If you’re involved in the world of decentralized finance or DeFi, you’ve likely heard of 1inch. As one of the most popular DEX aggregators in the space, 1inch offers users the ability to find the best prices and execute trades across multiple decentralized exchanges (DEXs) with just a single transaction.

Using 1inch as a DEX aggregator is a straightforward process that can greatly enhance your trading experience in the DeFi ecosystem. Instead of manually checking prices and swapping tokens on different DEXs, 1inch automatically finds the best prices for your desired trade and executes it on your behalf.

When using 1inch, you have the option to connect your wallet and trade directly from there. This means that you don’t have to worry about depositing funds onto a centralized exchange or going through a lengthy account verification process. With 1inch, you can trade directly from your wallet and maintain full control over your funds at all times.

1inch also offers a variety of advanced features for more experienced users. These include limit orders, which allow you to set a specific price at which you want to execute a trade, and the ability to split your trade across multiple DEXs to optimize for liquidity and minimize slippage.

In this complete guide, we’ll walk you through the process of using 1inch as a DEX aggregator, from connecting your wallet to executing trades and taking advantage of the platform’s advanced features. Whether you’re a beginner or an experienced DeFi user, this guide will provide you with all the information you need to make the most of 1inch and optimize your trading strategy.

What is 1inch DEX aggregator?

The 1inch DEX aggregator is a decentralized exchange aggregator that allows users to find and execute the best possible trades across various decentralized exchanges (DEXs). It was created to solve the problem of fragmented liquidity and high slippage in decentralized exchanges. With the 1inch DEX aggregator, users can access the liquidity pools of multiple DEXs through a single user interface, enabling them to get the best possible prices and execute trades efficiently.

When a user wants to make a trade, the 1inch DEX aggregator scans multiple DEXs and smart contracts to find the best possible trading routes and prices. It takes into account factors such as liquidity, fees, and slippage to provide users with the most optimal trading options. Once the best trading route is determined, the 1inch DEX aggregator splits the user’s trade across multiple DEXs to optimize for price and minimize slippage.

The 1inch DEX aggregator is built on the Ethereum blockchain and is designed to give users the best possible trading experience. It provides users with a transparent and efficient way to trade on decentralized exchanges, without the need to manually search and compare prices on different platforms. By aggregating liquidity from multiple sources, the 1inch DEX aggregator reduces the impact of low liquidity and high slippage, resulting in better execution prices for users.

The 1inch DEX aggregator also offers various additional features such as limit orders, gas optimizations, and smart contract integrations. It is a popular choice among DeFi traders and has gained recognition for its user-friendly interface and innovative approach to trading on decentralized exchanges.

Overall, the 1inch DEX aggregator is a powerful tool that provides users with access to the best possible trading opportunities across multiple decentralized exchanges. It revolutionizes the way users interact with DEXs by eliminating the need for manual price comparisons and offering a seamless trading experience.

Why use 1inch DEX aggregator?

When it comes to decentralized exchanges (DEXs), it can be overwhelming to navigate the multitude of platforms and find the best prices and liquidity for your trades. That’s where a DEX aggregator like 1inch comes in handy.

1inch is a decentralized exchange aggregator that finds the best prices and routes your trades across multiple DEXs. Here are some reasons why you should consider using 1inch:

1. Best prices:

1inch scans multiple DEXs to find the best prices for your trades. Instead of manually checking each exchange, 1inch automatically compares prices and helps you save money by finding the most competitive rates.

2. Improved liquidity:

By aggregating liquidity from various exchanges, 1inch provides better liquidity than individual DEXs. This means that you can easily find trading pairs with sufficient liquidity, helping you execute your trades more efficiently.

In addition to the best prices and improved liquidity, 1inch offers various other features that make it an appealing choice for traders:

- Multiple supported networks: 1inch supports various networks like Ethereum, Binance Smart Chain, and Polygon, allowing you to access a wide range of tokens and trading opportunities.

- Security and trust: 1inch is a decentralized platform that ensures the security of your funds through smart contract technology. Your assets remain in your own wallet, reducing counterparty risk.

- Advanced features: 1inch offers advanced features like limit orders and gas optimization, giving you more control over your trades and helping you save on transaction fees.

Overall, 1inch DEX aggregator simplifies the trading process by finding the best prices and liquidity across multiple DEXs. Whether you’re a beginner or an experienced trader, 1inch can help optimize your trades and improve your overall trading experience.

Advantages of using 1inch as a DEX aggregator

1inch is a decentralized exchange (DEX) aggregator that offers several advantages for users looking to trade cryptocurrencies:

| 1. Enhanced liquidity | 1inch sources liquidity from multiple DEXs, allowing users to access a larger pool of liquidity than they would have if they were trading on a single exchange. This results in better order execution and potentially lower slippage. |

| 2. Best prices | 1inch’s smart routing algorithm scans multiple DEXs to find the best prices for a given trade. This means that users can benefit from competitive pricing and potentially get better rates than they would on a single exchange. |

| 3. Cost savings | By aggregating liquidity from multiple DEXs, 1inch helps users save on gas fees, especially when trading smaller amounts. Users can efficiently compare gas fees across different DEXs and choose the one with the most cost-effective option. |

| 4. Reduced slippage | 1inch’s aggregation algorithm splits larger orders into smaller ones and routes them across different DEXs to minimize slippage. This ensures that users get closer to the average market price and reduces the impact of large buy or sell orders on the market. |

| 5. Wide range of supported tokens | 1inch supports a wide range of tokens, including both popular and less-known ones. This allows users to discover and trade a variety of assets without the need for multiple wallet integrations or switching between different DEX platforms. |

| 6. User-friendly interface | 1inch provides a user-friendly interface that simplifies the trading experience. It offers a clear and intuitive design, making it easy for both beginners and experienced traders to navigate and execute trades efficiently. |

Overall, 1inch’s DEX aggregator offers enhanced liquidity, competitive pricing, cost savings, reduced slippage, a wide range of supported tokens, and a user-friendly interface. These advantages make it a popular choice among traders looking for a comprehensive trading solution within the decentralized finance (DeFi) ecosystem.

How to use 1inch DEX aggregator?

1inch is a decentralized exchange (DEX) aggregator that allows users to find the best prices and liquidity across multiple DEX platforms all in one place. Here is a step-by-step guide on how to use 1inch DEX aggregator:

- Visit the 1inch website at https://1inch.io/.

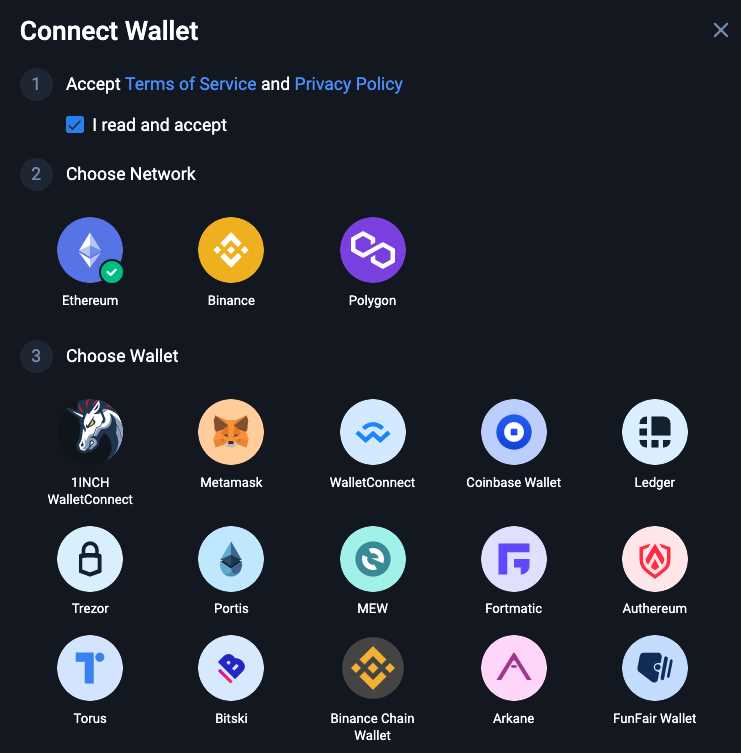

- Connect your wallet by clicking on the “Connect Wallet” button in the top right corner. Choose your preferred wallet provider and follow the prompts to connect your wallet.

- Once your wallet is connected, you can choose the cryptocurrency you want to swap from the drop-down menu on the left side of the screen. Enter the amount you want to swap.

- Choose the cryptocurrency you want to receive in the “To” field. You can manually enter the token or search for it in the search bar.

- Click on the “Swap” button to initiate the transaction.

- 1inch will automatically search for the best prices and liquidity across different DEX platforms. It will split your order across multiple DEXs to ensure you get the best possible rate.

- Review the transaction details, including the estimated gas fees, and click on the “Confirm Swap” button.

- Confirm the transaction in your wallet and wait for the transaction to be processed.

- Once the transaction is confirmed, you will receive the swapped tokens in your wallet.

Using 1inch DEX aggregator is a convenient way to get the best prices and liquidity when trading cryptocurrencies on decentralized exchanges. It saves you time and effort by automatically finding the best possible rates across multiple platforms.

Step-by-step guide to using 1inch as a DEX aggregator

1inch is a decentralized exchange (DEX) aggregator that allows users to find the best liquidity and prices across multiple DEXs. In this step-by-step guide, we will walk you through how to use 1inch as a DEX aggregator to make trades on the Ethereum blockchain.

Step 1: Connect your wallet

The first step is to connect your wallet to the 1inch platform. 1inch supports various wallets, such as MetaMask and WalletConnect. Click on the “Connect Wallet” button and follow the instructions to connect your preferred wallet.

Step 2: Select your tokens

Once your wallet is connected, you can choose the tokens you want to trade. You can either manually enter the token addresses or use the search function to find them. Make sure to select the correct token pair for your trade.

Step 3: Choose your trading strategy

1inch offers different trading strategies, such as “Best Market Price” and “Lowest Gas Cost.” Select the strategy that best suits your needs. Keep in mind that different strategies may have different trade-offs in terms of price and speed.

Step 4: Set your slippage tolerance

Slippage refers to the difference between the expected price of a trade and the price at which the trade is executed. Set your slippage tolerance based on your risk appetite. Higher slippage tolerance can result in faster trades but may lead to greater price impact.

Step 5: Review and confirm your trade

After configuring your trade settings, review the estimated price, liquidity, and fees. Ensure that all the details are correct before confirming the trade. Once you are satisfied, click on the “Swap” button to proceed.

That’s it! You have successfully used 1inch as a DEX aggregator to make a trade. You can track the status of your trade in your wallet or on the 1inch platform. Remember to always double-check the details before confirming any transactions.

Question-answer:

What is 1inch?

1inch is a decentralized exchange (DEX) aggregator that helps users find the best prices for their trades across different DEXs. It collects liquidity from various platforms and provides the most optimal routes for trading. It also uses smart contract technology to split a trade across multiple DEXs to get the best possible execution price.

How does 1inch work?

1inch works by accessing liquidity from multiple decentralized exchanges and finding the best prices for users. When a user wants to make a trade, 1inch queries the various DEXs and analyzes their order books. It then calculates the most cost-effective routes for the trade and splits the orders across multiple exchanges if necessary. The entire process is done on-chain using smart contract technology.