Are you tired of missing out on the best prices when trading crypto? Look no further than 1inch, the leading decentralized exchange aggregator.

1inch is revolutionizing the way traders access liquidity by connecting multiple decentralized exchanges into one easy-to-use platform. With 1inch, you can be confident that you are always getting the best prices and minimizing slippage.

How does 1inch achieve this? By utilizing advanced algorithms and smart contract technology, 1inch scans multiple exchanges in real-time to find the most optimal trading route for your crypto assets.

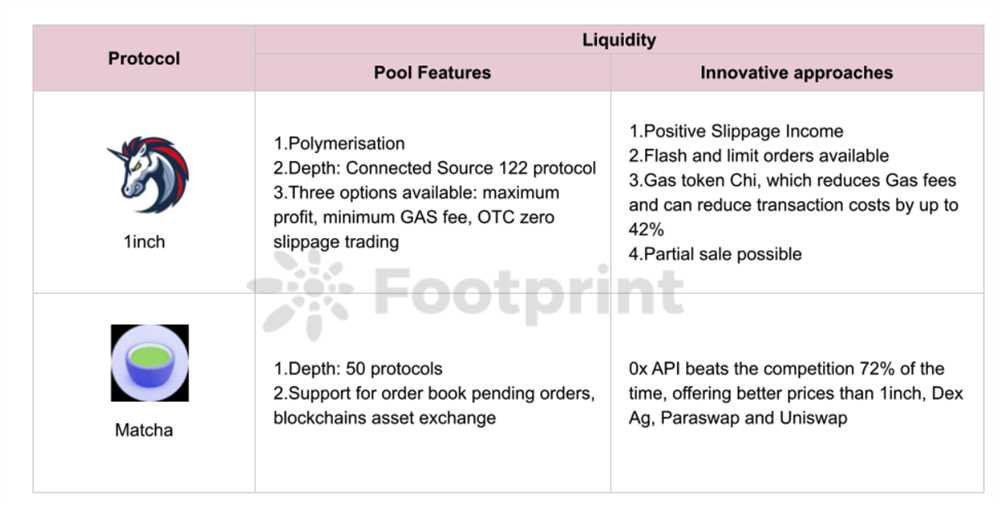

But what does this mean for you? It means that as a trader, you can avoid the frustration of trading at suboptimal prices due to liquidity fragmentation. 1inch aggregates liquidity from top decentralized exchanges such as Uniswap, SushiSwap, and many more, ensuring that you always get the best possible prices for your trades.

Additionally, 1inch minimizes slippage, allowing you to execute your trades with little to no impact on the market. This ensures that you can buy or sell your crypto assets at the price you want, without worrying about price fluctuations during the execution of your trade.

Experience the power of 1inch and take control of your trading experience today. With better prices and minimized slippage, you can maximize your profits and trade with confidence.

inch: Better Prices

One of the main advantages of using 1inch for cryptocurrency trading is the ability to ensure better prices. The platform utilizes various strategies and algorithms to find the most favorable prices for traders.

Through its aggregation feature, 1inch combines liquidity from multiple decentralized exchanges, allowing traders to access a larger pool of liquidity. This increases the likelihood of finding competitive prices and reduces the impact of large trades on the market.

The implementation of the 1inch Pathfinder algorithm also helps in achieving better prices. The algorithm splits orders across multiple liquidity sources, optimizing the execution process and reducing slippage. By intelligently routing trades, 1inch ensures that traders can achieve the best possible prices with minimal market impact.

In addition, 1inch provides users with access to a wide range of liquidity sources, including decentralized exchanges, lending platforms, and liquidity pools. This diversity of options further enhances the platform’s ability to find the best prices for traders.

Overall, 1inch’s commitment to continuously improving price discovery mechanisms and optimizing trade execution processes makes it a preferred choice for traders who seek better prices and minimal slippage in their cryptocurrency transactions.

| Advantages of 1inch in Ensuring Better Prices: |

|---|

| Aggregation of liquidity from multiple decentralized exchanges |

| Implementation of the 1inch Pathfinder algorithm |

| Diversity of liquidity sources |

Optimal Price Execution

At 1inch, we understand that getting the best price for your crypto trades is crucial. That’s why we have developed a sophisticated algorithm and cutting-edge technology to ensure optimal price execution for our users.

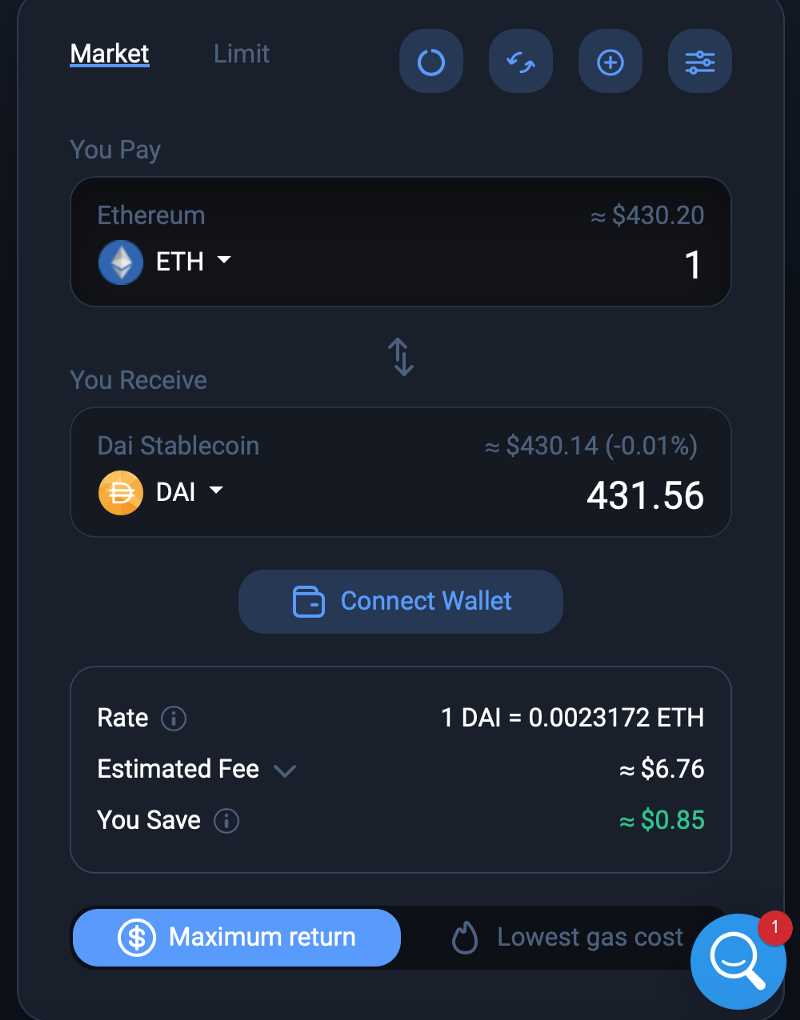

Our platform leverages multiple decentralized exchanges and liquidity sources to find the most favorable prices for your trades. Whether you are buying or selling crypto assets, our smart routing system automatically splits your trade across multiple exchanges to minimize slippage and maximize your gains.

We go above and beyond to ensure that you get the best possible price for your trades. Our algorithm takes into account various factors such as liquidity, trading volume, and market depth to execute your trades at the most opportune moment, maximizing your profits.

In addition to optimizing price execution, we also provide transparent and real-time information about the prices available on different exchanges. Our intuitive interface displays the available prices and liquidity across various platforms, allowing you to make informed decisions and choose the best option for your trades.

With 1inch, you can be confident that your trades are executed with precision and efficiency, ensuring better prices and minimizing slippage. Start trading with 1inch today and experience the benefits of optimal price execution for yourself.

Disclaimer: Trading cryptocurrencies carries a high level of risk and may not be suitable for all investors. Please conduct your own research and seek professional advice before making any investment decisions.

Aggregation of Liquidity

One of the key features that sets 1inch apart from other decentralized exchanges is its unique aggregation of liquidity. Unlike traditional exchanges that rely on a single source of liquidity, 1inch combines multiple liquidity sources to provide traders with the best possible prices and minimize slippage.

Through its innovative algorithm, 1inch aggregates liquidity from various decentralized exchanges, including but not limited to Uniswap, SushiSwap, Balancer, and Curve. By accessing liquidity from multiple sources, 1inch ensures that traders can always find the most favorable rates for their desired cryptocurrency trades.

Not only does 1inch aggregate liquidity from different exchanges, but it also optimizes the trading routes to minimize slippage. Slippage occurs when the price of a trade moves unfavorably during the execution process. With 1inch’s aggregation of liquidity, traders can enjoy minimal slippage and secure better prices for their trades.

1inch achieves this by splitting a large trade into smaller parts and executing them across different DEXs to take advantage of the liquidity available at each venue. This intelligent routing mechanism ensures that traders get the greatest possible value for their trades and minimizes the impact on the market.

By aggregating liquidity from multiple sources and optimizing trading routes, 1inch offers crypto traders a more efficient and cost-effective trading experience. Whether you’re a professional trader or a beginner, 1inch’s aggregation of liquidity can help you achieve better prices and maximize your returns.

Experience the power of liquidity aggregation with 1inch and take your crypto trading to the next level.

inch: Minimizing Slippage

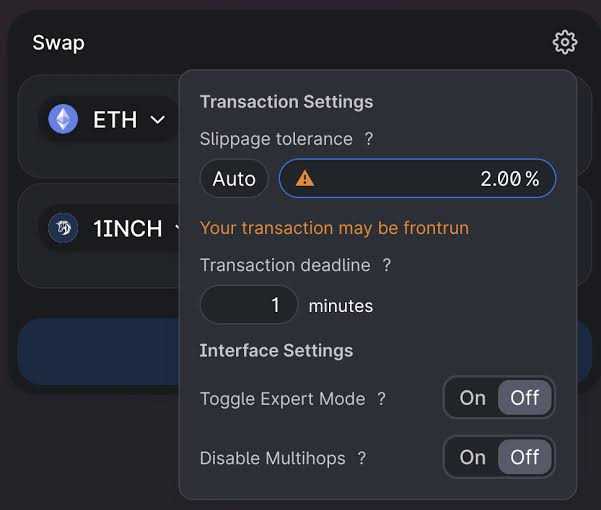

In the world of cryptocurrency trading, slippage can be a major concern for traders. Slippage refers to the difference between the expected price of a trade and the price at which the trade is actually executed. In other words, it is the cost traders incur due to the market’s inability to fulfill their trading orders at the desired price.

However, with the powerful 1inch platform, traders can minimize slippage and ensure better prices for their trades. How does 1inch achieve this?

Smart Contract Architecture

1inch’s smart contract architecture plays a crucial role in minimizing slippage. The platform combines multiple decentralized exchanges (DEXs) and liquidity sources, optimizing smart contract execution paths to ensure the best possible trading prices. By splitting an order into many smaller parts and executing them on different DEXs, 1inch minimizes the impact on individual liquidity pools, reducing slippage.

Agnostic Liquidity Sourcing

1inch is liquidity-source agnostic, meaning it can access liquidity from various DEXs seamlessly. This enables traders to benefit from the deep liquidity available across multiple platforms, allowing them to find the best possible prices for their trades without being limited to a single exchange.

By leveraging both smart contract architecture and agnostic liquidity sourcing, 1inch empowers crypto traders to execute trades with minimal slippage, increasing their chances of achieving their desired trading outcomes.

Don’t let slippage eat into your profits – trade with 1inch and experience the benefits of minimized slippage and better prices today!

Intelligent Routing

One of the key features that sets 1inch apart from other decentralized exchanges is its intelligent routing. This advanced technology ensures that crypto traders always get the best prices and minimizes slippage when executing their trades.

Intelligent routing works by splitting a trade across multiple liquidity sources to find the most optimal path. By aggregating liquidity from various decentralized exchanges and protocols, 1inch is able to access a wider range of trading opportunities, resulting in better prices for its users.

How Does Intelligent Routing Work?

When a user places a trade on 1inch, the platform’s algorithm analyzes the liquidity available on different exchanges and protocols in real-time. It then splits the trade into smaller orders and routes them to the exchanges where the best prices are available.

This dynamic routing system ensures that traders can take advantage of the best prices from multiple sources, allowing them to achieve the optimal execution for their trades.

The Benefits of Intelligent Routing

By using intelligent routing, 1inch offers several benefits to crypto traders:

1. Better Prices: By accessing liquidity from multiple sources, 1inch can find the best prices available in the market, ensuring that traders get the most value out of their trades.

2. Minimized Slippage: Slippage refers to the difference between the expected price of a trade and the price at which the trade is executed. 1inch’s intelligent routing minimizes slippage by splitting trades and routing them to the exchanges with the best prices, reducing the impact of large orders on the market.

3. Increased Liquidity: By aggregating liquidity from various decentralized exchanges and protocols, 1inch increases the overall liquidity available on its platform, offering more trading opportunities to users.

Overall, intelligent routing is a key feature that sets 1inch apart from other decentralized exchanges, providing traders with better prices, minimized slippage, and increased liquidity for their crypto trades.

Question-answer:

How does 1inch ensure better prices for crypto traders?

1inch uses smart contract technology to aggregate liquidity from various decentralized exchanges, allowing traders to access the best possible prices for their trades.

What is slippage in crypto trading?

Slippage refers to the difference between the expected price of a trade and the actual executed price. It occurs when there is not enough liquidity available to fill an order at the expected price, leading to a worse price for the trader.

How does 1inch minimize slippage for crypto traders?

1inch minimizes slippage by splitting large orders across multiple decentralized exchanges, optimizing for the best possible price across the entire order. This ensures that traders get the most favorable price for their trades.

Does 1inch support only a specific set of cryptocurrencies?

No, 1inch supports a wide range of cryptocurrencies. Traders can trade various tokens on 1inch, including popular ones like Bitcoin, Ethereum, and many others.

Can I use 1inch if I’m a beginner in crypto trading?

Yes, 1inch is designed to be user-friendly and accessible to beginners. The platform provides a simple and intuitive interface, making it easy for anyone to trade cryptocurrencies and get the best prices.