Exploring the 1inch Whitepaper: Unleashing the Potential for Decentralized Trading

The advent of blockchain technology has revolutionized the way we perceive and conduct financial transactions. One of the most exciting developments in this space is the rise of decentralized trading platforms, which eliminate the need for intermediaries and enable users to maintain control over their assets. One such platform that has been gaining significant attention is 1inch, a decentralized exchange aggregator that allows users to find the best trading prices across multiple decentralized exchanges.

The 1inch whitepaper provides a comprehensive analysis of the underlying principles and mechanisms that power this innovative platform. The document not only explores the technical intricacies of 1inch but also delves into the economic incentives and potential applications of decentralized trading. Through an in-depth examination of the whitepaper, we can gain a deeper understanding of the potential impact that 1inch and similar platforms can have on the future of finance.

One of the key concepts discussed in the whitepaper is the concept of “liquidity pool aggregation.” Traditional decentralized exchanges suffer from liquidity fragmentation, which results in users not being able to access the best trading prices. 1inch tackles this problem by aggregating liquidity across various exchanges, allowing users to access the deepest pools of liquidity for their trades. This not only improves the overall trading experience but also reduces price slippage and increases the efficiency of transactions.

Another important aspect highlighted in the whitepaper is the use of smart contract technology to execute trades. By leveraging smart contracts, 1inch ensures that trades are executed in a secure and trustless manner, eliminating the need for users to rely on centralized intermediaries. This not only mitigates the risk of hacks and fraud but also enhances the overall transparency and auditability of transactions.

In conclusion, the 1inch whitepaper provides a comprehensive and detailed analysis of the platform’s architecture, mechanisms, and potential applications. Through liquidity pool aggregation and the use of smart contract technology, 1inch aims to revolutionize the way decentralized trading is conducted. By eliminating intermediaries and providing users with access to the best trading prices, 1inch has the potential to democratize access to financial markets and empower individuals to maintain control over their assets.

The Rise of Decentralized Trading

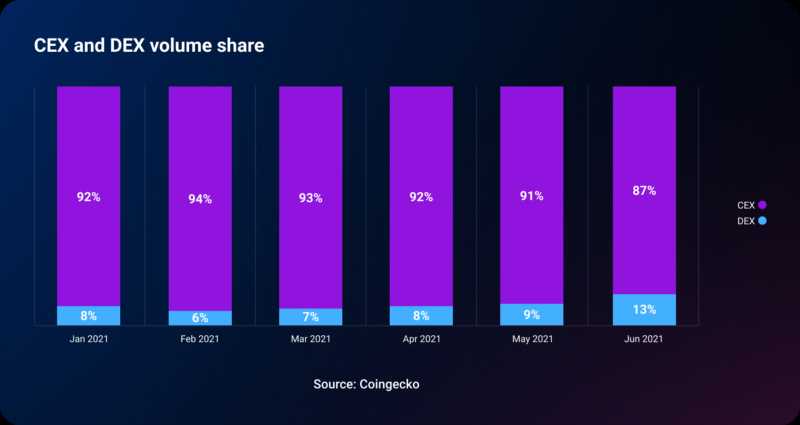

Decentralized trading has emerged as a transformative force in the financial industry. Traditionally, trading has been centralized and dominated by large institutions such as banks and brokerage firms. However, the advent of blockchain technology has enabled the rise of decentralized trading platforms, empowering individuals to trade directly with each other without the need for intermediaries.

One of the key advantages of decentralized trading is its ability to eliminate the middleman. By removing intermediaries, such as brokers and clearinghouses, decentralized trading platforms reduce costs and increase efficiency. This is especially beneficial for individuals who may not have access to traditional financial services or face high fees in centralized systems.

The Role of Smart Contracts

Decentralized trading platforms rely on smart contracts to facilitate peer-to-peer transactions. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They automatically execute transactions once predefined conditions are met, eliminating the need for trust between parties.

Smart contracts allow for the creation of decentralized exchanges, where users can trade digital assets directly with one another. These exchanges operate on blockchain networks, ensuring transparency, security, and immutability of transaction records.

The Benefits of Decentralized Trading

In addition to reducing costs and increasing efficiency, decentralized trading offers several other benefits. Firstly, it provides users with greater control over their assets. As users hold their private keys, they have full ownership and control over their digital assets, eliminating the risk of funds being frozen or confiscated by a third party.

Furthermore, decentralized trading platforms offer increased privacy compared to centralized exchanges. Instead of relying on a central authority to hold users’ personal information and transaction history, decentralized exchanges use pseudonymous addresses, protecting users’ privacy while still allowing for transparent transactions.

Finally, decentralized trading platforms promote financial inclusion by providing access to financial services to individuals who may not have had it before. By removing barriers to entry, such as high fees and geographical limitations, decentralized trading platforms open up the world of finance to a wider audience, democratizing access to financial markets.

In conclusion, the rise of decentralized trading has revolutionized the financial industry by empowering individuals to trade directly with each other without intermediaries. Through the use of smart contracts, decentralized trading platforms offer cost-efficiency, security, privacy, and financial inclusion. As blockchain technology continues to evolve, decentralized trading is expected to play an increasingly important role in the global financial system.

Overview of 1inch Protocol

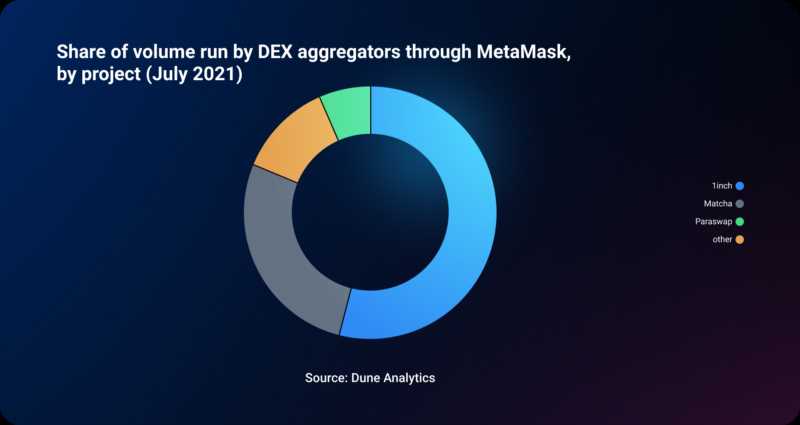

The 1inch Protocol is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges (DEXs) and provides users with the best possible trading rates. It was developed to address the issues of limited liquidity and high slippage faced by traders in the decentralized finance (DeFi) space.

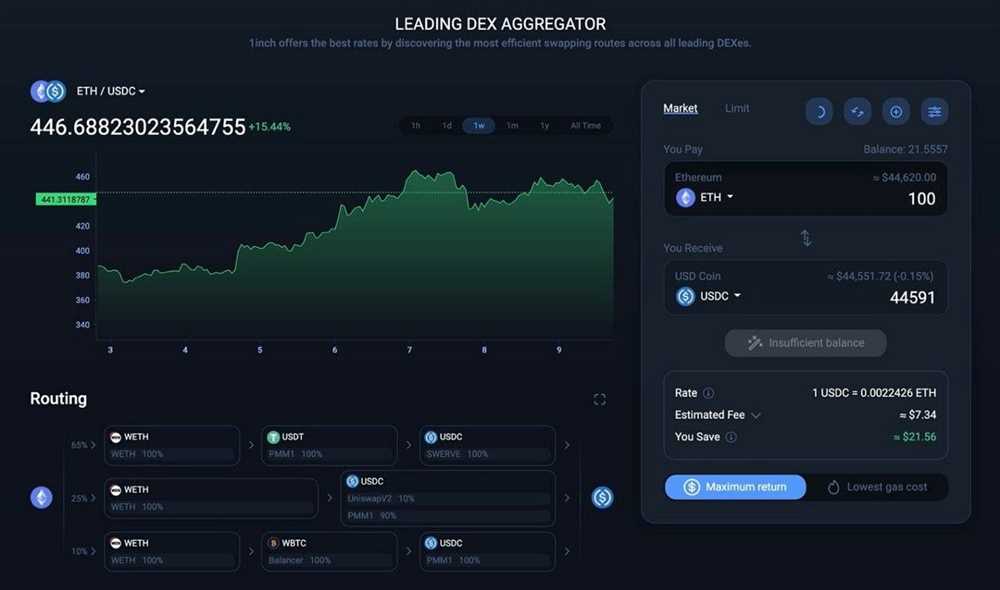

By aggregating liquidity from multiple DEXs, the 1inch Protocol ensures that users can access deep liquidity pools and obtain the most favorable prices for their trades. The protocol achieves this by splitting trades across multiple DEXs to minimize slippage and maximize returns for traders.

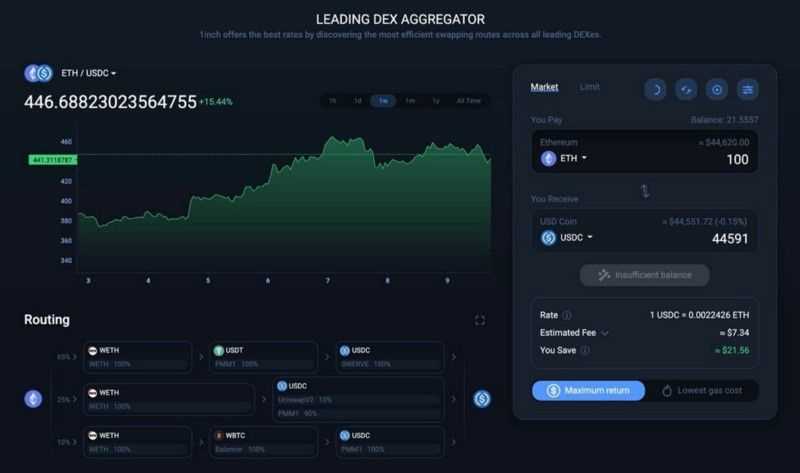

The key components of the 1inch Protocol include the Pathfinder, which is responsible for finding the most efficient trading paths across DEXs, and the Aggregation module, which executes trades across these paths. The Aggregation module also takes into account various factors such as gas costs, liquidity, and swapping fees to optimize trades for users.

The protocol is powered by the 1inch token (1INCH), which serves as the utility and governance token of the platform. Holders of the token can participate in the governance process and propose and vote on changes to the protocol.

The 1inch Protocol has gained significant popularity in the DeFi space due to its ability to provide users with improved liquidity and competitive trading rates. It has also partnered with various DeFi projects and DEXs to expand its reach and enhance the trading experience for users.

In conclusion, the 1inch Protocol is a decentralized exchange aggregator that aims to improve liquidity and trading rates for users in the decentralized finance space. With its advanced routing algorithms and optimization techniques, it offers users a seamless trading experience across multiple DEXs.

How 1inch Protocol Works

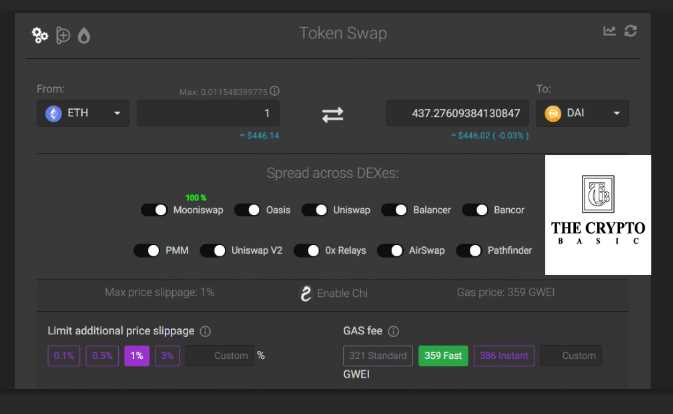

The 1inch Protocol is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges (DEXes). It operates by splitting a user’s trade across multiple DEXes to get the best possible price.

How is it achieved?

1inch Protocol uses an innovative routing algorithm called Pathfinder to find the most efficient trading paths across multiple DEXes. Pathfinder takes into account factors like token prices, transaction fees, and liquidity pools to determine the best trading route.

When a user submits a trade order on the 1inch Protocol, the platform splits the order into multiple smaller orders and routes them to different DEXes. This allows the protocol to achieve the best possible execution price by taking advantage of the liquidity available in various DEXes.

The 1inch Protocol also uses a unique feature called “Multi-Path Splitting” which further optimizes trades. This feature allows the protocol to split orders across multiple paths within a single DEX, increasing the chances of finding the best price.

Why use 1inch Protocol?

There are several advantages of using the 1inch Protocol:

- Best rates: By splitting trades across multiple DEXes, the protocol is able to provide users with the best possible rates.

- Reduced slippage: 1inch Protocol minimizes slippage by splitting orders and routing them to the DEXes with the highest liquidity.

- Lower fees: The protocol scans multiple DEXes to find the lowest transaction fees, ensuring users get the best value for their trades.

- Improved security: As a decentralized protocol, 1inch ensures that users retain control over their funds throughout the trading process.

- Greater choice: 1inch Protocol aggregates liquidity from various DEXes, giving users access to a wider range of trading options.

In conclusion, the 1inch Protocol is a powerful tool that optimizes decentralized trading by aggregating liquidity from multiple DEXes and splitting trades across various paths. By doing so, it allows users to achieve the best possible rates, reduce slippage, lower fees, and retain control over their funds.

Key Features of the 1inch Whitepaper

The 1inch Whitepaper presents several key features that set it apart from other decentralized trading platforms. These features include:

- Aggregation: The 1inch platform aggregates liquidity from various decentralized exchanges, allowing users to access the best available prices across multiple platforms. This aggregation feature helps users to optimize their trades and minimize slippage.

- Optimization: 1inch’s algorithms are designed to find the most efficient trading paths for users. By splitting trades across multiple exchanges and using smart contract technology, the platform aims to achieve the best possible execution for each trade.

- Security: The 1inch Whitepaper emphasizes the importance of security. The platform is built on top of Ethereum, which provides a secure and transparent environment for trading. Additionally, all smart contracts used by 1inch are thoroughly audited to ensure the safety of users’ funds.

- User-friendly interface: The 1inch platform offers a simple and intuitive interface, making it easy for users to navigate and execute trades. The team focuses on delivering a seamless user experience that caters to both experienced traders and beginners.

- Gas optimization: Gas fees have been a concern for Ethereum users, especially during times of high network congestion. The 1inch Whitepaper addresses this issue by implementing gas optimization techniques, such as batched transactions and lower gas limit recommendations, to reduce transaction costs for users.

- Governance: The 1inch token, called 1INCH, plays a vital role in the platform’s governance. Holders of the token can participate in community proposals and decision-making processes, giving them a voice in shaping the platform’s future development.

These key features highlight the unique value proposition of the 1inch platform, offering users a decentralized trading experience that combines liquidity aggregation, optimization, security, user-friendliness, gas optimization, and community governance.

Optimized Gas Usage

The 1inch whitepaper addresses the issue of optimized gas usage, which is crucial in decentralized trading platforms. Gas refers to the fee required to execute transactions on the Ethereum blockchain. It is a measure of computational effort required to execute a transaction or a smart contract.

In the context of decentralized trading, gas usage becomes extremely important as it directly impacts the cost and efficiency of trading. The 1inch protocol aims to optimize gas usage through several mechanisms:

1. Gas Token

The 1inch protocol introduces the concept of a Gas Token, which is a unique utility token that can be used to pay for gas fees. By utilizing the Gas Token, users can save on gas costs as the token can be bought or minted at times when gas fees are low and used when gas fees surge. This mechanism allows users to optimize their gas costs and improve trading efficiency.

2. Gas Token Burner

The Gas Token Burner is a smart contract that allows users to burn their Gas Tokens, effectively reducing the total gas consumed in a transaction. By burning Gas Tokens, users can reduce the amount of gas required for a transaction and further optimize gas usage.

The Gas Token Burner functions by calculating the gas refund based on the unused gas in the transaction and then burns an equivalent amount of Gas Tokens, effectively reducing the overall gas consumption.

It is important to note that the use of Gas Tokens and the Gas Token Burner is completely optional and users can choose whether or not to utilize these features based on their individual needs and preferences. However, these mechanisms provide users with an additional layer of optimization for gas usage and cost efficiency in decentralized trading.

In conclusion, optimized gas usage is a key focus of the 1inch protocol. By introducing the Gas Token and the Gas Token Burner, the protocol offers users the ability to optimize their gas costs and improve the efficiency of their trading activities on decentralized platforms.

DEX Aggregation

DEX Aggregation is the core technology behind the 1inch decentralized exchange (DEX) aggregator. It enables users to achieve the best trade execution by splitting trades across multiple DEXs and liquidity sources.

How DEX Aggregation Works

When a user wants to make a trade on the 1inch platform, the DEX aggregation algorithm splits the trade into smaller orders and finds the optimal route for each order. This is done by analyzing the available liquidity on different DEXs and selecting the most efficient path to execute the trade.

The algorithm takes into account various factors such as the exchange rates, fees, and slippage on each DEX. It also considers the depth of liquidity available for each token pair on different DEXs. By considering these factors, the algorithm ensures that users can achieve the best possible trade execution with minimal price slippage and fees.

The Benefits of DEX Aggregation

DEX aggregation offers several benefits to users:

- Increased liquidity: By aggregating liquidity from multiple DEXs, users have access to a larger trading pool, resulting in better trade execution.

- Lower slippage: By splitting trades across different DEXs, the algorithm reduces the impact of high slippage on individual DEXs, lowering the overall price impact.

- Lower fees: By finding the most efficient route for each trade, users can minimize the fees associated with executing trades on DEXs.

Overall, DEX aggregation improves the trading experience for users by providing them with the best possible trade execution in terms of price, liquidity, and fees.

| DEX | Liquidity | Slippage | Fees |

|---|---|---|---|

| DEX A | 1,000 ETH | 0.1% | 0.3% |

| DEX B | 2,000 ETH | 0.2% | 0.2% |

| DEX C | 500 ETH | 0.3% | 0.25% |

Question-answer:

What is the 1inch whitepaper about?

The 1inch whitepaper is an in-depth analysis of the decentralized trading protocol 1inch. It provides detailed information about the protocol’s design, architecture, and functionalities.

How does 1inch ensure decentralized trading?

1inch ensures decentralized trading by utilizing multiple decentralized exchanges (DEXs) and aggregating liquidity from various sources. It compares prices across different DEXs and routes trades to the most profitable options for users.

What are the advantages of using 1inch for trading?

Using 1inch for trading offers several advantages. It provides users with access to the best available prices and ensures optimal execution of their trades. Additionally, it reduces slippage and minimizes fees through its aggregation and routing algorithms.