Designing the Future of Decentralized Trading Key Insights from the 1inch Whitepaper

The world of decentralized trading is rapidly evolving, and 1inch is at the forefront of this exciting revolution. In their whitepaper titled “The Future of Decentralized Trading Design,” 1inch reveals key insights into their innovative approach to creating a decentralized trading platform.

1inch recognizes the limitations of traditional centralized exchanges, such as high fees, lack of transparency, and the risk of hacks and exit scams. To address these issues, they have developed a novel solution that leverages decentralized technology to create a more efficient, secure, and user-friendly trading experience.

One of the key insights from the whitepaper is the concept of “mooniswap,” which is a new automated market maker (AMM) protocol developed by 1inch. Unlike traditional AMMs, mooniswap aims to reduce impermanent loss by introducing a virtual balance mechanism. This innovative approach ensures that liquidity providers are protected against market manipulation and sudden price fluctuations.

Another important insight outlined in the whitepaper is the concept of “Chi GasToken.” This groundbreaking technology enables users to optimize their gas usage by reducing transaction costs on the Ethereum network. By utilizing Chi GasToken, traders can significantly reduce their fees and improve the overall efficiency of their transactions.

In conclusion, 1inch’s whitepaper provides invaluable insights into the future of decentralized trading design. With their innovative solutions, such as mooniswap and Chi GasToken, 1inch is poised to revolutionize the way we trade and interact with cryptocurrencies. Their commitment to transparency, security, and user-friendly design sets them apart in the ever-changing landscape of decentralized finance.

Exploring the 1inch Whitepaper: Revolutionary Insights into Decentralized Trading Design

The 1inch exchange protocol has captivated the crypto world with its innovative approach to decentralized trading. In their whitepaper, the team behind 1inch reveals their insights into the future of trading design and the revolutionary changes it can bring to the industry.

One of the key insights shared in the whitepaper is the concept of decentralized liquidity aggregation. 1inch aims to solve the problem of fragmented liquidity in decentralized exchanges by aggregating liquidity from various sources. This allows users to access the best available prices and maximize their trading efficiency.

Another important aspect highlighted in the whitepaper is the role of smart contracts in decentralized trading. 1inch utilizes smart contracts to ensure the transparent execution of trades and facilitate secure transactions without the need for intermediaries. This not only enhances the security of the trading process but also reduces costs and improves speed.

The whitepaper also discusses the importance of user experience in decentralized trading platforms. 1inch focuses on creating a seamless and user-friendly interface to ensure that users can easily navigate the platform and execute trades. The design principles adopted by 1inch prioritize simplicity, speed, and accessibility, making it easier for both experienced and novice traders to participate in decentralized trading.

Additionally, the whitepaper explores the role of governance tokens in decentralized trading platforms. 1inch introduces its native token, 1INCH, to incentivize active users and engage them in platform governance. The token plays a crucial role in decentralized decision-making, giving users a stake in the platform’s development and ensuring a more decentralized and democratic trading ecosystem.

In conclusion, the 1inch whitepaper offers groundbreaking insights into the future of decentralized trading design. By addressing liquidity fragmentation, leveraging smart contracts, prioritizing user experience, and introducing governance tokens, 1inch aims to revolutionize the way we trade cryptocurrencies and usher in a new era of decentralized finance.

Understanding the Future of Decentralized Trading

Decentralized trading has emerged as a transformative force in the world of finance. With the advent of blockchain technology, individuals now have the ability to trade assets directly with each other without the need for intermediaries.

This shift towards decentralized trading offers a number of key advantages. Firstly, it eliminates the need for trusted third parties, such as exchanges, to facilitate trades. This reduces costs and eliminates the risk of fraud and manipulation that can occur in centralized trading environments.

Furthermore, decentralized trading platforms offer unparalleled privacy and security. Transactions are recorded on a public blockchain, providing transparency and immutability. Additionally, because users retain control of their private keys, they have complete ownership and control over their assets.

The 1inch Protocol: Enabling Efficient Decentralized Trading

One platform that is spearheading the future of decentralized trading is the 1inch Protocol. This open-source liquidity aggregator is designed to find the lowest slippage available across multiple decentralized exchanges (DEXs).

The 1inch Protocol achieves this goal through a combination of smart contract technology and an innovative routing algorithm. By splitting trades across various DEXs, the protocol can source liquidity from multiple pools, resulting in better prices for users.

Additionally, the protocol enables users to execute complex trades such as arbitrage, leveraging the fragmented nature of liquidity across DEXs. This unlocks new opportunities for traders to capture value across different markets.

The Future Potential of Decentralized Trading

As decentralized trading continues to gain traction, its future potential becomes increasingly evident. With the development of layer 2 solutions and scaling technologies, decentralized trading platforms will be able to handle a larger volume of transactions with lower fees and faster confirmation times.

Furthermore, decentralized trading is poised to democratize access to financial markets. By removing barriers to entry and enabling peer-to-peer trading, individuals from all around the world can participate in the global financial system, regardless of their location or financial status.

Overall, the future of decentralized trading is bright. With its ability to offer transparency, security, and efficiency, decentralized trading is set to revolutionize the way individuals trade and interact with financial markets.

Innovations Driving the 1inch Protocol

The 1inch Protocol is revolutionizing decentralized trading through several key innovations:

- Aggregation: 1inch uses its aggregation algorithm to split a user’s trade across multiple liquidity sources, finding the best swapping routes and optimizing for minimal slippage and fees. This allows users to get the best possible trading execution.

- Gas optimization: The protocol leverages its smart contract to reduce gas costs for users by minimizing the number of on-chain transactions required for a trade. By combining multiple swaps into a single transaction, users are able to save on gas fees.

- Liquidity protocols: 1inch integrates with various liquidity protocols, including Uniswap, SushiSwap, Balancer, and more. This provides users with access to a wide range of liquidity pools, increasing the potential trading options and opportunities.

- Pathfinder: The Pathfinder algorithm developed by 1inch helps find the most efficient trading paths by considering factors such as token prices and available liquidity. This ensures users are able to execute trades at the best possible rates.

- DEX aggregation: The 1inch Protocol aggregates liquidity from multiple decentralized exchanges (DEXs), enabling users to access the best prices from various sources. This eliminates the need for users to manually search multiple DEXs for the best rates.

- Chi Gastoken: 1inch introduced the use of Chi Gastoken, a gas-saving technique, to further reduce transaction costs for traders. By using Chi Gastoken, users can save on gas fees by compressing the gas cost of each transaction.

- Referral program: 1inch has implemented a referral program that rewards users for inviting others to use the protocol. This incentivizes users to spread awareness and adoption of the platform, contributing to its growth and liquidity.

These innovations make the 1inch Protocol a powerful and efficient tool for decentralized trading, providing users with improved liquidity, cost savings, and enhanced trading execution.

Unleashing the Power of Aggregation Techniques

Decentralized trading platforms have revolutionized the way we trade digital assets. However, with the increasing number of decentralized exchanges (DEXs) and liquidity pools, it has become challenging for traders to find the most efficient and cost-effective trading routes.

This is where aggregation techniques come into play. Aggregation platforms like 1inch are designed to analyze and compare prices across multiple DEXs and liquidity pools, allowing traders to find the best prices and routes for their trades. By leveraging these aggregation techniques, traders can benefit from increased liquidity, reduced slippage, and lower transaction costs.

Efficient Routing and Transaction Execution

One of the key advantages of aggregation techniques is the ability to find the most efficient trading routes. Aggregation platforms analyze the liquidity and pricing information from various DEXs and liquidity pools and determine the optimal path to execute a trade. By splitting the trade across multiple DEXs, traders can minimize slippage and maximize their trading profits.

Aggregation platforms also optimize transaction execution by taking advantage of opportunities for arbitrage. By identifying price discrepancies between different exchanges, aggregation platforms can execute trades that take advantage of these arbitrage opportunities, resulting in higher profits for traders.

Access to Deeper Liquidity

Another key benefit of aggregation techniques is the ability to access deeper liquidity. By aggregating liquidity from multiple DEXs and liquidity pools, traders can tap into a larger pool of available liquidity. This increased liquidity not only improves trade execution but also reduces the risk of encountering large price slippage.

Furthermore, aggregation techniques enable traders to access liquidity on platforms that may have lower transaction fees or better token availability. By aggregating liquidity from multiple platforms, traders can choose the most favorable platform for their trades, resulting in reduced transaction costs and improved trading outcomes.

In conclusion, aggregation techniques are a crucial component of decentralized trading platforms like 1inch. By analyzing and comparing prices across multiple DEXs and liquidity pools, aggregation platforms empower traders with efficient routing, improved trade execution, and increased access to deeper liquidity. As the decentralized trading ecosystem continues to evolve, the power of aggregation techniques will play a vital role in unlocking the full potential of decentralized trading.

The Impact of Liquidity Providers on 1inch

Liquidity providers play a crucial role in the success of 1inch and its decentralized trading design. By providing liquidity to the platform, these individuals or entities ensure that there are sufficient funds available for users to execute their trades seamlessly.

One of the key benefits of liquidity providers on 1inch is that they help to minimize slippage. Slippage is the difference between the expected price of a trade and the actual executed price. By providing liquidity across various decentralized exchanges, liquidity providers help to reduce slippage and improve trading efficiency.

In addition, liquidity providers on 1inch are incentivized through various mechanisms. One such mechanism is the distribution of 1inch tokens as rewards. Liquidity providers are rewarded with 1inch tokens based on the volume and depth of liquidity they provide. This incentivizes liquidity providers to contribute more to the platform, which in turn attracts more users and enhances the overall trading experience.

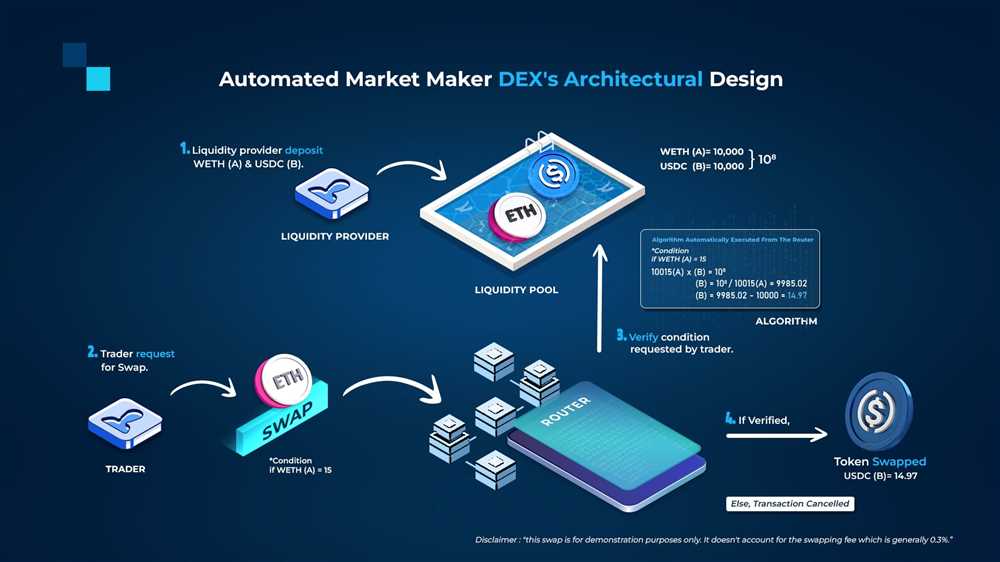

Liquidity providers also benefit from the automated market-making (AMM) system employed by 1inch. This system allows liquidity providers to earn fees on every trade that takes place on the platform. These fees are distributed proportionally to the liquidity provided by each provider. This creates a sustainable revenue stream for liquidity providers and encourages them to continue providing liquidity on 1inch.

Furthermore, liquidity providers are instrumental in the growth and development of the 1inch ecosystem. By providing liquidity, they contribute to the overall liquidity depth on the platform, making it more attractive to traders. This increased liquidity attracts more users, which in turn attracts more liquidity providers, creating a positive feedback loop and fostering the growth of the ecosystem.

In conclusion, liquidity providers play a vital role in the success of 1inch and its decentralized trading design. They help to minimize slippage, are incentivized through token rewards and AMM fees, and contribute to the growth and development of the platform. Without liquidity providers, 1inch would not be able to provide the seamless and efficient trading experience that it is known for.

Question-answer:

What is the main purpose of the 1inch whitepaper?

The main purpose of the 1inch whitepaper is to provide insights into the future of decentralized trading design and outline the key aspects of the 1inch protocol.

What are some key insights mentioned in the whitepaper?

The whitepaper highlights several key insights, including the importance of liquidity aggregation, the limitations of traditional decentralized exchanges, the benefits of multi-path routing, and the role of governance tokens in decentralized trading platforms.

What is liquidity aggregation?

Liquidity aggregation refers to the process of combining liquidity from multiple decentralized exchanges into a single pool. This allows traders to access a larger pool of liquidity, leading to better prices and reduced slippage.

What are some limitations of traditional decentralized exchanges?

Traditional decentralized exchanges often suffer from low liquidity and high slippage. Additionally, they lack efficient routing mechanisms, resulting in suboptimal trade executions. The whitepaper discusses how the 1inch protocol addresses these limitations.

How do governance tokens play a role in decentralized trading platforms?

Governance tokens are an integral part of decentralized trading platforms as they give users the ability to participate in the platform’s decision-making process. Token holders can vote on important protocol changes and upgrades, ensuring a more democratic and decentralized governance structure.