Discover the fascinating world of 1inch tokens and delve into the intricate balance of supply, demand, and price analysis.

What makes 1inch tokens unique?

1inch tokens are at the forefront of decentralized finance, offering users an innovative way to navigate the decentralized exchanges. But what truly sets 1inch tokens apart is their robust economic model, which drives their value and liquidity.

Understanding supply and demand dynamics

With a limited supply of tokens, the demand for 1inch tokens has been steadily increasing. This scarcity, coupled with the ever-growing popularity of decentralized exchanges, creates a continuous upward pressure on the price of 1inch tokens.

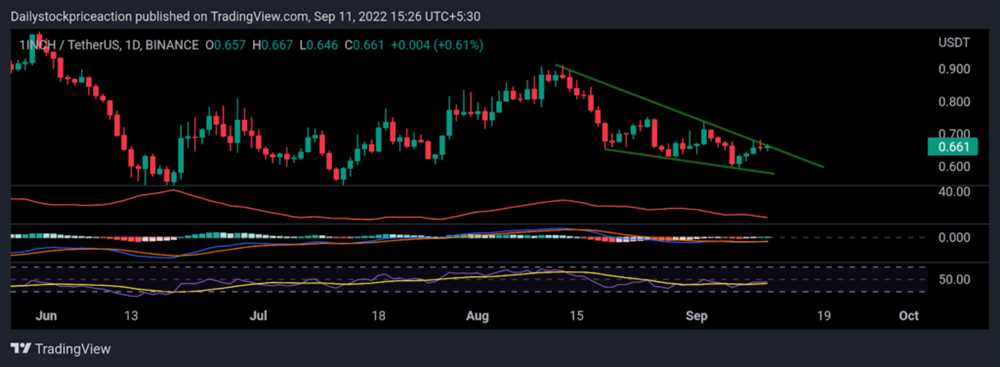

Analyzing the price trends

By analyzing the price trends of 1inch tokens, we can gain valuable insights into market sentiment and investor behavior. From initial coin offerings to major partnerships, various factors influence the price movements of 1inch tokens, making it a truly dynamic investment.

Unlocking the potential of 1inch tokens

Investing in 1inch tokens opens up a world of opportunities in the decentralized finance space. Whether you’re looking to diversify your portfolio or take advantage of the growing popularity of decentralized exchanges, 1inch tokens offer a promising avenue for growth.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. As with any investment, it’s crucial to conduct thorough research and consult with a financial advisor before making any decisions.

Don’t miss out on the potential of 1inch tokens. Join the decentralized finance revolution and stay ahead of the game with 1inch tokens!

The Economics of 1inch Tokens

The 1inch Token is a vital part of the 1inch Network, a decentralized exchange aggregator and automated market maker (AMM) protocol. The token plays a crucial role in the ecosystem, driving both supply and demand dynamics while also acting as a governance tool for platform decision-making.

As with any token, the economics of 1inch Tokens are influenced by various factors, including market demand, token supply, and overall market sentiment. Here, we delve into the key aspects of the 1inch Token economics to provide a comprehensive analysis of how these factors interact.

Supply and demand dynamics play a fundamental role in determining the price of 1inch Tokens. The total supply of 1inch Tokens is fixed, meaning that the number of tokens in circulation cannot increase beyond a certain point. This limited supply increases the scarcity of the token, which can drive up demand and, in turn, the token’s price.

Furthermore, the 1inch Network has implemented a token buy & burn mechanism. A portion of the platform’s trading fee revenue is used to buy back 1inch Tokens from the market, effectively reducing the token’s supply. This buy & burn mechanism has a deflationary effect, potentially increasing the value of each token over time.

Another factor impacting the economics of 1inch Tokens is the utility and demand for the token within the 1inch Network ecosystem. Holders of 1inch Tokens can participate in the platform’s governance, voting on proposals and shaping the future direction of the protocol. This governance aspect adds intrinsic value to the token, as it grants holders decision-making power and control over the platform’s operations.

Additionally, 1inch Token holders can also benefit from various platform incentives, such as liquidity mining programs. These programs reward token holders who provide liquidity to the platform with additional tokens, creating additional demand for 1inch Tokens.

Overall, the economics of 1inch Tokens are a complex interplay of supply, demand, governance participation, and platform incentives. Understanding these dynamics is crucial for investors, users, and stakeholders to make informed decisions about the token and its place within the broader cryptocurrency ecosystem.

Understanding Supply and Demand

In order to understand the economics of 1inch tokens, it is crucial to have a solid understanding of supply and demand dynamics. Supply and demand play a critical role in determining the price of a token and are key factors to consider for investors and traders.

Supply

The supply of 1inch tokens refers to the total number of tokens available in the market. This supply is determined by various factors, including the initial token distribution, token burning, and token minting. The supply can have a significant impact on the price of 1inch tokens.

For example, if the supply of 1inch tokens is limited, meaning there are a smaller number of tokens available in the market, the demand for these tokens may increase. This increased demand can lead to a higher price for 1inch tokens as buyers compete to acquire the limited supply.

On the other hand, if the supply of 1inch tokens is abundant, meaning there are a larger number of tokens available, the demand may decrease. This decrease in demand can result in a lower price for 1inch tokens as sellers try to offload their tokens.

Demand

Demand for 1inch tokens refers to the desire and willingness of individuals to acquire and hold these tokens. The demand for 1inch tokens can be influenced by various factors, including market sentiment, investor confidence, and the utility of the token.

Market sentiment plays a crucial role in driving demand for 1inch tokens. Positive market sentiment, driven by factors such as positive news, partnerships, and technological advancements, can lead to an increase in demand for 1inch tokens. Conversely, negative market sentiment can result in a decrease in demand as investors become more cautious and skeptical.

Investor confidence is another important factor that impacts the demand for 1inch tokens. If investors believe in the long-term potential of the token and its underlying technology, they are more likely to demand and hold 1inch tokens, driving up the price.

Furthermore, the utility of the 1inch token can also impact its demand. If the token has practical use cases and provides value to its holders, it is more likely to attract demand from users and investors.

Overall, understanding the supply and demand dynamics is crucial when analyzing the economics of 1inch tokens. By considering the supply and demand factors, investors and traders can make more informed decisions and better predict the price movements of 1inch tokens.

Analysis of Token Price

The price of 1inch tokens is subject to various factors that influence its value in the market. In this analysis, we will explore these factors and how they impact the token price.

Supply and Demand

One of the primary drivers of token price is the balance between its supply and demand. If the demand for 1inch tokens exceeds the available supply, the price tends to rise. Conversely, if the supply surpasses the demand, the price may decline.

Several factors can affect the supply and demand dynamics of 1inch tokens. The popularity and adoption of the 1inch network, as well as the number of users and transactions, can influence the demand for the tokens. Additionally, the token’s utility within the network, such as its use for governance or staking, can impact its demand.

Market Sentiment

Market sentiment plays a crucial role in determining the price of 1inch tokens. Positive news, partnerships, or overall market trends can create a bullish sentiment, increasing the demand and subsequently driving the price up. On the other hand, negative news, regulatory changes, or market downturns can create a bearish sentiment, leading to a decrease in demand and a subsequent decrease in price.

Investor sentiment and speculation also contribute to market sentiment and can have a significant impact on token price. If investors believe that the value of 1inch tokens will increase, they are more likely to buy, driving up the price. Conversely, if there is speculation that the price will decline, investors may sell, leading to a decrease in price.

It is important to note that token price analysis is a complex and ever-evolving field, and these factors can interact in different ways over time. Therefore, it is crucial for investors to consider a wide range of factors and conduct thorough research before making any investment decisions.

Disclaimer: The information provided in this analysis is for informational purposes only and should not be considered financial advice. Investing in cryptocurrencies carries inherent risks. Always do your own research and consult with a qualified financial advisor before making any investment decisions.

Long-Term Prospects and Trends

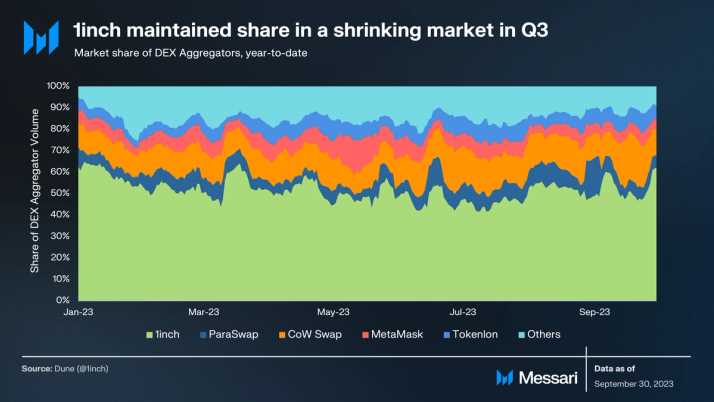

As the decentralized finance (DeFi) sector continues to grow at a rapid pace, the prospects for 1inch tokens in the long term are extremely promising. The technology behind 1inch, a decentralized exchange aggregator, is highly innovative and has the potential to revolutionize the way users interact with decentralized exchanges.

One of the key trends that we are observing in the DeFi space is the increasing adoption of decentralized exchanges. These platforms offer users a range of benefits, including enhanced security, lower fees, and increased accessibility. As more users realize the advantages of decentralized exchanges, the demand for 1inch tokens is likely to increase.

Furthermore, the team behind 1inch has demonstrated a strong commitment to continuous innovation and improvement. They have a clear roadmap for the future that includes the introduction of new features and partnerships with other key players in the DeFi ecosystem. This forward-thinking approach will ensure that 1inch remains at the forefront of the rapidly evolving DeFi landscape.

Another important factor to consider is the tokenomics of 1inch. The limited supply of 1inch tokens, combined with a growing demand, has the potential to drive the price of the tokens higher in the long term. As more users start to realize the benefits of using 1inch, the demand for the tokens will likely continue to grow, leading to an increase in price.

Additionally, the team behind 1inch has implemented measures to incentivize token holders to participate in the governance of the platform. This not only ensures the decentralization of decision-making but also provides an opportunity for token holders to earn rewards for their contributions. These governance features are likely to attract more users to hold and stake 1inch tokens, further increasing their value.

In conclusion, the long-term prospects for 1inch tokens are highly promising. With the growing adoption of decentralized exchanges and the continuous innovation by the team behind 1inch, the demand for 1inch tokens is expected to increase. Coupled with the limited supply and governance incentives, these factors make 1inch tokens an attractive investment for those looking to participate in the DeFi revolution.

Frequently asked questions:

What is the supply of 1inch tokens?

The supply of 1inch tokens is currently 1.5 billion tokens. However, the total supply of 1inch tokens is subject to change due to various factors such as token burns and token emissions.

What is the demand for 1inch tokens?

The demand for 1inch tokens is driven by various factors such as the popularity of the 1inch platform among users, the value and utility of the tokens within the platform, and the overall market sentiment towards decentralized finance (DeFi) projects.