When it comes to investing in cryptocurrencies, market cap is a key factor to consider. Market cap, short for market capitalization, is a measure of a cryptocurrency’s value and its potential for growth. In the case of 1inch Coin, understanding its market cap can provide insights into its investment potential.

What is market cap?

Market cap represents the total value of a cryptocurrency, calculated by multiplying its current price by the total number of coins in circulation. It is a significant metric that indicates the size and stability of a cryptocurrency. A high market cap suggests a larger and more established cryptocurrency, while a low market cap may suggest a newer or potentially riskier investment.

Assessing 1inch Coin’s market cap

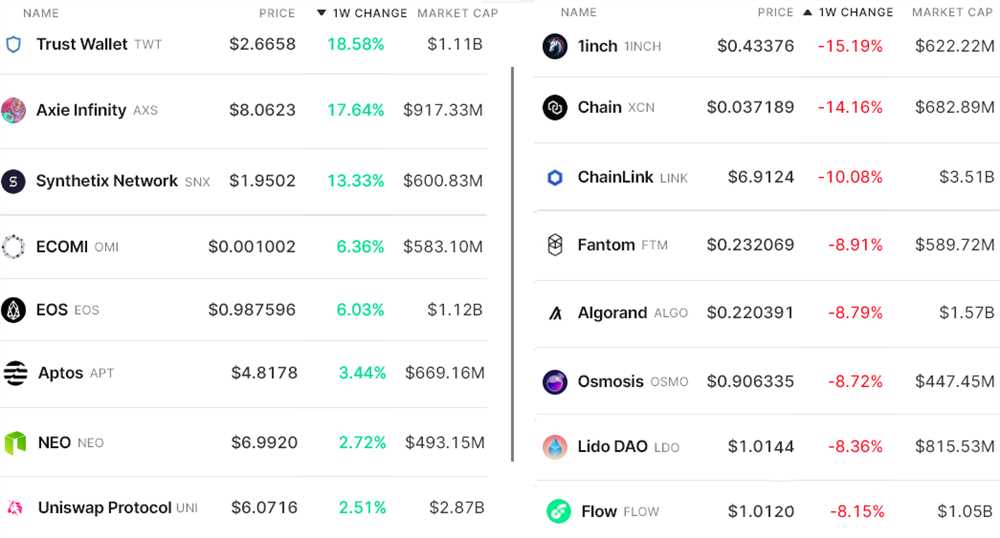

1inch Coin, an innovative decentralized exchange aggregator, has been gaining attention in the cryptocurrency market. To evaluate its investment potential, analyzing its market cap is essential.

Currently, 1inch Coin has a market cap of X. This places it among the top cryptocurrencies in terms of market size, indicating its established presence in the market. As a result, investors can have confidence in the coin’s stability and growth potential.

Why does market cap matter?

Market cap provides valuable insights into the investment potential of a cryptocurrency. It helps investors assess the coin’s liquidity, popularity, and potential for growth. A higher market cap suggests a larger and more widely accepted cryptocurrency, which can attract more investors and enhance its stability.

Conclusion

When considering an investment in 1inch Coin or any cryptocurrency, analyzing its market cap is crucial. Market cap helps investors determine the coin’s stability, growth potential, and overall investment attractiveness. With a strong market cap, 1inch Coin can be seen as a promising investment opportunity in the cryptocurrency market.

The Importance of Market Cap

Market capitalization, or market cap, is a crucial metric that investors use to assess an investment’s potential. It is a measure of a company or cryptocurrency’s valuation in the market. Market cap is calculated by multiplying the total number of outstanding shares or tokens by their current market price.

Market cap provides investors with an understanding of the size and strength of a company or cryptocurrency. It allows investors to gauge the market’s perception of the investment and its potential for growth. Generally, companies or cryptocurrencies with higher market caps are considered more stable and less susceptible to volatility.

When assessing the investment potential of 1inch Coin, market cap plays a significant role. As a decentralized exchange aggregator, 1inch Coin’s market cap reflects the demand and interest in its services. A higher market cap suggests a larger user base and increased adoption of the platform.

Furthermore, market cap provides insights into the market’s overall sentiment towards 1inch Coin. A growing market cap indicates positive sentiment as investors anticipate future growth and return on investment. On the other hand, a declining market cap may raise concerns about the investment’s viability and potential risks.

Investors also use market cap to compare 1inch Coin to its competitors and the broader market. By looking at the market cap of similar projects, investors can assess 1inch Coin’s competitive position and market share. This allows investors to make informed decisions about the investment’s potential returns and risks.

In summary, market cap is an important metric that investors use to assess an investment’s potential. For 1inch Coin, market cap reflects the demand for its services, the market’s sentiment towards the project, and its competitive position. By understanding the role of market cap, investors can make informed decisions about the investment’s potential returns and risks.

Factors Affecting 1inch Coin’s Market Cap

When assessing the investment potential of 1inch Coin, it is important to consider the various factors that can influence its market capitalization. Market cap, which is calculated by multiplying the coin’s current price by its circulating supply, is a key metric for evaluating the overall value and growth potential of a cryptocurrency.

1. Trading Volume

One of the primary factors affecting 1inch Coin’s market cap is its trading volume. Higher trading volume generally indicates a more active market and can contribute to increased liquidity and price stability. Coins with higher trading volume are often seen as more attractive to investors and can lead to greater demand and a subsequent increase in market cap.

2. Utility and Adoption

The utility and adoption of 1inch Coin also play a significant role in determining its market cap. If the coin has a strong use case and is widely adopted within the cryptocurrency ecosystem, it is more likely to attract a larger user base and generate increased demand. This increased utility and adoption can result in a higher market cap as more people invest in and hold the coin.

3. Team and Development

The team behind 1inch Coin and the ongoing development of the project are important factors that can influence market cap. A team with a strong track record, experienced developers, and a clear roadmap for the project’s future can instill confidence in investors and attract more interest in the coin. Regular updates and advancements in the project’s technology and features can also contribute to a higher market cap.

4. Market Sentiment

The overall sentiment and perception of the cryptocurrency market can have a significant impact on 1inch Coin’s market cap. Positive news and market trends, such as increased regulatory clarity or widespread adoption of cryptocurrencies, can create a favorable environment for growth. Conversely, negative news or market downturns can lead to a decrease in market cap as investors become more cautious or move their investments to other assets.

In conclusion, while market cap is an important metric for assessing the investment potential of 1inch Coin, it is crucial to consider the various factors that can affect it. Trading volume, utility and adoption, team and development, and market sentiment all play a role in determining the coin’s market cap and should be carefully evaluated before making any investment decisions.

Assessing Investment Potential

When it comes to assessing the investment potential of the 1inch Coin, market cap plays a crucial role. Market cap, short for market capitalization, is a measure of a cryptocurrency’s value. It is calculated by multiplying the total supply of coins by the current price per coin.

Market cap provides investors with an idea of the size and worth of a cryptocurrency. It helps investors gauge the potential growth and stability of the coin in the market. A higher market cap generally signifies a more established and widely recognized cryptocurrency.

However, market cap alone should not be the sole determining factor when assessing the investment potential of the 1inch Coin. It is important to consider other factors such as the team behind the project, the technology and innovation it brings, and the market demand for the coin.

The team behind the 1inch Coin plays a vital role in its success. Investors should research and assess the experience, expertise, and track record of the team members. A strong and competent team increases the likelihood of the coin’s success and adoption in the market.

Furthermore, investors should evaluate the technology and innovation that the 1inch Coin brings to the table. Is it solving a real-world problem? Does it have a unique selling point? These factors contribute to the coin’s long-term potential and adoption by users.

Lastly, investors should analyze the market demand for the 1inch Coin. Is there a market need for the coin’s use case? Is there an existing user base or potential for mass adoption? Understanding the market demand helps investors assess the growth potential and sustainability of the coin.

In conclusion, assessing the investment potential of the 1inch Coin requires considering various factors beyond just market cap. While market cap provides an indication of the coin’s size and worth, factors such as the team behind the project, the technology and innovation it brings, and the market demand for the coin are equally important in making an informed decision.

Question-answer:

What is market capitalization?

Market capitalization, or market cap, is a measure of a company’s or cryptocurrency’s total market value. It is calculated by multiplying the current price per share or coin by the total number of shares or coins in circulation. Market cap helps investors assess the size and potential of a company or cryptocurrency.

How is 1inch Coin’s market cap calculated?

1inch Coin’s market cap is calculated by multiplying the current price of 1inch Coin by the total number of coins in circulation. The current price per coin can be found on various cryptocurrency exchanges. The total number of coins in circulation can typically be found on the project’s official website or on coin market data websites.

Why is market cap important for assessing investment potential?

Market cap is important for assessing investment potential because it provides insight into the size and growth potential of a cryptocurrency. A higher market cap generally indicates a larger and more established project, which may be more stable and have a higher likelihood of long-term success. However, market cap is just one factor to consider when assessing investment potential, and investors should also consider other factors such as the project’s technology, team, and market demand.

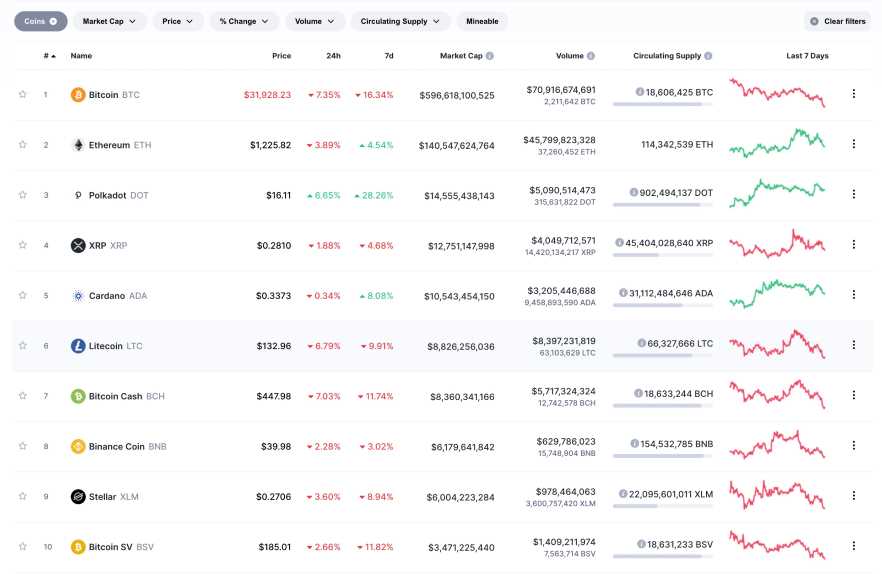

What is the current market cap of 1inch Coin?

The current market cap of 1inch Coin can be found by multiplying the current price of 1inch Coin by the total number of coins in circulation. As market prices fluctuate, it is recommended to check the current market cap on a reliable cryptocurrency data website or exchange.