In the rapidly evolving world of decentralized finance (DeFi), one platform has been making waves and gaining significant traction among users – the 1inch Aggregator. This innovative tool has emerged as a leader in the DeFi space, revolutionizing the way traders and investors access liquidity across various decentralized exchanges (DEXs).

The 1inch Aggregator’s success can be attributed to its unique approach of combining the liquidity pools of multiple DEXs into one, enabling users to get the best possible rates for their trades. By harnessing the power of smart contracts and algorithmic trading, 1inch has created a seamless and efficient user experience that maximizes profits and minimizes slippage.

Since its launch, the 1inch Aggregator has experienced remarkable growth and adoption within the DeFi community. Traders and investors have flocked to the platform, drawn by its competitive rates and enhanced liquidity. This surge in popularity can be attributed to the platform’s commitment to transparency, security, and user-centric design.

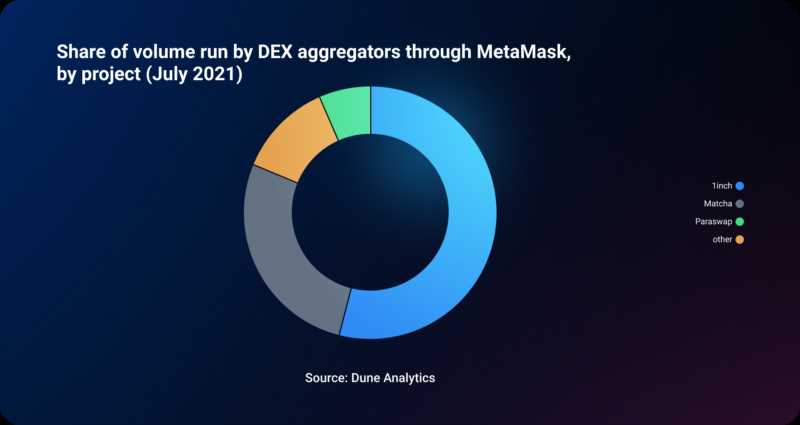

Moreover, the 1inch Aggregator’s integration with popular decentralized wallets and its user-friendly interface have played a crucial role in driving adoption. The platform has seamlessly integrated with wallets like MetaMask and Trust Wallet, making it accessible to a wide range of users. Additionally, the intuitive user interface of the platform ensures a smooth onboarding experience, even for beginners in the DeFi space.

As the DeFi ecosystem continues to expand and mature, it is clear that platforms like the 1inch Aggregator are here to stay. Its unique value proposition and commitment to innovation have positioned it as a frontrunner in the industry. With its growing user base and constant development of new features, the 1inch Aggregator is set to play a pivotal role in shaping the future of decentralized finance.

Understanding the Rise of the 1inch Aggregator in DeFi

The decentralized finance (DeFi) community has been experiencing a tremendous growth in the past few years, with new projects and platforms popping up almost every day. Among these projects, the 1inch Aggregator has gained significant attention and adoption in the DeFi space.

The 1inch Aggregator is a decentralized exchange (DEX) aggregator that allows users to find the best prices across multiple DEXs. It combines liquidity from various DEXs to provide users with the most competitive rates for their trades. This innovative solution has garnered the attention of many DeFi enthusiasts and traders.

One of the key reasons behind the rise of the 1inch Aggregator is its focus on improving user experience. The platform is designed to be user-friendly and intuitive, making it easy for both novice and experienced traders to navigate and execute trades. The interface is clean and simple, with all the necessary information presented in a clear and concise manner.

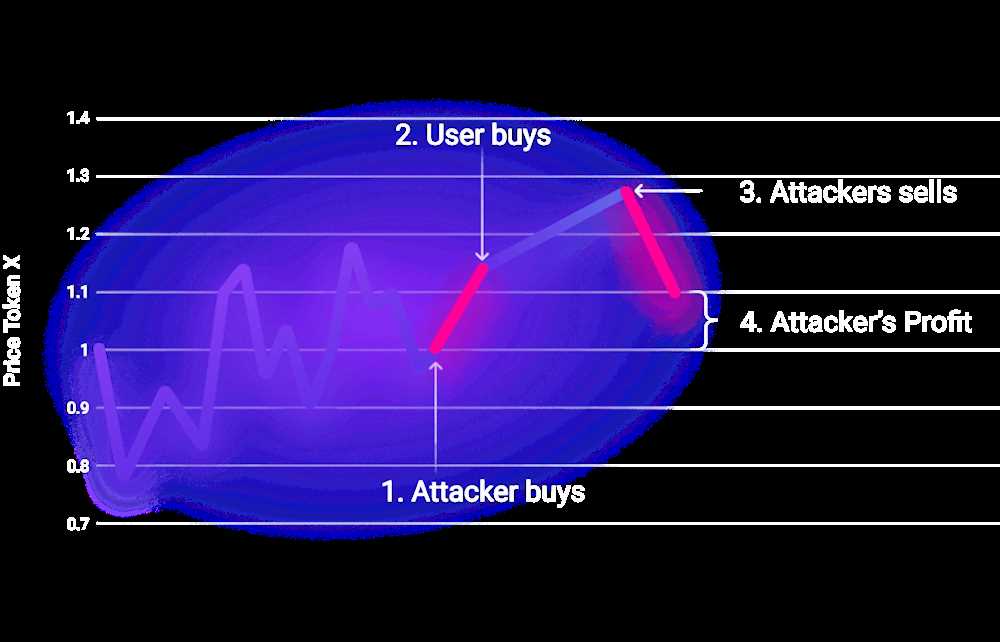

In addition to its user-friendly interface, the 1inch Aggregator also offers fast and efficient trade execution. The platform leverages smart contract technology to execute trades directly on the blockchain, eliminating the need for intermediaries and reducing the risk of slippage. This ensures that users are able to get the best possible price for their trades, without having to worry about delays or unauthorized access.

Furthermore, the 1inch Aggregator has gained a reputation for being a reliable and secure platform. The team behind the project has implemented various security measures to protect users’ funds and personal information. This includes the use of multi-signature wallets, regular security audits, and integration with reputable blockchain security providers.

Overall, the rise of the 1inch Aggregator in DeFi can be attributed to its innovative approach to DEX trading, focus on user experience, fast and efficient trade execution, and commitment to security. As the DeFi space continues to evolve and grow, it will be interesting to see how the 1inch Aggregator further establishes itself as a prominent player in the industry.

| Advantages of the 1inch Aggregator | Differentiating Factors |

|---|---|

| – Provides the best prices across multiple DEXs | – User-friendly interface |

| – Fast and efficient trade execution | – Secure platform with robust security measures |

| – Reduces slippage and ensures the best price for trades | – Integration with reputable blockchain security providers |

Examining the Factors Driving the Adoption of 1inch Aggregator

The 1inch Aggregator has witnessed significant growth and adoption within the decentralized finance (DeFi) community. Several key factors have contributed to the rapid adoption of this platform, making it a preferred choice for users:

- Efficiency: One of the primary factors driving the adoption of the 1inch Aggregator is its efficiency. The platform is designed to provide users with optimized trade routes, resulting in reduced slippage and lower transaction costs. By aggregating liquidity from multiple decentralized exchanges (DEXs), the 1inch Aggregator offers improved trading experiences for users.

- Cost-effectiveness: The 1inch Aggregator has gained popularity among users due to its cost-effectiveness. By routing trades through the most optimal paths, the platform minimizes gas fees and ensures that users obtain the best possible prices for their trades. This cost-saving feature has attracted traders who seek to maximize their profits and minimize their expenses.

- Increased liquidity: As a decentralized exchange aggregator, 1inch combines liquidity from multiple DEXs, increasing the overall liquidity available for users. This enhanced liquidity translates into better trade execution, reduced price impact, and improved market efficiency. Traders benefit from the ability to access deeper pools of liquidity, leading to improved trading opportunities.

- Advanced algorithms: The 1inch Aggregator leverages advanced algorithms to provide users with the best possible trading routes. These algorithms analyze various factors, such as exchange rates, liquidity pools, and gas fees, to determine the most optimal paths for executing trades. By utilizing these sophisticated algorithms, the 1inch Aggregator ensures that users can maximize their trade efficiency and minimize their costs.

- User-friendly interface: Another factor driving the adoption of the 1inch Aggregator is its user-friendly interface. The platform offers a seamless and intuitive trading experience, making it accessible to both experienced and novice users. With features such as automatic token swapping and one-click trading, users can easily navigate the platform and execute trades efficiently.

In summary, the 1inch Aggregator has gained popularity within the DeFi community due to its efficiency, cost-effectiveness, increased liquidity, advanced algorithms, and user-friendly interface. These factors have contributed to its rapid adoption and position as a preferred choice for users in the decentralized finance ecosystem.

Analyzing the Success Metrics of 1inch Aggregator in the DeFi Community

As the decentralized finance (DeFi) industry continues to grow and evolve, one protocol that has gained significant traction is the 1inch aggregator. Built on the Ethereum blockchain, 1inch allows users to access liquidity from various decentralized exchanges (DEXs) in a single transaction. This article will delve into the success metrics that have propelled 1inch aggregator to prominence within the DeFi community.

1. Volume and Liquidity

One of the key success metrics for any aggregator is the volume of trades executed and the liquidity provided to users. 1inch has excelled in this regard, with billions of dollars in trading volume and a deep pool of liquidity available across multiple DEXs. By pulling liquidity from various sources, 1inch ensures better pricing and reduced slippage for users.

This high volume and liquidity have been achieved due to the seamless integration of 1inch with top DeFi protocols like Uniswap, SushiSwap, and Kyber Network. The aggregator intelligently routes transactions to the most favorable exchange based on prices and liquidity, optimizing trades for users.

2. User-Friendly Interface and User Experience

Another crucial success metric for 1inch aggregator is its user-friendly interface and overall user experience. The platform provides a simple and intuitive interface, making it easy for both experienced and novice users to navigate and execute trades. The ability to connect to various wallets, such as MetaMask and WalletConnect, further enhances the user experience.

By prioritizing user experience, 1inch has managed to attract a wide range of DeFi enthusiasts, from casual traders to experienced investors. The platform’s user-friendly design and smooth transaction process have played a significant role in its rapid adoption within the DeFi community.

3. Competitive Fees and Tokenomics

Competitive fees and tokenomics are also important success metrics for 1inch aggregator. The platform offers low fees for executing trades, ensuring cost-effective transactions for users. Additionally, 1inch has its native token, the 1INCH token, which serves multiple purposes within the protocol.

Users can stake their 1INCH tokens to earn rewards, participate in governance, and access various features on the platform. This tokenomics model enhances the value proposition of 1inch aggregator, attracting users who are interested in not only trading but also actively participating in the protocol’s governance and ecosystem.

In conclusion, 1inch aggregator has achieved remarkable success within the DeFi community due to its impressive volume and liquidity, user-friendly interface, and competitive fees. Moreover, the platform’s native token and tokenomics model have contributed to its growing popularity. As the DeFi industry continues to expand, it will be interesting to see how 1inch aggregator further innovates and maintains its position as a leading aggregator in the DeFi space.

Predicting the Future Growth and Impact of 1inch Aggregator in DeFi

As the decentralized finance (DeFi) ecosystem continues to evolve and gain momentum, the 1inch Aggregator has emerged as a leading platform for efficient and cost-effective token swaps across various decentralized exchanges (DEXs). With its innovative approach to liquidity aggregation, 1inch has quickly gained popularity and traction, attracting a large user base and increasing its market share.

Looking ahead, it is highly likely that 1inch Aggregator will experience significant future growth and have a substantial impact on the DeFi landscape. There are several key factors that contribute to this prediction:

| Factor | Explanation |

|---|---|

| Increasing demand for decentralized solutions | With the growing interest in DeFi and the desire for control over one’s finances, there is a rising demand for decentralized solutions that allow users to trade tokens securely and efficiently. 1inch Aggregator’s ability to aggregate liquidity from multiple DEXs addresses this need and positions it for continued growth. |

| Continuous innovation and development | The team behind 1inch Aggregator has shown a strong commitment to innovation and continuously improving the platform’s functionality. This dedication to development ensures that the aggregator remains competitive and able to adapt to the evolving needs of the DeFi community. |

| Integration with other leading DeFi protocols | 1inch Aggregator has already established partnerships and integrations with various prominent DeFi protocols. This collaboration not only expands its reach but also enhances its value proposition by providing users with access to additional liquidity and diverse trading options. |

| Growing community support | The 1inch Aggregator has garnered a loyal and active community of supporters who appreciate its user-friendly interface, competitive pricing, and efficient token swaps. The growing community support contributes to the aggregator’s increasing adoption and, consequently, its future growth potential. |

In conclusion, the future growth and impact of 1inch Aggregator in the DeFi space look promising. Its innovative liquidity aggregation capabilities, commitment to development, strategic partnerships, and community support place it in a favorable position for continued expansion and influence within the rapidly evolving DeFi industry.

Question-answer:

What is the 1inch Aggregator?

The 1inch Aggregator is a decentralized finance (DeFi) platform that searches for the best trade prices across various decentralized exchanges (DEXs) and executes trades in a single transaction.

How has the 1inch Aggregator grown in the DeFi community?

The 1inch Aggregator has experienced significant growth in the DeFi community. It has seen a steady increase in the number of users utilizing its platform, as well as a rise in total value locked (TVL) in its liquidity pools. This growth can be attributed to the platform’s efficient and low-cost trading experience, as well as its ability to provide users with access to the best prices in the market.

What are the adoption trends of the 1inch Aggregator?

The adoption of the 1inch Aggregator has been impressive. Many users in the DeFi community have recognized the benefits of using the platform, such as its ability to minimize slippage and improve overall trading efficiency. As a result, more and more users are adopting the 1inch Aggregator as their go-to tool for trading on decentralized exchanges.