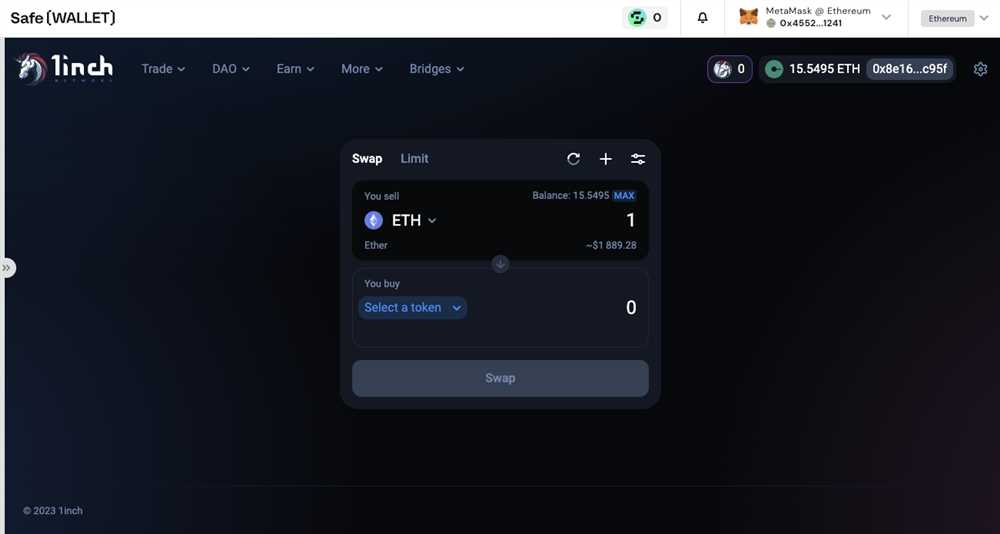

As the cryptocurrency market continues to evolve and attract more investors, the need for reliable and comprehensive information on new token listings becomes increasingly important. One platform that provides a wealth of information on token listings and offers a user-friendly interface for trading is the 1inch app.

With the 1inch app, users can explore the latest token listings and discover exciting investment opportunities. The app offers a wide range of tokens, including both well-known cryptocurrencies and promising up-and-coming projects. Whether you are a seasoned trader or a beginner looking to diversify your portfolio, the 1inch app provides a streamlined experience for finding and evaluating new tokens.

When exploring new token listings on the 1inch app, it is essential to evaluate the potential risks associated with each investment. The app provides vital information, such as the token’s market capitalization, trading volume, and price history, to help users make informed decisions. Additionally, the app offers a community-driven rating system that allows users to share their experiences and insights, further enhancing the evaluation process.

With its extensive range of tokens, easy-to-use interface, and comprehensive information, the 1inch app is a valuable tool for exploring new token listings. By utilizing this platform, investors can discover exciting opportunities while carefully assessing the associated risks, empowering them to make well-informed investment choices in the dynamic world of cryptocurrency.

Identifying Potential Investment Options

When exploring new token listings on the 1inch app, it’s important to carefully evaluate the potential investment options. Here are some key factors to consider:

Demand and Use Case

The first step in identifying potential investment options is to understand the demand and use case of the token. Look for tokens that solve real-world problems and have a clear purpose in their respective ecosystems. Tokens with strong utility and a growing user base are often good investment candidates.

Team and Advisors

The team behind a token can greatly influence its success. Evaluate the credentials and experience of the team members and advisors. Look for teams that have a track record of executing successful projects and have established partnerships within the industry. A strong team can increase the chances of a token’s long-term success.

Market and Competition

Assessing the market and competition is crucial in identifying potential investment opportunities. Look for tokens that operate in large and growing markets, as this can ensure long-term demand. Additionally, evaluate the competitive landscape to understand how the token differentiates itself from other players in the market.

Tokenomics and Distribution

Examining a token’s tokenomics and distribution can provide insights into its investment potential. Consider factors such as token supply, inflation rate, and distribution mechanisms. Tokens with well-planned tokenomics and fair distribution have a higher chance of maintaining value and attracting investor interest.

Note: When evaluating potential investment options, it’s important to conduct thorough research and consider the risks involved. Investing in tokens carries inherent risks, and it’s crucial to only invest what you can afford to lose.

Analyzing Token Metrics and Market Trends

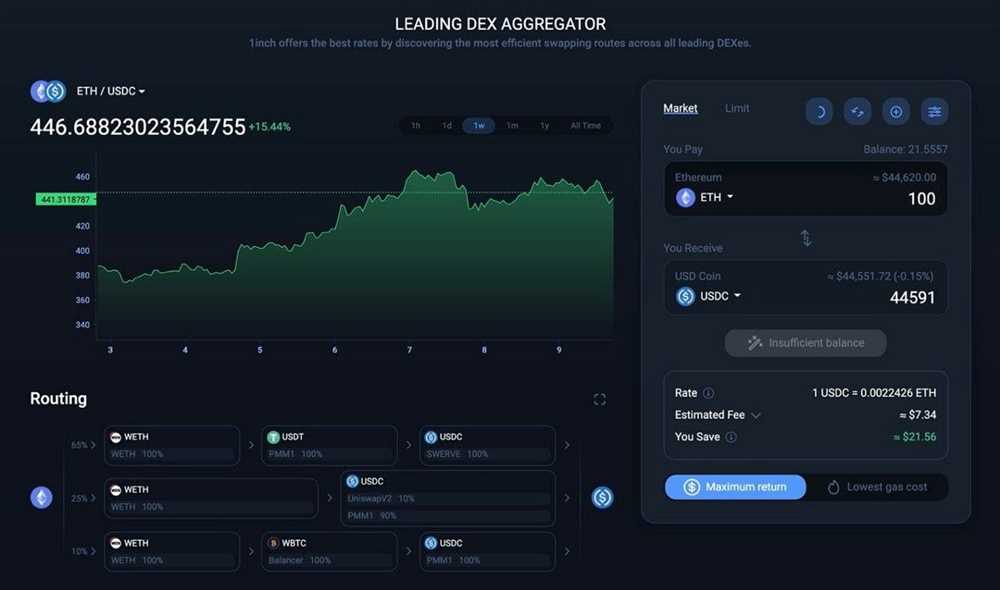

When exploring new token listings on 1inch App, it is important to analyze the token metrics and market trends to make informed investment decisions. By evaluating these factors, investors can gain insights into the potential growth and long-term viability of a token.

Token Metrics

Token metrics provide essential information about a token’s supply, distribution, and utilization. Key metrics to consider include:

- Total supply: The total number of tokens that will ever exist.

- Circulating supply: The number of tokens currently in circulation.

- Token distribution: How the tokens are distributed among investors, team members, advisors, and the community.

- Token utilization: The token’s purpose and how it is used within the ecosystem.

Examining these metrics can help investors gauge the token’s scarcity, potential price volatility, and utility within the project.

Market Trends

Monitoring market trends is crucial when evaluating new token listings. Here are some key trends to consider:

- Price history: Analyzing the token’s price performance over time can provide insights into its volatility and potential for growth.

- Trading volume: High trading volume indicates strong market interest and liquidity.

- Market capitalization: The total value of a token based on its current price and circulating supply.

- Community engagement: Assessing the level of community engagement and active participation can indicate the token’s popularity and future potential.

By analyzing token metrics and market trends, investors can make informed decisions about whether to invest in a new token listing on 1inch App. It is important to conduct thorough research and consider multiple factors before making any investment decisions.

Assessing Potential Risks and Mitigation Strategies

When exploring new token listings on the 1inch App, it is important to carefully assess the potential risks associated with investing in these tokens. While there can be great opportunities for profit, there are also significant risks that should be taken into consideration. Here are some key risks to consider:

1. Volatility:

The cryptocurrency market can be highly volatile, and this volatility can be even more pronounced with new token listings. Prices can fluctuate drastically within short periods of time, leading to potential losses for investors. It is crucial to carefully evaluate the historical price data and market trends before making any investment decisions.

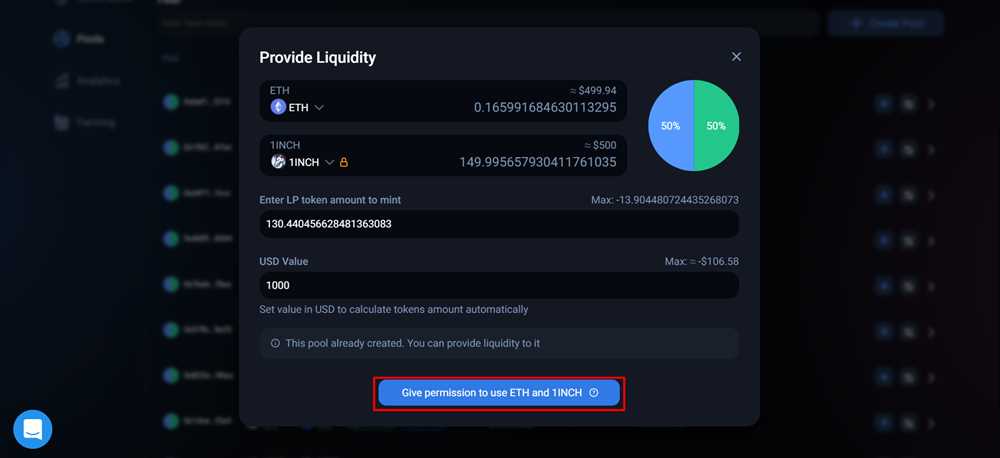

2. Lack of Liquidity:

Newly listed tokens may have low trading volumes and limited liquidity. This can make it difficult to buy or sell these tokens at desirable prices, and there may be a higher risk of slippage when executing trades. It is important to consider the liquidity of the token and the trading pairs available on the platform before investing.

3. Regulatory and Legal Risks:

The regulatory landscape for cryptocurrencies is constantly evolving and can vary significantly between jurisdictions. Investing in new tokens may expose investors to regulatory and legal risks, including potential bans, restrictions, or legal actions. It is important to stay informed about the regulatory environment and consider the legal implications before investing.

4. Team and Project Risks:

When evaluating new token listings, it is important to assess the team behind the project and the overall credibility of the project. Lack of transparency, inexperienced team members, or fraudulent activities can pose significant risks to investors. It is essential to conduct thorough research and due diligence on the project and its team.

5. Smart Contract Risks:

New tokens are often built on smart contract platforms such as Ethereum. Smart contracts can have vulnerabilities or be subject to hacking and exploitation. It is important to carefully review the details of the smart contract and assess the level of security and auditing that has been conducted on the contract before investing.

While there are potential risks associated with new token listings, there are also strategies that can help mitigate these risks:

1. Diversify Your Investments:

By diversifying your investments across different tokens and projects, you can spread out your risk and minimize potential losses. Investing in a variety of tokens with different risk profiles can help protect your portfolio.

2. Do Your Research:

Thoroughly research the project, team, and token before making any investment decisions. Look for project documentation, whitepapers, and audits. Check for any red flags or warning signs and ensure the project is transparent and has a strong community following.

3. Stay Informed:

Keep up-to-date with the latest news and developments in the cryptocurrency market. Stay informed about regulatory changes, market trends, and any potential risks or warnings related to new token listings. This will help you make informed investment decisions.

4. Use Risk Management Tools:

Utilize risk management tools such as stop-loss orders and limit orders to protect your investments. Set clear entry and exit points, and consider implementing a disciplined trading strategy to minimize potential losses.

By carefully assessing the potential risks and implementing effective mitigation strategies, you can navigate the world of new token listings on the 1inch App more confidently and make informed investment decisions.

Question-answer:

How can I explore new token listings on the 1inch app?

To explore new token listings on the 1inch app, you can simply open the app and go to the “New Token Listings” section. Here, you will find a list of recently added tokens and you can click on each token to get more details about it.

What are the benefits of exploring new token listings on the 1inch app?

Exploring new token listings on the 1inch app can provide you with opportunities to discover promising tokens that have recently been added to the market. By staying up-to-date with the latest token listings, you can potentially find investment opportunities before they become widely known, giving you a chance to get in early and potentially make higher returns.

How can I evaluate the risks associated with new token listings?

Evaluating the risks associated with new token listings on the 1inch app is important to make informed investment decisions. You can evaluate the risks by analyzing the token’s team, project, whitepaper, market conditions, and conducting thorough research. Additionally, you can consider factors such as liquidity, volatility, and the token’s track record. It’s important to be cautious and only invest what you can afford to lose.

Are there any specific criteria I should consider when evaluating new token listings?

When evaluating new token listings, you should consider various criteria such as the token’s utility and use case, the team behind the project, the token’s market cap, liquidity, trading volume, and community support. It’s also important to consider any red flags or warning signs that may indicate potential risks or scams.

Can exploring new token listings on the 1inch app guarantee profitable investment opportunities?

No, exploring new token listings on the 1inch app does not guarantee profitable investment opportunities. While it can provide you with opportunities to discover new tokens, the crypto market is highly volatile and there are always risks associated with investing in new or unknown tokens. It’s important to do your own research, evaluate the risks, and make informed decisions based on your own risk tolerance and investment strategy.