Are you tired of traditional exchanges with high fees and limited liquidity? Look no further than 1inch – a decentralized exchange aggregator that is revolutionizing the world of cryptocurrency trading.

What sets 1inch apart?

1inch stands out from the crowd with its innovative technology and user-friendly interface. Unlike traditional exchanges, 1inch pools liquidity from various decentralized exchanges, ensuring the best possible rates for your trades. This means you will always get the most value for your money.

How does 1inch work?

1inch uses an automated market-making algorithm to find the most efficient routes across multiple decentralized exchanges. This algorithm splits your trade across different liquidity pools to optimize your trading experience. By leveraging the power of decentralized finance (DeFi), 1inch is able to provide you with the most competitive rates and the lowest slippage.

Discover the future of trading with 1inch today and experience the benefits of decentralized finance. Start trading now and take advantage of our competitive rates and user-friendly interface.

Overview of 1inch

1inch is a decentralized exchange aggregator that allows users to find the best trading routes across multiple DEXs. It was founded in 2019 by Sergej Kunz and Anton Bukov, and it has quickly gained popularity for its innovative approach to decentralized trading.

How it Works

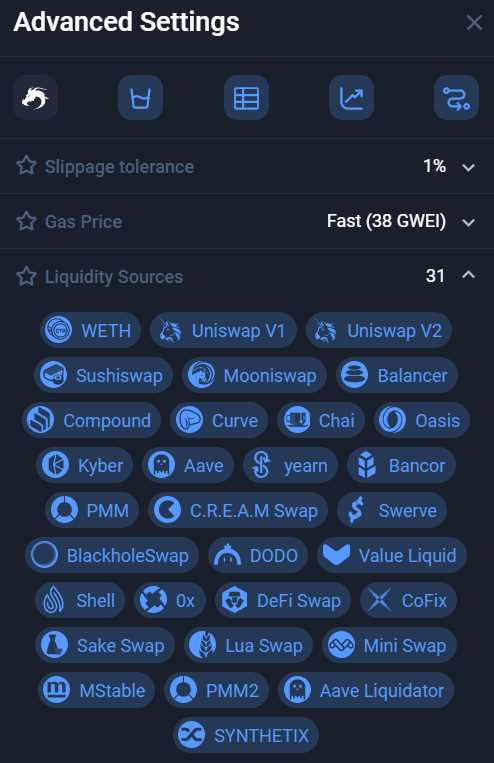

1inch works by splitting users’ trades across multiple decentralized exchanges in order to optimize for the best price and lowest slippage. The platform sources liquidity from various DEXs, including but not limited to Uniswap, SushiSwap, Balancer, and Kyber Network. Through its smart contract routing system, 1inch ensures that users get the most efficient and cost-effective trading experience.

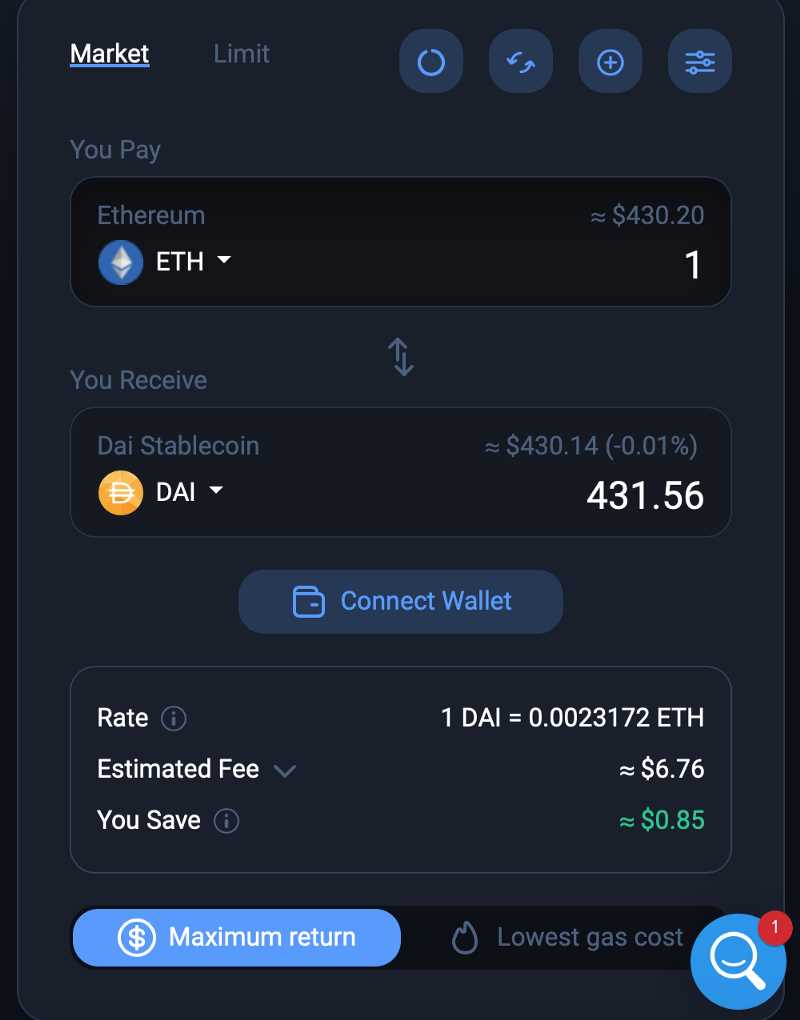

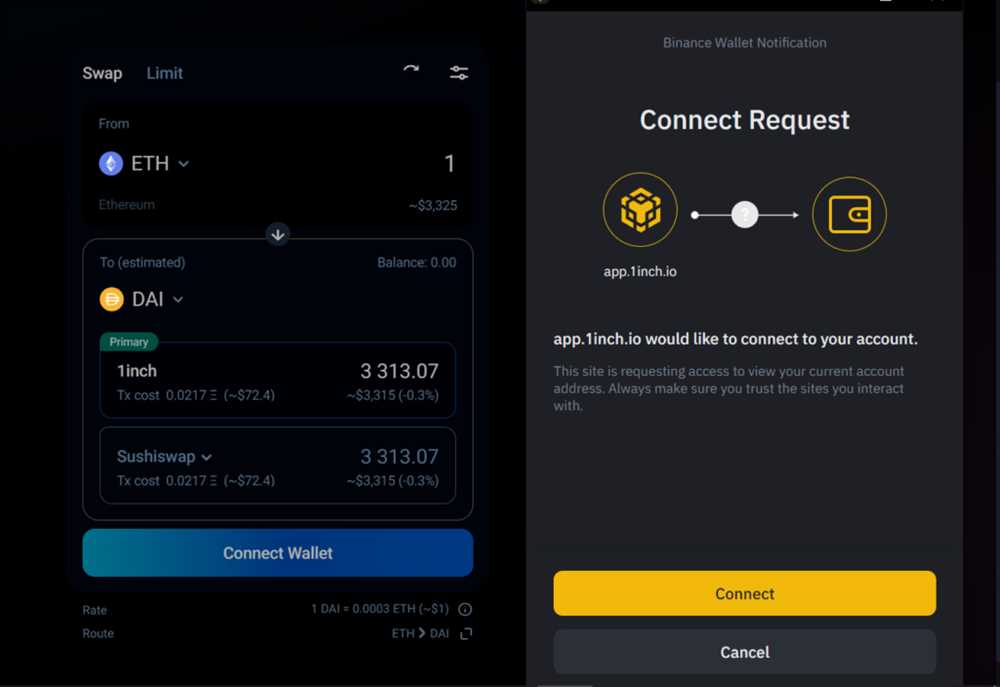

When a user wants to make a trade, they simply input the details of the trade, including the token they want to buy or sell and the desired amount. 1inch then calculates the optimal trading route based on the available liquidity across various decentralized exchanges. The platform splits the trade into multiple parts and executes them simultaneously, ensuring that the user gets the best possible price.

1inch also offers a range of advanced features, such as limit orders, gas optimization, and Pathfinder, a powerful tool for finding the most efficient paths for trading. These features make 1inch a versatile and user-friendly platform for decentralized trading.

What Sets it Apart

What sets 1inch apart from other decentralized exchanges is its ability to provide users with the best trading routes across multiple liquidity sources. By aggregating liquidity from various DEXs, 1inch is able to offer users the most optimal trading experience with minimal slippage.

1inch also stands out for its commitment to transparency and security. The platform’s smart contracts have undergone extensive audits by renowned security firms, and the team behind 1inch is constantly working to enhance the platform’s security measures and ensure the safety of users’ funds.

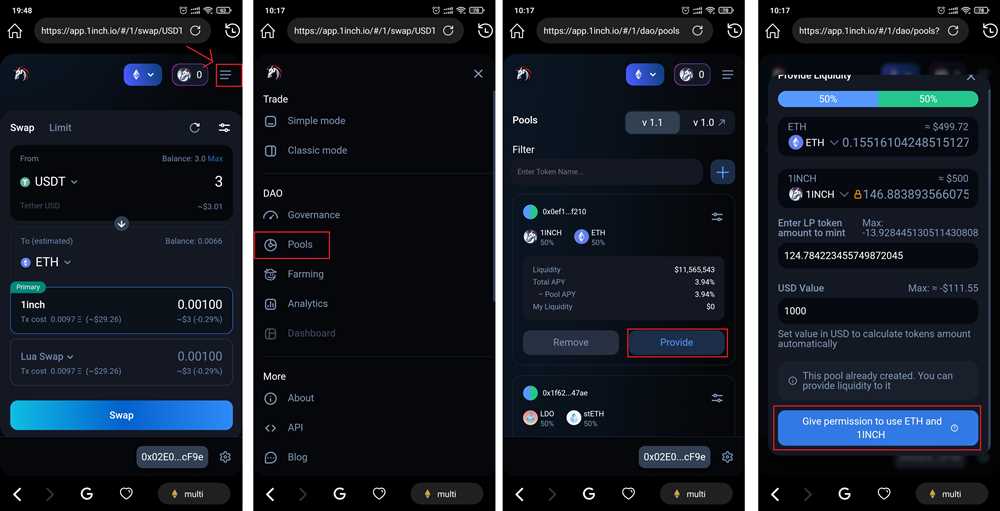

Furthermore, 1inch is known for its community-driven approach. The platform has its own governance token, 1INCH, which enables users to participate in the platform’s decision-making process. Holders of the 1INCH token can vote on proposals and shape the future direction of the platform.

In conclusion, 1inch revolutionizes decentralized trading by providing users with the best trading routes and optimizing for the best prices and lowest slippage. With its advanced features and commitment to security and transparency, 1inch has positioned itself as a leader in the decentralized exchange space.

How 1inch Works

1inch is a decentralized exchange aggregator that sources liquidity from various DEXs (Decentralized Exchanges) to provide users with the best possible trading rates. Here’s a step-by-step breakdown of how 1inch works:

1. Source the Best Rates

When a user wants to make a trade, 1inch scans multiple DEXs to find the best rates available. It aggregates all liquidity sources to optimize the trading process and ensure users get the most favorable rates.

2. Splitting Orders

1inch intelligently splits users’ orders across multiple DEXs to minimize slippage and maximize trading efficiency. By splitting the order, 1inch ensures that users get the best possible outcome, even if it means using multiple liquidity sources.

3. Gas Optimization

Gas fees can significantly impact the cost of executing trades on the Ethereum network. 1inch analyzes gas prices across different networks and suggests the most cost-effective network for users to execute their trades, saving them money on transaction fees.

4. Implementing Limit Orders and Optimized Swaps

1inch offers advanced trading features such as limit orders and optimized swaps. This allows users to set desired price levels for their trades or use algorithms that focus on reducing slippage by swapping sequentially through multiple liquidity sources.

5. Instant Withdrawals

Once a trade is completed, 1inch allows users to instantly withdraw their funds to their wallets without any additional steps or waiting periods. This ensures that users have access to their assets as quickly as possible.

By combining these steps, 1inch provides users with a seamless and efficient trading experience across multiple DEXs. Whether you’re a beginner or an experienced trader, 1inch offers the tools and technology to make decentralized trading easy and accessible to all.

What Sets 1inch Apart

1. Decentralized Aggregation

One of the key features that sets 1inch apart from other DeFi protocols is its decentralized aggregation service. By leveraging smart contract technology, 1inch is able to aggregate liquidity from various decentralized exchanges (DEXs) into one platform. This provides users with access to the best trading prices and reduces slippage, resulting in cost savings and improved trading efficiency.

2. Pathfinder Algorithm

1inch uses a proprietary algorithm called Pathfinder to optimize trading routes and ensure the best possible outcomes for users. The algorithm takes into account factors such as liquidity, fees, and gas costs to determine the most efficient path for executing a trade. This helps users maximize their returns and minimize their costs.

3. Gas Optimization

Gas fees are a significant concern for users of decentralized platforms. 1inch addresses this issue by monitoring gas prices in real time and automatically routing transactions through the most cost-effective channels. This ensures that users pay the lowest possible fees while still enjoying the benefits of decentralized trading.

4. Community Governance

Unlike many other DeFi protocols, 1inch is governed by its community through a decentralized autonomous organization (DAO). Token holders have the power to vote on proposals and make decisions that shape the future of the protocol. This ensures a fair and inclusive governance model that aligns the interests of the community with the development and growth of 1inch.

5. Non-Custodial Solution

1inch is a non-custodial platform, which means that users retain full control over their funds at all times. The platform does not hold or have access to user assets, reducing the risk of theft or loss. This makes 1inch a secure and trusted option for traders looking to take advantage of the benefits of decentralized finance.

Overall, these unique features set 1inch apart from other DeFi protocols, making it a powerful and innovative platform for decentralized trading and liquidity aggregation.

Question-answer:

What is 1inch?

1inch is a decentralized exchange aggregator that sources liquidity from various exchanges and allows users to make trades at the best possible prices. It aims to provide the best rates by splitting a user’s trade across multiple DEXs.

How does 1inch work?

1inch works by utilizing smart contracts to split and route user orders across different decentralized exchanges. It scans multiple platforms to find the best prices and executes trades on behalf of the users, providing them with the most optimal rates and reducing slippage.

What sets 1inch apart from other decentralized exchanges?

1inch is different from other decentralized exchanges because it is an aggregator that combines liquidity from various DEXs. This allows users to access deeper order books and get better rates compared to trading on a single platform. Additionally, 1inch’s advanced algorithm ensures that trades are executed at the best possible prices.

Can I use 1inch if I don’t have a crypto wallet?

No, you need a crypto wallet to use 1inch. This is because 1inch operates on the Ethereum blockchain and requires users to connect their wallets to interact with the platform. There are various wallet options available, such as MetaMask and Ledger, that you can use with 1inch.