Analyzing the Effects of 1inch Network on the Adoption of DeFi among Regular Users and its Influence in the Mainstream Market.

Decentralized Finance (DeFi) has revolutionized the financial landscape by offering open, permissionless, and trustless financial services to users around the world. One of the key players in the DeFi space is the 1inch Network, an innovative and efficient decentralized exchange aggregator.

With its advanced algorithms and partnerships with top liquidity providers, the 1inch Network allows users to access the best prices and deep liquidity across multiple decentralized exchanges. By splitting a user’s orders across different liquidity sources, the 1inch Network ensures that users always get the most favorable rates for their trades.

But what truly sets the 1inch Network apart is its impact on DeFi adoption and mainstream users. By providing a seamless and user-friendly experience, 1inch has made DeFi accessible to a wider audience. Its intuitive interface and simple navigation empower users to interact with DeFi protocols without any prior technical knowledge.

Furthermore, the 1inch Network acts as a bridge between different blockchains, enabling users to seamlessly swap assets across different networks. This interoperability feature not only expands the possibilities for DeFi users but also attracts mainstream users who are looking for a hassle-free way to diversify their crypto portfolios.

In conclusion, the 1inch Network has had a profound impact on DeFi adoption and mainstream users. By offering efficient and user-friendly solutions, 1inch has not only made DeFi more accessible but has also contributed to the integration of decentralized finance into the mainstream financial ecosystem.

The Rise of 1inch Network

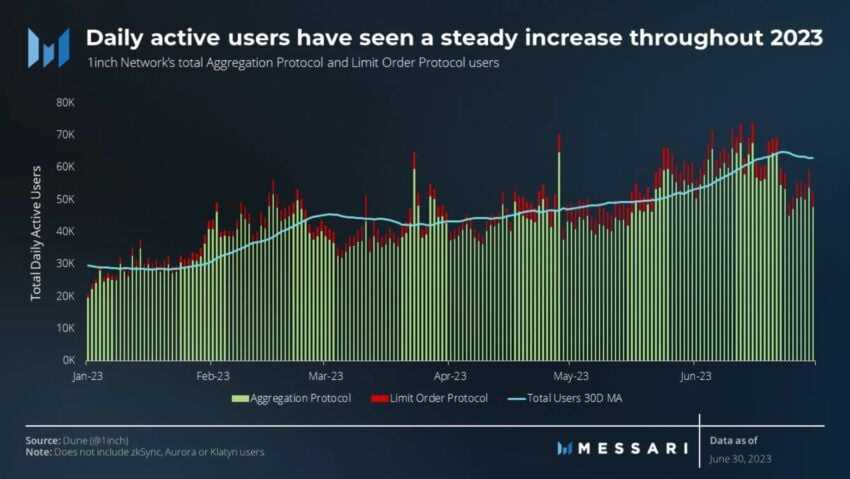

The 1inch Network has emerged as a powerful force in the decentralized finance (DeFi) space, revolutionizing the way users interact with decentralized exchanges (DEXs) and aggregators. Launched in 2019 by Sergej Kunz and Anton Bukov, 1inch quickly gained popularity and widespread adoption due to its innovative approach to solving the liquidity problem faced by many DEXs.

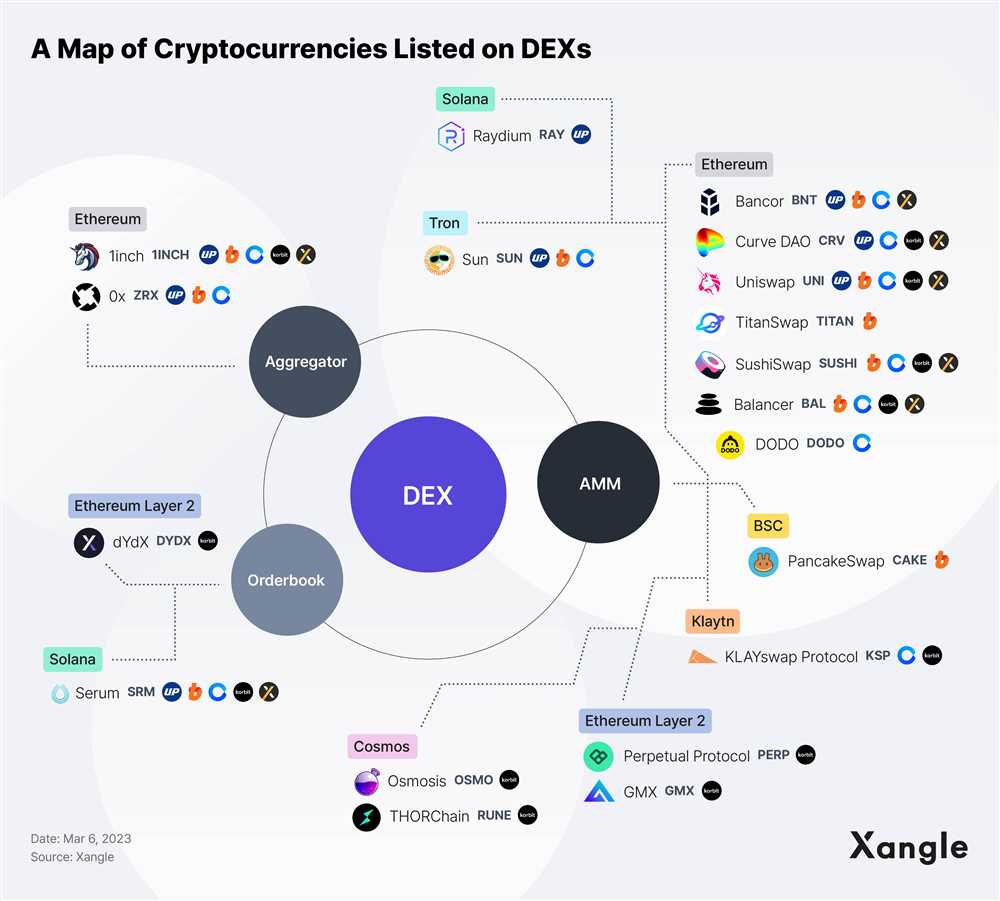

One of the key features that propelled 1inch Network to success is its ability to source liquidity from multiple DEXs and aggregators, enabling users to access the best available prices for their trades. By integrating with different liquidity sources, such as Uniswap, Kyber Network, and Balancer, 1inch can achieve optimal execution for users, reducing slippage and maximizing trading efficiency.

Another factor contributing to the rise of 1inch Network is its user-friendly interface and intuitive design. The platform is designed to provide a seamless trading experience for both experienced DeFi users and newcomers. With its simple and intuitive user interface, 1inch Network makes it easy for anyone to navigate and leverage the power of decentralized finance.

Furthermore, 1inch has also introduced its liquidity mining program, which incentivizes liquidity providers (LPs) by rewarding them with 1INCH tokens for providing liquidity to the platform. This has not only attracted more liquidity into the network but has also encouraged users to actively participate in the ecosystem, fostering its growth and sustainability.

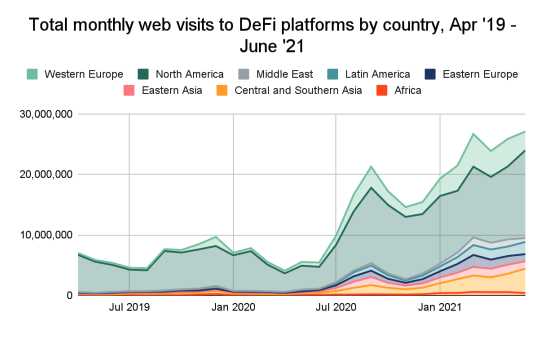

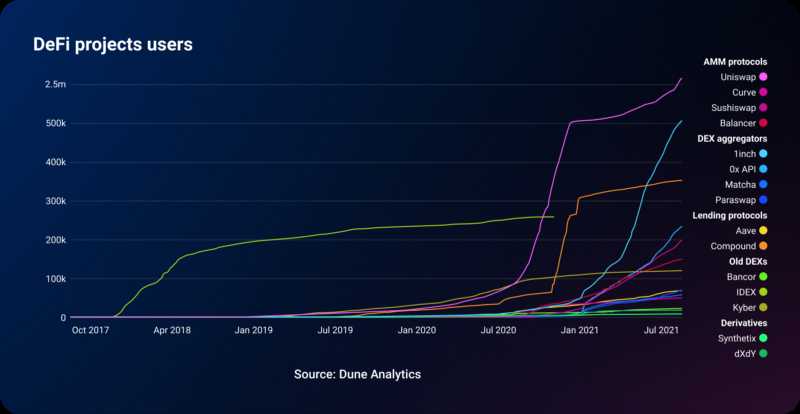

The rise of 1inch Network has had a significant impact on DeFi adoption and mainstream users. It has democratized access to decentralized exchanges and provided users with a more efficient and cost-effective way to trade cryptocurrencies. Moreover, by aggregating liquidity from various DEXs, 1inch has played a crucial role in improving the overall liquidity of the DeFi market, making it more attractive for traders and investors alike.

In conclusion, the rise of 1inch Network can be attributed to its innovative approach, user-friendly interface, and liquidity mining program. As it continues to evolve and expand its network, 1inch is poised to make a lasting impact on the DeFi ecosystem and drive further adoption among mainstream users.

inch Protocol and Changing Dynamics in the DeFi Landscape

The emergence of the 1inch Network and its inch Protocol has significantly impacted the decentralized finance (DeFi) landscape. The inch Protocol is a decentralized exchange (DEX) aggregator built on Ethereum that allows users to access multiple liquidity sources to find the best rates for their trades. This innovative protocol has brought about a paradigm shift in the way DeFi operates and has reshaped the dynamics of the industry.

Improved Liquidity Access

One of the key aspects of the inch Protocol is its ability to aggregate liquidity from various decentralized exchanges. Traditionally, users had to manually check multiple DEXs to compare rates and find the best one for their trades. This process was time-consuming and often resulted in missed opportunities. However, with the inch Protocol, users can access the liquidity of multiple exchanges through a single interface, making it much more convenient and efficient for them to find the best rates for their trades.

Reduced Slippage and Improved Trading Experience

Another significant impact of the inch Protocol is the reduction in slippage during trades. Slippage is the difference between the expected price of a trade and the actual executed price. High slippage can lead to substantial losses for traders. By aggregating liquidity from multiple exchanges, the inch Protocol minimizes slippage by finding the best rates across different pools. This not only reduces the risk of losses but also improves the overall trading experience for users.

In addition, the inch Protocol also supports transaction batching, which further enhances the trading experience. By bundling multiple transactions into a single transaction, users can save on gas fees and enjoy faster transaction speeds. This feature is particularly beneficial during periods of high network congestion when gas fees tend to spike.

Promoting DeFi Adoption and Mainstream Users

The inch Protocol has played a vital role in promoting DeFi adoption and attracting mainstream users to the space. Its user-friendly interface and enhanced trading experience make it more accessible and appealing to those who are new to decentralized finance. By simplifying the trading process and offering competitive rates, the inch Protocol has helped bridge the gap between traditional finance and DeFi, making it easier for mainstream users to participate in the decentralized economy.

In conclusion, the inch Protocol has brought significant changes to the dynamics of the DeFi landscape. By improving liquidity access, reducing slippage, and promoting adoption among mainstream users, it has made decentralized finance more accessible, efficient, and user-friendly. The impact of the inch Protocol on DeFi adoption and mainstream users is undeniable, and it will continue to shape the industry’s future.

Enhancing Access and Adoption for Mainstream Users

The 1inch Network is playing a crucial role in enhancing access and adoption for mainstream users in the decentralized finance (DeFi) ecosystem. With its intuitive interface and user-friendly features, it is bridging the gap between traditional finance and DeFi, making it easier for newcomers to enter the space.

Simplified User Experience

One of the key ways 1inch Network is enhancing access and adoption for mainstream users is through its simplified user experience. The platform provides a seamless onboarding process, allowing users to easily connect their wallets and start trading within minutes. The intuitive interface makes it easy for users to navigate and understand the various features and functionalities offered by the platform.

Additionally, 1inch Network offers a wide range of educational resources, including tutorials and guides, to help users understand the intricacies of DeFi. This educational approach is designed to empower users with the knowledge they need to make informed decisions and take advantage of the opportunities presented by DeFi.

Liquidity Aggregation

An important aspect of enhancing access and adoption for mainstream users is the availability of liquidity. The 1inch Network addresses this by aggregating liquidity from various decentralized exchanges (DEXs) into a single platform. This means that users can access the liquidity of multiple DEXs without the need to manually navigate through different platforms.

The liquidity aggregation feature ensures that users can achieve the best possible trading outcomes by automatically routing their trades to the most favorable pools and exchanges. This not only enhances the user experience but also results in cost savings and improved trading efficiency for mainstream users.

Furthermore, the 1inch Network’s liquidity aggregation also reduces the complexity of DeFi for mainstream users. By consolidating liquidity from different DEXs, users no longer need to worry about individual liquidity constraints and can enjoy a seamless trading experience.

Simplified Access, Enhanced Adoption

In conclusion, the 1inch Network is playing a vital role in enhancing access and adoption for mainstream users in the DeFi ecosystem. Through its simplified user experience, educational resources, and liquidity aggregation feature, it is making DeFi more accessible and understandable to a wider audience. As a result, more and more mainstream users are entering the DeFi space and benefiting from the opportunities it offers.

Impact on DeFi Market Growth and Connectivity

The 1inch Network has had a significant impact on the growth and connectivity of the decentralized finance (DeFi) market. Through its innovative approach to decentralized exchange aggregation, it has greatly improved the accessibility and efficiency of DeFi trading.

One of the key challenges in the DeFi market is the fragmentation of liquidity across various decentralized exchanges (DEXs). This fragmentation can result in higher slippage and lower liquidity, making it difficult for traders to execute large orders without significant price impact. The 1inch Network addresses this issue by aggregating liquidity from multiple DEXs, allowing traders to access the best available prices and execute trades with minimal slippage.

In addition to improving liquidity, the 1inch Network also enhances connectivity between different DeFi protocols. It achieves this through its unique Pathfinder algorithm, which dynamically routes trades across multiple DEXs to find the most optimal path. This connectivity enables users to access liquidity from a wide range of protocols, expanding the trading possibilities and opportunities within the DeFi ecosystem.

Improved User Experience

The 1inch Network’s impact on DeFi market growth is further amplified by its focus on user experience. Through its user-friendly interface and intuitive design, it lowers the barriers to entry for mainstream users, attracting a larger user base to DeFi. This increased adoption and participation contribute to the overall growth and maturation of the DeFi market.

Moreover, the 1inch Network’s integration with popular wallets such as MetaMask and Ledger enhances the convenience and security of DeFi trading for users. By seamlessly connecting with existing wallets, it simplifies the onboarding process and eliminates the need for users to create new accounts or manage additional credentials.

Empowering Developers

Beyond its impact on users, the 1inch Network also empowers developers to build on top of its infrastructure. It provides an open-source API that allows developers to access and utilize its liquidity aggregation and routing capabilities in their own applications. This integration potential fuels innovation within the DeFi space, further driving the growth and expansion of the market.

In conclusion, the 1inch Network’s impact on the DeFi market is multi-dimensional. Its liquidity aggregation and connectivity solutions address key pain points, improving the efficiency and accessibility of DeFi trading. By enhancing the user experience and empowering developers, it contributes to the overall growth and adoption of DeFi, making it more accessible to mainstream users and driving innovation within the ecosystem.

Question-answer:

What is the 1inch Network?

The 1inch Network is a decentralized exchange aggregator that sources liquidity from various popular DEXs and offers the best rates to users.

How does the 1inch Network contribute to the adoption of DeFi?

The 1inch Network contributes to the adoption of DeFi by providing users with access to the best liquidity and rates across multiple decentralized exchanges, making it easier and more convenient to trade and access DeFi protocols.

Why is the 1inch Network important for mainstream users?

The 1inch Network is important for mainstream users because it simplifies the process of trading and using DeFi protocols. It aggregates liquidity from various DEXs, allowing users to access the best rates and trade more efficiently.

Can you provide some examples of how the 1inch Network has impacted DeFi adoption?

Yes, the 1inch Network has significantly impacted DeFi adoption by providing users with a seamless trading experience and access to the best liquidity. It has also partnered with other projects in the DeFi space to expand its offerings and enhance the overall user experience.