Comparing the 1inch Aggregator to Other Decentralized Exchange Aggregators in the Market

Are you tired of manually searching for the best prices across multiple decentralized exchanges?

Introducing the 1inch Aggregator – the ultimate solution for seamless and efficient decentralized trading.

Decentralized exchanges have revolutionized the way we trade cryptocurrencies, providing security, transparency, and control over our assets. However, with the growing number of DEXs, it can be overwhelming to find the best deal.

That’s where the 1inch Aggregator steps in. By leveraging smart contract technology and advanced algorithms, this powerful tool scans multiple DEXs in real-time to find you the best prices for your trades.

No more wasted time comparing prices manually. With the 1inch Aggregator, you can take advantage of the best rates available across various decentralized exchanges, all in one place.

Why choose the 1inch Aggregator?

1. Optimal Execution: Our advanced algorithms ensure that your trades are executed at the best available rates, maximizing your profits.

2. Wide Coverage: The 1inch Aggregator supports an extensive list of DEXs, allowing you to access liquidity from across the decentralized ecosystem.

3. User-Friendly Interface: The intuitive interface makes it easy for anyone, from beginners to experienced traders, to navigate and make trades seamlessly.

4. Security and Privacy: As a decentralized aggregator, your funds and data are secure. You retain full control over your assets, with no need for centralized intermediaries.

Start trading efficiently with the 1inch Aggregator today.

With its unparalleled features and user-centric design, the 1inch Aggregator is the go-to choice for traders seeking the best prices and optimal execution in the decentralized trading landscape.

Don’t settle for less. Join the thousands of traders who have already discovered the power of the 1inch Aggregator and revolutionize your decentralized trading experience.

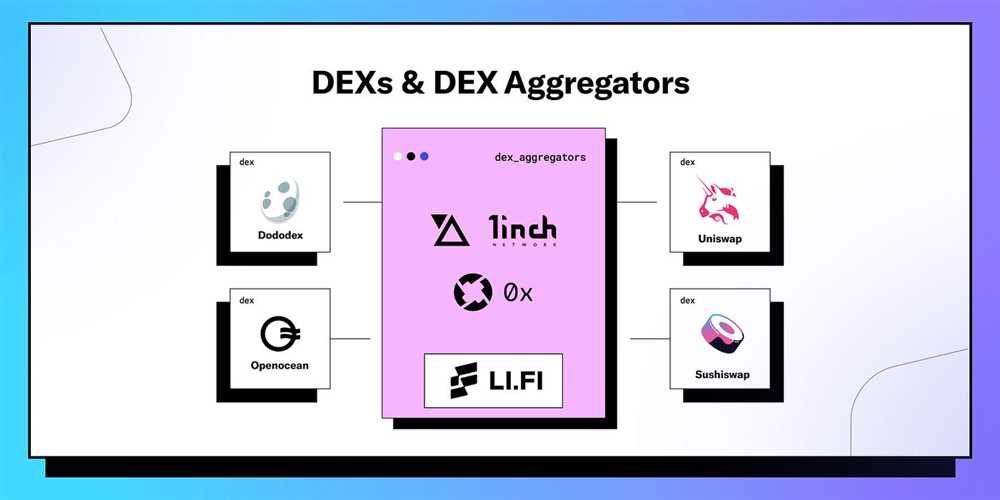

Comparing Decentralized Exchange Aggregators

Decentralized exchange aggregators have emerged as a popular solution for traders looking to access the best prices and liquidity across multiple decentralized exchanges (DEXs). These platforms offer a more efficient and cost-effective way to trade cryptocurrencies compared to traditional centralized exchanges.

One of the top decentralized exchange aggregators in the market is the 1inch Aggregator. It stands out for its user-friendly interface, advanced features, and extensive network of supported DEXs. However, it is important to compare and evaluate other decentralized exchange aggregators to make an informed decision.

Another prominent decentralized exchange aggregator is the Kyber Network. It has gained popularity for its high liquidity, robust security measures, and seamless token swaps. Kyber Network also offers a wide range of tokens for trading, making it a preferred choice for many traders.

SushiSwap is another decentralized exchange aggregator that has gained significant attention in the crypto community. It provides users with improved price discovery and access to liquidity across multiple DEXs. SushiSwap also offers rewards to liquidity providers, incentivizing them to contribute to the platform.

When comparing decentralized exchange aggregators, it is crucial to consider factors such as user experience, supported DEXs, liquidity, security, and additional features. Each aggregator may have its own strengths and weaknesses, so it is important to assess them based on your specific trading needs.

By comparing and evaluating different decentralized exchange aggregators, traders can choose the platform that best suits their preferences and trading strategies. Whether it is the 1inch Aggregator, Kyber Network, SushiSwap, or any other aggregator, these platforms provide a convenient and efficient way to trade cryptocurrencies in a decentralized manner.

Understanding 1inch Aggregator

The 1inch Aggregator is a decentralized exchange aggregator that provides users with the ability to access various decentralized exchanges (DEXs) and swap their tokens at the best available rates.

How Does It Work?

The 1inch Aggregator works by splitting the user’s order across multiple DEXs and combining them into the best possible trades. It scans various DEXs to find the most optimal combination of liquidity and rates, ensuring that users get the best value for their tokens.

The aggregator’s algorithm takes into account factors such as slippage, gas fees, and trading volume to determine the most efficient route for the trade. It also checks for potential arbitrage opportunities to further enhance the user’s gains.

Benefits of Using 1inch Aggregator

There are several benefits to using the 1inch Aggregator:

| 1 | Best Rates | The aggregator scans multiple DEXs to find the best rates for token swaps, ensuring users get the maximum value for their trades. |

| 2 | Low Slippage | By splitting orders across multiple DEXs, the aggregator minimizes slippage and helps users avoid losing value due to price slippage. |

| 3 | Reduced Gas Fees | The 1inch Aggregator utilizes smart contract technology to optimize gas fees and minimize transaction costs for users. |

| 4 | Arbitrage Opportunities | The aggregator also scans for arbitrage opportunities, allowing users to take advantage of price discrepancies and maximize their profits. |

| 5 | Intuitive UI | The 1inch Aggregator provides an intuitive and user-friendly interface, making it easy for users to navigate and execute their trades. |

Overall, the 1inch Aggregator is a powerful tool that combines the liquidity and benefits of multiple DEXs, allowing users to optimize their token swaps and maximize their gains.

Features of Decentralized Exchange Aggregators

Decentralized exchange aggregators, such as the 1inch Aggregator, offer a range of features that make them a popular choice for traders in the cryptocurrency space.

Liquidity Pool Integration: Decentralized exchange aggregators are able to tap into multiple liquidity pools, which increases the overall liquidity available for traders. This allows for better execution of trades and helps to minimize slippage.

Optimal Pricing: By accessing various decentralized exchanges, aggregators can find the best prices for specific token pairs. This leads to more competitive rates for traders and ensures that they are getting the best value for their trades.

Multiple Token Support: Decentralized exchange aggregators support a wide range of tokens, including both popular and less commonly traded cryptocurrencies. This allows traders to access a diverse selection of tokens and take advantage of various market opportunities.

Gas Fee Optimization: Through smart contract optimization and transaction bundling, decentralized exchange aggregators are able to minimize gas fees for traders. This helps to reduce the cost of trading and makes it more affordable for users.

Advanced Trading Options: Decentralized exchange aggregators often provide advanced trading options, such as limit orders and stop-loss orders. This gives traders more flexibility and control over their trades, allowing them to implement specific trading strategies.

User-Friendly Interface: Decentralized exchange aggregators strive to provide a user-friendly interface that is intuitive and easy to navigate. This ensures that traders of all experience levels can easily access and utilize the platform.

Security: Decentralized exchange aggregators prioritize security and employ robust security measures to protect user funds. This includes the use of smart contracts and encryption technologies to safeguard transactions and user data.

Transparency: Decentralized exchange aggregators often provide transparent transaction information, allowing users to view the details of each trade, including the sources of liquidity and the associated fees. This transparency helps to build trust and confidence among traders.

In conclusion, decentralized exchange aggregators offer a range of features that enhance the trading experience for cryptocurrency traders. From greater liquidity and optimal pricing to advanced trading options and security measures, these aggregators are revolutionizing the way traders interact with the decentralized exchange ecosystem.

Question-answer:

What is a decentralized exchange aggregator?

A decentralized exchange aggregator is a platform that allows users to trade cryptocurrencies across multiple decentralized exchanges (DEXs) in one single transaction. It combines liquidity from various DEXs and is designed to provide the best possible trading rates and lower slippage for users.

How does the 1inch Aggregator work?

The 1inch Aggregator works by scanning multiple decentralized exchanges and finding the most optimal trade route for users. It takes into account factors such as liquidity, trading fees, and slippage to provide the best possible trading rates. The aggregator splits the user’s trade across multiple exchanges, ensuring that they get the most favorable price for their transaction.