Looking to invest in the rapidly growing cryptocurrency market?

Don’t miss out on the potential gains offered by the 1inch Coin!

Attracting the attention of investors worldwide, 1inch has emerged as a promising decentralized exchange (DEX) protocol, facilitating efficient and cost-effective trades across various platforms.

But what is the future price of 1inch Coin?

Our team of market analysts and trend experts has conducted an in-depth analysis of 1inch Coin and its market dynamics. Leveraging cutting-edge technologies and mathematical models, we have developed a prediction framework that can help you make informed investment decisions.

Why rely on guesswork when you can make data-driven choices?

Our comprehensive market analysis takes into account various factors, such as historical price trends, trading volume, market sentiment, and technological advancements, to provide you with a reliable prediction of the future price of 1inch Coin.

Take the guesswork out of investing and stay ahead of the market with our accurate price predictions!

Whether you’re a seasoned investor or just stepping into the world of cryptocurrencies, our insights can empower you to make smarter investment decisions and maximize your potential returns.

Don’t wait! Stay informed and stay ahead with our accurate price predictions for 1inch Coin. Start making smarter investment decisions today!

Understanding the 1inch Coin

The 1inch Coin is a decentralized cryptocurrency that plays a vital role in the 1inch Network. The 1inch Network is a decentralized exchange (DEX) aggregator that sources liquidity from various DEXes to provide users with the best possible trading opportunities.

The 1inch Coin serves multiple purposes within the network. Firstly, it is used for governance, allowing holders to participate in the decision-making process regarding network upgrades and changes. This gives the community a voice in the development and evolution of the 1inch Network.

Additionally, the 1inch Coin is used as a utility token within the ecosystem. Holders of the coin can access various features and benefits, such as fee discounts, enhanced trading options, and priority access to new features and services. This creates an incentive for users to hold and utilize the 1inch Coin.

Moreover, the 1inch Coin has a deflationary model. A portion of the fees generated by the 1inch Network is used to buy and burn 1inch Coins, reducing the total supply over time. This mechanism helps to create scarcity and potentially increase the value of the coin for holders.

It’s important to note that investing in cryptocurrencies, including the 1inch Coin, comes with risks. The market for cryptocurrencies is highly volatile, and the value of the 1inch Coin can fluctuate significantly. It’s essential to do thorough research and understand the risks before making any investment decisions.

In conclusion, the 1inch Coin is an integral part of the 1inch Network, providing governance rights and utility within the ecosystem. It offers holders various benefits and advantages and has a deflationary model that could potentially increase its value over time. However, it’s crucial to approach cryptocurrency investments with caution and make informed decisions.

Market Analysis of 1inch Coin

1inch Coin is a digital asset that has gained significant attention and popularity in the cryptocurrency market. As an open-source decentralized exchange aggregator, 1inch Coin aims to provide users with the best possible rates for their trades across various decentralized exchanges.

Increasing Adoption

1inch Coin has witnessed an impressive surge in adoption since its launch. With its unique approach towards finding the most lucrative trading opportunities for its users, 1inch Coin has attracted a large number of traders and investors alike. The platform’s user-friendly interface and advanced trading features contribute to its growing popularity.

Furthermore, 1inch Coin has formed strategic partnerships with major cryptocurrency projects and platforms, enhancing its credibility and expanding its reach. These partnerships have resulted in increased liquidity and trading volume on the 1inch platform, making it an attractive option for traders looking to optimize their profits.

Market Trends

The market trends of 1inch Coin are highly promising. The coin has seen a steady increase in its value since its inception, reflecting the confidence of the crypto community in its potential. Its market capitalization has also been on an upward trajectory, demonstrating a growing interest from investors.

1inch Coin is well-positioned in a rapidly evolving decentralized finance (DeFi) landscape. With the growing popularity of decentralized exchanges, the demand for liquidity and efficient trading solutions is only expected to increase. As a key player in the DeFi space, 1inch Coin has the potential to capitalize on this demand and secure a strong market position.

Additionally, the development team behind 1inch Coin is committed to continuous innovation and improvement. They regularly introduce new features and enhancements to the platform, ensuring its competitiveness in the market. This dedication to innovation further fuels the positive market sentiment surrounding 1inch Coin.

In summary, the market analysis of 1inch Coin reveals a coin with significant potential and a bright future in the cryptocurrency market. Its increasing adoption, strategic partnerships, and favorable market trends position it as a promising investment option for traders and investors alike.

Historical Price Trends

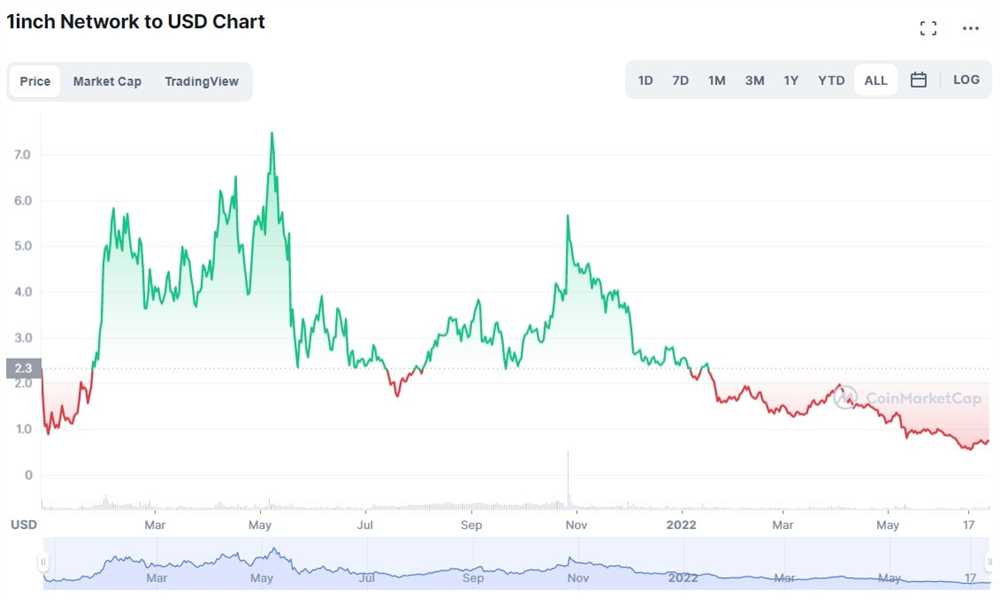

When analyzing the price of the 1inch Coin, it is essential to consider the historical trends. By examining the past price movements, we can gain valuable insights into potential future price fluctuations.

Over the past year, the price of 1inch Coin has experienced significant volatility. In January 2021, the coin started trading at $0.75. By March 2021, the price had surged to an all-time high of $5.78. This rapid increase in value attracted investors and traders alike.

However, the market sentiment changed in April 2021, and the price underwent a correction, declining to $2.15. Throughout May 2021, the price remained relatively stable, fluctuating between $2.10 and $2.50.

In June 2021, the price of 1inch Coin experienced another surge. It reached $4.80, driven by positive market sentiment and increased demand from investors. This trend continued throughout the summer, with the coin reaching an all-time high of $6.92 in August 2021.

Since then, the price of 1inch Coin has fluctuated, influenced by various factors such as market dynamics, regulatory news, and overall cryptocurrency sentiment. It is important to stay updated on the latest market developments and carefully analyze historical price trends to make informed investment decisions.

As with any investment, it is crucial to conduct thorough research, consider risk factors, and consult with financial advisors before making any investment decisions related to 1inch Coin.

Factors Affecting the Price

When it comes to predicting the price of the 1inch coin, it is important to consider various factors that can affect its value. These factors include:

1. Market Demand: The demand for the 1inch coin in the cryptocurrency market can heavily influence its price. If there is high demand from investors and traders, the price is likely to increase. On the other hand, if there is low demand, the price may drop.

2. Market Sentiment: Market sentiment plays a crucial role in determining the price of the 1inch coin. Positive sentiment, such as news about partnerships or technological advancements, can drive up the price. Conversely, negative sentiment, such as regulatory actions or security breaches, can cause the price to decline.

3. Supply and Circulation: The total supply of 1inch coins and their circulation in the market can impact the price. If there is a limited supply or a decrease in circulation, it can create scarcity and drive up the price. Conversely, an increase in supply or circulation can put downward pressure on the price.

4. Market Trends: Monitoring market trends and patterns can provide insights into the future direction of the 1inch coin’s price. Technical analysis, such as chart patterns and indicators, can help identify potential price movements based on historical data.

5. Overall Cryptocurrency Market: The performance and trends of the overall cryptocurrency market can also influence the price of the 1inch coin. Factors such as Bitcoin’s price movement, regulatory developments, and investor sentiment towards cryptocurrencies as a whole can impact the price of individual coins, including 1inch.

6. News and Events: News and events, both within the cryptocurrency space and in the wider world, can have a significant impact on the price of the 1inch coin. Positive news, such as new partnerships or listings on major exchanges, can cause the price to rise. Negative news, such as hacking incidents or regulatory crackdowns, can lead to price declines.

It is important for potential investors and traders to consider these factors and conduct thorough research before making any decisions regarding the 1inch coin. While these factors can provide insights, they are not guarantees, and the price of the 1inch coin can be subject to high volatility and unpredictable market conditions.

Predicting the Price of 1inch Coin

As the popularity of cryptocurrency continues to grow, investors are seeking new opportunities to maximize their profits. One coin that has been gaining attention in the market is 1inch Coin. With its innovative approach to decentralized trading, 1inch Coin has the potential to revolutionize the way we buy and sell digital assets.

Market Analysis

In order to predict the price of 1inch Coin, it is important to analyze the current market trends. By studying the historical data and market indicators, we can gain insights into the factors that may influence the future price of the coin. Some key factors to consider include the overall market sentiment, trading volume, liquidity, and the performance of similar coins in the market.

Trends

By analyzing the trends in the cryptocurrency market, we can identify patterns and make predictions about the future price of 1inch Coin. It is important to consider both short-term and long-term trends. Short-term trends may be influenced by news events, market fluctuations, and investor sentiment. Long-term trends may be influenced by the adoption of decentralized trading platforms, regulatory developments, and the overall growth of the cryptocurrency market.

| Factors to Consider | Impact on Price |

|---|---|

| Market Sentiment | Positive sentiment may drive prices up, while negative sentiment may lead to a decrease in price. |

| Trading Volume | Higher trading volume often indicates increased demand and can lead to an increase in price. |

| Liquidity | A higher level of liquidity can attract more investors and potentially drive up the price. |

| Performance of Similar Coins | If similar coins have experienced significant price increases, it may indicate a positive trend for 1inch Coin. |

In conclusion, predicting the price of 1inch Coin requires a thorough analysis of market trends and factors that may influence its price. By staying informed and conducting in-depth research, investors can make more informed decisions about whether to buy or sell 1inch Coin.

Technical Analysis

In order to predict the price of 1inch Coin, a technical analysis can be conducted using various tools and indicators. Technical analysis is a method that uses historical price data and trading volume to forecast future price movements.

One commonly used tool in technical analysis is moving averages. Moving averages track the average price of an asset over a specific time period and can help identify trends. For example, a rising moving average may indicate an uptrend, while a falling moving average may suggest a downtrend. Traders often use different combinations of moving averages, such as the 50-day and 200-day moving averages, to generate buy or sell signals.

Another commonly used tool is the Relative Strength Index (RSI), which measures the speed and change of price movements. The RSI ranges from 0 to 100 and can be used to identify overbought or oversold conditions. When the RSI is above 70, it may indicate that the asset is overbought and due for a correction. Conversely, when the RSI is below 30, it may suggest that the asset is oversold and due for a reversal.

Additionally, chart patterns such as triangles, head and shoulders, and double tops or bottoms can provide insights into future price movements. These patterns are formed by the price action on the chart and can indicate trend reversals or continuations.

It’s important to note that technical analysis is not always accurate and should be used in conjunction with other forms of analysis, such as fundamental analysis. It is also important to regularly update and adjust the analysis as new data becomes available.

Disclaimer: The information provided here is for informational purposes only and should not be considered as financial advice. Investing in cryptocurrencies is highly speculative and carries a high level of risk. Always do your own research and consult with a professional before making any investment decisions.

Question-answer:

What is the predicted price of the 1inch Coin?

The predicted price of the 1inch Coin is expected to increase in the near future due to its growing popularity and adoption in the cryptocurrency market.

What factors are influencing the price of the 1inch Coin?

Several factors can influence the price of the 1inch Coin, including overall market trends, demand and supply dynamics, changes in investor sentiment, and developments in the 1inch ecosystem.

Is it a good time to invest in the 1inch Coin?

As with any investment, it is important to conduct thorough research and consider your own risk tolerance before investing in the 1inch Coin or any other cryptocurrency. It is recommended to consult with a financial advisor or do your own analysis before making any investment decisions.

What are the potential risks associated with investing in the 1inch Coin?

Investing in the 1inch Coin, like any other cryptocurrency, carries inherent risks. These include market volatility, regulatory changes, technological risks, and the potential for loss of investment. It is important to be aware of these risks and only invest what you can afford to lose.