The Impact of 1inch on the Decentralized Finance Landscape Insights from the Whitepaper

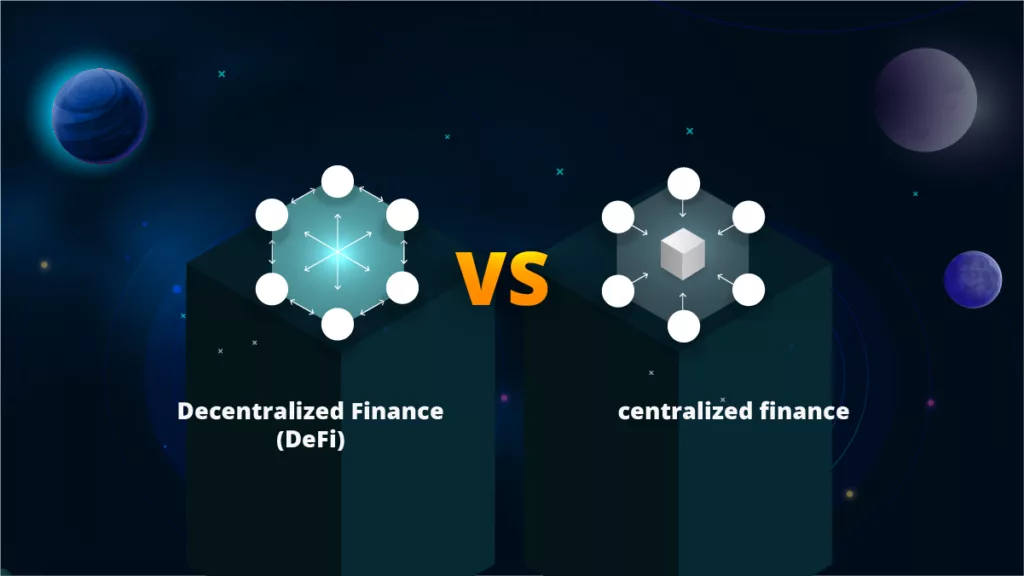

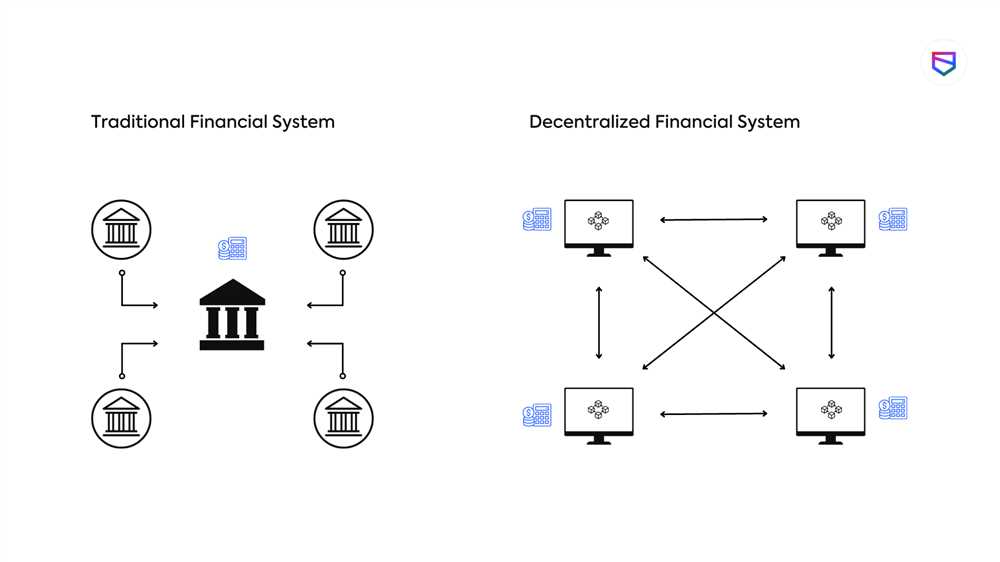

Decentralized finance, or DeFi, has emerged as one of the most exciting and disruptive sectors in the cryptocurrency industry. It promises to revolutionize traditional financial systems by eliminating intermediaries and providing users with greater financial freedom and control. One platform that has made a significant impact on the DeFi space is 1inch, a decentralized exchange aggregator.

1inch is a protocol that connects decentralized exchanges (DEXs) and pools to provide users with the best possible trading rates. By splitting trades across multiple platforms, 1inch is able to optimize for the lowest slippage and highest returns. This is achieved through the use of smart contract technology, which enables automated execution of trades based on predetermined algorithms.

The impact of 1inch on decentralized finance has been profound. It has democratized access to liquidity by allowing users to trade across multiple platforms without the need for multiple accounts or wallets. This has opened up new opportunities for small investors and traders, who can now compete on a level playing field with larger market participants.

Furthermore, 1inch has increased the efficiency of trading in the DeFi space. By aggregating liquidity from multiple sources, it reduces the need for users to manually search for the best rates and execute trades on different DEXs. This not only saves time and effort but also minimizes the risk of price slippage, which can erode trading profits.

In conclusion, 1inch has had a transformative impact on decentralized finance. By connecting decentralized exchanges and optimizing trading routes, it has made trading more accessible, efficient, and profitable for users. As the DeFi ecosystem continues to evolve, platforms like 1inch will play a crucial role in shaping the future of finance.

The Evolution of Decentralized Finance

Decentralized finance, also known as DeFi, has rapidly evolved since its inception, transforming the traditional financial landscape by leveraging blockchain technology and smart contracts. Here, we explore the key milestones in the evolution of DeFi.

- Introduction of Ethereum: The launch of Ethereum in 2015 laid the foundation for the decentralized finance movement. By providing a powerful blockchain platform that supports smart contracts, Ethereum enabled the creation of decentralized applications (dApps) and protocols.

- Initial Coin Offerings (ICOs): In 2017, ICOs gained popularity as a fundraising method for blockchain projects. Through ICOs, startups raised capital by selling tokens to investors, allowing participants to support projects and gain potential returns. This created an alternative funding mechanism outside traditional venture capital.

- Decentralized Exchanges (DEXs): DEXs emerged as an alternative to centralized exchanges, allowing users to trade cryptocurrencies directly from their wallets without the need for intermediaries. Platforms like Uniswap, SushiSwap, and 1inch introduced automated market makers (AMMs) and liquidity pools, enabling decentralized trading and earning fees through providing liquidity.

- Decentralized Lending and Borrowing: Yield farming and lending protocols became popular, providing users with the opportunity to earn interest on their assets or borrow against their holdings without relying on traditional banks. Platforms like Aave, Compound, and MakerDAO pioneered this space, enabling a new wave of decentralized financial services.

- Decentralized Derivatives: The introduction of decentralized derivatives platforms expanded the capabilities of DeFi, enabling users to trade options, futures, and other derivatives without centralized intermediaries. Platforms like Synthetix and dYdX offered synthetic assets and created a decentralized market for derivatives trading.

- Decentralized Insurance: To mitigate risks associated with DeFi, decentralized insurance protocols like Nexus Mutual and Cover were introduced, allowing users to protect their funds and assets against smart contract failures, hacks, and other risks.

- Cross-chain Interoperability: With the growth of different blockchain networks, the need for cross-chain interoperability became crucial. Projects like Polkadot, Cosmos, and Ethereum 2.0 aim to bridge different blockchains, enabling seamless transfers of assets and data across various networks.

As DeFi continues to evolve, new innovations and challenges are expected to emerge. The growing ecosystem holds the potential to provide decentralized alternatives to traditional financial systems, democratizing access to financial services and empowering individuals worldwide.

Understanding the Growth of DeFi

Decentralized Finance, or DeFi, has experienced significant growth over the past few years. This emerging sector has disrupted traditional financial systems by providing open, permissionless, and interoperable financial services.

One of the driving forces behind the growth of DeFi is the rise of decentralized exchanges (DEXs) like 1inch. These platforms offer users the ability to trade cryptocurrencies directly from their wallets, removing the need for intermediaries and centralized exchanges. The automation and efficiency of DEXs have attracted many users, as they provide peer-to-peer trading with lower fees and greater privacy.

Another factor contributing to the growth of DeFi is the increasing popularity of yield farming. Yield farming involves leveraging DeFi protocols to maximize returns by lending, staking, or providing liquidity. This strategy has incentivized users to lock up their assets in protocols and has brought billions of dollars into the DeFi ecosystem.

Additionally, the development of lending and borrowing platforms in DeFi has allowed users to earn interest on their holdings and access loans without the need for a traditional bank. These platforms use smart contracts to facilitate peer-to-peer lending, enabling users to earn interest by lending out their assets or borrow against their collateralized holdings.

Furthermore, the open and permissionless nature of DeFi has democratized access to financial services, allowing anyone with an internet connection to participate. This inclusivity has attracted users from all around the world, including those who are unbanked or underbanked, providing them with opportunities for financial growth and empowerment.

Overall, the growth of DeFi can be attributed to the innovative solutions it offers, such as DEXs, yield farming, lending and borrowing platforms, and its inclusive nature. As the sector continues to evolve, it is likely to play a significant role in shaping the future of finance.

The Emergence of 1inch Protocol

We live in a world where decentralized finance has gained significant traction in recent years. With the rise of blockchain technology, new projects and protocols have emerged, aiming to revolutionize the way we interact with financial services. One such protocol that has made a significant impact is 1inch.

1inch protocol was introduced in 2020 as an automated market maker (AMM) and decentralized exchange (DEX) aggregator. Its main goal is to provide users with the best possible trading experience by sourcing liquidity from various DEXs and offering the most optimal routes for trading.

The emergence of 1inch protocol has brought forth several key advantages for users. Firstly, it allows for improved liquidity across multiple DEXs, which in turn leads to reduced slippage and better execution prices. This is achieved through its unique algorithm that splits trades across different DEXs to ensure the most favorable outcomes.

Moreover, 1inch protocol offers users the ability to save on gas fees by utilizing the most efficient routes for trading. By optimizing transaction routing, users can minimize the costs associated with executing trades on Ethereum and other blockchain networks.

Additionally, 1inch protocol is designed to be flexible and adaptable. It allows developers to build on top of it and integrate their own protocols. This opens up new possibilities for innovation and expansion within the decentralized finance ecosystem.

In conclusion, the emergence of 1inch protocol has had a profound impact on the decentralized finance landscape. By providing users with improved liquidity, reduced slippage, and cost-efficient trading routes, 1inch has become a vital tool for traders and developers alike. As blockchain technology continues to evolve, it is likely that 1inch and similar protocols will play an increasingly important role in shaping the future of finance.

Key Features of 1inch Protocol

The 1inch Protocol introduces several key features that aim to enhance the efficiency and accessibility of decentralized finance (DeFi) trading. These features include:

1. Aggregation of Liquidity: The 1inch Aggregation Protocol, used by the 1inch DEX Aggregator, combines liquidity from various decentralized exchanges (DEXs) to provide users with the best possible trading rates. By aggregating liquidity, the protocol minimizes slippage and maximizes the amount of assets users receive.

2. Splitting Trades: The 1inch Aggregation Protocol splits large orders across various DEXs to reduce price impact and minimize market distortion. By splitting trades, the protocol ensures that trades are executed at the best possible rates without causing significant market disruptions.

3. Gas Token Optimization: The 1inch Protocol optimizes gas usage by utilizing gas tokens. These tokens are purchased during times of low network activity and used during times of high network congestion. By leveraging gas tokens, the protocol helps users save on transaction costs and enables faster and more cost-efficient trading.

4. Referral Program: The 1inch Protocol offers a referral program that rewards users for referring others to the platform. By referring new users, participants can earn a portion of the trading fees generated by their referrals. This incentivizes users to help grow the 1inch ecosystem and strengthens the network effect.

5. Smart Contract Optimization: The 1inch Protocol is built with a focus on gas efficiency and cost optimization. The protocol uses smart contract technology to minimize gas costs while ensuring the security and integrity of transactions. This allows users to trade on the protocol with minimal friction and optimal cost savings.

6. Governance Token (1INCH): The 1inch Protocol has its own governance token, known as 1INCH. Token holders can participate in the governance of the protocol by voting on proposals and protocol upgrades. This gives users a voice in the development and direction of the 1inch ecosystem, fostering a decentralized and community-driven platform.

These key features make the 1inch Protocol a powerful tool for traders and participants in the DeFi ecosystem, offering enhanced trading capabilities, cost savings, and community participation opportunities.

Aggregation of Liquidity

One of the key features of the 1inch protocol is its ability to aggregate liquidity from multiple decentralized exchanges (DEXs). This allows users of the platform to access the best possible prices for their trades across a wide range of DEXs.

To achieve this, the 1inch protocol utilizes a unique algorithm that takes into account factors such as available liquidity, slippage, and trading fees to determine the optimal trading route. By aggregating liquidity from multiple DEXs, the protocol is able to find the best possible trades for its users.

The aggregation of liquidity provided by 1inch has several benefits. Firstly, it allows users to access a larger pool of liquidity, which can lead to better prices and improved execution for their trades. Additionally, by aggregating liquidity from multiple sources, the protocol reduces the risk of front-running and other forms of manipulation that can occur on individual DEXs.

Furthermore, the aggregation of liquidity also helps to improve the overall efficiency of the decentralized finance (DeFi) ecosystem. By consolidating liquidity from various DEXs, the protocol reduces the fragmentation that can occur in the DeFi market, making it easier for users to find the liquidity they need for their trades.

In summary, the aggregation of liquidity provided by the 1inch protocol is a key feature that sets it apart from other decentralized exchanges. By leveraging its unique algorithm and pooling liquidity from multiple DEXs, the protocol is able to provide users with access to the best possible prices and improved execution for their trades.

| Benefits of Aggregation of Liquidity: |

|---|

| Access to a larger pool of liquidity |

| Improved prices and execution |

| Reduced risk of manipulation |

| Improved efficiency of the DeFi ecosystem |

Optimization of Trading Costs

One of the primary goals of 1inch is to optimize trading costs in decentralized finance. Traditional decentralized exchanges can suffer from high slippage and high fees due to the fragmented liquidity across multiple liquidity sources. 1inch addresses this issue by aggregating liquidity from various sources, including both decentralized and centralized exchanges, to achieve better pricing and reduce trading costs.

Through its Pathfinder algorithm, 1inch is able to calculate the most efficient trading routes by considering factors such as slippage, transaction fees, and gas costs. This allows users to find the best exchange rates and minimize their overall trading costs.

Benefits of Optimized Trading Costs

By optimizing trading costs, 1inch provides several significant benefits to users:

- Better Execution Prices: By aggregating liquidity, 1inch can find the best prices across multiple decentralized exchanges, resulting in better execution prices for users.

- Reduced Slippage: Slippage occurs when the price of an asset changes between the time a trade is initiated and the time it is executed. By comparing prices across different exchanges, 1inch can minimize slippage and ensure that users get the best possible price for their trades.

- Lower Fees: Traditional decentralized exchanges often charge high fees due to the fragmentation of liquidity. 1inch’s aggregation of liquidity allows for lower fees, as it can leverage the combined liquidity of multiple exchanges.

- Improved Profitability: By achieving better execution prices, reducing slippage, and lowering fees, 1inch ultimately improves the profitability of trades for its users.

Overall, the optimization of trading costs is a key feature of 1inch that sets it apart from traditional decentralized exchanges. By leveraging advanced algorithms and aggregating liquidity, 1inch provides users with better execution prices, reduced slippage, lower fees, and improved profitability.

Question-answer:

What is 1inch?

1inch is a decentralized exchange aggregator that sources liquidity from various exchanges and liquidity providers to offer users the best possible trading rates. It is built on the Ethereum blockchain and aims to optimize and improve the trading experience in the decentralized finance (DeFi) ecosystem.

How does 1inch work?

1inch works by splitting users’ trades across multiple decentralized exchanges to ensure they get the best possible prices and minimal slippage. It aggregates liquidity from various platforms and sources to provide the most cost-effective trading options to users. The platform also utilizes smart contract technology to automate the trading process and provide secure and transparent transactions.

What are the advantages of using 1inch?

There are several advantages of using 1inch. Firstly, it offers users the best possible trading rates by aggregating liquidity from various sources. This helps to minimize slippage and optimize trading outcomes. Secondly, 1inch provides a user-friendly interface that allows for easy and intuitive trading. Additionally, the platform is built on the Ethereum blockchain, ensuring security, transparency, and immutability of transactions. Lastly, 1inch is constantly evolving and improving, with new features and updates being regularly released to enhance the trading experience.