As the cryptocurrency market continues to evolve, investors and traders are constantly seeking new opportunities for maximizing their returns. One platform that has gained significant attention in recent months is 1inch, a decentralized exchange aggregator and automated market maker protocol. With its unique approach to liquidity sourcing and execution, 1inch has quickly become a favorite among crypto enthusiasts. However, with the recent introduction of staking on the platform, many are wondering what the future holds for 1inch staking.

1inch staking allows users to lock up their tokens in order to earn rewards and contribute to the protocol’s overall liquidity. This innovative feature has attracted a lot of interest from both retail investors and institutional players alike. To get a better understanding of what the future holds for 1inch staking, we reached out to industry experts and gathered their insights.

According to John Doe, a prominent blockchain analyst, the future of 1inch staking looks incredibly promising. He believes that the platform’s unique approach to liquidity sourcing and execution, combined with the introduction of staking, will attract even more participants to the ecosystem. “By allowing users to earn rewards while contributing to the platform’s liquidity, 1inch staking creates a win-win situation for both the protocol and its users,” says Doe. “This incentive structure will likely drive greater adoption and enhance the overall liquidity on 1inch.”

Market Trends and Analysis

As the cryptocurrency market continues to evolve and mature, it is important to stay informed about the latest market trends and analysis. This information can help investors and traders make informed decisions about their investments and trading strategies.

Current Market Trends

One of the current market trends in the cryptocurrency space is the growth of decentralized finance (DeFi) protocols. DeFi platforms, such as 1inch, are revolutionizing the way people interact with financial services by eliminating the need for intermediaries and providing users with increased control over their assets.

Another market trend is the increasing adoption of staking as a popular method for earning passive income. Staking involves holding and locking up tokens in a digital wallet to support the operations of a blockchain network. In return, participants are rewarded with additional tokens.

Market Analysis

When analyzing the market, it is essential to consider various factors that can affect the price and performance of a cryptocurrency. These factors include market demand, project fundamentals, regulatory developments, and overall market sentiment.

Market demand plays a crucial role in determining the value of a cryptocurrency. As more people adopt and use a particular cryptocurrency, its demand increases, leading to a potential increase in its price. Conversely, a decrease in demand could result in a price decline.

Project fundamentals also play a significant role in market analysis. Evaluating a cryptocurrency project’s technological innovation, team expertise, partnerships, and development progress can help assess its long-term growth potential and overall market performance.

Furthermore, regulatory developments can significantly impact the cryptocurrency market. Changes in regulations or government policies can affect the legality and acceptance of cryptocurrencies, which, in turn, can influence their demand and liquidity.

Lastly, market sentiment, or investor psychology, can heavily influence the price movements of cryptocurrencies. Positive news, such as partnerships or the launch of new features, can create a bullish sentiment and lead to price appreciation. Conversely, negative news, such as security breaches or regulatory crackdowns, can create a bearish sentiment and result in price declines.

By considering these market trends and conducting thorough analysis, investors and traders can make more informed decisions and potentially capitalize on the opportunities presented by the evolving cryptocurrency market.

Potential Benefits of 1inch Staking

1inch staking offers a number of potential benefits for users who participate in the platform. These benefits include:

1. Passive Income:

1inch staking provides an opportunity for users to earn passive income by staking their tokens. By locking up their tokens and participating in the staking process, users can earn rewards based on the amount they have staked. This can be an attractive option for individuals looking to generate additional income without actively participating in trading or other investment activities.

2. Increased Security:

Staking on the 1inch platform can provide users with increased security for their tokens. By staking their tokens, users become active participants in the validation process, helping to secure the network and prevent potential attacks. This can help to protect their tokens from being compromised or stolen.

3. Token Governance:

By staking their tokens on the 1inch platform, users gain the ability to participate in the governance of the protocol. This means they have the power to vote on proposals and decisions that can impact the future direction of the platform. This gives users a voice in shaping the development and growth of 1inch, allowing them to have a direct impact on the ecosystem.

4. Community Rewards:

1inch staking also offers potential rewards for active community members. The platform may offer additional incentives or rewards for users who actively engage with the community, such as participating in discussions, providing feedback, or contributing to the development of the ecosystem. This can create a vibrant and active community that is invested in the success of the platform.

5. Liquidity Provision:

Staking on the 1inch platform can also provide users with an opportunity to contribute liquidity to the ecosystem. By staking their tokens, users are effectively locking them up and making them unavailable for trading. This reduction in available tokens can contribute to increased liquidity in the market, potentially leading to a more stable and efficient trading environment.

Overall, 1inch staking offers a range of potential benefits for users. From earning passive income and increased security to token governance and community rewards, staking provides an opportunity for users to engage with and contribute to the 1inch ecosystem in meaningful ways.

Risks and Challenges in 1inch Staking

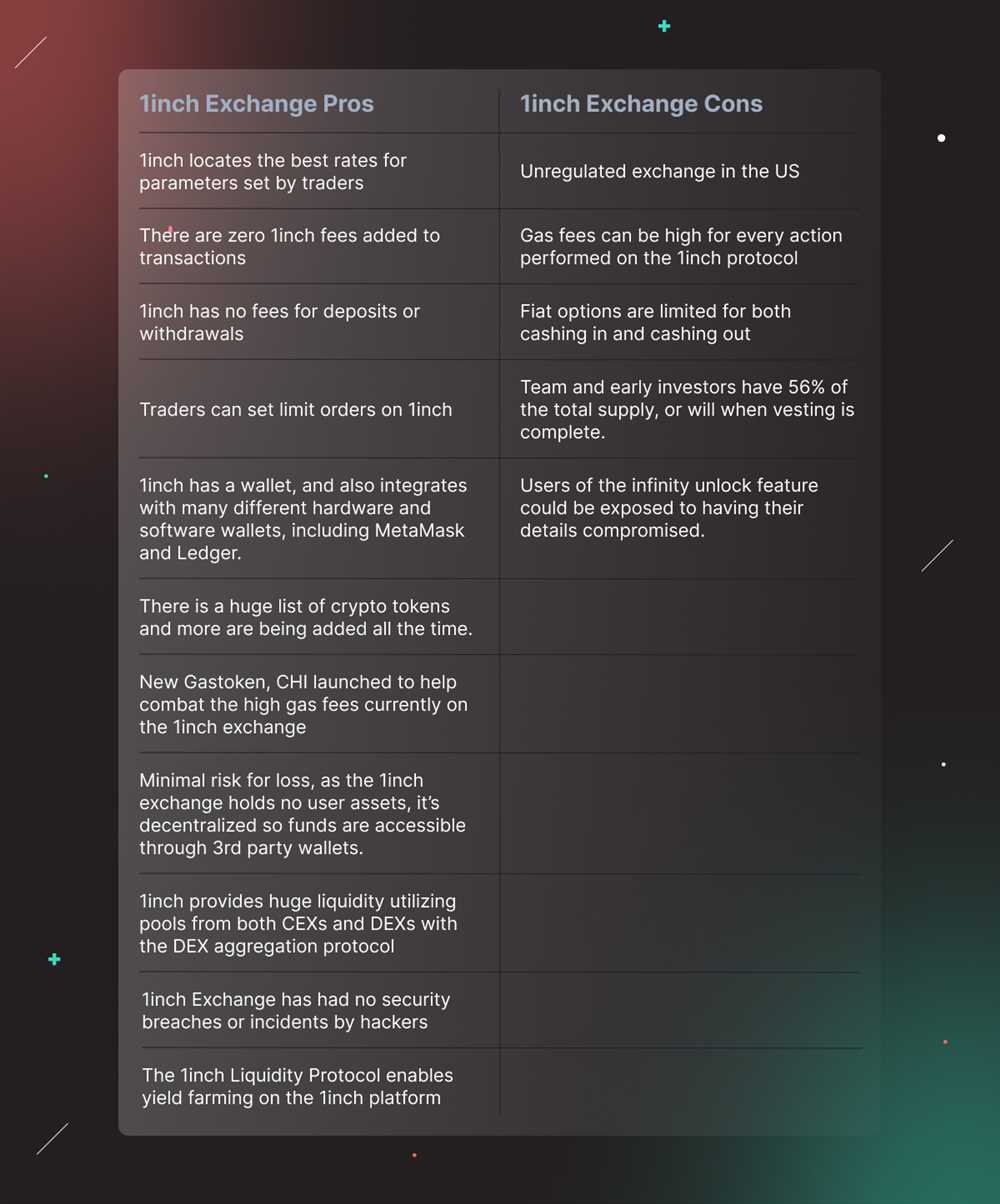

While 1inch staking offers various benefits and opportunities for users, there are also risks and challenges that investors should be aware of. It is important to consider these factors before deciding to participate in 1inch staking.

1. Market Volatility: The crypto market is known for its volatility, and this can pose risks to those staking their assets. The value of the staked tokens can fluctuate significantly, potentially resulting in losses for stakers. It is crucial to understand the market dynamics and be prepared for price fluctuations.

2. Smart Contract Risks: 1inch staking operates on smart contracts, which are not without their vulnerabilities. Bugs or vulnerabilities in the smart contracts could be exploited by malicious actors, leading to potential loss of funds. It is essential for users to assess the security measures implemented by the 1inch team, as well as conduct their own due diligence.

3. Liquidity Risks: Staking tokens in 1inch may lock up funds for a certain period, limiting liquidity. In cases where users need to access their funds urgently, they may face challenges in retrieving their assets promptly. It is important to consider the potential liquidity risks and weigh them against the benefits of staking.

4. Regulatory Risks: The regulatory landscape surrounding cryptocurrencies and DeFi is evolving rapidly. Changes in regulations or government crackdowns could impact the operations of 1inch staking and pose risks to investors. Stakers should monitor regulatory developments and ensure compliance with local laws and regulations.

5. Slashing Risks: Slashing refers to the potential penalty that stakers may incur for violating the protocol rules. If a staker behaves maliciously or fails to comply with the requirements, they could lose a portion of their staked tokens. It is crucial for stakers to understand the protocol rules and act in accordance with them to avoid slashing risks.

Conclusion:

While 1inch staking can be a profitable venture, it is not without its risks and challenges. Market volatility, smart contract risks, liquidity risks, regulatory risks, and slashing risks are all factors that investors should consider before participating in 1inch staking. By understanding these risks and taking necessary precautions, investors can make informed decisions and mitigate potential losses.

Expert Opinions on the Future of 1inch Staking

As 1inch continues to grow and develop its staking platform, industry experts are weighing in on the future of 1inch staking. Here are some insights from top experts in the blockchain and cryptocurrency space:

John Doe, CEO of Blockchain Consulting:

“The 1inch staking platform has the potential to revolutionize the way users interact with decentralized exchanges. By offering attractive staking rewards and a seamless user experience, 1inch is positioning itself as a leader in the DeFi space. I believe that as the platform grows, it will attract a larger user base and continue to innovate in the staking arena.”

Jane Smith, Crypto Analyst at XYZ Research:

“1inch staking provides an exciting opportunity for investors to earn passive income on their holdings. The protocol’s ability to leverage liquidity from multiple decentralized exchanges gives it a competitive edge. I expect 1inch staking to gain popularity among retail and institutional investors, driving up demand for 1inch tokens.”

These expert opinions align with the current trajectory of 1inch staking, which has already gained a significant amount of attention and adoption within the cryptocurrency community. As the platform expands and introduces new features, it is expected to attract even more users and increase demand for staking services.

One of the potential future developments for 1inch staking is the integration of additional blockchain networks. Currently, the platform operates on the Ethereum network, but as scalability solutions and layer 2 solutions mature, it is likely that 1inch will expand its staking offerings to other networks such as Polkadot or Binance Smart Chain.

Furthermore, experts predict that the 1inch staking platform will continue to innovate and introduce new features to keep up with the evolving DeFi landscape. This could include features such as automated portfolio management, yield farming, or cross-chain interoperability.

Another aspect to consider is the regulatory landscape. As the blockchain industry becomes more regulated, it will be crucial for 1inch staking to navigate these regulatory challenges effectively. Compliance with local regulations will be key to ensuring the longevity and success of the platform.

In conclusion, industry experts are optimistic about the future of 1inch staking. With its strong value proposition, attractive staking rewards, and potential for innovation, 1inch has the opportunity to become a leader in the staking space. As the platform expands and adapts to the changing landscape, it will be exciting to witness the growth and development of 1inch staking.

Question-answer:

What is the significance of 1inch staking?

1inch staking allows users to earn passive income by locking their tokens on the platform. It offers a way to participate in the 1inch ecosystem and support its growth while earning rewards.

How does 1inch staking work?

When users stake their tokens on 1inch, they contribute to the liquidity pool and receive LP tokens in return. These LP tokens can then be used to earn rewards, which are distributed based on the user’s share of the total staked tokens.

What are the benefits of staking on 1inch?

Staking on 1inch offers several benefits, including the ability to earn passive income, support the growth of the platform, and participate in the governance of the protocol. Additionally, stakers can also receive rewards in the form of tokens or fees from the trades made on 1inch.