In the rapidly evolving world of decentralized finance (DeFi), 1inch has emerged as a prominent player, empowering users with cross-protocol swaps. With its cutting-edge technology and user-friendly interface, 1inch revolutionizes the way users navigate the DeFi landscape. By connecting multiple liquidity sources and aggregating them in one place, 1inch allows users to find the best possible rates and execute seamless swaps between different protocols.

1inch’s cross-protocol swaps offer a range of benefits to DeFi users. Firstly, by pooling liquidity from various decentralized exchanges, 1inch ensures that users can access a larger pool of funds, increasing the likelihood of finding better rates and minimizing slippage. This can result in significant cost savings for traders and liquidity providers alike.

Moreover, 1inch’s cross-protocol swaps eliminate the need for users to manually navigate between different protocols to execute trades. By providing a single interface that connects to multiple platforms, 1inch simplifies the process and saves users valuable time and effort. Whether it’s swapping tokens between Ethereum and Binance Smart Chain, or between any other supported protocols, 1inch makes it effortless and efficient.

Additionally, 1inch’s advanced algorithm ensures that users always get the best possible deal. By splitting orders across multiple liquidity sources and optimizing for gas fees, 1inch maximizes returns for users, regardless of the size of their trades or the complexity of their routing. This level of optimization is particularly valuable in a highly competitive and rapidly changing DeFi market.

In conclusion, 1inch plays a crucial role in empowering DeFi users with cross-protocol swaps. By offering a user-friendly interface, pooling liquidity from multiple sources, and providing optimized swaps, 1inch simplifies the DeFi experience and ensures that users get the best possible rates. As the DeFi space continues to evolve, 1inch remains at the forefront, driving innovation and empowering users to navigate this exciting new financial landscape with ease.

The Power of 1inch: How it Empowers DeFi Users with Cross-Protocol Swaps

In the decentralized finance (DeFi) landscape, where multiple protocols exist, the ability to seamlessly swap tokens across different platforms is crucial. This is where 1inch comes into play, offering users a powerful tool to execute cross-protocol swaps with ease.

What is 1inch?

1inch is a decentralized exchange (DEX) aggregator that operates across various DeFi protocols. It leverages smart contract technology to provide users with high-quality and efficient trading experiences.

With its intelligent routing algorithm, 1inch searches for the best token swap prices across different liquidity pools, ensuring that users get the most favorable rates possible.

The Benefits of Cross-Protocol Swaps

By integrating various DeFi protocols, 1inch grants users access to a wide range of liquidity pools and tokens. This gives users the ability to capitalize on arbitrage opportunities and find the best prices for their desired token swaps.

Moreover, cross-protocol swaps eliminate the need for users to manually execute multiple transactions across different platforms. Instead, 1inch streamlines the process, allowing users to swap tokens in a single transaction.

Empowering DeFi Users

1inch empowers DeFi users by offering them a seamless and user-friendly interface to navigate the complex DeFi ecosystem. Its intuitive user interface simplifies the process of token swapping and ensures transparency and security throughout the transaction.

Furthermore, 1inch is committed to providing users with the best trading experience by continuously optimizing its algorithms and integrating new protocols to offer even more liquidity and competitive rates.

In summary, 1inch plays a vital role in empowering DeFi users with its cross-protocol swaps. By leveraging its automated aggregation and routing technology, users can effortlessly access liquidity across multiple platforms and achieve the best possible outcomes for their token swaps.

Uniting DeFi Protocols for Seamless Swapping

The decentralized finance (DeFi) ecosystem has experienced explosive growth, with an increasing number of protocols offering a wide range of financial services. However, the fragmented nature of these protocols often makes it challenging for users to seamlessly swap assets across different platforms.

This is where 1inch comes in. 1inch is a decentralized exchange aggregator that connects users to multiple decentralized exchanges (DEXs) to find the best swap rates across different protocols. By aggregating liquidity from various DEXs, 1inch allows users to access a larger pool of assets and find the most competitive prices for their swaps.

Through its smart contract technology, 1inch is able to split a user’s swap across multiple DEXs to get the best possible rate. This not only helps users save on fees but also ensures that the swap execution is optimized for maximum efficiency.

Furthermore, 1inch’s Pathfinder algorithm is designed to improve the routing of swaps by considering factors such as gas prices, token prices, and liquidity. This ensures that users can execute their swaps in the most cost-effective and secure manner.

In addition to its seamless swapping functionality, 1inch also provides users with a powerful analytics dashboard that displays relevant information about their trades and portfolio. Users can track their transaction history, monitor their portfolio performance, and access advanced trading metrics to make informed decisions.

By uniting DeFi protocols for seamless swapping, 1inch empowers users to take full advantage of the opportunities offered by the DeFi space. With its efficient swap execution, competitive prices, and comprehensive analytics, 1inch is revolutionizing the way users interact with decentralized finance.

Breaking Down Barriers Between Liquidity Pools

In the world of decentralized finance (DeFi), liquidity pools play a crucial role in enabling efficient and seamless trading. However, one of the major challenges faced by DeFi users is the fragmentation of liquidity across different protocols. This fragmentation leads to limited access to liquidity and higher costs for traders.

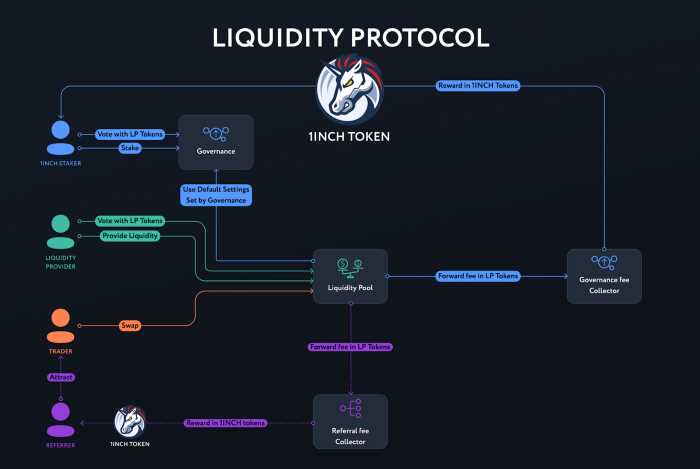

1inch is empowering DeFi users by breaking down barriers between liquidity pools. With its Aggregation Protocol, 1inch is able to source liquidity from various decentralized exchanges (DEXs) and protocols, consolidating them into a single pool. This aggregation allows for better access to liquidity and competitive prices for traders.

Improving Liquidity Access:

By sourcing liquidity from multiple DEXs and protocols, 1inch ensures that users have access to a larger pool of assets. This means that traders can execute larger trades without slippage, as the aggregated liquidity pool is more resilient to price impact. Furthermore, the aggregation protocol also enables participants to earn fees from providing liquidity, incentivizing them to contribute to the pool.

Reducing Costs:

Another key benefit of breaking down barriers between liquidity pools is the reduction in trading costs. By consolidating liquidity from various DEXs, 1inch allows users to find the best prices across different protocols. This ensures that traders can minimize their fees and optimize their trading strategies. The aggregation protocol also dynamically routes trades to ensure the most cost-effective execution.

Conclusion:

Through its Aggregation Protocol, 1inch is playing a crucial role in breaking down barriers between liquidity pools in the DeFi ecosystem. By consolidating liquidity from different protocols, 1inch enables better access to liquidity, lower trading costs, and improved trading strategies for users. This empowers DeFi traders and contributes to the overall growth and efficiency of the decentralized finance space.

Advancing DeFi Accessibility Through 1inch Protocol

The 1inch Protocol has emerged as a transformative force in the decentralized finance (DeFi) space, offering users a seamless experience for swapping tokens across multiple protocols. By incorporating cutting-edge technology, 1inch has significantly enhanced the accessibility of DeFi, opening up new opportunities for users to participate and benefit from the decentralized economy.

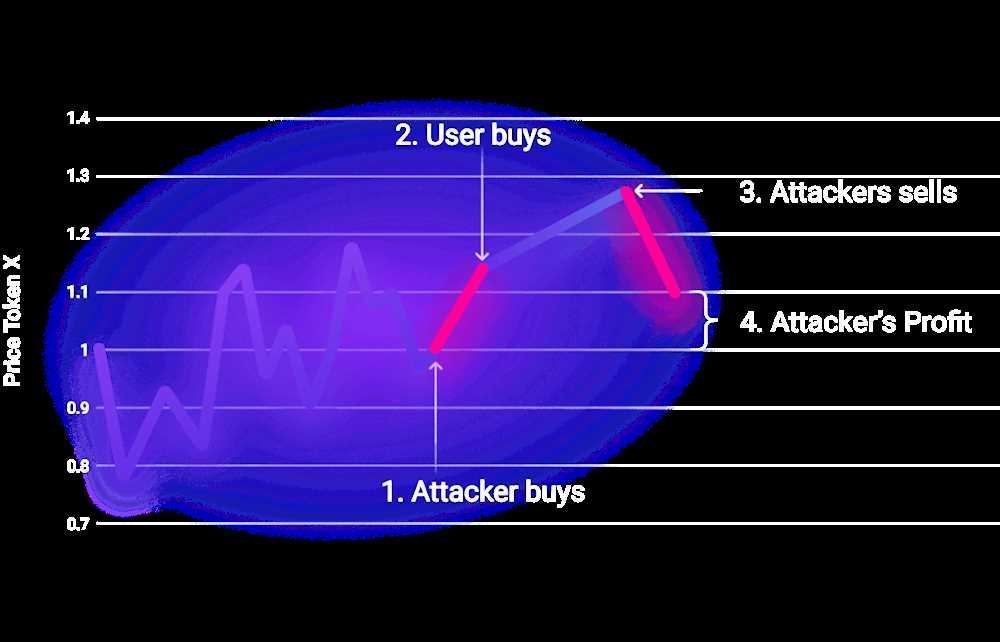

One of the key features of the 1inch Protocol is its ability to aggregate liquidity from various decentralized exchanges (DEXs). This aggregation enables users to access the best possible prices for their token swaps, as the protocol intelligently routes their trades through the most liquid pools. By automatically analyzing the available liquidity and splitting trades across multiple DEXs, 1inch ensures that users can achieve optimal rates and minimize slippage.

The 1inch Protocol also supports cross-protocol swaps, allowing users to seamlessly exchange tokens between different blockchains and protocols. This functionality eliminates the need for users to manually navigate between different platforms and perform multiple transactions. With 1inch, users can easily swap tokens across Ethereum, Binance Smart Chain, and other supported chains, all through a single interface.

In addition to its liquidity aggregation and cross-protocol capabilities, 1inch also offers a gas optimization feature. Gas fees have been a significant hurdle for many DeFi users, often making transactions uneconomical for smaller trades. 1inch addresses this issue by automatically splitting large transactions into smaller ones, optimizing gas usage and reducing costs for users. This feature enhances accessibility and affordability, particularly for those with limited capital to invest.

The user interface of 1inch is intuitive and user-friendly, making it accessible to both experienced DeFi enthusiasts and newcomers to the space. The platform offers a variety of tools and features, including advanced swap settings, personalized prices, and limit orders, empowering users with greater control over their trades. By simplifying the user experience and removing technical barriers, 1inch makes it easier for individuals to participate in the DeFi ecosystem.

| Advantages of 1inch Protocol for DeFi Users |

|---|

| 1. Access to the best possible rates across various DEXs through liquidity aggregation. |

| 2. Seamless cross-protocol swaps between different blockchains and protocols. |

| 3. Gas optimization that reduces costs and makes DeFi transactions more affordable. |

| 4. Intuitive user interface and user-friendly experience for both newcomers and experienced users. |

In conclusion, the 1inch Protocol plays a vital role in advancing the accessibility of DeFi. By offering liquidity aggregation, cross-protocol swaps, gas optimization, and a user-friendly interface, 1inch empowers individuals to participate in the decentralized economy with ease. The protocol’s innovative features and commitment to user experience position it as a key player in driving the widespread adoption of DeFi.

Question-answer:

What is 1inch?

1inch is a decentralized exchange aggregator that sources liquidity from various DEXs to provide users with the best possible trading rates and minimal slippage.

How does 1inch empower DeFi users with cross-protocol swaps?

1inch empowers DeFi users with cross-protocol swaps by allowing them to seamlessly trade tokens across different protocols, thereby increasing liquidity and providing better trading opportunities.

Can you give an example of how 1inch works?

Sure! Let’s say you want to trade a token on Ethereum for a token on Binance Smart Chain. Instead of manually swapping tokens on both chains, you can use 1inch to find the best rates and execute the trade in a single transaction. 1inch will source liquidity from multiple DEXs on both chains to ensure you get the best possible rate.