Decentralized Finance (DeFi) has revolutionized the way we think about traditional finance. With the rise of platforms like 1inch, users now have the ability to trade and invest in a completely decentralized manner. But what impact do these trades have on prices in the DeFi ecosystem?

In this article, we will analyze the price impact of trades executed through 1inch, one of the leading decentralized exchanges in DeFi. By examining the underlying mechanics of how trades are executed and the liquidity available on the platform, we can gain a better understanding of how 1inch impacts prices.

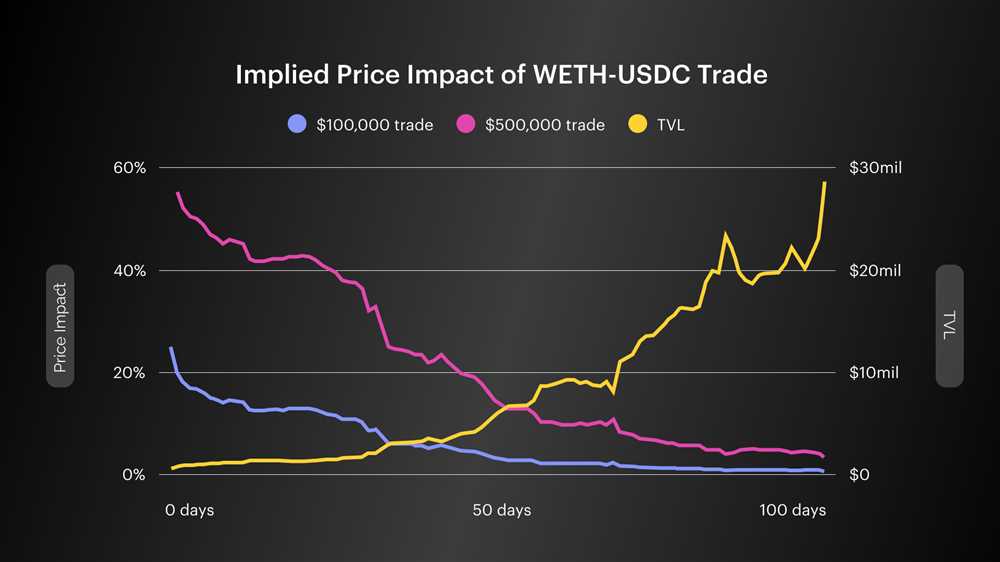

One of the key factors that determines the price impact of a trade on 1inch is the liquidity of the trading pair. Liquidity refers to the amount of assets available for buying and selling. When liquidity is low, even a small trade can have a significant impact on the price, as the buying or selling pressure can move the market. On the other hand, when liquidity is high, larger trades are needed to have a noticeable effect on the price.

Furthermore, the slippage tolerance set by the trader also plays a role in determining the price impact. Slippage tolerance is the maximum difference between the expected price of a trade and the actual executed price. If a trader has a high slippage tolerance, they are willing to accept a larger price impact in order to execute the trade quickly. Conversely, a low slippage tolerance means the trader is more sensitive to price changes and prefers to wait for an optimal price.

By understanding these factors, we can gain insights into the price impact of trades executed through 1inch. This analysis can help traders make more informed decisions and contribute to the overall understanding of how decentralized exchanges influence the price dynamics of the DeFi market.

Understanding the Importance of Analyzing Price Impact in DeFi

In the decentralized finance (DeFi) space, analyzing price impact is crucial for traders and investors. Price impact refers to the effect of a trade on the price of an asset. Understanding and measuring price impact is essential for making informed decisions and managing risks.

What is Price Impact?

Price impact is a measure of how a trade affects the market price of an asset. When a large buy or sell order is executed, it can move the price of the asset in a favorable or unfavorable direction. This movement is known as price impact.

Price impact is influenced by several factors, including the size of the trade relative to the overall market volume and the depth of the liquidity pool. A large trade in a illiquid market can have a significant price impact, while a small trade in a liquid market may have minimal impact.

The Importance of Analyzing Price Impact

Analyzing price impact is crucial for several reasons:

| 1. Slippage | Price impact is directly related to slippage, which is the difference between the expected price of a trade and the actual executed price. By understanding the potential price impact of a trade, traders can mitigate slippage and minimize losses. |

| 2. Liquidity | Price impact is a reflection of the liquidity of an asset. Higher price impact indicates lower liquidity, making it more difficult to execute large trades without moving the market. Analyzing price impact helps traders assess the liquidity of an asset and adjust their trading strategies accordingly. |

| 3. Risk Management | Price impact analysis is essential for managing risk. By understanding the potential price impact of a trade, investors can evaluate the risk-reward ratio and determine if a trade is worth executing. It also helps in designing more effective risk management strategies. |

| 4. Market Efficiency | Analyzing price impact is crucial for assessing the efficiency of a market. In an efficient market, large trades should have minimal impact on the price. If a market has high price impact, it may indicate inefficiencies and opportunities for arbitrage. |

Overall, analyzing price impact is essential for making informed decisions, minimizing risks, and maximizing returns in the DeFi space. By understanding the factors that influence price impact and using appropriate analysis tools, traders and investors can navigate the decentralized market with confidence.

Examining the Role of 1inch in Decentralized Finance

Decentralized Finance (DeFi) has revolutionized the traditional financial system by providing an open and permissionless alternative for financial transactions. One platform that has played a significant role in the growth and adoption of DeFi is 1inch.

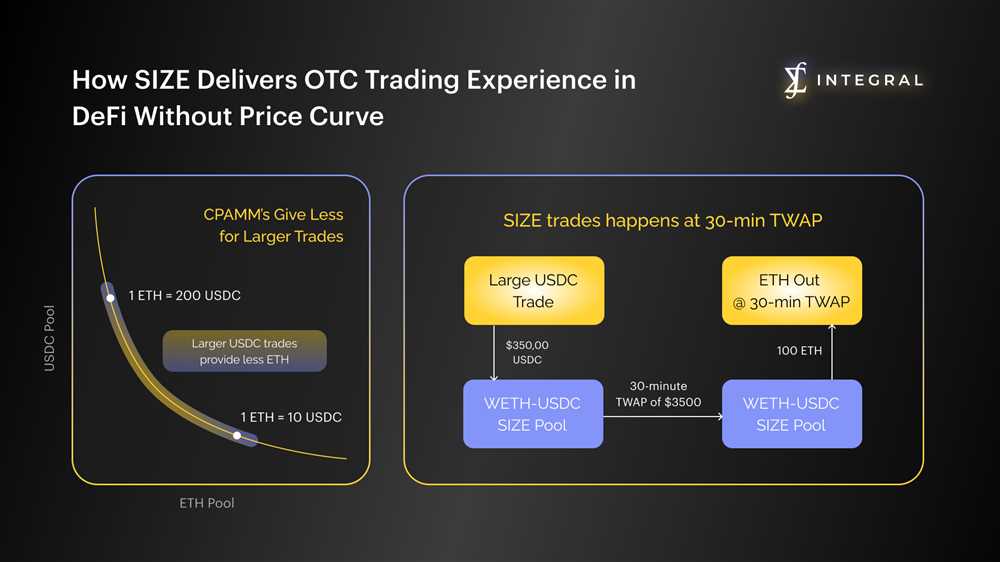

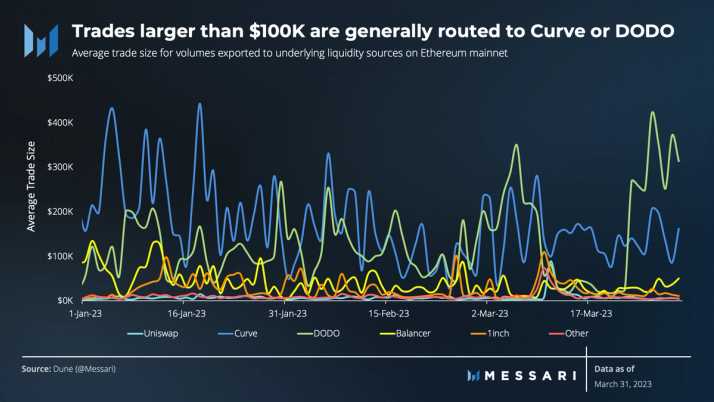

1inch is a decentralized exchange aggregator that routes trades across multiple liquidity sources to ensure users get the best possible prices. By aggregating liquidity from various decentralized exchanges, 1inch provides users with improved access to liquidity and helps minimize slippage.

One of the key benefits of using 1inch is its ability to split a large trade across multiple decentralized exchanges. This splitting mechanism allows traders to avoid moving the market price by executing large trades in small increments. By doing so, 1inch helps mitigate price impact and ensures traders get the best possible execution price.

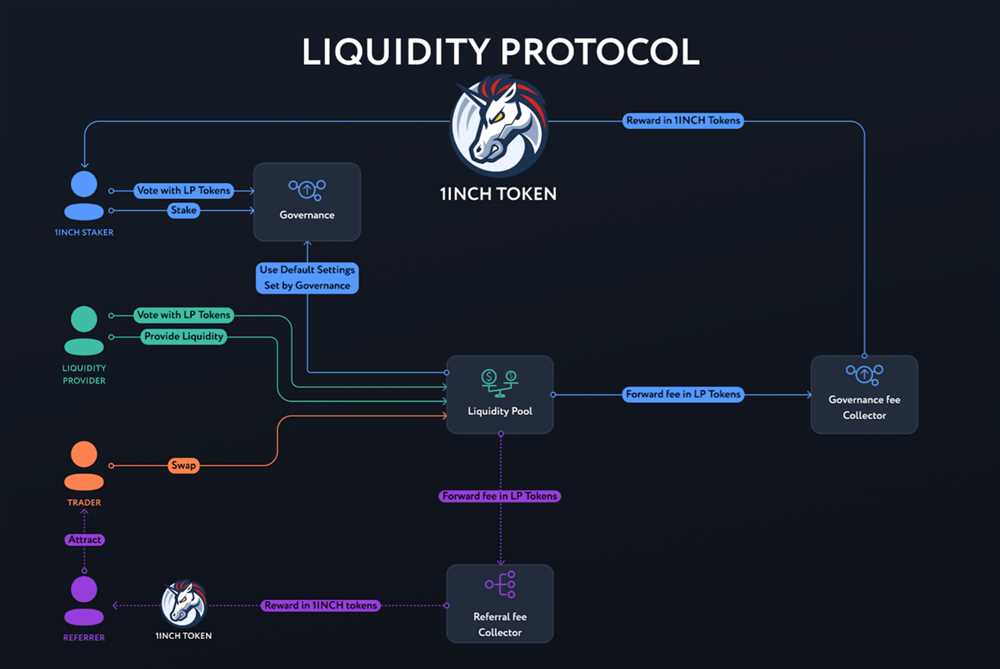

In addition to its role as an exchange aggregator, 1inch also provides users with other valuable features. It offers liquidity providers the ability to earn fees by providing liquidity to its platform. This incentivizes liquidity provision and helps deepen the liquidity pool for 1inch users.

Furthermore, 1inch has its native token, 1INCH, which serves as the governance token for the platform. Tokenholders can participate in the decision-making process and have a say in the platform’s future development and improvements.

Overall, 1inch has emerged as a crucial player in the DeFi ecosystem. Its exchange aggregation technology has improved liquidity access and execution prices for traders, while its incentivized liquidity provision has deepened the liquidity pool. As DeFi continues to grow, 1inch is likely to play an even more significant role in shaping the future of decentralized finance.

Analyzing the Factors Influencing Price Impact in 1inch Trades

In decentralized finance (DeFi), price impact refers to the change in the price of an asset caused by a trade. It is an important metric used to assess the efficiency and liquidity of a trading protocol like 1inch. Understanding the factors that influence price impact can provide valuable insights for traders and developers in optimizing trading strategies and improving the overall user experience.

There are several key factors that can influence the price impact of 1inch trades:

| Factor | Description |

|---|---|

| Trade Size | The size of the trade, measured in the amount of the asset being bought or sold, can have a significant impact on the price. Larger trades are more likely to cause a higher price impact, as they require a larger amount of liquidity to be executed. |

| Liquidity | The availability of liquidity in the market can also affect price impact. If there is a high level of liquidity, it is easier to execute large trades without significantly impacting the price. Conversely, low liquidity can result in larger price impacts, as a smaller amount of liquidity is available to accommodate the trade. |

| Market Depth | Market depth refers to the volume of buy and sell orders at different price levels. It represents the amount of liquidity available at each price point. Deeper market depth indicates a higher level of liquidity and can help lower price impact, as there is more liquidity available to absorb the trade. |

| Slippage | Slippage is the difference between the expected price of a trade and the actual executed price. It occurs when there is a lack of liquidity or a delay in the execution of the trade. High slippage can result in larger price impacts, as the executed price deviates more from the expected price. |

| Volatility | Volatility in the price of the asset being traded can also impact price impact. Higher volatility can result in larger price impacts, as the price of the asset may change more rapidly during the execution of the trade. |

| Protocol Fees | Some trading protocols, like 1inch, charge fees for executing trades. These fees can also contribute to price impact, as they increase the overall cost of the trade and may discourage traders from executing large trades. |

By analyzing these factors, traders and developers can gain a deeper understanding of price impact in 1inch trades and make more informed decisions. They can optimize trade execution by taking into account factors such as trade size, liquidity, market depth, slippage, volatility, and protocol fees. This can ultimately lead to improved trading strategies and a better user experience in the DeFi ecosystem.

Implications and Insights on Price Impact of 1inch Trades in DeFi

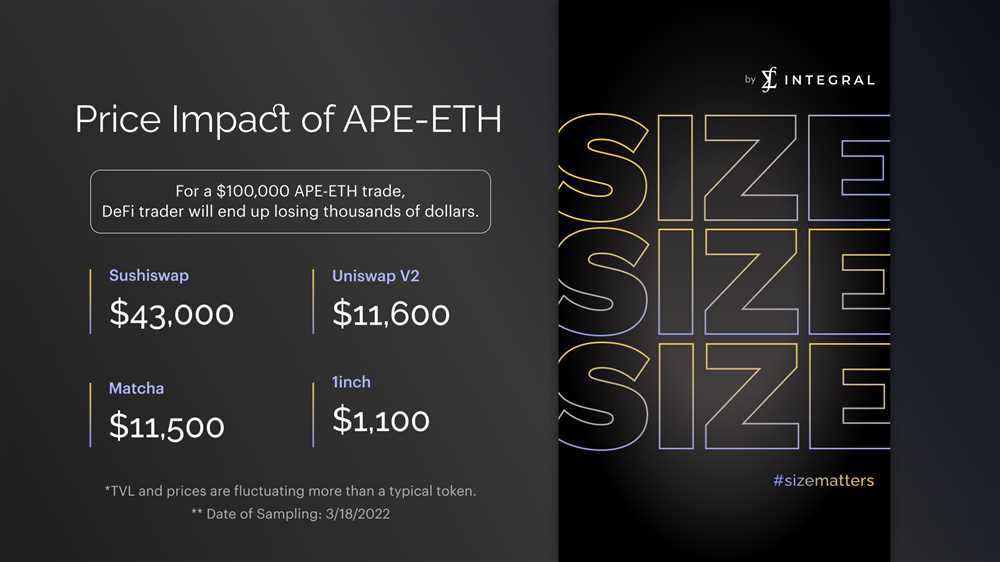

The price impact of trades in the decentralized finance (DeFi) space has always been a topic of interest for investors and traders. With the rise of decentralized exchanges (DEXs), such as 1inch, understanding the price impact of trades becomes even more crucial.

1inch is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges to provide users with the best possible trading prices. Due to its unique algorithm, 1inch is able to split trades across multiple DEXs to minimize price impact and offer users the most favorable trading conditions.

By analyzing the price impact of 1inch trades in DeFi, valuable insights can be gained regarding market dynamics and the efficiency of the 1inch algorithm. This analysis can help traders and investors make more informed decisions and optimize their trading strategies.

One implication of studying the price impact of 1inch trades is the identification of liquidity gaps in the DeFi ecosystem. Price impact is directly related to the liquidity available on each DEX, and by analyzing the price impact of 1inch trades, we can identify DEXs that may have lower liquidity compared to others. This information can be used by liquidity providers and market makers to allocate their funds and optimize their trading activities.

Furthermore, studying the price impact of 1inch trades can provide insight into the effectiveness of the 1inch algorithm. If the algorithm is successful in minimizing price impact and providing users with better trading prices, it can inspire the development of similar algorithms or improvements in existing ones. This can ultimately lead to a more efficient and effective DeFi ecosystem.

Additionally, analyzing the price impact of 1inch trades can shed light on the overall market dynamics of the DeFi space. It can uncover trends and patterns in the liquidity and trading volume of different tokens, providing valuable information for traders and investors. Understanding these market dynamics can help in assessing the risks and opportunities present in the DeFi market.

In conclusion, analyzing the price impact of 1inch trades in DeFi has significant implications and insights for the market as a whole. It can identify liquidity gaps, assess the efficiency of the 1inch algorithm, and provide valuable information on market dynamics. By understanding these factors, traders and investors can make better-informed decisions and optimize their trading strategies in the ever-evolving world of DeFi.

Question-answer:

What is 1inch and how does it work?

1inch is a decentralized exchange aggregator that sources liquidity from various different exchanges to provide users with the best possible trading rates. It uses smart contracts to split user trades across multiple liquidity sources and algorithms to find the most efficient trading paths.

How does 1inch analyze the price impact of its trades in DeFi?

1inch uses an algorithm called Efficient Frontier to estimate the potential price impact of a trade. This algorithm calculates the optimal trading volume for each liquidity source in order to minimize price slippage and maximize the trade’s chances of being executed at a favorable rate.

Why is analyzing the price impact of 1inch trades important?

Analyzing the price impact of 1inch trades is important because it helps users understand the potential risks and rewards associated with their trades. By knowing the estimated price impact, users can make more informed decisions and potentially optimize their trading strategies to minimize losses and maximize gains.

Are there any limitations or challenges when analyzing the price impact of 1inch trades in DeFi?

Yes, there are some limitations and challenges when analyzing the price impact of 1inch trades. One challenge is the constantly changing liquidity landscape in DeFi, which makes it difficult to accurately predict the price impact of a trade. Additionally, the potential slippage and impact of large trades can also affect the accuracy of the analysis.

How can users mitigate the price impact of their trades on 1inch?

Users can mitigate the price impact of their trades on 1inch by using the Limit Order feature. This feature allows users to set a specific price at which they want their trade to be executed, ensuring that they don’t pay more than they are willing to for a particular asset. Users can also use 1inch’s advanced settings to adjust slippage tolerance and choose specific liquidity sources to further optimize their trades.