In the world of decentralized finance (DeFi), the issue of front-running and price manipulation remains a significant challenge. However, the emergence of the 1inch app has brought a promising solution that has the potential to reshape the landscape of DeFi trading. With its innovative technology and user-friendly interface, the 1inch app is revolutionizing how traders can protect their assets and minimize the risk of falling victim to front-running and price manipulation.

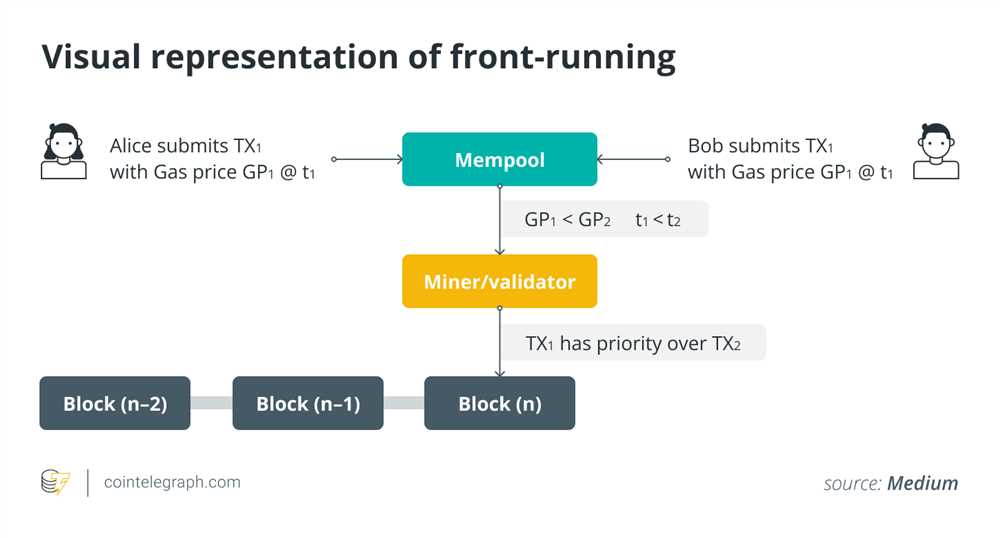

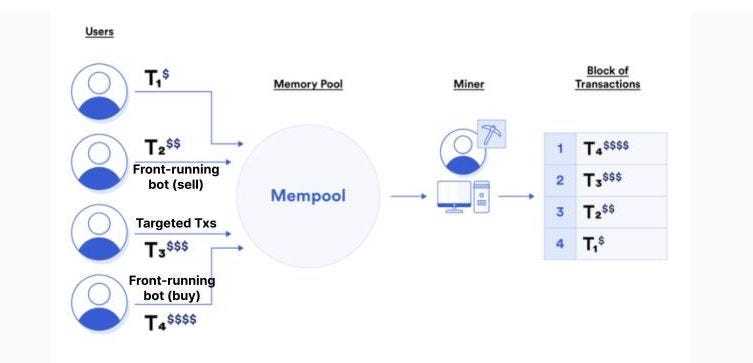

Front-running, also known as transaction frontrunning, is a form of market manipulation where an individual or group of actors exploit their advance knowledge of pending trading activity to profit at the expense of others. This unethical practice not only erodes trust in the DeFi ecosystem but also undermines the principles of fairness and transparency. The 1inch app tackles this issue head-on through its unique feature called “DEX Aggregation.”

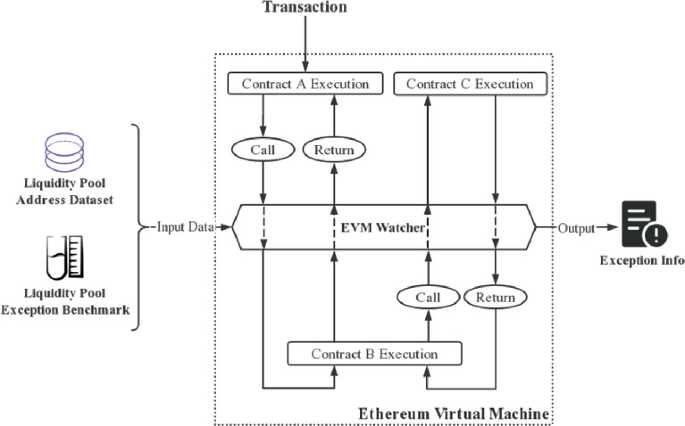

Through DEX Aggregation, the 1inch app leverages smart contract technology to aggregate liquidity from multiple decentralized exchanges (DEXs), including but not limited to Uniswap, Balancer, and SushiSwap. By doing so, the app ensures that traders get the best possible price for their trades, while also making it extremely difficult for front-runners to manipulate the market. This is achieved by splitting trades across multiple DEXs, preventing any single actor from gaining an unfair advantage.

Furthermore, the 1inch app employs an intelligent routing algorithm that dynamically assesses the liquidity and prices across various DEXs. This algorithm takes into account factors such as gas fees, slippage, and token availability to ensure that each trade is executed in the most efficient and secure manner possible. By streamlining the trading process and minimizing the reliance on a single DEX, the 1inch app acts as a powerful deterrent to front-running and price manipulation.

In conclusion, the 1inch app is making a significant impact in reducing front-running and price manipulation within the DeFi space. Its innovative DEX Aggregation feature and intelligent routing algorithm provide traders with a secure and efficient trading experience while mitigating the risks associated with unfair market practices. As the DeFi ecosystem continues to evolve, the 1inch app stands as a testament to the power of technology and innovation in creating a more transparent and equitable financial landscape.

How 1inch App Reduces Front-Running and Price Manipulation

The 1inch App has been designed to address the serious issues of front-running and price manipulation that exist in decentralized finance (DeFi). By utilizing innovative technology and implementing strategic measures, the 1inch App significantly reduces the risks associated with these unethical practices.

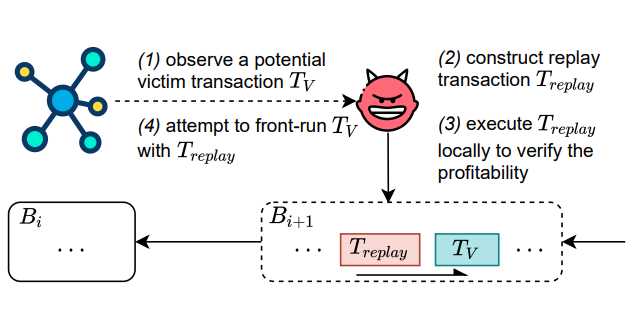

Front-running is a manipulative strategy where individuals or entities exploit their knowledge of pending transactions to gain an unfair advantage. This is typically done by placing orders before executing a large transaction, causing the price to move in their favor. The 1inch App combats front-running by utilizing an algorithm called Pathfinder, which splits a user’s transaction into multiple parts and routes them through different liquidity sources. This minimizes the chances of front-runners identifying and manipulating transactions, as the transaction details are obfuscated.

Price manipulation is another prevalent issue in the DeFi space, where bad actors artificially inflate or deflate prices to their advantage. To counter this, the 1inch App uses a combination of on-chain and off-chain protocols. On-chain protocols ensure that the best prices are obtained by aggregating liquidity from multiple decentralized exchanges (DEXs). Off-chain protocols, on the other hand, provide additional protection by monitoring market conditions, detecting irregularities, and alerting users to potential price manipulation.

Additionally, the 1inch App actively promotes transparency and accountability. It provides users with detailed information and analytics on liquidity sources, token prices, and transaction costs, enabling them to make informed decisions. The integrated user interface also displays the expected final outcome of a transaction, empowering users to assess potential risks and rewards.

The 1inch App’s commitment to reducing front-running and price manipulation has made it a trusted platform in the DeFi space. It has successfully addressed the vulnerabilities that have plagued decentralized exchanges, ensuring a fair and secure trading environment for users.

| Benefits of 1inch App |

|---|

| – Minimizes the risk of front-running |

| – Reduces the chances of price manipulation |

| – Aggregates liquidity from multiple DEXs |

| – Provides transparent information and analytics |

| – Empowers users to make informed trading decisions |

Enhancing Security Against Front-Running

Front-running is a malicious practice where a trader exploits their knowledge of pending transactions to execute their own trades before those transactions are processed. This unethical behavior enables the front-runner to profit at the expense of other traders by manipulating prices.

1inch App, with its advanced algorithms and smart contract technology, has implemented several measures to enhance security against front-running:

Transaction Randomization

To counter front-running, 1inch App employs transaction randomization techniques that obfuscate the underlying transactions. By randomizing the order and timing of transactions, potential front-runners are unable to accurately predict and front-run the trades.

Gas Optimization

1inch App continuously works towards minimizing the exposure time of transactions by optimizing gas usage. By reducing the time between transaction submission and execution, the window for front-running is significantly reduced.

Slippage Protection

1inch App provides slippage protection functionality to prevent malicious actors from exploiting price manipulation. Users have the option to set slippage limits, which ensure that their transactions are executed at the expected prices or are reverted if the slippage exceeds the defined thresholds.

These security measures implemented by 1inch App make it increasingly difficult for front-runners to successfully engage in their nefarious activities. By prioritizing user security and guarding against front-running, 1inch App aims to foster a fair and transparent trading environment.

Preventing Price Manipulation with Smart Contract Technology

In the world of decentralized finance (DeFi), price manipulation is a persistent problem. Traders and investors are often at the mercy of malicious actors who exploit the lack of transparency and centralized control in the market. One way to address this issue is through the use of smart contract technology.

Smart contracts, which are self-executing contracts with the terms of the agreement directly written into the code, can help prevent price manipulation in several ways. Firstly, they eliminate the need for intermediaries and middlemen, reducing the risk of manipulation by these parties.

Secondly, smart contracts can enforce transparency and fairness by automatically executing transactions based on predefined conditions. This means that market participants cannot manipulate the price of an asset or engage in front-running, as the smart contract will only execute the transaction if the conditions are met.

Furthermore, smart contracts can be designed to prevent price manipulation by implementing mechanisms such as time-locked transactions and decentralized price oracles. Time-locked transactions ensure that trades cannot be executed within a specific time period, preventing malicious actors from rapidly buying or selling an asset to manipulate its price.

Decentralized price oracles, on the other hand, provide real-time and accurate price information to smart contracts, ensuring that the execution of transactions is based on reliable data. This eliminates the risk of market manipulation through false or manipulated price feeds.

Overall, smart contract technology has the potential to greatly reduce price manipulation and improve the integrity of decentralized markets. By eliminating intermediaries, enforcing transparency, and implementing mechanisms to prevent manipulation, smart contracts can level the playing field for traders and investors in the DeFi space.

| Benefits of Smart Contract Technology in Preventing Price Manipulation |

|---|

| Eliminates the need for intermediaries and middlemen |

| Enforces transparency and fairness |

| Implements time-locked transactions to prevent rapid price manipulation |

| Utilizes decentralized price oracles for reliable price information |

Ensuring Decentralized and Transparent Trading

One of the main challenges faced by decentralized exchanges (DEXs) is the issue of front-running and price manipulation. These unethical practices can have a significant impact on the overall fairness and transparency of the trading process. However, with the advent of the 1inch app, there has been a significant improvement in ensuring decentralized and transparent trading.

The 1inch app is designed to provide users with the best possible prices by splitting their orders across multiple DEXs. This not only helps to eliminate front-running but also reduces the potential for price manipulation. By leveraging the power of smart contract technology, the 1inch app ensures that trades are executed securely and without interference from any external parties.

In addition to eliminating front-running and price manipulation, the 1inch app also promotes transparency in the trading process. All transactions on the platform are recorded on the blockchain, making them immutable and publicly accessible. This allows users to verify the authenticity of their trades and ensures that there is no room for manipulation or fraud.

Furthermore, the 1inch app provides users with comprehensive data and analytics, allowing them to make informed trading decisions. Users can access information about the liquidity and trading volumes of various DEXs, enabling them to identify the most suitable trading opportunities. This level of transparency empowers traders and reduces the risk of falling victim to unfair practices.

Overall, the 1inch app is playing a crucial role in ensuring decentralized and transparent trading. By addressing the issue of front-running and price manipulation, it is creating a more level playing field for all traders. Through its focus on transparency and accessibility, the 1inch app is helping to establish trust and integrity within the decentralized trading ecosystem.

Facilitating Fair Market Competition and Balanced Pricing

The 1inch App has greatly contributed to facilitating fair market competition and ensuring balanced pricing within the cryptocurrency ecosystem. By employing various innovative algorithms and techniques, the platform has effectively reduced front-running and price manipulation practices that were prevalent in the decentralized finance (DeFi) space.

One of the key features of the 1inch App is its ability to route orders through multiple decentralized exchanges (DEXs) in order to achieve the best possible prices for users. This not only helps to prevent price manipulation by individual DEXs but also promotes healthy competition among them. By bringing together liquidity from multiple sources, the platform ensures that users get the most competitive rates for their trades, without any undue influence on the prices.

Moreover, the 1inch App leverages the power of its Pathfinder algorithm to find the most cost-effective routes for trades, considering factors such as gas costs and slippage. This ensures that users are able to execute their trades at the lowest possible costs, thereby promoting fairness and balance in the market. By mitigating the impact of slippage and high gas fees, the platform makes trading more accessible and affordable for both retail and institutional investors.

Furthermore, the 1inch App incorporates various mechanisms to detect and prevent front-running, a practice where traders exploit advance knowledge of pending transactions to their advantage. By splitting large orders into smaller ones and randomizing their execution, the platform makes it extremely difficult for front-runners to gain an unfair advantage. This helps to level the playing field and ensures that all traders have an equal opportunity to transact without being subjected to price manipulation.

The transparent and open-source nature of the 1inch App also plays a significant role in facilitating fair market competition and balanced pricing. By providing users with access to the underlying smart contract code, the platform promotes trust and fosters a sense of security. This encourages more participation and liquidity in the market, leading to healthier competition and improved pricing conditions.

| Benefits of the 1inch App in facilitating fair market competition: | Benefits of the 1inch App in ensuring balanced pricing: |

|---|---|

| – Reduces front-running | – Routes orders through multiple DEXs for competitive pricing |

| – Prevents price manipulation | – Uses Pathfinder algorithm for cost-effective trades |

| – Levels the playing field for all traders | – Mitigates slippage and high gas fees |

| – Increases market participation and liquidity | – Prevents front-running through order randomization |

Overall, the 1inch App has had a profound impact on reducing front-running and price manipulation in the cryptocurrency market. By facilitating fair market competition and ensuring balanced pricing, the platform has created a more transparent and trustworthy environment for traders and investors.

Q&A:

What is the 1inch app?

The 1inch app is a decentralized exchange aggregator that sources liquidity from various exchanges to offer users the most favorable trading rates. It allows users to swap tokens at the best available prices across multiple decentralized exchanges.

How does the 1inch app reduce front-running?

The 1inch app reduces front-running by splitting a user’s trade across multiple decentralized exchanges, making it difficult for frontrunners to predict and manipulate the trade. This is achieved through the use of smart contracts that divide the trade to minimize slippage and prevent frontrunning.

What is front-running?

Front-running is a practice where traders exploit their knowledge of pending transactions to gain an unfair advantage by placing their own orders ahead of those transactions. This allows them to profit from the price movement caused by the pending transaction.

How does the 1inch app reduce price manipulation?

The 1inch app reduces price manipulation by aggregating liquidity from multiple decentralized exchanges and splitting a user’s trade across them. This reduces the impact of any single exchange or market participant on the price, making it more difficult for manipulators to artificially influence prices.

Is the 1inch app safe to use?

Yes, the 1inch app is designed with security in mind. It uses smart contracts to ensure the safety of user funds and employs various techniques to prevent front-running and price manipulation. However, users should still exercise caution and make sure they are interacting with the official and secure version of the app.