Decentralized trading has gained significant traction in recent years as more and more individuals seek to trade cryptocurrencies and other digital assets in a secure and transparent manner. However, the decentralized trading landscape is still evolving, and there are many challenges that need to be overcome in order to achieve widespread adoption.

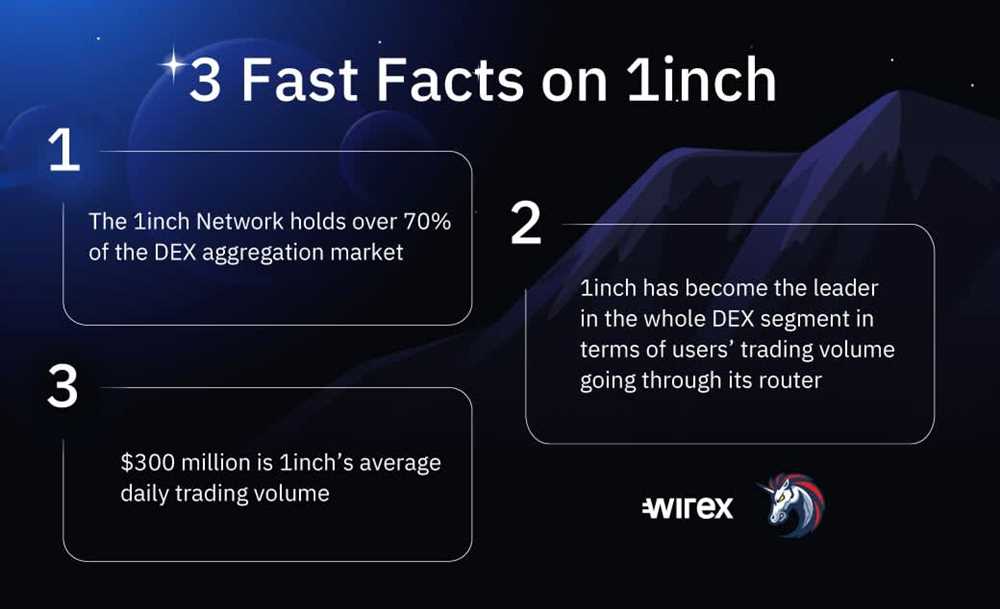

In their whitepaper, the team behind 1inch, a decentralized exchange aggregator, provides valuable insights into the path to decentralized trading. The whitepaper outlines the problems currently facing the decentralized trading space and proposes innovative solutions to address these challenges.

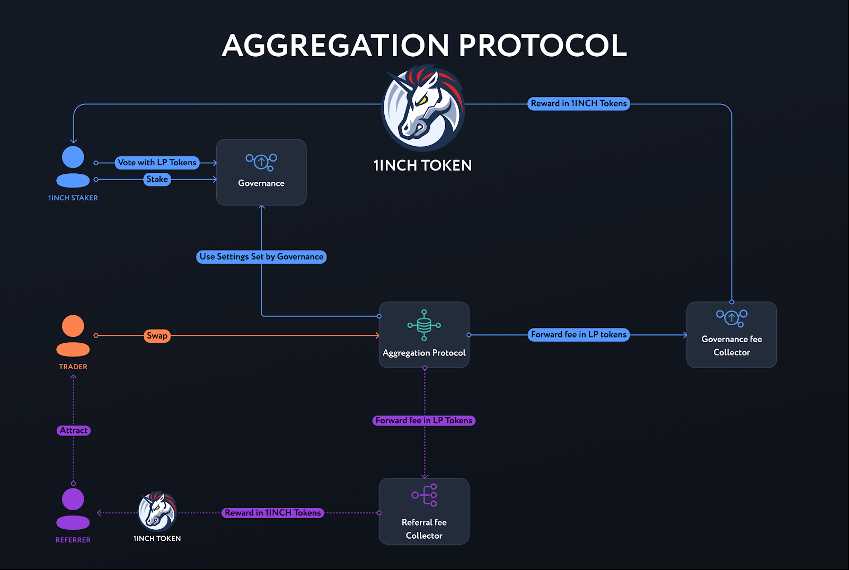

One of the key issues highlighted in the whitepaper is the problem of liquidity fragmentation. With decentralized exchanges operating on different protocols and networks, liquidity is spread out across multiple platforms, making it difficult for traders to find the best prices and execute trades efficiently. The 1inch team proposes a solution in the form of a decentralized exchange aggregator that sources liquidity from various exchanges and protocols, allowing traders to access the best prices all in one place.

Another challenge discussed in the whitepaper is the issue of front-running and transaction frontrunning of trades. Front-running occurs when traders exploit their knowledge of pending transactions to gain an unfair advantage in executing their own trades. The 1inch team addresses this problem by implementing a solution known as Pathfinder, which utilizes multiple sources of liquidity to ensure trades are executed in a fair and transparent manner.

The 1inch whitepaper also delves into the complexities of gas fees and provides insights into their innovative GasToken mechanism. Gas fees on the Ethereum network have skyrocketed in recent times, making trading on decentralized exchanges expensive and unviable for many users. The GasToken mechanism proposed by 1inch aims to reduce gas costs by allowing users to store gas when it is cheaper and use it later when fees are higher. This mechanism not only saves users money but also improves overall efficiency on the Ethereum network.

Overall, the 1inch whitepaper provides a comprehensive analysis of the challenges and opportunities in the decentralized trading space. The insights and solutions proposed by the 1inch team pave the way for a more efficient, transparent, and user-friendly decentralized trading ecosystem.

The Path to Decentralized Trading Insights

In the world of decentralized finance (DeFi), trading has evolved from a centralized model to one that is decentralized. This shift has brought about new opportunities and challenges for traders and investors.

Decentralized trading platforms, such as 1inch, have emerged to provide access to a wide range of liquidity pools and decentralized exchanges (DEXs). These platforms utilize smart contracts and algorithms to facilitate trading without the need for intermediaries.

One of the key insights from the 1inch whitepaper is the importance of aggregation in decentralized trading. Aggregation allows traders to access multiple liquidity sources and DEXs to get the best possible prices for their trades. By aggregating liquidity from various sources, traders can minimize slippage and maximize their trading profits.

Another important insight highlighted in the whitepaper is the role of routing in decentralized trading. Routing algorithms are used to determine the most efficient path for executing a trade across different liquidity sources. This ensures that trades are executed at the best possible prices and with minimal price impact.

The 1inch whitepaper also emphasizes the significance of composability in decentralized trading. Composability refers to the ability to combine different DeFi protocols and services to create new and innovative trading strategies. This allows traders to customize their trading experience and take advantage of unique trading opportunities.

Furthermore, the whitepaper discusses the challenges and opportunities of liquidity in decentralized trading. Liquidity is crucial for the efficient functioning of trading platforms, and the 1inch platform aims to address this by providing liquidity aggregation and routing solutions.

In conclusion, the path to decentralized trading insights involves understanding the importance of aggregation, routing, and composability in the DeFi ecosystem. By leveraging these insights, traders can optimize their trading strategies and maximize their profits in the decentralized trading landscape.

from the 1inch Whitepaper

The 1inch whitepaper outlines a vision for decentralized trading that aims to eliminate inefficiencies and improve liquidity in the market. The paper introduces the concept of “aggregation” as a way to optimize trades by combining liquidity pools and routing algorithms.

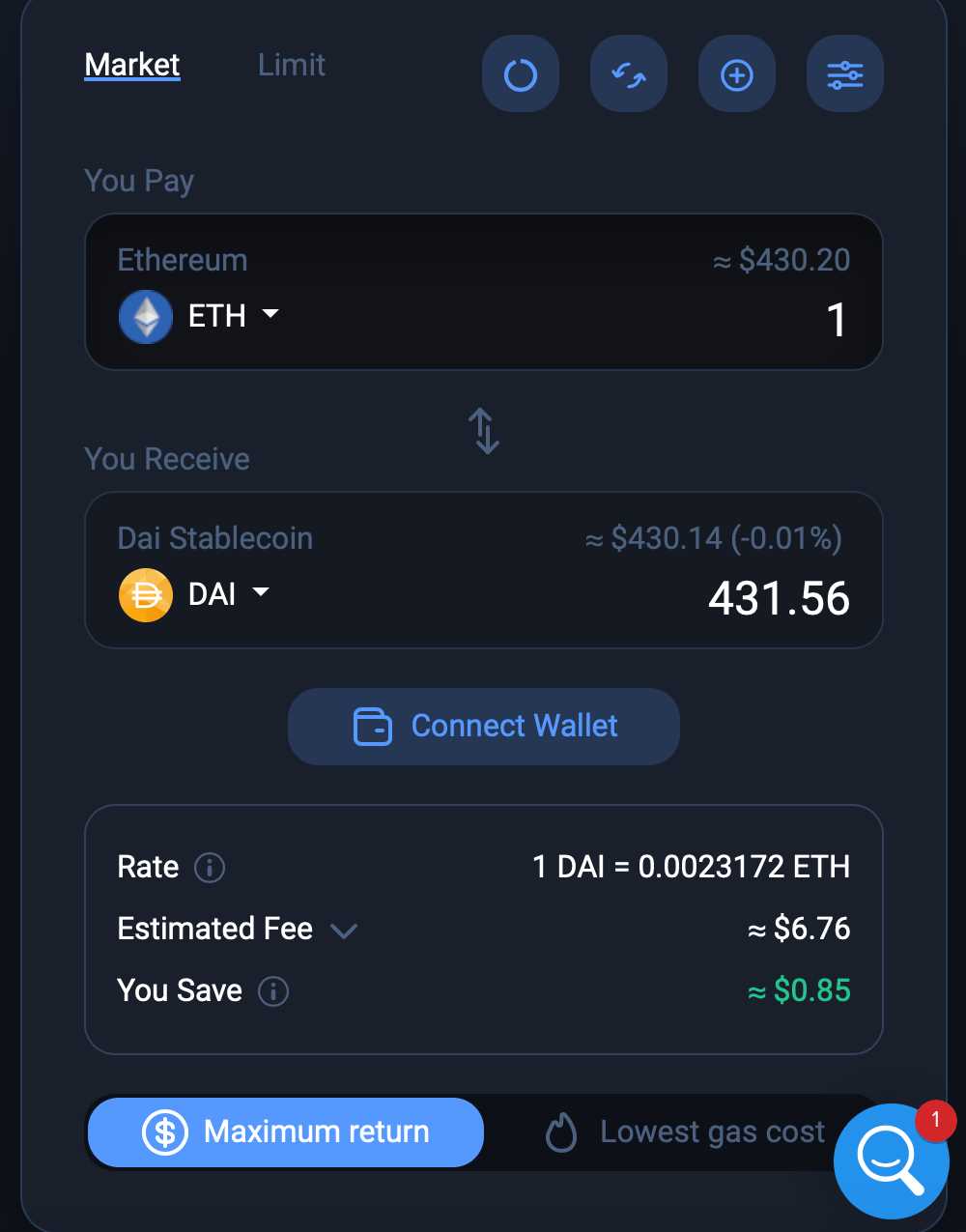

According to the whitepaper, aggregation is achieved by splitting a trade across multiple decentralized exchanges (DEXs) to find the best prices for each token. This allows traders to access deeper liquidity and lower slippage compared to trading on a single exchange.

To achieve this, 1inch uses a Pathfinder algorithm that calculates the most efficient routes for trades based on factors such as prices, fees, and available liquidity. The algorithm takes into account the dynamic nature of the market and adapts its routing strategies accordingly to optimize trades in real-time.

The whitepaper also highlights the importance of security and transparency in decentralized trading. 1inch employs smart contracts to ensure that trades are executed securely and without the need for intermediaries. This eliminates counterparty risk and reduces the potential for manipulation or fraud.

Furthermore, the whitepaper introduces the concept of “mooniswap,” a virtual automated market maker (AMM) designed to provide better rates for liquidity providers. Mooniswap achieves this by reducing the impact of price changes during the time when liquidity is being provided. This ensures that liquidity providers are not adversely affected by arbitrageurs and can provide stable liquidity to the market.

In conclusion, the 1inch whitepaper presents a comprehensive roadmap for decentralized trading that aims to address the limitations of traditional exchanges. By utilizing aggregation and smart contract technology, 1inch aims to create a more efficient and transparent trading environment that benefits both traders and liquidity providers.

Understanding Decentralized Trading

Decentralized trading refers to the process of exchanging assets directly between participants on a blockchain network without the need for intermediaries such as centralized exchanges.

This form of trading has gained popularity in recent years due to its ability to offer increased privacy, security, and control over assets. It allows individuals to trade directly with each other, eliminating the need to trust a third party with their funds.

Decentralized trading relies on the use of smart contracts, which are self-executing contracts with the terms of the agreement directly written into the code. These smart contracts eliminate the need for a trusted intermediary by automating the execution of trades.

One key advantage of decentralized trading is that it removes the single point of failure that exists in centralized exchanges. Centralized exchanges are vulnerable to hacks, theft, and manipulation, which can result in the loss of funds for traders.

In decentralized trading, assets are stored in wallets that are controlled by the traders themselves. This ensures that users have full custody and control over their assets at all times. Additionally, decentralized trading platforms usually do not require users to create an account or provide personal information, further enhancing privacy.

Benefits of Decentralized Trading

- Increased Privacy: Decentralized trading platforms do not require users to create an account or provide personal information, ensuring increased privacy.

- Enhanced Security: Assets are stored in wallets that are controlled by the users themselves, reducing the risk of hacks and theft.

- Elimination of Intermediaries: Decentralized trading eliminates the need for intermediaries, allowing for direct peer-to-peer trading.

- Full Control over Assets: Users have full custody and control over their assets at all times, reducing the risk of funds being lost or frozen.

Challenges of Decentralized Trading

- Liquidity: Decentralized trading platforms may have lower liquidity compared to centralized exchanges, making it harder to execute large trades.

- User Experience: Decentralized trading platforms can sometimes be more complex and difficult to use compared to centralized exchanges, which may deter some users.

- Regulatory Concerns: The regulatory landscape for decentralized trading is still evolving, and there may be legal and compliance challenges to navigate.

- Smart Contract Risk: While smart contracts offer automation and transparency, they are not infallible and can still have vulnerabilities that could be exploited by hackers.

Despite these challenges, decentralized trading is gaining traction as more users embrace the advantages it offers in terms of privacy, security, and control over assets. As the space continues to evolve and mature, it is expected that decentralized trading will become more accessible and user-friendly, attracting a broader audience.

What is Decentralized Trading?

Decentralized trading refers to a system of exchanging assets directly between parties without the need for intermediaries such as traditional exchanges or brokers. It leverages blockchain technology to enable peer-to-peer transactions in a trustless and transparent manner.

In a decentralized trading environment, participants maintain custody of their assets at all times, eliminating the need to trust a centralized entity with their funds. Transactions are executed through smart contracts, which are self-executing sets of code that automatically execute the terms of an agreement.

One of the key advantages of decentralized trading is that it removes barriers to entry and lowers the cost of participation. Anyone with a compatible digital wallet and internet connection can participate, regardless of their location or financial status. This opens up trading opportunities to a wider range of individuals and promotes financial inclusion.

Decentralized trading also offers increased privacy and security. Users do not need to disclose personal information or create accounts on centralized platforms, reducing the risk of data breaches and identity theft. Additionally, the use of blockchain technology ensures that transactions are immutable and tamper-proof.

However, decentralized trading is not without its challenges. Due to the fragmented nature of decentralized exchanges (DEXs), liquidity can be lower compared to centralized exchanges. This can result in higher slippage and trading costs for users.

Furthermore, decentralized trading platforms often face scalability issues due to the limitations of current blockchain technology. Processing a high volume of transactions can be slow and costly, leading to potential bottlenecks and delays.

| Advantages | Challenges |

|---|---|

| Lower cost of participation | Lower liquidity |

| Increased privacy and security | Scalability issues |

| Financial inclusion |

Despite these challenges, decentralized trading is an innovative and rapidly evolving space. Projects like 1inch are working on solutions to improve liquidity and scalability through various mechanisms such as liquidity aggregation and layer 2 scaling solutions. As the technology continues to mature, decentralized trading has the potential to revolutionize the financial industry and reshape the way assets are bought and sold.

Benefits of Decentralized Trading

Decentralized trading platforms, like 1inch, offer several key benefits compared to traditional centralized exchanges:

1. Enhanced Security

With decentralized trading, users have full control over their funds and trades. There is no need to deposit funds on an exchange and trust a third party with the security of their assets. Instead, trades are executed directly from the user’s wallet, minimizing the risk of hacks or theft.

2. Increased Privacy

Decentralized trading platforms do not require users to provide personal information or go through a KYC process. This allows for anonymous trading, protecting the privacy of users and their trading activities.

3. Global Access

Decentralized trading platforms are accessible to anyone with an internet connection and a compatible wallet. This means that users from all around the world can participate in decentralized trading, without any geographical restrictions.

4. Lower Fees

Decentralized trading platforms typically have lower fees compared to centralized exchanges. Since there is no middleman involved, users can avoid high trading fees and enjoy more cost-effective trading.

5. Transparency

Decentralized trading platforms utilize blockchain technology, which offers transparent and immutable records of all trades. This means that anyone can verify the authenticity of transactions and ensure fair trading practices are being followed.

6. Liquidity Aggregation

Decentralized trading platforms like 1inch utilize liquidity aggregation protocols, which combine liquidity from different decentralized exchanges. This ensures that users can access the best available prices and deeper liquidity pools.

| Benefits of Decentralized Trading |

|---|

| Enhanced Security |

| Increased Privacy |

| Global Access |

| Lower Fees |

| Transparency |

| Liquidity Aggregation |

Increased Security and Privacy

Security and privacy are paramount when it comes to decentralized trading. The 1inch protocol places a strong emphasis on both to ensure that users can trust the platform with their assets and personal information.

Focus on Smart Contract Audits

The 1inch team understands the importance of thorough code audits to identify and fix potential vulnerabilities in the smart contracts. Regular audits are conducted by reputable auditing firms to ensure the overall security of the protocol.

Additionally, the team actively works on improving the security of the protocol by implementing bug bounty programs. This allows external developers and security experts to discover and report any potential issues, helping to minimize the risk of exploits.

Trade Anonymously with Privacy Features

Privacy is another crucial aspect of decentralized trading. The 1inch protocol incorporates various privacy features to protect users’ identities and transaction details.

The use of zero-knowledge proofs enables users to prove certain facts (such as the validity of a trade) without revealing any sensitive information. This ensures that trading can be done anonymously, giving users greater control over their privacy.

Furthermore, users have the option to interact with the 1inch protocol directly from their own wallets, without the need to create an account or provide personal information. This not only enhances privacy but also eliminates the risk of data breaches and unauthorized access to user data.

In conclusion, the 1inch protocol prioritizes security and privacy to provide users with a safe and private decentralized trading experience. Through thorough smart contract audits and the incorporation of privacy features, users can confidently trade and transact on the platform while maintaining control over their personal information.

Question-answer:

What is the 1inch whitepaper about?

The 1inch whitepaper is about the path to decentralized trading and provides insights into how the 1inch decentralized exchange aggregator works.

How does 1inch achieve the best trading rates?

1inch achieves the best trading rates by splitting orders across multiple decentralized exchanges and using smart contract technology to optimize the trades.

What are the advantages of using the 1inch exchange aggregator?

The advantages of using the 1inch exchange aggregator include better trading rates, lower slippage, and the ability to access multiple liquidity sources in one platform.