Gas fees are an integral part of the 1inch ecosystem, playing a crucial role in facilitating smooth and secure transactions. Gas fees represent the cost of computational resources required to execute a transaction on the Ethereum network. As the popularity and usage of 1inch continue to grow, understanding the role of gas fees becomes essential for users and developers alike.

Why are gas fees important?

Gas fees serve two primary purposes: incentivizing miners and deterring spam and malicious activities. Miners are the backbone of blockchain networks, and gas fees are the rewards they receive for including transactions in a block and securing the network. High gas fees attract more miners and increase network security, while low gas fees can lead to slower transaction confirmations and potential vulnerabilities.

How do gas fees affect 1inch transactions?

Gas fees impact the speed and cost of 1inch transactions. When users interact with the 1inch platform, they must pay gas fees to execute their trades or liquidity provisions. The gas fees are not fixed and can vary depending on network congestion and the complexity of the transaction. As such, users need to carefully consider the current gas fee market and adjust their expectations accordingly.

The future of gas fees in 1inch transactions

As the Ethereum network evolves and transitions to Ethereum 2.0, gas fees are expected to become more efficient and predictable. Layer 2 solutions such as rollups and sidechains are also being developed to help alleviate the issue of high gas fees. These solutions aim to provide faster and cheaper transactions while maintaining security. As a result, users can look forward to a more seamless and cost-effective experience when using 1inch in the future.

The Importance of Gas Fees

Gas fees play a critical role in the functioning of the 1inch platform. Gas fees are the transaction fees paid by users to miners in order to execute smart contract operations on the Ethereum network. These fees are denominated in Ether and help to incentivize miners to include transactions in the blockchain.

Gas fees are essential for the security and efficiency of the platform. By requiring users to pay gas fees, 1inch ensures that only legitimate and financially viable transactions are processed. This helps to prevent spam attacks and other malicious activities that could potentially harm the platform and its users.

Gas fees also help to prioritize transactions on the Ethereum network. When users are willing to pay higher gas fees, their transactions are given higher priority by miners. This means that transactions with higher gas fees are more likely to be included in the next block and processed faster, ensuring timely execution of trades on 1inch.

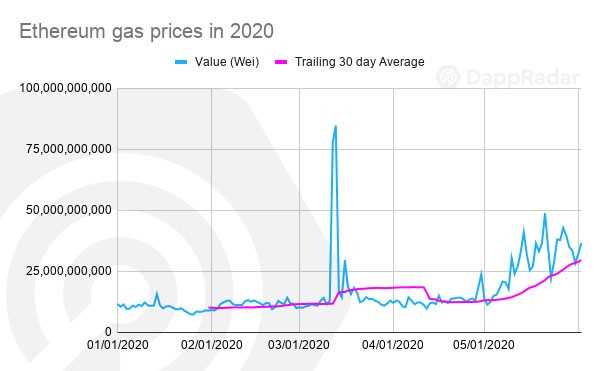

Gas fees can vary depending on network congestion. During times of high network activity, such as during periods of high trading volume, gas fees tend to increase. This is because miners prioritize transactions with higher gas fees, leading to a higher demand for block space.

It is important for users to carefully consider the gas fees when using the 1inch platform. Users should assess the current gas fee market conditions and adjust their trading strategies accordingly. This can help users optimize their transaction costs and ensure a smooth and efficient trading experience on 1inch.

In conclusion, gas fees are a crucial aspect of the 1inch platform. They ensure the security and efficiency of the platform, help prioritize transactions, and require users to carefully consider their trading strategies. By understanding the importance of gas fees, users can make informed decisions and maximize their experience on the 1inch decentralized exchange.

Understanding Gas Fees in Cryptocurrency Transactions

Gas fees play a crucial role in cryptocurrency transactions. When you send or receive cryptocurrency, you must pay a fee to the network to process your transaction. This fee is known as the gas fee.

The gas fee is required to incentivize miners or validators to include your transaction in a block and add it to the blockchain. Miners dedicate computational power and resources to validate and process transactions, and they are rewarded with fees for their efforts.

The gas fee is determined by the network’s congestion level and the complexity of the transaction. If a network is heavily congested, the gas fee tends to be higher as there is greater demand for transaction processing. Similarly, if a transaction involves complex smart contracts or requires more computational resources, the gas fee will also be higher.

Gas fees are typically denominated in cryptocurrency tokens, such as Ether (ETH) in the case of the Ethereum network. The fee is paid to the miners in addition to the amount being transferred, and it is deducted from the sender’s account.

Gas Price and Gas Limit

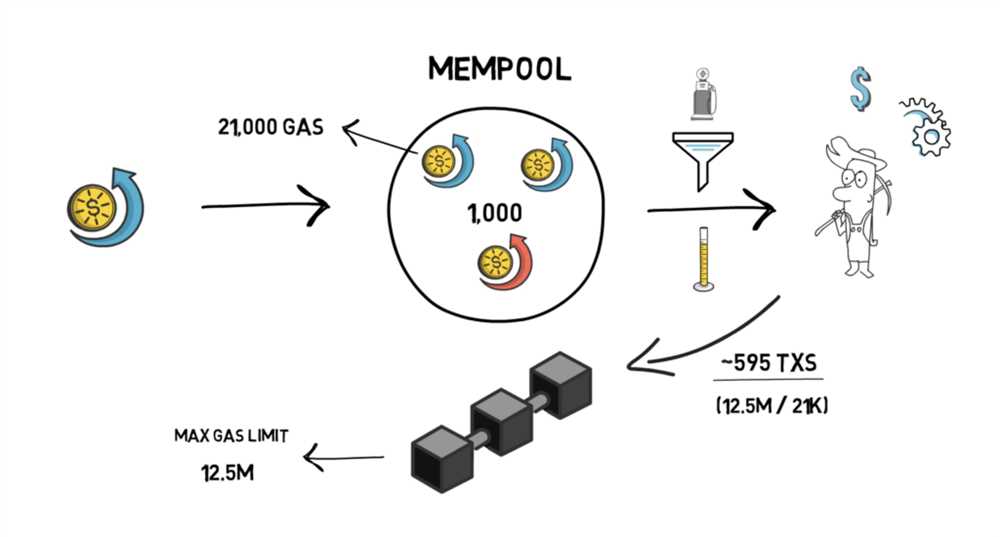

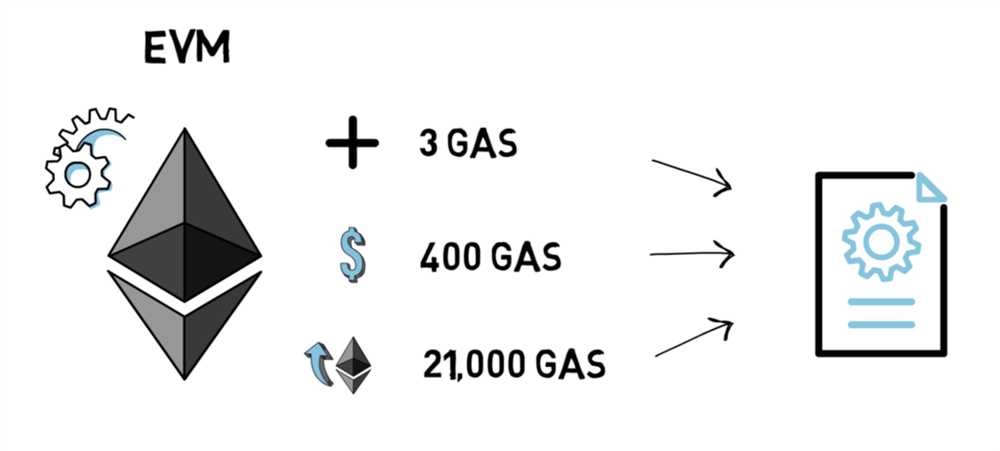

Gas fees are calculated based on two factors: gas price and gas limit.

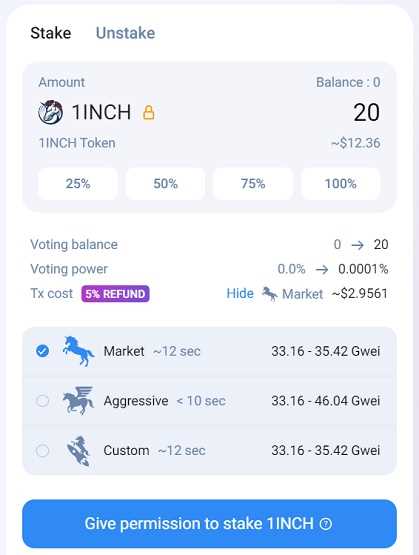

The gas price represents the amount of cryptocurrency you are willing to pay for each unit of gas. It is measured in gwei, a fraction of an Ether. Higher gas prices increase the likelihood of miners including your transaction in a block sooner, but they also result in higher fees.

The gas limit, on the other hand, defines the maximum amount of gas you are willing to spend on a transaction. It is a safety measure to prevent infinite loops or malicious activities from consuming excessive resources on the network. If a transaction exceeds the specified gas limit, it will fail and be reverted.

Tips for Managing Gas Fees

Here are some tips to help you manage gas fees effectively:

- Monitor the network congestion and choose the right time to transact.

- Optimize your transactions by minimizing the complexity of smart contracts and reducing the number of computational operations.

- Use gas fee estimation tools to get an idea of the current gas prices and set an appropriate gas price for your transaction.

- Consider using layer 2 scaling solutions or alternative blockchains with lower fees if the gas fees on the main network are too high for your needs.

By understanding gas fees and implementing these strategies, you can optimize your cryptocurrency transactions and minimize the costs associated with them.

The Role of Gas Costs in 1inch Exchange

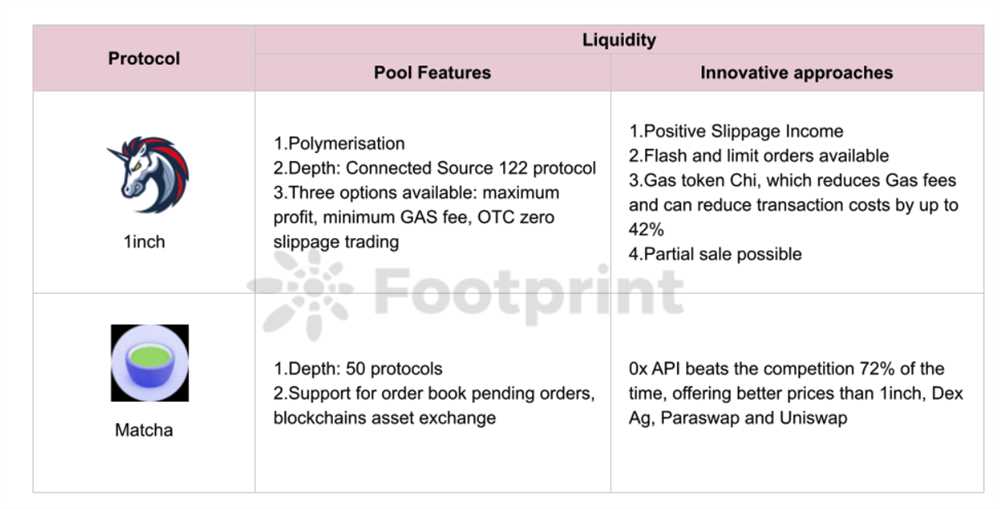

The emergence of decentralized exchanges (DEXs) has revolutionized the way people trade cryptocurrencies. 1inch is a popular DEX aggregator that focuses on finding the best prices across multiple DEXs and executing trades for its users. However, one crucial factor that traders need to consider when using 1inch is the gas costs associated with their transactions.

Gas costs play a vital role in the efficiency and affordability of transactions on the Ethereum network. Gas is the unit that measures the computational effort required to execute a transaction or a smart contract. In simple terms, gas costs are the fees that users need to pay to miners to have their transactions processed and validated.

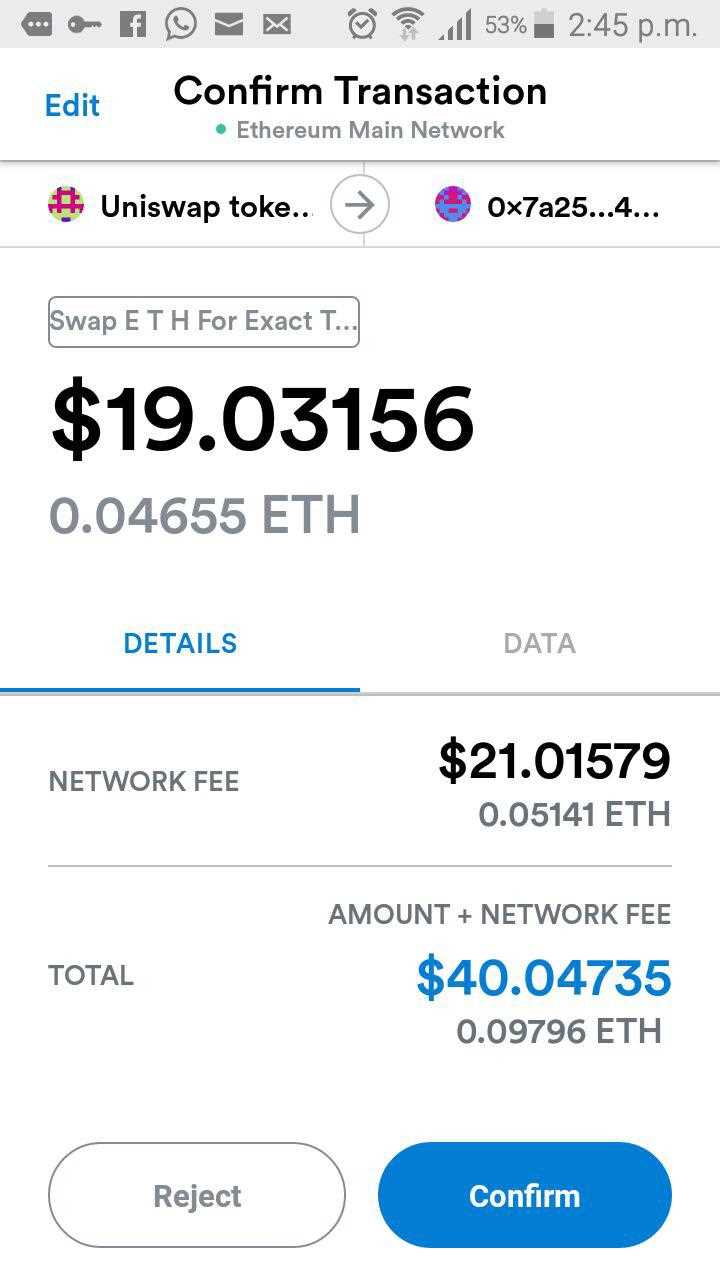

When using 1inch, traders need to pay gas fees for various actions, such as placing orders, swapping tokens, or withdrawing funds. The gas costs can vary depending on factors like network congestion and the complexity of the transaction. Higher gas fees are generally associated with faster transaction processing times, while lower gas fees might result in slower transaction times.

High gas costs can be a significant concern for traders, especially during times of high network congestion or when dealing with small transactions. Paying excessive gas fees can significantly eat into the profitability of trades, reducing the overall gains or even resulting in losses.

It is important for 1inch users to carefully consider the gas costs before executing transactions. Traders can leverage tools like gas estimators or fee prediction platforms to estimate the gas fees required for their desired transactions. By optimizing the gas fees, users can minimize costs and maximize their trading efficiency.

Additionally, it is worth mentioning that gas costs are influenced by the Ethereum network itself and are not within the control of 1inch or its developers. However, 1inch aims to provide users with the best possible user experience by optimizing transactions and minimizing gas costs whenever feasible.

Overall, gas costs play a crucial role in 1inch transactions. Traders need to carefully consider and manage these costs to ensure the profitability and efficiency of their trades. By staying informed about gas fees and leveraging the right tools, users can make the most out of their trading experience on 1inch.

Gas Fees: A Key Factor in Decentralized Finance

In the world of decentralized finance (DeFi), gas fees play a crucial role in the smooth functioning of transactions. Gas fees are the charges imposed on users when they interact with smart contracts on the Ethereum network. These fees are paid in Ether (ETH) and compensate the miners for validating and executing the transactions.

Gas fees are determined by market demand and the complexity of the transaction. They can vary greatly depending on factors such as network congestion and the urgency of the transaction. High gas fees can lead to delays and increased costs, while low gas fees may result in slower transaction processing times.

Gas fees are an essential consideration for users of DeFi platforms like 1inch. When executing trades or providing liquidity, users must factor in gas fees to determine the profitability of their actions. High gas fees can eat into profits or render certain transactions unfeasible.

Several strategies can help users optimize gas fees when using 1inch. One approach is to monitor gas prices and wait for lower fees during periods of network congestion. Gas price trackers like GasNow and GasTracker provide real-time data to help users make informed decisions about when to execute their transactions.

Another strategy is to utilize layer 2 scaling solutions like Loopring or Optimism. These solutions aim to reduce gas fees and improve transaction speed by processing transactions off-chain and then settling them on the Ethereum mainnet.

- Users can also consider adjusting transaction parameters to reduce gas fees. For example, lowering the desired transaction speed or using limit orders instead of market orders can help reduce the amount of gas required.

- Moreover, users can take advantage of gas fee estimators provided by wallets or DeFi platforms. These estimators help users estimate the gas fees required for their transactions, allowing them to make more informed decisions.

- Additionally, users should also be mindful of the gas-guzzling nature of certain DeFi protocols. Some protocols require more complex computations and thus incur higher gas fees. Evaluating the potential gas fees associated with a specific protocol before engaging in transactions can help users avoid unexpected costs.

In conclusion, gas fees are a critical factor in the optimization of decentralized finance transactions. Understanding how gas fees work and implementing strategies to minimize costs can significantly impact the profitability and efficiency of using DeFi platforms like 1inch.

Question-answer:

Why do gas fees matter in 1inch transactions?

Gas fees are important in 1inch transactions because they determine the cost of executing the transaction on the Ethereum network. Users have to pay gas fees to miners in order to have their transactions included in the blockchain.

How are gas fees determined in 1inch transactions?

Gas fees in 1inch transactions are determined by the current congestion on the Ethereum network. When the network is busy, gas fees tend to be higher, and when the network is less congested, gas fees are lower. Users can check the current gas fees on websites like GasNow or GasTracker.

Can I choose to pay more or less gas fees in 1inch transactions?

Yes, users have the option to choose how much gas fees they are willing to pay for their 1inch transactions. They can adjust the gas price or gas limit to increase or decrease the fees. However, it’s important to note that setting lower fees may result in slower transaction confirmations or even failed transactions if other users are willing to pay higher fees.

What happens if I don’t pay enough gas fees in 1inch transactions?

If you don’t pay enough gas fees in 1inch transactions, your transaction may not be processed by the Ethereum network. Miners prioritize transactions with higher gas fees, so if your fees are too low, your transaction may remain pending or be rejected. It’s important to set gas fees at an appropriate level to ensure timely transaction processing.

Are gas fees in 1inch transactions the same for every transaction?

No, gas fees in 1inch transactions can vary depending on factors such as network congestion, gas price, gas limit, and the complexity of the transaction. Each transaction is unique, so the gas fees associated with it may differ from other transactions.