Exploring the Impact of 1inch Aggregator on Reducing Market Manipulation in DeFi Trading

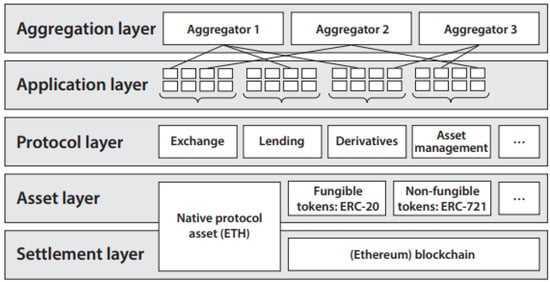

Decentralized Finance (DeFi) has revolutionized the traditional financial system by providing users with access to various financial services without the need for intermediaries. However, the DeFi space is not without its challenges, and one of the major concerns is trading manipulation.

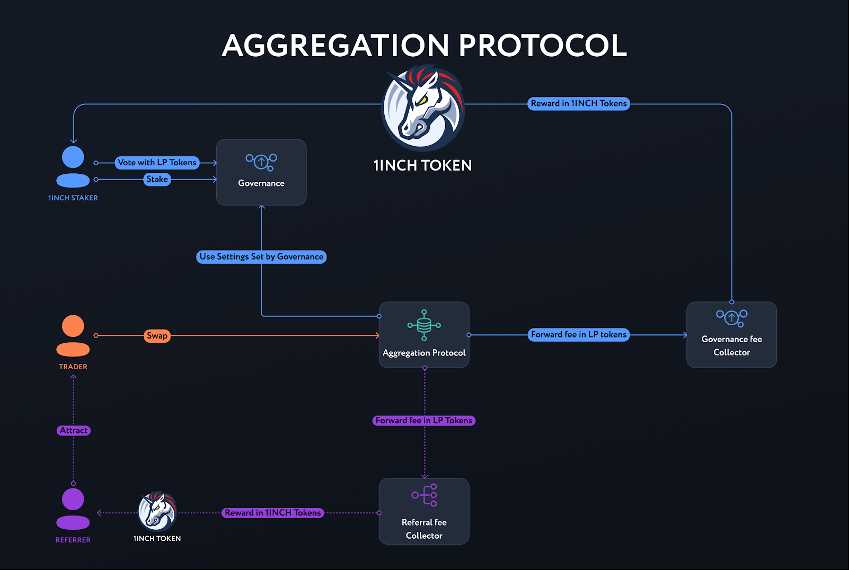

1inch aggregator is a platform that aims to address this issue and ensure fair trading practices in the DeFi ecosystem. It functions as a decentralized exchange (DEX) aggregator, which means it integrates various DEXes into one platform to provide users with the best possible trading rates.

One of the key features of 1inch aggregator is its anti-manipulation algorithm, which aims to reduce the impact of manipulative trading practices such as front-running and sandwich attacks. These practices involve traders taking advantage of the time delay in blockchain transactions to gain an unfair advantage over other traders.

Through careful exploration of different DEXes and utilizing advanced algorithms, 1inch aggregator is able to split a single trade across multiple DEXes to achieve the best possible price. By doing so, it minimizes the likelihood of price manipulation and ensures fair trading for all participants in the DeFi ecosystem.

In addition to its anti-manipulation measures, 1inch aggregator also offers other benefits such as improved liquidity and reduced slippage. By aggregating liquidity from multiple DEXes, it increases the pool of available liquidity, making it easier for users to execute trades without impacting the market.

Overall, 1inch aggregator is an innovative solution that not only addresses the issue of trading manipulation in DeFi but also provides users with a more efficient and transparent trading experience. Its exploration of different DEXes and implementation of advanced algorithms ensure fair trading practices, ultimately benefiting the entire DeFi ecosystem.

inch Aggregator: Solving DeFi Trading Manipulation

DeFi (Decentralized Finance) trading manipulation has been a significant concern in the cryptocurrency space. Manipulative practices such as front-running, spoofing, and wash trading can distort market prices, affect traders’ profitability, and undermine trust in the overall DeFi ecosystem. To tackle these issues, the 1inch aggregator introduces an innovative solution.

The 1inch aggregator is a DeFi protocol that operates as a decentralized exchange (DEX) aggregator. It aims to provide users with the best trading rates by combining liquidity from various DEXs, such as Uniswap, SushiSwap, and Kyber Network. By accessing multiple DEXs, the 1inch aggregator reduces the risk of price manipulation and ensures fair trading conditions for users.

One of the primary advantages of the 1inch aggregator is its Pathfinder algorithm. This algorithm searches for the most efficient trading paths across multiple DEXs, taking into account factors such as gas costs, slippage, and liquidity depth. By optimizing the trading path, the 1inch aggregator minimizes the impact of manipulation and maximizes traders’ profitability.

Additionally, the 1inch aggregator incorporates anti-manipulation measures to prevent market distortions. It implements smart contract-based limit orders, which enable users to set specific price targets for their trades. This feature prevents front-running and spoofing by ensuring that trades are executed at the desired price and not influenced by market manipulators.

The 1inch aggregator also promotes transparency in DeFi trading by providing users with detailed information about liquidity sources, trading history, and transaction fees. This transparency helps users make informed decisions and enhances trust in the DeFi ecosystem.

In conclusion, the 1inch aggregator is an innovative solution for reducing DeFi trading manipulation. By combining liquidity from multiple DEXs, optimizing trading paths, and implementing anti-manipulation measures, it creates a fair and transparent trading environment for DeFi users. The 1inch aggregator sets a new standard for DeFi trading and paves the way for a more trustworthy and efficient decentralized finance ecosystem.

Exploring the Game-Changing Technology

In the world of decentralized finance (DeFi), technology plays a crucial role in ensuring fair and efficient trading. With the rise of various platforms and protocols, it becomes increasingly important to have a solution that can help reduce the chances of manipulation and provide users with the best possible trading experience.

This is where the 1inch aggregator comes into play. This groundbreaking technology is designed to address the challenges faced by traders in the DeFi space. By leveraging smart contract technology and advanced algorithms, it allows users to access multiple decentralized exchanges and liquidity sources simultaneously.

The 1inch aggregator works by splitting the user’s orders across various exchanges and sources to find the best possible prices for their trades. This not only helps to reduce slippage but also minimizes the chances of manipulation by ensuring that trades are executed at the most favorable rates.

Furthermore, the aggregator algorithm is designed to continuously monitor the market and make real-time adjustments to the trading strategy. This ensures that users always have access to the latest information and can take advantage of favorable market conditions.

Another game-changing feature of the 1inch aggregator is its ability to provide users with access to liquidity that may not be readily available on individual exchanges. By tapping into multiple liquidity sources, users can find better prices and execute larger trades without impacting the market.

The 1inch aggregator has gained significant recognition and adoption within the DeFi community due to its ability to provide users with a seamless and efficient trading experience. With its innovative technology and focus on reducing manipulation, it has become a go-to platform for many traders looking to maximize their profits and minimize their risks.

Overall, the 1inch aggregator is a game-changer in the DeFi space. By exploring this groundbreaking technology, traders can access the best possible prices, reduce the chances of manipulation, and take advantage of liquidity that may not be available elsewhere. With its continuous improvement and commitment to providing users with the best trading experience, the 1inch aggregator is set to revolutionize the way we trade in the decentralized finance ecosystem.

How 1inch Aggregator Cuts Out Trading Manipulation

Trading manipulation is a significant concern in the decentralized finance (DeFi) space. It involves the intentional act of influencing prices or misrepresenting trading volumes to exploit market participants. 1inch Aggregator, an innovative platform in the DeFi space, tackles this issue head-on by utilizing various mechanisms to cut out trading manipulation.

One of the key features of 1inch Aggregator is its algorithm that sources liquidity from multiple decentralized exchanges (DEXs) simultaneously. By aggregating liquidity from various sources, such as Uniswap, Sushiswap, and Balancer, 1inch diminishes the impact of any single exchange on the overall market. This reduces the likelihood of price manipulation by individuals or cartels within a specific exchange.

Furthermore, 1inch Aggregator employs a smart contract-based routing system that selects the most favorable trades across different DEXs. This routing algorithm ensures that users get the best possible price for their trades, while also preventing the manipulation of prices by prioritizing sources with higher liquidity. This mechanism makes it more difficult for manipulators to significantly impact the price of a particular token.

Another way in which 1inch Aggregator cuts out trading manipulation is through its multi-chain functionality. It operates on multiple blockchains, including Ethereum, Binance Smart Chain, and Polygon (formerly Matic). By expanding its reach across multiple chains, 1inch reduces the concentration of trading volumes on any single platform, making it harder for manipulators to influence prices. This enhanced decentralization makes the platform more resilient against trading manipulation attempts.

| Key Features: | Benefits: |

| Aggregation of liquidity from multiple DEXs | Reduces the impact of individual exchanges on prices |

| Smart contract-based routing system | Ensures users get the best possible prices while preventing manipulation |

| Multi-chain functionality | Increases decentralization and reduces concentration of trading volumes |

In conclusion, 1inch Aggregator employs several measures to cut out trading manipulation in the DeFi space. By aggregating liquidity from multiple DEXs, utilizing a smart contract-based routing system, and operating on multiple blockchains, 1inch reduces the influence of manipulators and provides a more secure and fair trading experience for its users.

Optimizing DeFi Trading with 1inch Aggregator

The 1inch Aggregator is a powerful tool that optimizes decentralized finance (DeFi) trading by reducing manipulation and improving efficiency. By aggregating liquidity from various decentralized exchanges, the 1inch Aggregator ensures users get the best possible price for their trades.

Reducing Slippage

One of the main advantages of using the 1inch Aggregator is its ability to reduce slippage. Slippage is the difference between the expected price of a trade and the actual price at which the trade is executed. In DeFi trading, slippage can significantly impact the profitability of a trade.

The 1inch Aggregator addresses this issue by splitting large trades into multiple smaller trades across different decentralized exchanges. By doing so, it minimizes the impact on the market and reduces the risk of substantial price fluctuations. This optimization technique helps traders secure better prices and maximize their profits.

Exploring Multiple Liquidity Sources

Another benefit of using the 1inch Aggregator is its ability to explore multiple liquidity sources. Instead of relying on a single decentralized exchange, the aggregator scans multiple exchanges to identify the best available liquidity for a specific trade.

This approach enhances the efficiency of trading in DeFi by ensuring that traders have access to a wider pool of liquidity. By exploring multiple sources, the 1inch Aggregator minimizes the chance of encountering low liquidity or high slippage, further optimizing the trading experience.

Maximizing Efficiency and Cost-Savings

By optimizing trading strategies, the 1inch Aggregator enables users to maximize their efficiency and cost-savings. Instead of manually searching for the best prices and liquidity across different exchanges, traders can rely on the aggregator to do the work for them.

The 1inch Aggregator automatically routes trades through the most efficient paths, ensuring that users get the best possible deal. This automation saves users time and reduces trading costs by minimizing fees and reducing slippage.

- Optimizes decentralized finance (DeFi) trading

- Reduces slippage and price fluctuations

- Explores multiple liquidity sources

- Maximizes efficiency and cost-savings

In conclusion, the 1inch Aggregator is a powerful tool that optimizes DeFi trading by reducing manipulation, minimizing slippage, exploring multiple liquidity sources, and maximizing efficiency. By leveraging this aggregator, traders can have a more streamlined and profitable trading experience in the decentralized finance ecosystem.

Question-answer:

What is the 1inch aggregator?

The 1inch aggregator is a decentralized finance (DeFi) platform that allows users to find and execute the most efficient trades for their cryptocurrencies across multiple decentralized exchanges (DEXs).

How does the 1inch aggregator reduce trading manipulation?

The 1inch aggregator reduces trading manipulation by splitting a user’s trade into multiple parts and executing them on different DEXs, ensuring that no single entity can manipulate the price. This process is known as “decentralized exchange hopping.”

Can the 1inch aggregator be used on any cryptocurrency?

Yes, the 1inch aggregator supports a wide range of cryptocurrencies, including popular ones like Bitcoin and Ethereum, as well as many other tokens on various chains.