The 1inch protocol has quickly become one of the most popular and widely used decentralized exchanges in the cryptocurrency world. With its unique approach to optimizing trading routes and providing users with the best possible prices, it has gained significant attention from the trading community. But how exactly does the 1inch protocol ensure fair trading and protect the interests of its users? This article will dissect the 1inch whitepaper to explore the various mechanisms in place to ensure fairness and transparency.

One of the key features of the 1inch protocol is its ability to aggregate liquidity from various decentralized exchanges (DEXs). By routing trades through multiple liquidity sources, 1inch aims to provide users with the most favorable prices for their trades. This approach solves the problem of fragmented liquidity that is often encountered in decentralized exchanges, where each DEX operates independently and has limited liquidity.

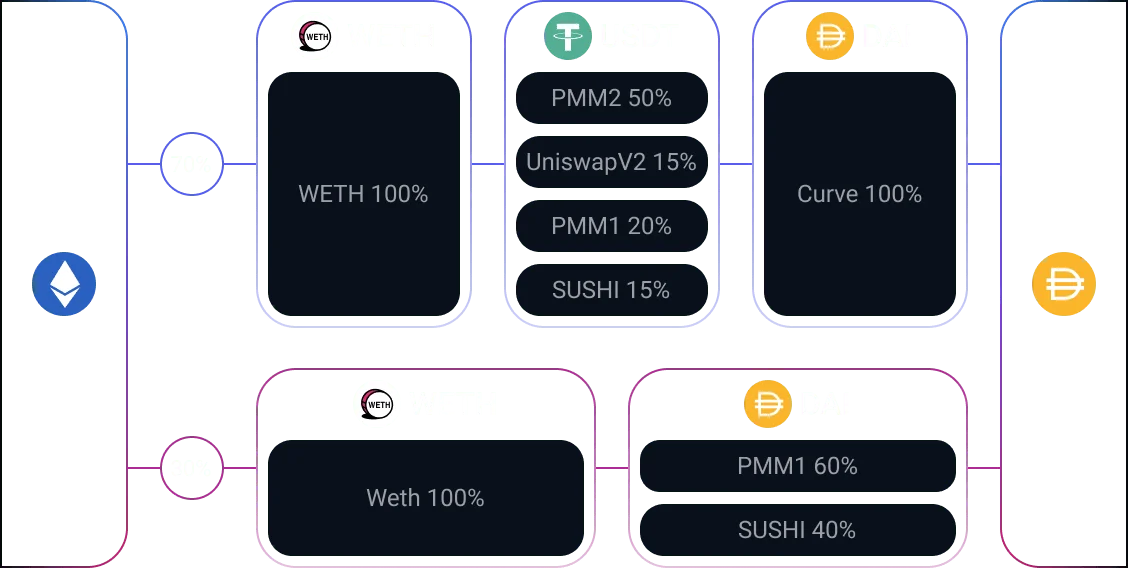

The 1inch protocol achieves fairness by employing the concept of Pathfinder algorithms. These algorithms analyze different liquidity sources to determine the optimal route for a trade, taking into account factors such as slippage, gas costs, and liquidity depth. By optimizing trading routes, 1inch ensures that users get the best prices while minimizing the risks associated with trading on DEXs.

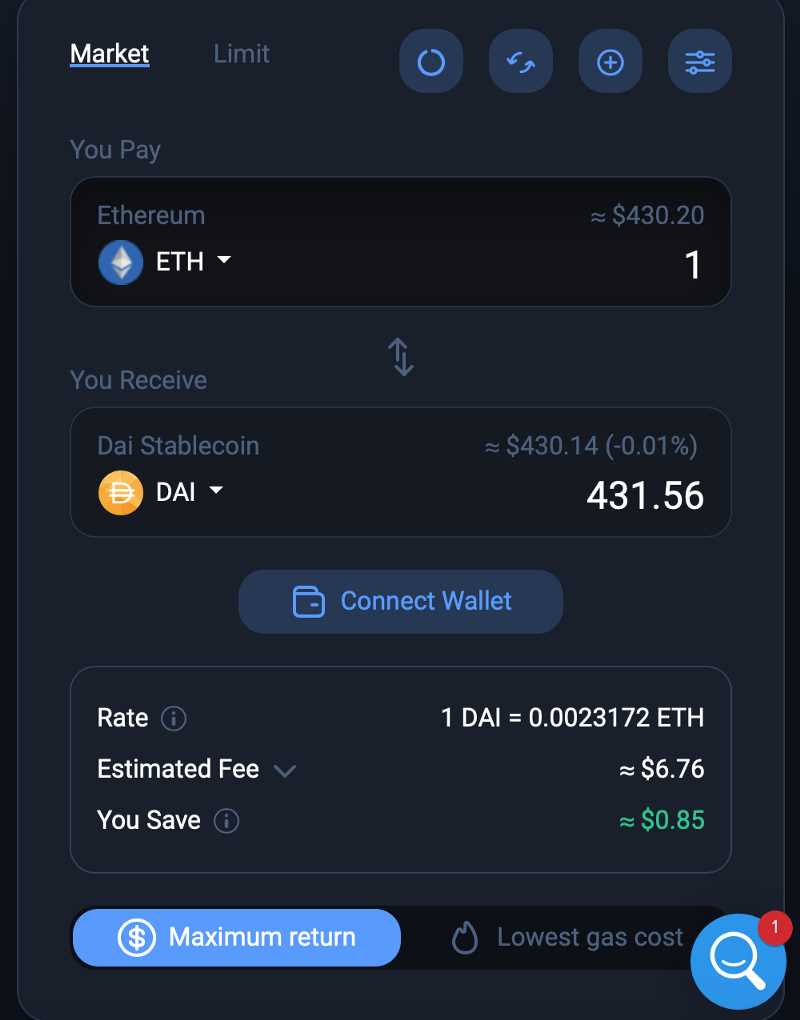

In addition to optimizing trading routes, 1inch also incorporates a unique feature called “Chi Gastoken”. This feature enables users to save on gas fees when executing trades on the Ethereum network. By using Chi Gastoken, users can effectively reduce their gas costs and ensure that they are not overpaying for their transactions. This not only saves users money but also enhances the overall trading experience on the 1inch platform.

The 1inch whitepaper goes into great detail about the technical aspects of the protocol, explaining the algorithms and mechanisms that ensure fair trading. By dissecting the whitepaper, we can gain a deeper understanding of how 1inch optimizes trading routes, aggregates liquidity, and protects the interests of its users. As decentralized finance continues to gain traction, protocols like 1inch play a crucial role in ensuring fair and transparent trading in the cryptocurrency world.

The Importance of Fair Trading

Fair trading is integral to maintaining a healthy and sustainable marketplace. It ensures that all participants, regardless of their size or resources, have an equal opportunity to engage in a transaction without any unfair advantage. Without fair trading practices, markets can become skewed towards certain individuals or entities, leading to a lack of competition and potential exploitation.

One of the main reasons why fair trading is important is because it fosters trust among market participants. When traders know that the rules are consistent and applied fairly, they are more likely to engage in transactions with confidence. This trust is essential in attracting new participants and sustaining existing ones, as it creates a level playing field where everyone has a chance to succeed.

Fair trading also promotes innovation and efficiency within the market. When all participants have an equal opportunity to access liquidity and execute trades, it encourages competition and incentivizes the development of new and improved trading strategies. This leads to more efficient markets, where prices reflect true supply and demand dynamics, ultimately benefiting all participants.

Furthermore, fair trading is crucial in preventing market manipulation and fraud. By enforcing rules that promote transparency and discourage unfair practices, regulators and participants can protect against manipulation tactics such as wash trading, front running, and pump and dump schemes. This helps to maintain the integrity of the market and safeguards the interests of all participants.

In conclusion, fair trading plays a vital role in ensuring the health and sustainability of a marketplace. It fosters trust, promotes innovation and efficiency, and protects against market manipulation and fraud. By upholding fair trading practices, we can create a more inclusive and equitable trading environment for all participants.

Understanding the 1inch Protocol

The 1inch Protocol is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges (DEXs) to provide users with the best possible trading rates. It was designed to solve the problem of fragmented liquidity and high trading costs that are often associated with decentralized exchanges.

At its core, the 1inch Protocol utilizes an algorithm called Pathfinder, which is responsible for finding the optimal trading path across multiple DEXs. Pathfinder considers various factors such as the available liquidity, trading fees, slippage, and gas costs to determine the best route for a trade. By considering all these variables, the 1inch Protocol aims to ensure that users get the most favorable trading rates.

The 1inch Protocol also introduces the concept of “Chi Tokens,” which are ERC20 tokens that can be used to reduce the gas fees associated with token swaps. By using Chi Tokens, users can save on gas costs and potentially obtain better trading rates. This feature makes the 1inch Protocol attractive for users who are looking to optimize their trades and minimize their costs.

How does the 1inch Protocol ensure fairness?

The 1inch Protocol is built on the principles of transparency and fairness. To ensure fair trading, it employs several mechanisms:

- Decentralization: The 1inch Protocol is decentralized, meaning that it is not controlled by any single entity. This helps to eliminate any potential bias or manipulation.

- Smart Contract: All trades executed through the 1inch Protocol are done via smart contracts, which are transparent and immutable. This ensures that trades are executed exactly as intended.

- Open Source: The source code of the 1inch Protocol is open and auditable, allowing anyone to review and verify its functionality. This helps to build trust among users.

- Competition: The 1inch Protocol is designed to encourage healthy competition among liquidity providers. By sourcing liquidity from various DEXs, it creates a competitive environment that ultimately benefits users.

Benefits of using the 1inch Protocol

By using the 1inch Protocol, users can enjoy several benefits:

| Benefit | Description |

|---|---|

| Best Trading Rates | The 1inch Protocol sources liquidity from multiple DEXs to ensure that users get the best trading rates available in the market. |

| Reduced Trading Costs | The use of Chi Tokens and the optimization algorithms of the 1inch Protocol can help users save on gas costs and minimize their overall trading expenses. |

| Fair and Transparent Trading | The decentralized nature, smart contract execution, and open source code of the 1inch Protocol ensure fair and transparent trading for all users. |

| Increased Liquidity | By aggregating liquidity from various DEXs, the 1inch Protocol provides users with access to a larger pool of liquidity, increasing the chances of executing trades at desired rates. |

How the Protocol Ensures Fair Trading

The 1inch protocol is designed to ensure fair trading by implementing several features that promote transparency, efficiency, and equal opportunities for all participants.

Aggregation and Liquidity

One of the key aspects of fair trading is ensuring that users have access to the best available prices across multiple decentralized exchanges (DEXs). The 1inch protocol addresses this by aggregating liquidity from various DEXs, allowing users to find the most optimal trading routes and obtain the best possible prices.

By splitting large orders into smaller ones and routing them through multiple DEXs, the protocol minimizes the risk of slippage and front-running, providing fair and equitable trading opportunities.

Gas Cost Optimization

The 1inch protocol also considers the gas cost optimization aspect to ensure fair trading. Gas costs can be a significant barrier to entry for small traders, limiting their ability to participate in profitable trades.

To address this, the protocol leverages algorithmic smart contract techniques to reduce the gas costs associated with executing trades. By optimizing gas costs, the protocol makes trading more accessible to all participants and promotes fair trading opportunities for users of all sizes.

| Feature | Benefit |

|---|---|

| DEX Aggregation | Provides access to the best available prices across multiple DEXs. |

| Slippage Minimization | Reduces the risk of slippage and front-running. |

| Gas Cost Optimization | Makes trading more accessible by reducing gas costs. |

In conclusion, the 1inch protocol ensures fair trading by aggregating liquidity from different DEXs, minimizing slippage, optimizing gas costs, and providing equal opportunities for all participants. These features work together to create a transparent and efficient trading environment where users can trade with confidence.

The Components of the 1inch Whitepaper

The 1inch whitepaper consists of several key components that outline the protocol’s design and functionality, ensuring fair trading for all users. These components include:

1. Introduction

The whitepaper begins with an introduction that provides an overview of the 1inch protocol and its objectives. It explains the need for a decentralized exchange aggregator and highlights the problem of fragmented liquidity across different decentralized exchanges.

2. Problem Statement

This section of the whitepaper dives deeper into the problem of fragmented liquidity and how it creates inefficiencies for traders. It discusses issues such as slippage, high gas fees, and complex trading workflows. By presenting these challenges, the whitepaper sets the stage for the 1inch solution.

3. Protocol Overview

The protocol overview section explains how the 1inch protocol works to address the liquidity fragmentation problem. It provides an overview of the key components of the protocol, such as the Pathfinder algorithm, the smart contract architecture, and the role of decentralized exchanges and liquidity providers.

4. Pathfinder Algorithm

This section delves into the specifics of the Pathfinder algorithm, which powers the 1inch protocol. It explains how the algorithm finds the most efficient trading paths across different decentralized exchanges to minimize slippage and maximize trading outcomes for users.

5. Smart Contract Architecture

Here, the whitepaper outlines the smart contract architecture of the 1inch protocol. It explains how the protocol interacts with decentralized exchanges and liquidity providers through the use of smart contracts, ensuring trustless and secure trading.

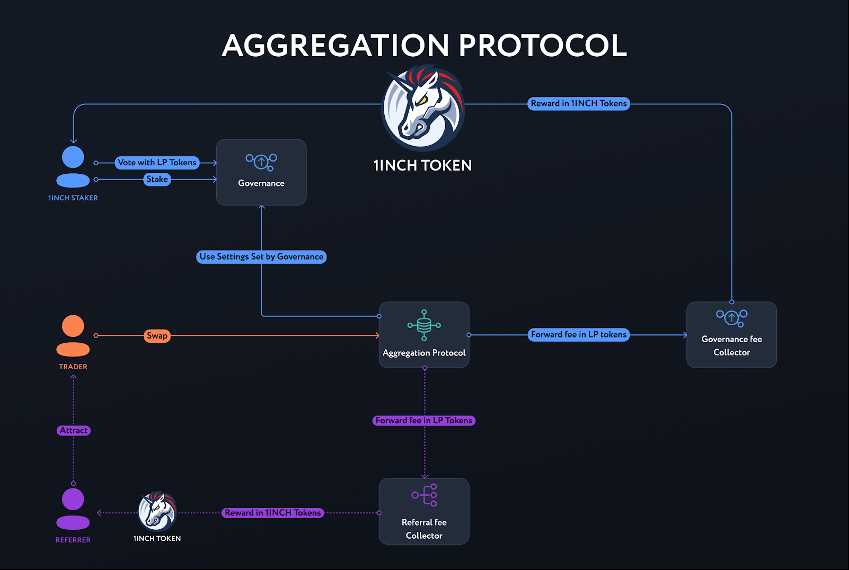

6. Governance and Governance Tokens

This section discusses the governance aspect of the 1inch protocol, including the role of governance tokens. It explains how the protocol is governed by its community through decentralized voting and decision-making processes.

7. Security and Audits

The whitepaper highlights the importance of security in the 1inch protocol and discusses the steps taken to ensure it. It mentions the audits conducted by reputable third-party firms to identify and mitigate potential security vulnerabilities.

8. Conclusion

The whitepaper concludes by summarizing the key points discussed throughout the document. It emphasizes the significance of the 1inch protocol in providing fair and efficient trading for users and outlines the future plans and developments for the protocol.

| 1. Introduction | 5. Smart Contract Architecture |

| 2. Problem Statement | 6. Governance and Governance Tokens |

| 3. Protocol Overview | 7. Security and Audits |

| 4. Pathfinder Algorithm | 8. Conclusion |

Exploring the Technical Details

The 1inch protocol is built on the Ethereum blockchain and utilizes smart contracts to facilitate decentralized exchanges. The protocol is designed to ensure fair trading by aggregating liquidity from various decentralized exchanges (DEXs) and executing trades at the best possible rates.

One of the key components of the 1inch protocol is the Pathfinder algorithm. This algorithm is responsible for finding the most efficient trading routes across multiple DEXs in order to optimize trades. It takes into account factors such as liquidity, gas fees, and slippage to determine the best possible trade execution.

Another important aspect of the protocol is the integration with various DEX protocols. The 1inch team has developed connectors for popular DEXs such as Uniswap, Kyber Network, and Balancer, allowing the protocol to access liquidity from these platforms. By integrating with multiple DEXs, the 1inch protocol is able to offer users a wider selection of trading options and better rates.

The 1inch protocol also employs a chi-squared based approach to measure the fairness of trades. This approach ensures that the protocol takes into account the price impact of trades and prevents front-running. By analyzing past transactions and comparing them to the expected distribution, the protocol can identify any anomalies and take appropriate action to maintain fairness.

A notable feature of the 1inch protocol is its Gas Token mechanism. Gas Tokens are ERC-20 tokens that can be used to pay for gas fees on the Ethereum network. By using Gas Tokens, users can save on gas fees when executing trades through the 1inch protocol. This feature makes trading more cost-effective for users and encourages adoption of the protocol.

In conclusion, the 1inch protocol is a sophisticated platform that leverages smart contracts and advanced algorithms to ensure fair and efficient trading. By aggregating liquidity from multiple DEXs and optimizing trades, the protocol offers users better rates and a wider selection of trading options. The integration with various DEX protocols and the use of Gas Tokens further enhance the user experience and make trading more cost-effective.

Question-answer:

What is the 1inch protocol?

The 1inch protocol is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges to provide users with the best possible trading rates.

How does the 1inch protocol ensure fair trading?

The 1inch protocol ensures fair trading by splitting up a user’s trade across multiple decentralized exchanges to avoid slippage and ensure the best possible execution price.

What is the purpose of the 1inch whitepaper?

The purpose of the 1inch whitepaper is to provide a detailed explanation of how the 1inch protocol works, its benefits, and how it ensures fair trading for users.

How does the 1inch protocol prevent front-running?

The 1inch protocol prevents front-running by using a combination of Pathfinder, an on-chain price oracle, and the Chi Gas Token to minimize the impact of frontrunners on users’ trades.