Welcome to the world of cryptocurrency trading! Whether you’re a beginner or an experienced trader, 1inch Exchange is here to provide you with a comprehensive set of educational resources to help you navigate the exciting and sometimes volatile market.

At 1inch Exchange, we understand that getting started in trading can be overwhelming. That’s why we’ve created a series of educational materials designed specifically for beginner traders. Our goal is to empower you with the knowledge and skills you need to make informed trading decisions and maximize your potential for success.

Our educational resources cover a wide range of topics, starting from the basics of cryptocurrency trading and explaining key concepts such as blockchain, wallets, and decentralized finance (DeFi). We also provide step-by-step guides on how to set up an account, conduct trades, and manage your portfolio. Whether you’re new to the world of cryptocurrency or looking to expand your trading skills, our resources are tailored to meet your needs.

With 1inch Exchange’s educational resources, you’ll gain a deeper understanding of the cryptocurrency market and develop the confidence to make strategic trades. Join us on this educational journey and take your trading skills to the next level!

What is 1inch Exchange?

1inch Exchange is a decentralized exchange (DEX) aggregator that aims to provide users with the best possible trading rates across multiple liquidity pools. It was launched in 2020 by Sergej Kunz and Anton Bukov.

The main idea behind 1inch Exchange is to solve the problem of fragmented liquidity by aggregating prices from various DEXs and executing trades on the user’s behalf. By doing so, it aims to minimize slippage and maximize trading efficiency.

1inch Exchange achieves this by utilizing a smart contract that automatically splits a user’s trade across multiple DEXs, ensuring that the best possible rates are obtained. This significantly enhances liquidity and offers users a seamless trading experience.

Furthermore, 1inch Exchange is built on the Ethereum blockchain and operates as a decentralized platform, meaning that users have full control over their funds and trades. It also supports a wide range of tokens, allowing users to access a diverse set of trading opportunities.

In addition to the trading features, 1inch Exchange also offers other services such as yield farming, where users can earn passive income by providing liquidity to various liquidity pools.

Overall, 1inch Exchange provides a user-friendly and efficient solution for trading cryptocurrencies, making it an attractive option for both beginner and experienced traders alike.

Why use 1inch Exchange?

1inch Exchange is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges (DEXs) to provide users with the best possible trading rates. Here are some reasons why you should consider using 1inch Exchange:

| 1. Best Trading Rates | 1inch Exchange uses its advanced algorithms to find the most optimal trading routes across multiple DEXs, allowing users to access the best possible rates and prices. This ensures that you get the most value for your trades. |

| 2. No Need for Multiple Accounts | With 1inch Exchange, you don’t need to create multiple accounts and manage different wallets on different DEXs. It aggregates liquidity from various sources, so you can trade directly from a single platform. |

| 3. Lower Slippage | By sourcing liquidity from multiple DEXs, 1inch Exchange minimizes slippage, which is the difference between the expected price of a trade and the price at which the trade is executed. This means you can trade large amounts without significantly impacting the market. |

| 4. Gas Fee Optimization | 1inch Exchange intelligently splits trades across multiple DEXs to optimize gas fees. Gas fees can be a significant cost when trading on Ethereum, and 1inch Exchange helps to reduce these fees by taking advantage of lower fees on different DEXs. |

| 5. User-Friendly Interface | 1inch Exchange provides a user-friendly interface that is designed to make trading easy and accessible for both beginner and experienced traders. The platform offers advanced trading features while maintaining a simple and intuitive user experience. |

These are just a few reasons why 1inch Exchange is a popular choice among traders. Whether you are a beginner looking for the best trading rates or an experienced trader wanting to optimize your trades, 1inch Exchange offers a powerful and efficient solution.

Educational Resources for Beginner Traders

As a beginner trader, it is essential to have access to educational resources that can help you understand the market, trading strategies, and various tools available. Here are some top resources to consider:

1. Online Trading Courses: Many platforms offer online trading courses specifically designed for beginners. These courses cover topics such as market analysis, chart reading, risk management, and trading psychology.

2. Trading Books: There are numerous trading books available that provide valuable insights and knowledge for beginner traders. Some recommended titles include “Trading in the Zone” by Mark Douglas and “A Beginner’s Guide to the Stock Market” by Matthew R. Kratter.

3. Webinars and Video Tutorials: Many trading platforms and experienced traders provide webinars and video tutorials that cover various topics related to trading. These resources can be extremely helpful in understanding different strategies and concepts.

4. Trading Simulators: Using trading simulators can be an excellent way for beginners to practice trading without risking real money. These simulators simulate real market conditions and allow traders to learn and experiment with different strategies.

5. Online Forums and Communities: Joining online trading forums and communities can provide beginners with an opportunity to learn from experienced traders, ask questions, and share insights. These platforms are also great for networking and staying updated with the latest industry trends.

In conclusion, education is crucial for beginner traders, and these resources can provide valuable guidance and knowledge. It is essential to take the time to explore and learn from these resources to enhance your trading skills and increase your chances of success in the market.

Understanding Decentralized Exchanges

Decentralized exchanges (DEXs), also known as decentralized finance (DeFi) exchanges, are a type of cryptocurrency exchange that operates on a decentralized network. Unlike traditional exchanges that rely on centralized authorities to facilitate transactions, DEXs allow users to trade directly with each other using smart contracts.

Smart contracts are self-executing contracts with the terms of the agreement directly written into lines of code. They automatically execute transactions when predefined conditions are met. In the context of DEXs, smart contracts facilitate the trading process by automating order matching and settlement.

Ethereum is the most popular blockchain platform for decentralized exchanges due to its support for smart contracts. DEXs built on Ethereum often utilize the network’s native cryptocurrency, Ether (ETH), as well as other tokens based on the Ethereum blockchain, commonly referred to as ERC-20 tokens.

One main advantage of decentralized exchanges is that they eliminate the need for intermediaries, such as centralized exchanges or brokers. This reduces counterparty risk and provides users with greater control over their funds.

Another key feature of decentralized exchanges is their non-custodial nature. Unlike centralized exchanges, where users have to deposit their funds into the platform, DEXs allow users to maintain control of their funds at all times. This ensures that users are not exposed to the risk of hacks or theft from the exchange.

However, decentralized exchanges also come with certain limitations. One major challenge is liquidity, as DEXs often have lower trading volumes compared to centralized exchanges. This can result in higher slippage and less competitive pricing for users.

Furthermore, the user experience on decentralized exchanges can be more complex compared to traditional exchanges. Users need to interact with decentralized wallets, navigate different interfaces, and handle transaction fees and gas costs.

In conclusion, decentralized exchanges offer a more secure and autonomous way of trading cryptocurrencies. While they have their limitations, DEXs are an important part of the growing DeFi ecosystem, providing users with greater control and privacy over their digital assets.

Getting Started with 1inch Exchange

1inch Exchange is a decentralized exchange aggregator that sources liquidity from various exchanges to provide users with the best possible trading rates. Whether you’re a beginner trader or an experienced investor, 1inch Exchange offers a user-friendly platform with advanced features to enhance your trading experience.

Creating an Account

The first step to get started with 1inch Exchange is to create an account. Simply navigate to the 1inch Exchange website and click on the “Connect Wallet” button. You can choose from various supported wallets such as MetaMask or WalletConnect to connect to the platform. Once your wallet is connected, you can proceed with the next steps.

Exploring the Interface

After connecting your wallet, you will be directed to the 1inch Exchange interface. The interface is intuitive and designed to make trading seamless. On the left side, you will find the trading pair selection and price chart. You can choose between different trading pairs and customize the chart according to your preferences.

On the right side, you will find the order form where you can enter the amount of tokens you want to trade and choose the transaction type (buy or sell). You can also set advanced options such as slippage tolerance and enable features like limit orders and gas token payments.

Placing a Trade

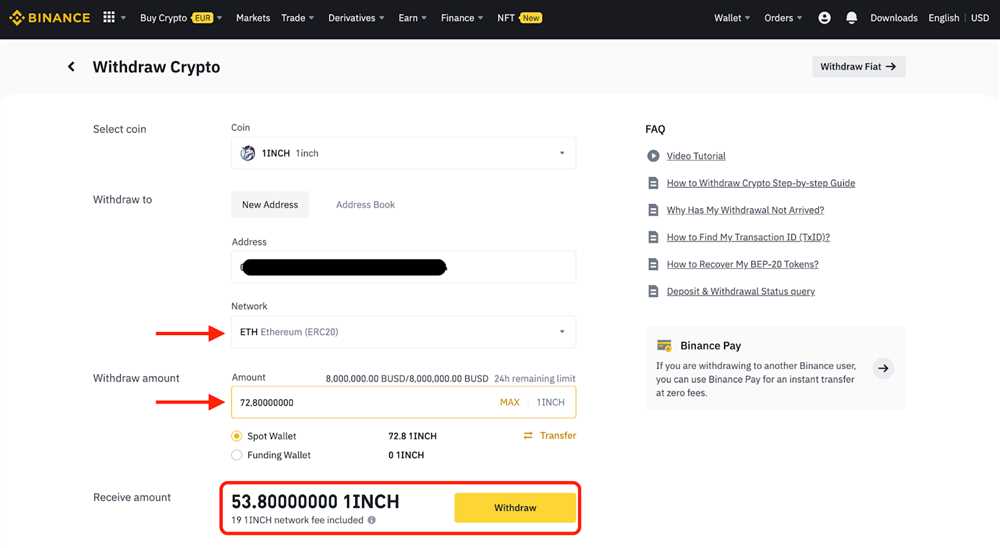

Once you have familiarized yourself with the interface, you can start placing trades. To place a trade, simply enter the amount of tokens you want to trade and click on the “Swap” button. 1inch Exchange will automatically find the best possible trading routes across various exchanges to provide you with the most optimal rates.

Before finalizing the trade, make sure to review the details such as the estimated gas fees and the total amount you will receive. Once you are satisfied with the trade details, click on the “Confirm” button to execute the trade.

Tracking Your Trades

1inch Exchange provides a comprehensive trade history feature that allows you to track your trades. You can access your trade history by clicking on the “Trades” tab on the top navigation menu. This feature provides valuable insights into your trading performance and allows you to analyze your trades.

Additionally, 1inch Exchange supports various portfolio tracking tools and integrations, making it easier for you to keep track of your overall portfolio.

That’s it! You are now ready to start trading on 1inch Exchange. Remember to always do your own research and trade responsibly. Happy trading!

Learning to Trade on 1inch Exchange

1inch Exchange is a decentralized exchange that allows users to trade various cryptocurrencies. Learning how to trade on 1inch Exchange can open up a world of opportunities in the world of decentralized finance (DeFi). Here are some steps to get started:

1. Set up a Wallet: Before you can start trading on 1inch Exchange, you’ll need a compatible wallet. Some popular options include MetaMask, Trust Wallet, and Ledger.

2. Connect your Wallet: Once you have a wallet, you’ll need to connect it to the 1inch Exchange platform. This will allow you to securely trade your cryptocurrencies without having to worry about the safety of your funds.

3. Research and Analyze: Before making any trades on 1inch Exchange, it’s important to research and analyze the cryptocurrencies you’re interested in trading. Look at factors such as price history, market trends, and project fundamentals.

4. Choose your Trading Pair: On 1inch Exchange, you can trade various cryptocurrencies against each other. Consider which trading pairs you want to trade and keep an eye on their prices.

5. Set your Preferences: 1inch Exchange offers various trading preferences that you can adjust according to your needs. These preferences include slippage tolerance, gas rates, and routing paths. Make sure to set these preferences carefully to optimize your trading experience.

6. Place your Trade: Once you have done your research and set your preferences, it’s time to place your trade on 1inch Exchange. Enter the amount you want to trade and review the transaction details before confirming the trade.

7. Review and Monitor: After your trade is executed, it’s important to review and monitor your positions. Keep an eye on market movements and be ready to make adjustments if necessary.

8. Learn from Experience: Trading on 1inch Exchange is a learning process. Take note of your successful trades as well as your mistakes. Learn from both your wins and losses to improve your trading strategies.

Remember, trading cryptocurrencies involves risks, and it’s important to only trade what you can afford to lose. Start small, gain experience, and gradually increase your trading activities on 1inch Exchange.

Question-answer:

What is 1inch Exchange?

1inch Exchange is a decentralized exchange aggregator that sources liquidity from various exchanges and offers the best rates for users. It operates on the Ethereum blockchain and aims to provide users with the most efficient and cost-effective way to swap tokens.

How does 1inch Exchange work?

1inch Exchange works by splitting a user’s trade across multiple decentralized exchanges to find the best price. It uses a smart contract that automatically routes the trade to different exchanges, ensuring that users get the best deal possible. This aggregation of liquidity allows 1inch Exchange to offer better rates and lower fees compared to trading directly on a single exchange.