As the decentralized finance (DeFi) space continues to gain traction, investors are looking for promising projects with strong tokenomics. One such project is 1inch, a decentralized exchange (DEX) aggregator that aims to provide users with the best possible trading rates across multiple liquidity sources. Understanding the tokenomics of 1inch is essential for investors looking to maximize their gains in the ever-evolving DeFi landscape.

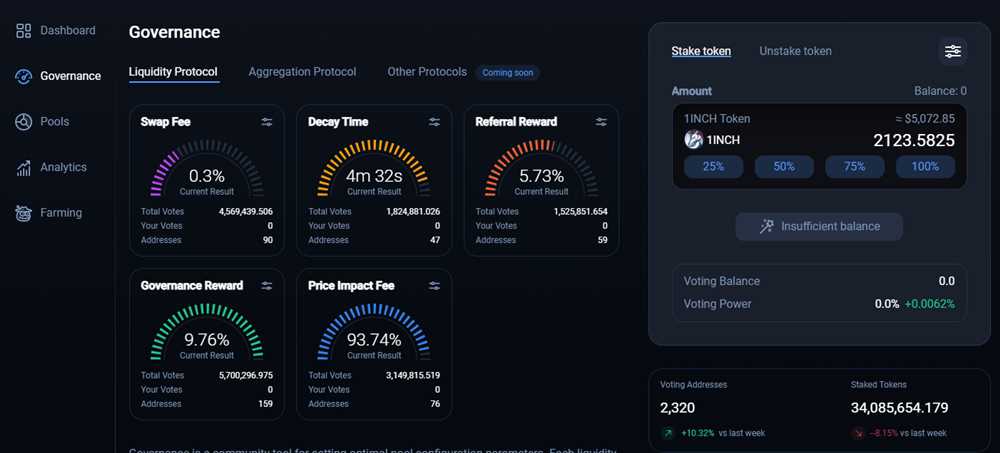

1inch is powered by its native governance token, also called 1inch. The token serves several important functions within the 1inch ecosystem, including governing protocol parameters, participating in community governance, and earning rewards. By holding 1inch tokens, investors can actively participate in the decision-making process of the platform and shape its future development.

One key aspect of 1inch tokenomics is its liquidity mining program, which incentivizes users to provide liquidity to the platform. Liquidity providers (LPs) can stake their tokens in eligible pools and earn 1inch tokens as rewards. This not only helps to increase the liquidity on the platform but also provides an opportunity for investors to earn passive income by participating in the program.

Another unique feature of 1inch tokenomics is the buyback and burn mechanism. A portion of the fee generated by trades on the platform is used to buy back 1inch tokens from the market. These tokens are then permanently removed from circulation, reducing the total supply and potentially increasing the value of the remaining tokens. This mechanism creates a deflationary pressure on the token, making it a potentially attractive investment for long-term holders.

In conclusion, understanding the tokenomics of 1inch is crucial for investors looking to capitalize on the growth of the DeFi space. The token serves as a governance tool, provides opportunities for earning passive income through liquidity mining, and benefits from a deflationary mechanism. By staying informed and participating in the 1inch ecosystem, investors can position themselves for potential success in the dynamic world of decentralized finance.

What is 1inch DeFi Tokenomics?

1inch is a decentralized exchange (DEX) aggregator that sources liquidity from various exchanges to provide users with the best possible trading rates. In order to incentivize users to trade on the platform and provide liquidity, 1inch has its own native token called 1INCH.

Token Utility

The 1INCH token serves multiple purposes within the 1inch ecosystem. Firstly, it is used to govern the platform. Token holders have the ability to vote on proposals and changes to the protocol. This allows users to have a say in the future development and direction of 1inch.

Additionally, holding 1INCH tokens can provide users with various benefits. For example, token holders can stake their 1INCH and earn a portion of the trading fees generated on the platform. This provides an additional stream of income for users who hold and stake their tokens.

Furthermore, the 1INCH token can be used for liquidity mining. Users can provide liquidity to specified token pools and earn 1INCH tokens as a reward. This encourages users to contribute to the liquidity of the platform, increasing its overall efficiency and availability.

Token Supply and Distribution

The total supply of 1INCH tokens is capped at 1.5 billion. Initially, a portion of the token supply was distributed through an airdrop to users who had previously interacted with the 1inch platform. This was done to incentivize early adoption and usage of the platform.

As for ongoing token distribution, 1inch employs a combination of liquidity mining and governance rewards. This means that users can earn 1INCH tokens by providing liquidity or actively participating in the governance of the protocol. This distribution mechanism ensures that the token is widely distributed among platform users, providing a more decentralized and fair ecosystem.

Conclusion

1inch DeFi tokenomics revolves around the 1INCH token, which serves as a governance token, a means to earn trading fees, and a reward for liquidity providers. The token has a limited supply and is distributed through a combination of airdrops, liquidity mining, and governance rewards. By holding and staking 1INCH tokens, users can actively participate in the development and growth of the 1inch platform.

Key Features of 1inch DeFi Tokenomics

1. Governance Rights: The 1inch token, with the symbol 1INCH, provides its holders with governance rights within the 1inch Network. This means that token holders have the power to vote on key decisions and proposals that impact the future of the protocol. This democratic governance structure allows token holders to actively participate in shaping the direction of the platform.

2. Liquidity Mining: 1INCH token holders can participate in liquidity mining to earn additional tokens. Liquidity mining is a process where users provide liquidity to decentralized exchanges (DEXs) by locking their tokens in specific pools. In return, users are rewarded with additional tokens, such as 1INCH tokens, as an incentive for their participation. This rewards users for helping to provide liquidity, which is crucial for the functioning of the platform.

3. Fee Discounts: Holding 1INCH tokens can also provide users with fee discounts on transactions made on the 1inch platform. By holding and using 1INCH tokens, users can benefit from reduced transaction costs, making it more attractive to use the 1inch platform for trading and swapping cryptocurrencies.

4. Protocol Revenue: The 1inch protocol generates revenue from various sources, such as swap fees and liquidity provider fees. A portion of this revenue is used to buy and burn 1INCH tokens from the market, reducing the total supply of tokens over time. The buy and burn mechanism helps to create scarcity and potentially increase the value of the remaining tokens, benefitting long-term token holders.

Conclusion:

1inch DeFi tokenomics offer a range of features that provide value to token holders. With governance rights, liquidity mining opportunities, fee discounts, and the buy and burn mechanism, 1INCH tokens have the potential to be a valuable asset within the decentralized finance ecosystem. Investors and users of the 1inch platform should carefully consider these tokenomics features when making investment decisions.

Benefits of Investing in 1inch DeFi Tokenomics

Investing in 1inch DeFi tokenomics comes with a range of benefits that make it an attractive option for investors in the decentralized finance space. Here are some key advantages:

1. Access to a Diverse and Liquid Market

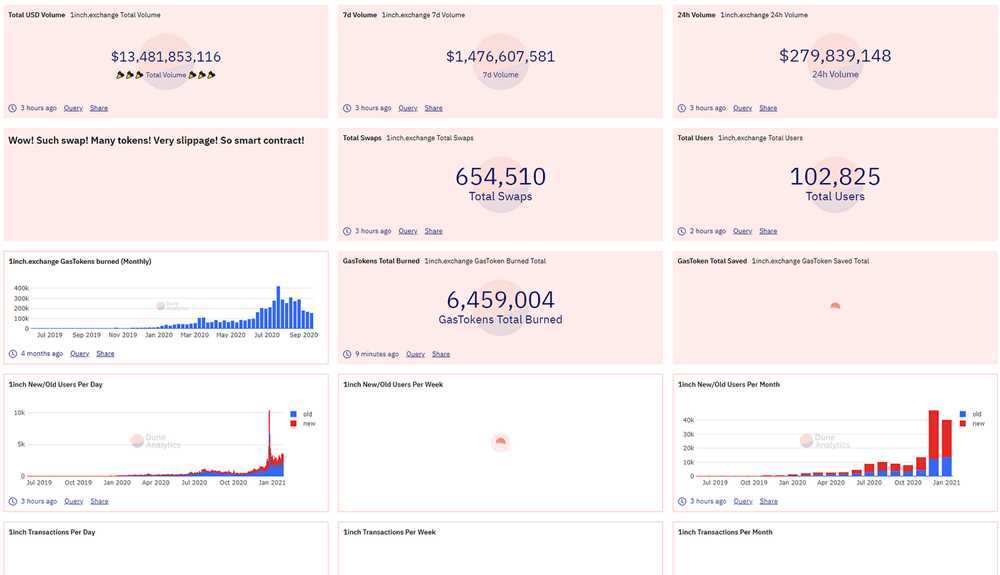

By investing in 1inch DeFi tokenomics, you gain access to a diverse and liquid market. The 1inch Network aggregates liquidity from various decentralized exchanges, which ensures that you can easily trade your tokens without significant price slippage.

2. Earn Trading Fees through the 1inch Liquidity Protocol

The 1inch Liquidity Protocol allows users to earn trading fees by providing liquidity to the network. By investing in 1inch DeFi tokenomics, you can participate in this protocol and earn a portion of the trading fees generated by the platform, providing you with passive income.

3. Potential for Price Appreciation

As the adoption of the 1inch Network grows and more users utilize its services, there is a potential for the value of the 1inch token to appreciate. This increase in demand can drive up the price of the token, allowing investors to benefit from capital appreciation.

4. Governance Rights and Decision-Making Power

Holding 1inch tokens also grants you governance rights within the 1inch Network. This means that you have the power to participate in important governance decisions, such as protocol upgrades and parameter changes, ensuring that your voice is heard in the platform’s development.

5. Token Buybacks and Burns

The 1inch Network uses a portion of its protocol’s trading fees for regular token buybacks and burns. These mechanisms reduce the token’s circulating supply, which can positively impact the token’s price. By investing in 1inch DeFi tokenomics, you can benefit from these token buybacks and burns.

| Benefits | Description |

|---|---|

| Access to a Diverse and Liquid Market | Gain access to a broad and liquid market for easy trading. |

| Earn Trading Fees through the 1inch Liquidity Protocol | Participate in the liquidity protocol and earn trading fees. |

| Potential for Price Appreciation | Opportunity for the 1inch token value to increase as adoption grows. |

| Governance Rights and Decision-Making Power | Participate in governance decisions within the 1inch Network. |

| Token Buybacks and Burns | Benefit from token buybacks and burns that reduce circulating supply. |

Question-answer:

What is 1inch DeFi token?

1inch DeFi token is the native token of the 1inch decentralized exchange (DEX) platform. It is used for governance, utility, and value accrual within the platform.

How can I earn 1inch tokens?

There are several ways to earn 1inch tokens. You can provide liquidity to the 1inch pools and earn rewards in 1inch tokens. Additionally, you can participate in the 1inch token airdrops and earn tokens by staking other tokens on the platform.

What is the total supply of 1inch tokens?

The total supply of 1inch tokens is 1.5 billion. However, it is important to note that the tokens will be released gradually over the course of four years through liquidity mining, community growth programs, and other initiatives.