose the Right Pools:

Not all pools offer the same liquidity mining rewards. Research and analyze different pools to find the ones that offer attractive rewards and align with your investment goals.

2. Diversify Your Portfolio:

Spread your liquidity across multiple pools to minimize risk and maximize potential rewards. By diversifying, you can take advantage of different opportunities and adapt to changing market conditions.

3. Monitor Market Conditions:

Stay informed about market trends and keep track of the performance of the tokens in the pools you are participating in. This will help you make more informed decisions about when to enter or exit a pool.

4. Use Impermanent Loss Protection:

Consider using impermanent loss protection mechanisms offered by some liquidity mining platforms, including the 1inch app. These mechanisms can help mitigate the impact of volatile price movements on your liquidity provider positions.

5. Stay Updated on Reward Changes:

Rewards for liquidity mining can change over time, so it’s important to stay updated on any changes or adjustments made by the 1inch app. Regularly check the app’s website or follow their official social media channels for the latest news and updates.

6. Understand Gas Fees:

Gas fees can vary depending on network congestion and the complexity of transactions. Before participating in liquidity mining, consider the cost of gas fees and factor them into your overall profitability calculations.

7. Monitor Platform Usage:

Keep an eye on the overall usage of the 1inch app and the liquidity pools you are participating in. High-demand pools may offer better rewards, but they can also lead to increased competition and diluted returns.

8. Continuously Evaluate and Adjust:

Liquidity mining is not a set-it-and-forget-it strategy. Regularly evaluate the performance of your liquidity provider positions and adjust your strategies based on market conditions and emerging opportunities.

9. Consider Staking Rewards:

In addition to liquidity mining, consider staking your earned rewards to earn additional income. Some platforms offer staking options that can provide additional returns on your existing liquidity mining rewards.

10. Learn from the Community:

Engage with the liquidity mining community to learn from experienced participants and stay updated on emerging trends and strategies. Online forums, social media groups, and Discord channels can be valuable sources of information and insights.

By following these tips and strategies, you can increase your chances of success in liquidity mining on the 1inch app. Remember to stay informed, diversify your portfolio, and continuously adapt your strategies based on market conditions for the best results.

Question-answer:

What is liquidity mining on the 1inch app?

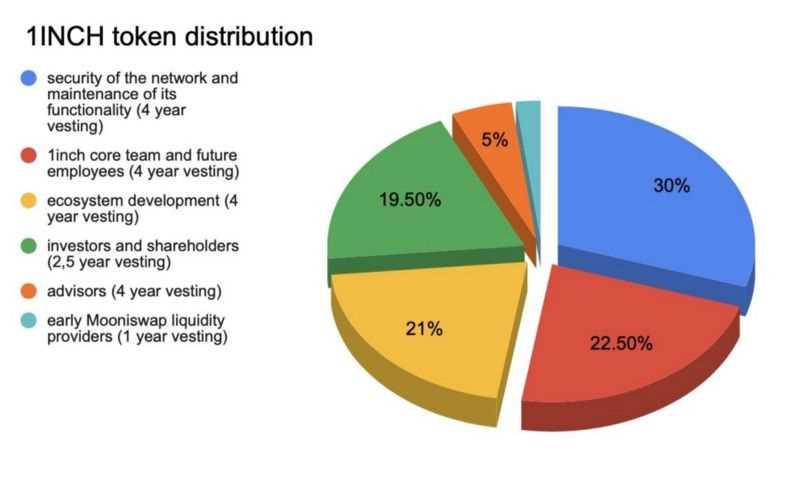

Liquidity mining on the 1inch app refers to the process of providing liquidity to the platform’s decentralized exchange (DEX) pools and earning rewards in the form of 1INCH tokens. Users can deposit their tokens into specific liquidity pools and contribute to the liquidity of the platform. In return, they receive a portion of the trading fees generated on the platform and also earn additional 1INCH tokens as rewards for their participation.