Ensuring Fair Pricing for USDT Trades: Understanding How 1inch’s Liquidity Protocol Works

1inch is revolutionizing the world of decentralized finance (DeFi) with its innovative liquidity protocol. By leveraging advanced algorithms and cutting-edge technology, 1inch ensures fair pricing for USDT trades, creating a more transparent and efficient trading experience.

With 1inch’s liquidity protocol, users can trade their USDT tokens without worrying about slippage or unfair market conditions. The protocol aggregates liquidity from various decentralized exchanges, ensuring that users always get the best possible price for their trades.

Unlike traditional centralized exchanges, where liquidity can be limited and pricing can be manipulated, 1inch’s liquidity protocol provides a decentralized and trustless solution. By tapping into multiple liquidity sources, the protocol ensures that the market remains fair and competitive.

When users make a trade on 1inch, the liquidity protocol automatically splits their trade across multiple decentralized exchanges. This not only ensures fair pricing but also minimizes the impact on the market, preventing price slippage and protecting users from losing value.

The liquidity protocol also takes into account fees and other transaction costs, providing users with a transparent view of the true cost of their trades. This allows users to make informed decisions and maximize their profits.

Whether you’re a seasoned trader or new to the world of DeFi, 1inch’s liquidity protocol is the ideal solution for fair and efficient trading. Experience the future of finance with 1inch and enjoy the benefits of a decentralized and transparent marketplace.

Introducing 1inch’s Liquidity Protocol

1inch’s Liquidity Protocol is a revolutionary solution that ensures fair pricing for USDT trades. By leveraging decentralized finance (DeFi) principles, 1inch has created an innovative system that provides users with access to the best prices and deep liquidity across various decentralized exchanges.

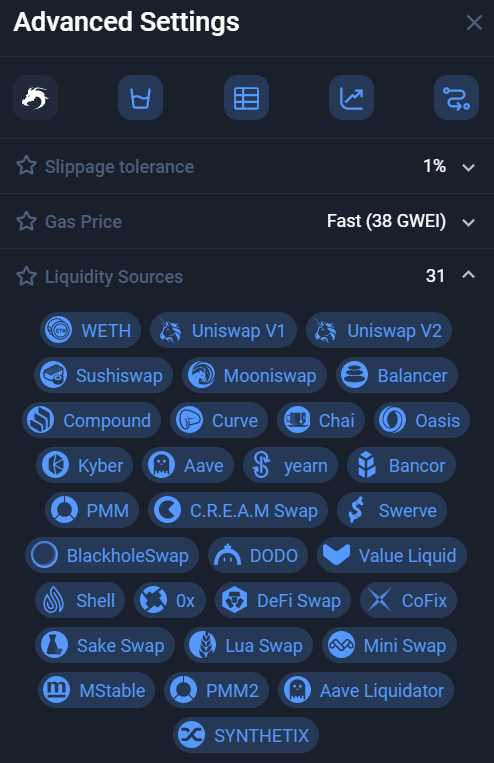

The Liquidity Protocol combines smart contract technology with complex algorithms to aggregate liquidity from multiple sources, including decentralized exchanges, lending platforms, and liquidity pools. This allows users to execute trades with minimal slippage and the most favorable exchange rates.

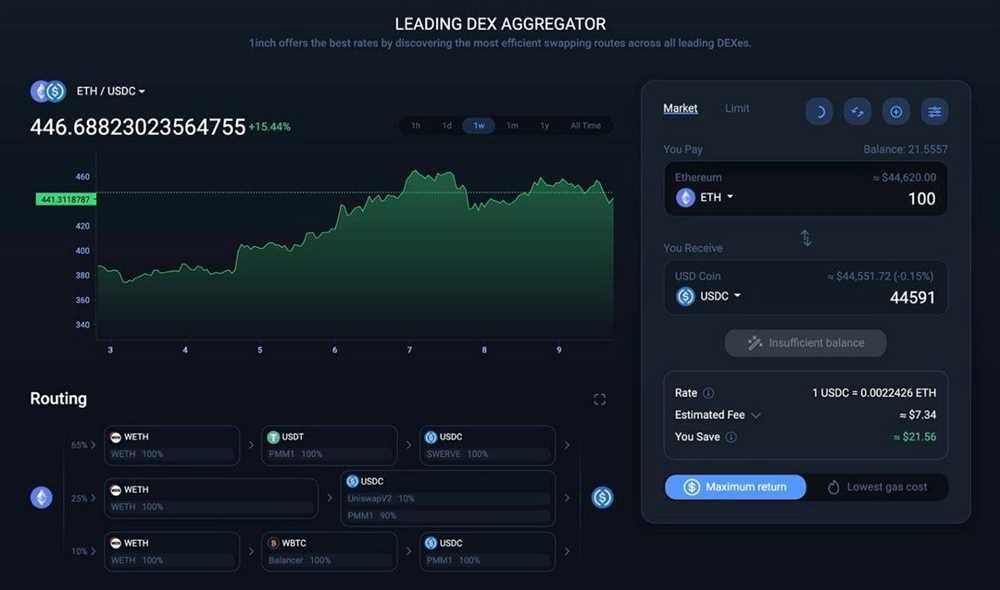

One of the key features of the Liquidity Protocol is its advanced routing algorithm, which intelligently analyzes the available liquidity across different markets and automatically routes trades to the most efficient and cost-effective exchange. This ensures that users can always achieve the best possible price for their USDT trades, regardless of market conditions.

In addition to fair pricing, 1inch’s Liquidity Protocol also offers enhanced security and transparency. The protocol is built on Ethereum, one of the most secure and established blockchain networks. All trades and transactions are executed through smart contracts, which eliminate the need for intermediaries and reduce the risk of manipulation or fraud.

Furthermore, the protocol’s open-source nature allows for complete transparency, as anyone can verify the integrity and accuracy of the underlying code. This ensures that users can trust the liquidity provided by the protocol and have full visibility into the processes and mechanisms governing their trades.

Overall, 1inch’s Liquidity Protocol is a game-changer for USDT trades. It brings together the best elements of decentralized finance, including fair pricing, deep liquidity, enhanced security, and transparency. With this revolutionary solution, users can trade USDT with confidence and take advantage of the opportunities offered by the rapidly growing DeFi ecosystem.

What is 1inch?

1inch is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges (DEXs) to provide users with the best possible rates for their trades. It was launched in 2020 by a team of experienced Ethereum developers.

The main idea behind 1inch is to solve the issue of fragmentation in the DeFi space, where liquidity is spread across multiple DEXs, making it difficult for users to find the best prices. By aggregating liquidity from different exchanges, 1inch is able to offer users the most competitive rates and reduce slippage.

How does it work?

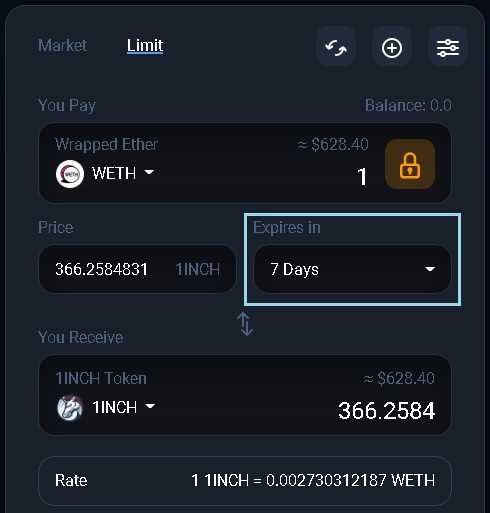

When a user submits a trade on 1inch, the protocol splits the trade into multiple smaller trades across different DEXs to find the best possible rates. It takes into account factors such as gas fees, liquidity, and exchange rates to ensure that users get the most efficient trades.

1inch also utilizes smart contract technology to execute trades on behalf of users, eliminating the need for them to manually interact with each individual DEX. This not only saves time but also reduces the risk of errors or front-running.

Benefits of using 1inch

1inch offers several benefits to users:

- Best rates: By aggregating liquidity from multiple DEXs, 1inch is able to offer users the best possible rates for their trades.

- Reduced slippage: By splitting trades across different exchanges, 1inch minimizes slippage and ensures that users get the most efficient trades.

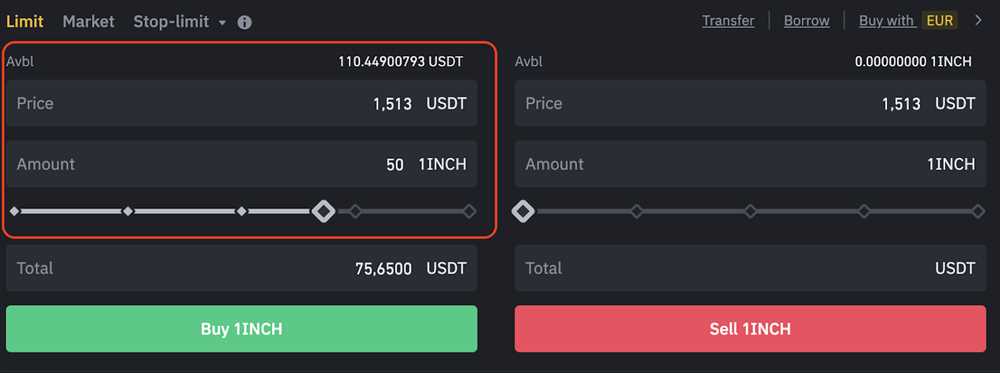

- Fast and seamless trades: Users can execute trades quickly and easily through 1inch’s user-friendly interface.

- Decentralization: 1inch is a decentralized protocol built on Ethereum, which means that users have full control over their funds.

Overall, 1inch is a powerful tool for traders looking to get the best possible rates for their trades in the decentralized finance (DeFi) space. It offers a user-friendly experience, reduced slippage, and the benefits of decentralization – all in one platform.

The Importance of Fair Pricing

When it comes to trading cryptocurrencies, fair pricing is of utmost importance. Fair pricing ensures that traders are getting a fair value for their trades and prevents manipulation in the market. Without fair pricing, traders may be subject to overpaying or receiving less than what their trades are worth, leading to significant financial losses.

One of the main issues in the cryptocurrency market is the lack of transparency and liquidity. Many exchanges lack the necessary liquidity to facilitate large trades, leading to slippage and widening spreads. This means that traders may end up paying more than the market price or receiving less than the market price for their trades.

Transparency and Liquidity

1inch’s Liquidity Protocol aims to solve the issues of transparency and liquidity in the cryptocurrency market. By aggregating liquidity from various sources, the protocol ensures that traders can access the best possible prices for their trades. This eliminates the problem of slippage and provides fair pricing for USDT trades.

The protocol achieves this by using an algorithm that splits trades across multiple decentralized exchanges, finding the best prices and lowest fees for the traders. This ensures that traders are always getting the most favorable prices for their trades and are not being taken advantage of.

Economic Impact

The importance of fair pricing extends beyond individual traders and has a significant impact on the overall economy. Fair pricing promotes efficiency in the market, encouraging investors and businesses to participate in the cryptocurrency ecosystem. When investors and businesses are confident that they are receiving fair value for their trades, they are more likely to engage in larger transactions, driving liquidity and innovation in the market.

Moreover, fair pricing reduces market manipulation and fraudulent activities, making the market more attractive to both institutional and retail investors. This leads to a healthier and more robust market that is less prone to sudden price fluctuations and crashes.

Overall, fair pricing is the backbone of a well-functioning cryptocurrency market. It ensures transparency, liquidity, and investor confidence, driving growth and innovation in the industry. By leveraging 1inch’s Liquidity Protocol, traders can have the peace of mind knowing that they are getting fair pricing for their USDT trades, facilitating a more efficient and equitable trading experience for all.

How 1inch’s Liquidity Protocol Works

The liquidity protocol created by 1inch is designed to ensure fair pricing for USDT trades. Here’s a breakdown of how it works:

Aggregation of Liquidity

The 1inch protocol aggregates liquidity from various decentralized exchanges (DEXs) to provide users with the best possible rates for USDT trades. By tapping into the liquidity pools of multiple DEXs, 1inch increases the chances of finding the most optimal trading opportunities.

Path Selection

Once the liquidity is aggregated, the 1inch protocol determines the most efficient path for executing the USDT trades. It analyzes the available liquidity pools on different DEXs and calculates the prices and fees associated with each potential trade route. This allows the protocol to find the path that offers the best possible result for the user.

Smart Contract Execution

After determining the optimal path, the 1inch protocol executes the USDT trades using smart contracts. The protocol ensures that the trades are executed securely and transparently, providing users with the confidence that their funds are being handled with utmost care.

On-Chain Liquidity

The liquidity provided by the 1inch protocol is stored on-chain, which means that users can access and utilize it directly from their wallets. This eliminates the need for users to deposit their funds on centralized exchanges and allows for seamless and secure trading experiences.

In conclusion, 1inch’s liquidity protocol leverages aggregation, path selection, smart contract execution, and on-chain liquidity to ensure fair pricing and optimal trading opportunities for USDT trades. By providing users with access to multiple liquidity sources, the protocol maximizes efficiency and transparency in the trading process.

Benefits of Using 1inch’s Liquidity Protocol

1inch’s Liquidity Protocol provides several benefits to users who trade USDT:

1. Enhanced Liquidity

The protocol aggregates liquidity from various decentralized exchanges, allowing users to access a larger pool of available funds. This increased liquidity reduces slippage and ensures better prices for USDT trades.

2. Optimal Pricing

By utilizing smart routing algorithms, 1inch’s Liquidity Protocol automatically finds the most efficient path for executing USDT trades. This ensures that users receive the best possible prices, regardless of the exchange they use.

3. Reduced Gas Fees

The protocol minimizes gas fees by splitting trades into multiple smaller transactions to take advantage of lower gas prices on different exchanges. This optimization results in cost savings for users and makes trading more affordable.

Overall, 1inch’s Liquidity Protocol offers enhanced liquidity, optimal pricing, and reduced gas fees, making it a reliable and cost-effective solution for trading USDT.

Question-answer:

What is the liquidity protocol of 1inch and how does it work?

The liquidity protocol of 1inch is designed to ensure fair pricing for trades involving USDT. It works by aggregating liquidity from various decentralized exchanges and optimizing the trade routes to find the best possible prices for users.

Why is fair pricing important for USDT trades?

Fair pricing is important for USDT trades because it ensures that users are getting the best possible prices for their trades. Without fair pricing, users may end up paying higher fees or getting less USDT for their trades.