1inch is a decentralized exchange aggregator that has quickly risen to become one of the most popular platforms in the cryptocurrency space. Since its launch in 2019, 1inch has experienced significant growth and has revolutionized the way users swap and trade tokens on various decentralized exchanges.

The idea behind 1inch was born out of the frustration of fragmented liquidity across different decentralized exchanges, which made it challenging for traders to get the best prices for their trades. The founders of 1inch, Sergej Kunz and Anton Bukov, recognized this problem and set out to create a solution that would allow users to access the best prices and liquidity across multiple decentralized exchanges.

With this goal in mind, 1inch developed an innovative algorithm that splits orders across multiple decentralized exchanges, allowing users to find the most efficient routes and get the best prices for their trades. This algorithm, known as Pathfinder, became the backbone of 1inch’s exchange aggregator, providing users with the ability to execute trades at the best possible rates.

Since its launch, 1inch has continued to innovate and add new features to its platform. In 2020, the platform introduced the concept of “aggregation”, which allows users to swap tokens at a lower cost by splitting their trades into multiple smaller transactions. This feature has proven to be incredibly popular among traders, as it allows them to save on gas fees and get better overall rates.

Today, 1inch has become a market leader in the decentralized finance (DeFi) space, with a user-friendly interface and a robust ecosystem of integrations and partnerships. The platform has also launched its own governance token, 1INCH, which allows users to participate in protocol upgrades and decision-making processes.

The evolution of 1inch from a simple idea to a market leader is a testament to the power of innovation and the importance of addressing the needs of users in the cryptocurrency space. As the decentralized finance industry continues to grow and evolve, 1inch is well-positioned to play a crucial role in shaping the future of decentralized exchanges and providing users with the best possible trading experience.

The Birth of a Revolutionary Concept

In the fast-paced world of decentralized finance (DeFi), innovation is key to success. This is exactly what led to the birth of 1inch, a revolutionary concept that has since become a market leader in the DeFi space.

The Idea Takes Shape

The idea for 1inch came about in 2019 when founders Sergej Kunz and Anton Bukov recognized the need for a decentralized exchange aggregator. They noticed that decentralized exchanges (DEXs) were becoming increasingly popular, but traders faced challenges when trying to find the best prices across multiple platforms.

The concept was simple yet powerful – to create a platform that would aggregate liquidity from various DEXs, allowing users to find the best prices for their trades in a single interface. This would not only save traders time but also help them optimize their trades by providing access to the best liquidity pools available.

The 1inch Protocol Emerges

With the idea in mind, Kunz and Bukov set out to develop the 1inch protocol. They were not alone in their mission, as they enlisted the help of a team of talented developers and blockchain experts.

The result was a protocol that utilizes smart contract technology to automatically split users’ trades across multiple DEXs, optimizing for the best prices and minimizing slippage. The protocol’s intelligent routing algorithm ensures that traders always get the most competitive rates available.

Furthermore, the 1inch protocol is built to be non-custodial, meaning users retain full control over their assets throughout the trading process. This aligns with the principles of decentralization and trustless interactions that are at the core of the DeFi movement.

| Key Features of the 1inch Protocol |

|---|

| Decentralized exchange aggregation |

| Automatic trade splitting |

| Intelligent routing algorithm |

| Non-custodial nature |

Since its launch, the 1inch protocol has gained significant traction in the DeFi community. Its innovative capabilities have attracted users and developers alike, leading to its rapid growth and establishment as a market leader.

The birth of 1inch and its revolutionary concept has ushered in a new era of decentralized finance. By providing users with access to the best prices and liquidity across multiple DEXs, 1inch has empowered traders and helped drive the mainstream adoption of DeFi.

The Idea Behind 1inch Protocol

The 1inch Protocol was born out of the need for a more efficient and user-friendly way to navigate the decentralized finance (DeFi) ecosystem. In its early stages, DeFi lacked a seamless and cost-effective solution for users to swap tokens across multiple decentralized exchanges (DEXs) with ease.

The founders of 1inch, Sergej Kunz and Anton Bukov, recognized this problem and set out to develop a solution that would provide users with the best possible rates for their token swaps. They envisioned a protocol that would aggregate liquidity from various DEXs, such as Uniswap, Balancer, and Kyber, to offer users the most optimal trading routes.

Enabling Efficient Token Swaps

1inch Protocol achieves this by utilizing a combination of smart contract technology and an intelligent routing algorithm. When a user wants to swap tokens, they send the transaction to the 1inch Protocol, which then splits it into multiple parts and routes it through different DEXs to achieve the best possible rate.

This innovative approach to token swaps allows users to save on gas fees and achieve better rates compared to manually trading on a single DEX. Instead of having to manually search for the best rates across various DEXs and execute multiple transactions, users can leverage the 1inch Protocol to perform the swap in a single transaction.

Ensuring User Safety and Security

Another key aspect of the 1inch Protocol is its focus on user safety and security. The protocol incorporates various security measures to minimize the risk of hacks and ensure the safety of user funds. These measures include thorough code audits, continuous monitoring of smart contract activity, and integration with leading security solutions.

The 1inch team is committed to the ongoing development and improvement of the protocol. They actively engage with the community and take feedback into account when making updates to ensure that the 1inch Protocol remains at the forefront of innovation in the DeFi space.

In conclusion, the 1inch Protocol was born out of the need to simplify and optimize token swaps in the DeFi ecosystem. By aggregating liquidity from multiple DEXs and utilizing an intelligent routing algorithm, the protocol enables users to achieve the best rates while saving on gas fees. With a strong focus on user safety and security, the 1inch Protocol is a leading solution in the ever-evolving world of decentralized finance.

Overcoming Challenges and Gaining Traction

Building 1inch from an idea to a market leader hasn’t been without its fair share of challenges. From fierce competition to regulatory hurdles, the team behind 1inch has had to navigate through various obstacles to gain traction in the decentralized finance (DeFi) space.

One of the main challenges for 1inch was facing well-established decentralized exchanges (DEXs) like Uniswap and Kyber Network. These platforms had already built a reputation and had a substantial user base. However, 1inch overcame this challenge by offering unique features and innovations that set it apart from the competition.

Another obstacle that 1inch had to overcome was the complexity of the DeFi ecosystem itself. The team had to develop a user-friendly interface that would make it easy for both beginners and experienced traders to navigate and use the platform. Through a combination of smart design and intuitive user experience, 1inch was able to gain traction and attract users.

Regulatory challenges also posed a significant threat to the growth of 1inch. The team had to constantly stay updated with the changing regulations and ensure compliance with local laws. This required a dedicated legal team and a proactive approach to staying ahead of the curve.

However, despite these challenges, 1inch was able to gain traction and establish itself as a market leader in the DeFi space. The platform’s unique features, such as its aggregation protocol and Pathfinder algorithm, have attracted a large number of users looking for the best possible trades across multiple liquidity sources.

Additionally, partnerships with other DeFi projects and collaborations within the industry have helped 1inch gain credibility and expand its reach. By working with other leading platforms and forming strategic alliances, 1inch has been able to further cement its position as a market leader.

In conclusion, 1inch has successfully overcome numerous challenges and gained traction in the DeFi space. With its unique features, user-friendly interface, and strategic partnerships, the platform has solidified its position as a market leader and continues to innovate and evolve.

Laying the Foundation: Development and Partnerships

The journey of 1inch from a simple idea to becoming a market leader in the decentralized finance (DeFi) space involved strategic development and key partnerships. At its core, 1inch aimed to solve the problem of fragmented liquidity in the DeFi ecosystem by aggregating various decentralized exchanges (DEXes) into one platform.

The development of 1inch was driven by a team of experienced developers and engineers who relentlessly worked towards achieving their vision. They built a powerful smart contract that allowed users to access multiple DEXes at once, ensuring the best possible rates for trades. By leveraging the power of Ethereum’s blockchain, 1inch provided users with a seamless and efficient trading experience.

However, developing a robust platform was not enough to ensure success. 1inch recognized the importance of partnerships in expanding its reach and establishing itself as a market leader. The team strategically formed alliances with various DeFi projects, including prominent protocols and decentralized applications (dApps).

One of the most notable partnerships was forged between 1inch and Binance, one of the largest centralized exchanges in the crypto industry. This partnership allowed 1inch to tap into Binance’s extensive user base and liquidity, attracting a wider audience to its platform. The integration with Binance also opened up new possibilities for cross-chain and cross-platform trading, further enhancing the capabilities of 1inch.

Additionally, 1inch partnered with other leading DeFi platforms such as Compound, Aave, and MakerDAO. These collaborations enabled 1inch to offer users access to a wider range of lending and borrowing protocols, further enhancing the utility of the platform. By integrating with these well-established projects, 1inch gained credibility and established itself as a trusted platform within the DeFi community.

The strategic alliances and partnerships formed by 1inch played a critical role in its journey from an innovative idea to a market leader. By focusing on development and collaborating with industry leaders, 1inch was able to create a robust platform that addressed the liquidity challenges faced by DeFi users. These partnerships not only expanded the reach of 1inch but also enhanced its functionality, making it one of the most trusted and widely used platforms in the DeFi ecosystem.

Rapid Expansion and Market Domination

Following its successful launch and early adoption, 1inch quickly began to expand its reach and establish itself as a dominant player in the decentralized finance (DeFi) market. The platform’s user-friendly interface, efficient execution, and competitive pricing soon attracted a growing number of users.

1inch’s innovative approach to liquidity aggregation and decentralized exchanges allowed it to tap into a wide range of liquidity sources and optimize trade execution, giving users access to the best possible prices across multiple decentralized platforms. This unique value proposition made 1inch an attractive choice for traders and investors looking for fast and cost-effective transactions.

With its strong foundation and growing user base, 1inch continued to innovate and develop new features to meet the evolving needs of the market. The platform introduced liquidity pools, allowing users to stake their assets and earn passive income through yield farming. This expansion into the yield farming space further solidified 1inch’s position as a leader in the DeFi ecosystem.

As 1inch gained momentum, it also formed strategic partnerships and collaborations with other leading projects in the industry. These partnerships allowed for a broader integration of 1inch services and increased accessibility for users. Additionally, 1inch made significant efforts to expand its presence in international markets, with localized versions of the platform being released in different languages.

The rapid expansion of 1inch also caught the attention of investors, leading to several successful funding rounds and the accumulation of significant capital. This funding not only helped fuel the platform’s growth but also provided resources to further enhance its capabilities and expand its team.

Today, 1inch continues to dominate the DeFi market by offering a comprehensive suite of services, including token swaps, yield farming, and governance. Its commitment to innovation, user experience, and security has solidified its position as the go-to platform for many DeFi enthusiasts and market participants.

1inch’s Rise to Prominence: Platform Features and Growth

1inch is a decentralized exchange (DEX) aggregator that allows users to trade tokens across multiple liquidity sources in a single transaction. Since its launch in 2020, it has rapidly gained popularity and become one of the leading platforms in the decentralized finance (DeFi) ecosystem. The platform’s rise to prominence can be attributed to its innovative features and continuous growth.

One of the key features that sets 1inch apart from other DEX aggregators is its smart contract architecture. The platform utilizes a unique algorithm called Pathfinder, which searches for the most efficient and cost-effective trading routes across different liquidity pools. This ensures that users get the best possible prices for their trades and minimizes slippage.

Additionally, 1inch pioneered the concept of “mooniswap” pools, which are designed to reduce impermanent loss for liquidity providers. Mooniswap pools utilize virtual balances and dynamic fees to achieve a more balanced reward distribution. This innovative approach has attracted liquidity providers to the platform, resulting in a deeper liquidity pool and improved trading experience for users.

As the DeFi ecosystem evolved, so did 1inch. The platform expanded its services beyond just token swaps and introduced features like yield farming and governance. Users can now stake their tokens on 1inch and earn additional rewards in the form of governance tokens. This not only incentivizes liquidity provision but also gives the community a voice in the platform’s decision-making process.

Furthermore, 1inch has been proactive in forging partnerships and integrations with other DeFi projects. It has collaborated with major platforms like Compound, MakerDAO, and Uniswap to provide users with a seamless and interconnected DeFi experience. These integrations have not only expanded the platform’s capabilities but also contributed to its rapid growth and adoption.

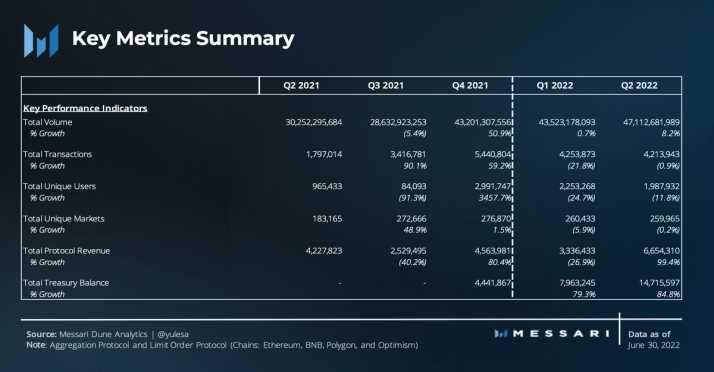

As a result of these platform features and strategic partnerships, 1inch has experienced significant growth in a relatively short period. Its trading volume has soared, and it has attracted a large and active user base. The platform’s commitment to innovation, user-centric design, and continuous improvement has solidified its position as a market leader in the DeFi space.

In conclusion, 1inch’s rise to prominence can be attributed to its unique platform features, such as Pathfinder and mooniswap pools, as well as its continuous growth through partnerships and expansion into new services. As the DeFi ecosystem continues to evolve, 1inch remains at the forefront, offering users a seamless and efficient trading experience.

Question-answer:

What is 1inch?

1inch is a decentralized exchange aggregator that sources liquidity from various exchanges to provide users with the best possible trading rates. It finds the most efficient trading routes across different DEXs to minimize slippage and maximize returns.

How did 1inch evolve over time?

1inch started as an idea in 2019 and quickly gained popularity due to its innovative approach to decentralized trading. It received funding from leading investors and expanded its team to further develop the platform. Over time, it became a market leader and one of the most trusted platforms in the DeFi space.

What are some of the key features of 1inch?

1inch offers a range of features that make it stand out in the market. Some of the key features include the ability to source liquidity from multiple exchanges, the use of advanced algorithms to find the most efficient trading routes, and the option to execute trades with low slippage.

Who are some of the major investors that have supported 1inch?

1inch has received investments from notable investors such as Binance, Pantera Capital, and Galaxy Digital. These investments have helped the platform grow and expand its services to cater to a wider audience.

What sets 1inch apart from other decentralized exchanges?

1inch differentiates itself from other decentralized exchanges by offering superior trading rates, thanks to its aggregation of liquidity from multiple platforms. Its advanced algorithms also help users find the most efficient trading routes, minimizing slippage and maximizing returns.