Maximize Your Returns: Yield farming allows you to optimize your cryptocurrency holdings and earn high returns on your investment. With 1inch Coin, you can participate in this lucrative market and take advantage of the benefits it offers.

High-Yielding Opportunities: By staking your 1inch Coin and providing liquidity to decentralized finance (DeFi) protocols, you can earn generous rewards in the form of interest, fees, or additional tokens. These opportunities often surpass traditional investment options, providing you with a chance to grow your wealth.

Easy and Convenient: Yield farming with 1inch Coin is simple and straightforward. The platform provides user-friendly interfaces and intuitive features that make participating in DeFi accessible to anyone, regardless of their technical expertise. You can easily start earning rewards and increasing your crypto holdings with just a few clicks.

Secure and Transparent: 1inch Coin is built on blockchain technology, ensuring the highest level of security and transparency. Your funds are protected by decentralized protocols, eliminating the risks associated with centralized platforms. The transparent nature of blockchain allows you to track and verify your transactions, providing you with peace of mind.

Join the 1inch Coin Community: By becoming a part of the 1inch Coin community, you gain access to a network of like-minded individuals who share a passion for decentralized finance and yield farming. Connect with other users, learn from their experiences, and collaborate on new strategies to maximize your profits.

Don’t miss out on the incredible benefits of yield farming with 1inch Coin. Start growing your crypto holdings today and unlock the potential of decentralized finance.

Increased Earnings Potential

By participating in yield farming with 1inch Coin, you have the opportunity to significantly increase your earnings. The unique design of the 1inch platform allows users to take advantage of various liquidity pools and automated market makers to maximize their profits.

With yield farming, you can earn passive income by providing liquidity to different DeFi protocols. By locking up your 1inch Coin and other assets in these pools, you contribute to the overall liquidity of the platform and receive rewards in return.

The more liquidity you provide, the more potential earnings you can generate. As the demand for liquidity increases, so does your ability to earn. This means that you have the opportunity to earn a higher return on your investment compared to traditional savings accounts or other investment options.

The decentralized nature of yield farming also ensures that there are no intermediaries involved, allowing you to directly benefit from the rewards. You have full control over your funds and can withdraw them at any time, giving you flexibility and peace of mind.

Furthermore, the 1inch platform employs advanced algorithms and smart contracts to optimize your earnings. These algorithms automatically find the best opportunities for you to earn the highest yields, ensuring that you make the most of your investment.

Overall, by participating in yield farming with 1inch Coin, you unlock increased earnings potential. With the ability to earn passive income, take advantage of various liquidity pools, and leverage advanced algorithms, you can maximize your profits and grow your wealth.

Diversification of Crypto Holdings

Diversification is a key strategy in any investment portfolio, and the world of cryptocurrencies is no exception. By diversifying your crypto holdings, you can spread your risk and increase the potential for returns.

When it comes to yield farming, diversification becomes even more important. Yield farming involves providing liquidity to decentralized finance (DeFi) platforms in exchange for rewards. While the potential rewards can be high, the risks are also substantial. By diversifying your crypto holdings, you can mitigate some of these risks.

Benefits of Diversification in Yield Farming

1. Risk Mitigation: By spreading your investments across different assets and platforms, you can reduce the impact of any single token or platform failing. If one of your investments performs poorly, the others may still perform well, minimizing your losses.

2. Exposure to Multiple Tokens: Diversifying your crypto holdings allows you to gain exposure to a wider range of tokens. This gives you the opportunity to benefit from the potential growth of multiple projects and increases your chances of finding that next big winner.

3. Access to Different Yield Farming Strategies: Different platforms offer unique yield farming strategies, each with its own set of risks and rewards. By diversifying, you can take advantage of a variety of strategies and optimize your returns.

4. Flexibility: Diversification provides flexibility in terms of liquidity management. By diversifying your holdings, you can easily move your assets to different platforms or take advantage of new opportunities that arise in the market.

How to Diversify Your Crypto Holdings

Here are some strategies for diversifying your crypto holdings:

- Invest in a range of cryptocurrencies: Consider allocating your investments across different cryptocurrencies, including both major ones like Bitcoin and Ethereum, as well as promising altcoins.

- Participate in multiple yield farming platforms: Look for reputable platforms that offer different yield farming opportunities and spread your liquidity across them.

- Consider different yield farming strategies: Explore different strategies within yield farming, such as liquidity provision, lending, and staking, to diversify your returns.

- Regularly monitor and rebalance your holdings: Keep track of your investments and adjust your portfolio as needed to maintain diversification.

Remember, diversification does not guarantee profits or protect against losses. However, by diversifying your crypto holdings, you can better navigate the volatile world of cryptocurrencies and increase your chances of success in yield farming.

Lower Transaction Costs

One of the significant advantages of Yield Farming with 1inch Coin is the lower transaction costs it offers. Traditional financial systems typically involve various intermediaries, such as banks or brokers, which add fees and commissions to every transaction. These costs can quickly accumulate, especially for frequent traders or large investors.

With 1inch Coin, however, the decentralized nature of the platform eliminates the need for intermediaries, resulting in significantly lower transaction costs. By directly interacting with smart contracts on the Ethereum blockchain, users can yield farm and trade with minimal fees.

In addition to avoiding the fees charged by intermediaries, 1inch Coin also implements advanced techniques like gas optimization to further reduce transaction costs. Gas optimization improves efficiency by optimizing the allocation of computational resources required for each transaction.

Lower transaction costs with 1inch Coin benefit both individual users and the entire DeFi ecosystem. Individual users can maximize their profits by minimizing the fees associated with their yield farming activities. This enables them to retain a higher percentage of their earnings, consequently increasing their overall yield.

Furthermore, lower transaction costs promote greater participation and growth within the DeFi space. By providing a cost-effective option for yield farming, 1inch Coin attracts more users, increases liquidity, and fuels the development of innovative DeFi projects.

In summary, by leveraging the decentralized nature of the platform and implementing gas optimization techniques, Yield Farming with 1inch Coin offers lower transaction costs compared to traditional financial systems. This advantage not only benefits individual users but also contributes to the growth and expansion of the DeFi ecosystem as a whole.

Easy Access to Liquidity

One of the major benefits of yield farming with 1inch Coin is the easy access to liquidity it provides. Liquidity is the backbone of any financial ecosystem, and having access to it is crucial for investors and traders.

With 1inch Coin, users can easily unlock liquidity by providing their assets and participating in yield farming. By staking their assets in liquidity pools, users can earn rewards in the form of additional tokens or fees.

What is Liquidity?

Liquidity refers to the ease with which an asset can be bought or sold in the market without significantly impacting its price. In the context of cryptocurrency, liquidity is essential for smooth trading and efficient price discovery.

Without sufficient liquidity, it can be challenging to enter or exit a position quickly and at a favorable price. This can lead to slippage, where the execution price deviates significantly from the expected price, resulting in potential losses for the trader.

The Role of 1inch Coin

1inch Coin plays a vital role in providing users with easy access to liquidity. By staking their assets in 1inch liquidity pools, users contribute to the overall liquidity of the platform.

The liquidity provided by users is then used to facilitate trades and transactions, ensuring that there is always a sufficient supply of assets available. This not only benefits the users participating in yield farming but also enhances the trading experience for all participants on the 1inch platform.

Furthermore, by participating in yield farming with 1inch Coin, users can earn additional tokens or fees. These rewards incentivize users to provide liquidity, further enhancing the liquidity pool and creating a positive feedback loop.

In conclusion, easy access to liquidity is a significant advantage of yield farming with 1inch Coin. By providing liquidity to the platform, users can earn rewards while contributing to a healthy and vibrant financial ecosystem.

Question-answer:

What is yield farming?

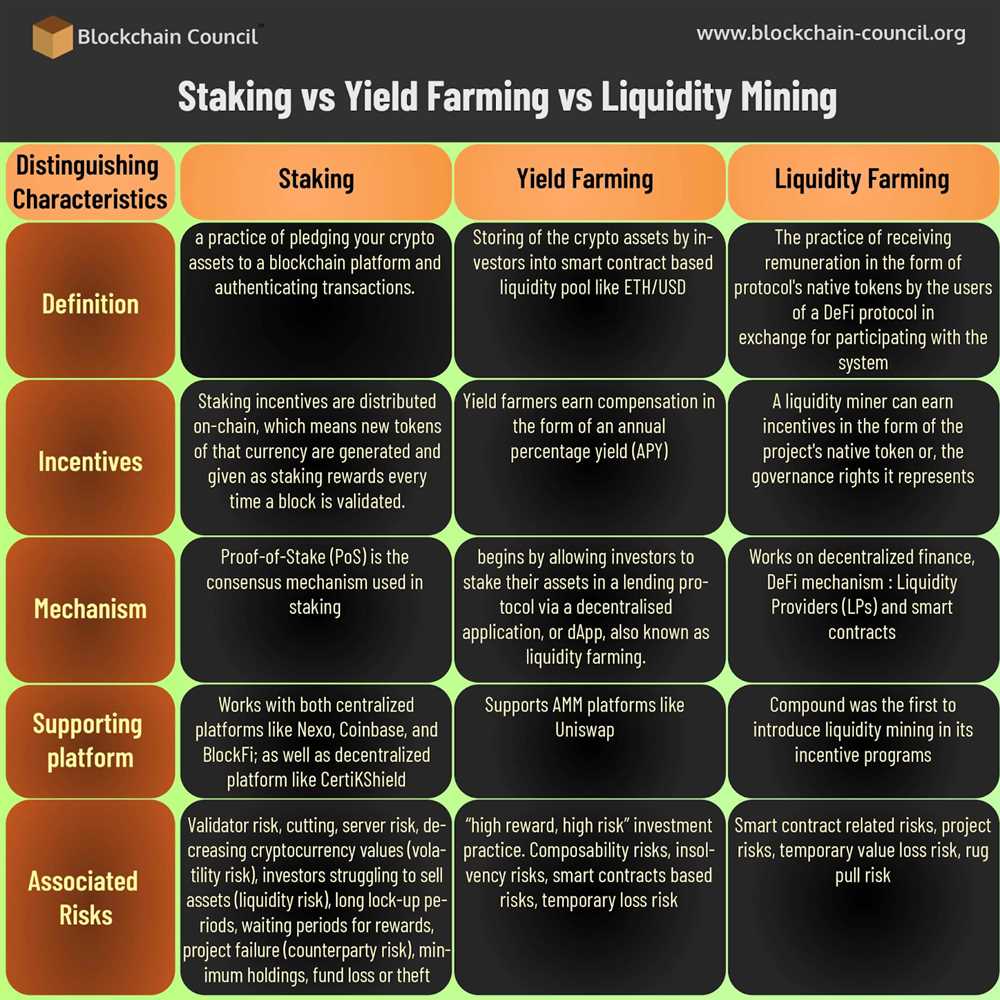

Yield farming, also known as liquidity mining, is a way to generate rewards with cryptocurrency holdings by lending or staking them. It involves providing funds to liquidity pools on decentralized exchanges and earning returns on those funds.

What is 1inch Coin?

1inch Coin is the native token of the 1inch Network, a decentralized exchange aggregator. It is used to incentivize liquidity providers, reward users, and as a governance token for voting on protocol upgrades and changes.

How can I benefit from yield farming with 1inch Coin?

You can benefit from yield farming with 1inch Coin by providing liquidity to the 1inch Liquidity Protocol and earning rewards in 1inch Coin. The more liquidity you provide, the more rewards you can earn.

What are the advantages of yield farming with 1inch Coin?

There are several advantages of yield farming with 1inch Coin. Firstly, you can earn higher returns compared to traditional investments. Secondly, you have the opportunity to earn additional rewards in 1inch Coin on top of the regular yield farming returns. Lastly, you can participate in the governance of the 1inch Network and have a say in the future development of the protocol.