Are you looking for a promising investment opportunity in the world of cryptocurrencies? Consider investing in 1inch, the decentralized exchange aggregator that offers unparalleled opportunities for both risk and return.

What is 1inch?

1inch is a cutting-edge platform that revolutionizes the way we trade cryptocurrencies. By combining the liquidity of numerous decentralized exchanges, 1inch ensures that users always get the best prices and lowest slippage for their trades. With its innovative algorithm, 1inch opens up a world of possibilities for investors and traders in the crypto market.

Why invest in 1inch?

1inch offers a unique investment opportunity with a high potential for lucrative returns. By investing in 1inch, you become an active participant in the growing decentralized finance (DeFi) ecosystem. As the popularity of DeFi continues to soar, 1inch is well-positioned to benefit from this trend, potentially resulting in substantial gains for investors.

Please note that investing in cryptocurrencies carries inherent risks, and past performance is not indicative of future results. It is important to thoroughly research and assess the risks involved before making any investment decisions.

Diversify your portfolio with 1inch

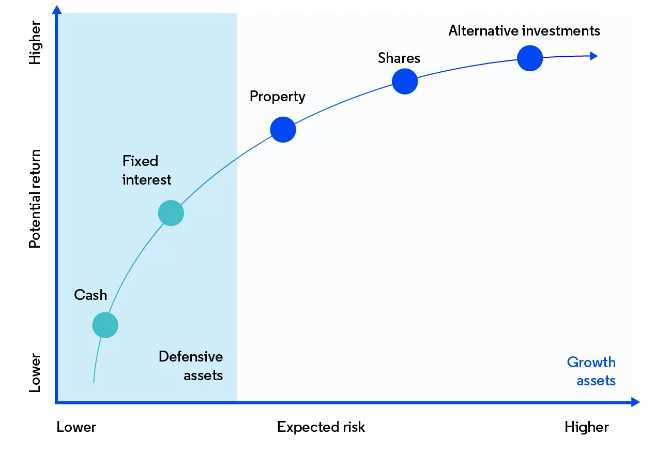

Adding 1inch to your investment portfolio allows you to diversify your holdings and tap into the potential of the rapidly expanding DeFi sector. By investing in 1inch, you gain exposure to the growing popularity of decentralized exchanges and the increasing adoption of cryptocurrencies.

Take advantage of the 1inch token

Investing in 1inch also provides an opportunity to benefit from the platform’s native token, 1INCH. As the demand for 1inch’s services increases, the value of the 1INCH token may appreciate, potentially resulting in significant profits for investors.

Remember, investing in cryptocurrencies involves risks, including the risk of losing your entire investment. It is important to conduct your own research and seek advice from a qualified financial professional before making any investment decisions.

Conclusion

With its unique approach to decentralized trading and its potential for high returns, investing in 1inch can be a lucrative opportunity for investors looking to diversify their portfolio. However, it is crucial to carefully assess and understand the risks involved before making any investment decisions.

Don’t miss out on the potential of 1inch – start your investment journey today!

What is 1inch?

1inch is a decentralized exchange aggregator that provides users with the best rates by sourcing liquidity from various decentralized exchanges. It is built on the Ethereum blockchain and allows users to access multiple liquidity sources in a single platform.

1inch uses a smart contract to split the user’s trade across multiple decentralized exchanges to ensure they get the best possible price. It automatically finds the most efficient trading paths and splits the trade into multiple orders to minimize slippage and maximize returns for the user.

The platform is powered by the 1inch token, which is an ERC-20 utility token used for governance and as a medium of exchange within the ecosystem. Holders of the 1inch token can participate in the decision-making process of the platform and earn rewards for their contributions.

Overall, 1inch is a secure and efficient solution for traders looking to optimize their trading strategies and maximize their returns through decentralized exchanges.

Why invest in 1inch?

Investing in 1inch can offer numerous benefits to both experienced and novice investors. Here are some compelling reasons to consider investing in 1inch:

1. Innovative Technology

1inch is powered by cutting-edge technology that allows users to access the best prices across decentralized exchanges (DEXs). By leveraging intelligent routing algorithms, 1inch ensures that users get the most favorable rates for their trades. This technology has revolutionized the way trades are executed, offering users unparalleled efficiency and cost savings.

2. Liquidity Aggregation

1inch is the leading liquidity aggregator in the decentralized finance (DeFi) space. It sources liquidity from various DEXs, ensuring that users have access to deep liquidity pools and can execute trades with minimal slippage. This aggregated liquidity not only improves trading conditions but also reduces the risk of market manipulation.

3. Governance and Utility

Investing in 1inch allows you to participate in the governance of the 1inch ecosystem. By holding 1inch tokens, you can vote on governance proposals and influence the development and direction of the platform. Additionally, 1inch tokens have utility within the ecosystem, allowing holders to access premium features and receive rewards.

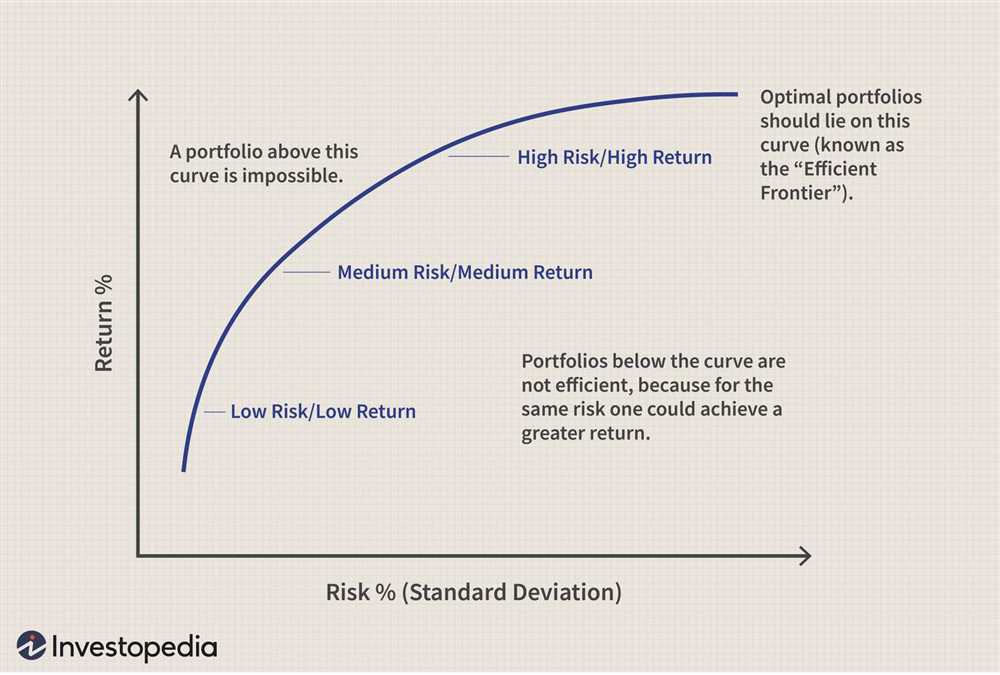

These are just a few reasons why investing in 1inch can be a lucrative opportunity. With its innovative technology, liquidity aggregation, and governance model, 1inch has positioned itself as a leader in the DeFi space. Take advantage of this opportunity and start investing in 1inch today!

Comprehensive Risk Analysis

When considering any investment opportunity, it is crucial to perform a thorough risk analysis. The same applies to investing in 1inch, a decentralized exchange aggregator.

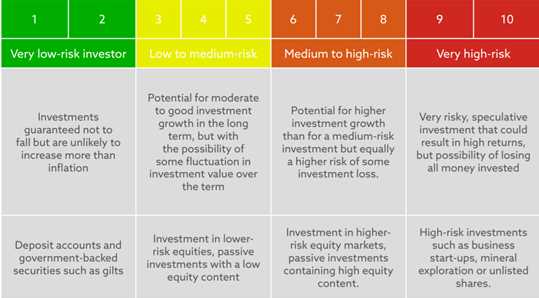

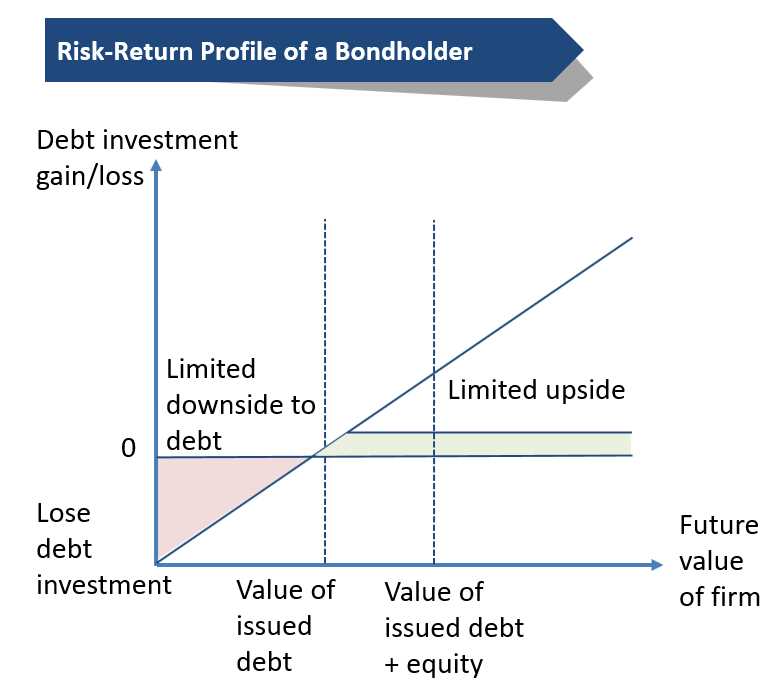

Market Risk: The cryptocurrency market is known for its volatility. While 1inch has proven to be resilient in the face of market fluctuations, there is always a risk that the value of the tokens could be affected by external factors beyond our control.

Regulatory Risk: Cryptocurrencies operate in an evolving regulatory landscape. It is important to consider the potential impact of changing regulations on the 1inch platform and its token. Any unforeseen regulatory actions could have an adverse effect on the value and usability of the tokens.

Technology Risk: 1inch relies on cutting-edge blockchain technology. While the team behind 1inch ensures the highest standards of security and efficiency, there is always a possibility of technological vulnerabilities or exploits. It is essential to stay updated on any potential security risks and how the team is addressing them.

Competition Risk: The decentralized finance (DeFi) space is highly competitive, with new projects emerging regularly. While 1inch has established itself as a leading decentralized exchange aggregator, there is always a risk that new competitors could offer more innovative solutions and attract users away from the platform.

Liquidity Risk: Liquidity is essential for the smooth operation of any exchange platform. While 1inch has gained significant liquidity, there is a risk that sudden market shifts or changes in trading volume could impact liquidity on the platform, potentially affecting the ease of executing trades.

Please note that this risk analysis is by no means exhaustive. It is important to conduct further research and consult with a financial advisor before making any investment decisions.

Market Volatility

When considering investing in any asset, it is important to analyze market volatility. Market volatility refers to the fluctuation in prices and the degree of uncertainty in the market. Understanding market volatility is crucial for investors as it helps them make informed decisions and manage their risks effectively.

1inch is no exception when it comes to market volatility. As a decentralized exchange aggregator, the price of 1inch tokens can be influenced by various factors, including market trends, trading volume, news events, and overall market sentiment.

One of the main advantages of investing in 1inch is that it has a strong track record of adapting to market conditions and managing volatility. The team behind 1inch is constantly working on improving the platform’s efficiency and resilience to market fluctuations.

- 1. Stable Development: The 1inch team is committed to ongoing development and improvement of the platform. They regularly release updates and enhancements to ensure the platform remains efficient and can handle high trading volumes.

- 2. Liquidity: 1inch has a deep pool of liquidity sourced from multiple decentralized exchanges, which helps to minimize slippage and ensure a smooth trading experience even during times of high volatility.

- 3. Risk Management: 1inch incorporates various risk management strategies, such as tight risk controls, to mitigate potential losses during periods of extreme market volatility.

While volatility can create opportunities for substantial gains, it can also lead to significant losses if not managed properly. Therefore, it is important for investors to carefully consider their risk tolerance and investment goals before investing in 1inch or any other volatile asset. Diversification and setting appropriate stop-loss orders are some of the risk management strategies that can help investors navigate through market volatility.

In conclusion, market volatility is an inherent characteristic of the cryptocurrency market, and investing in 1inch carries certain risks associated with this volatility. However, with a strong development team, ample liquidity, and robust risk management strategies, 1inch is well-equipped to handle market fluctuations, offering attractive investment opportunities for those willing to bear the associated risks.

Regulatory Risks

When investing in 1inch, it is important to consider the potential regulatory risks that may impact the platform and its users. Regulatory risks refer to the possibility of government regulations or policies that could affect the operations, growth, and profitability of the 1inch platform.

One of the main regulatory risks for 1inch is the possibility of strict regulations or bans on cryptocurrencies and decentralized finance (DeFi) platforms. Governments around the world are still grappling with how to regulate these new and innovative technologies. If governments decide to implement strict regulations or outright bans on cryptocurrencies or DeFi platforms, it could severely impact 1inch’s ability to operate and provide its services.

Another regulatory risk for 1inch is the potential for changes in tax regulations related to cryptocurrencies. As governments continue to develop tax policies for cryptocurrencies, investors and users of 1inch may be subject to unexpected tax liabilities or complications. These changes in tax regulations could create additional costs and administrative burdens for both the platform and its users.

Furthermore, regulations regarding customer protection and anti-money laundering (AML) measures could have an impact on 1inch. Governments may require stricter KYC (Know Your Customer) procedures, which could make it more difficult for users to access the platform or for 1inch to comply with regulatory requirements. Compliance with AML regulations could also increase operational costs for 1inch.

It is important to note that regulatory risks are often uncertain and can vary widely across jurisdictions. The regulatory landscape for cryptocurrencies and DeFi platforms is constantly evolving, and new regulations or policies could be enacted at any time. Investors should thoroughly research and stay informed about the regulatory environment in their jurisdiction before investing in 1inch.

Table: Summary of Regulatory Risks

| Regulatory Risk | Description |

|---|---|

| Strict Regulations or Bans | Possibility of governments implementing strict regulations or bans on cryptocurrencies and DeFi platforms. |

| Changes in Tax Regulations | Potential changes in tax regulations related to cryptocurrencies, resulting in unexpected tax liabilities or complications. |

| Customer Protection and AML | Requirements for stricter KYC procedures and compliance with AML regulations, leading to difficulties and increased operational costs. |

| Evolution of Regulatory Landscape | The regulatory environment for cryptocurrencies and DeFi platforms is constantly changing, and new regulations or policies could be introduced at any time. |

Competition

When it comes to decentralized exchanges (DEXs), there is no shortage of competition in the market. While 1inch has established itself as a leading DEX aggregator, there are other players that are vying for a piece of the pie.

One of the main competitors of 1inch is Uniswap, which is one of the most popular DEXs in the market. Uniswap has gained a lot of attention and usage due to its user-friendly interface and its ability to provide liquidity through automated market making. However, 1inch offers a unique advantage by allowing users to access liquidity from multiple DEXs and take advantage of the best prices and lowest fees available.

Another competitor of 1inch is SushiSwap, which is a fork of Uniswap. SushiSwap aims to incentivize liquidity providers by rewarding them with its native token, SUSHI. While SushiSwap has gained some traction in the market, 1inch still remains a strong competitor due to its advanced algorithmic routing and integration with multiple DEXs.

Key Differentiators

1inch stands out from its competitors in several ways. First, its smart contract is open-source and audited, which provides users with a high level of security and trust. Additionally, 1inch has a user-friendly interface that makes it easy for both beginners and experienced traders to navigate and trade on the platform.

Furthermore, 1inch’s algorithmic routing system allows it to provide users with the best possible trades by scanning multiple DEXs and finding the best prices, lowest fees, and optimal liquidity pools. This gives users a significant advantage in terms of getting the most out of their trades.

Conclusion

While there is fierce competition in the decentralized exchange market, 1inch has managed to establish itself as a leader in DEX aggregation. Its unique features and advanced algorithmic routing system set it apart from its competitors, making it a preferred choice for traders looking to optimize their trades.

Question-answer:

What is 1inch?

1inch is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges (DEXs).

Why should I invest in 1inch?

Investing in 1inch can potentially provide significant returns as the platform continues to gain popularity and usage among the decentralized finance (DeFi) community.

What are the risks of investing in 1inch?

Investing in 1inch carries the risk of price volatility, as the cryptocurrency market can be highly unpredictable. There are also regulatory risks and risks associated with the overall security of the platform and the underlying smart contracts.