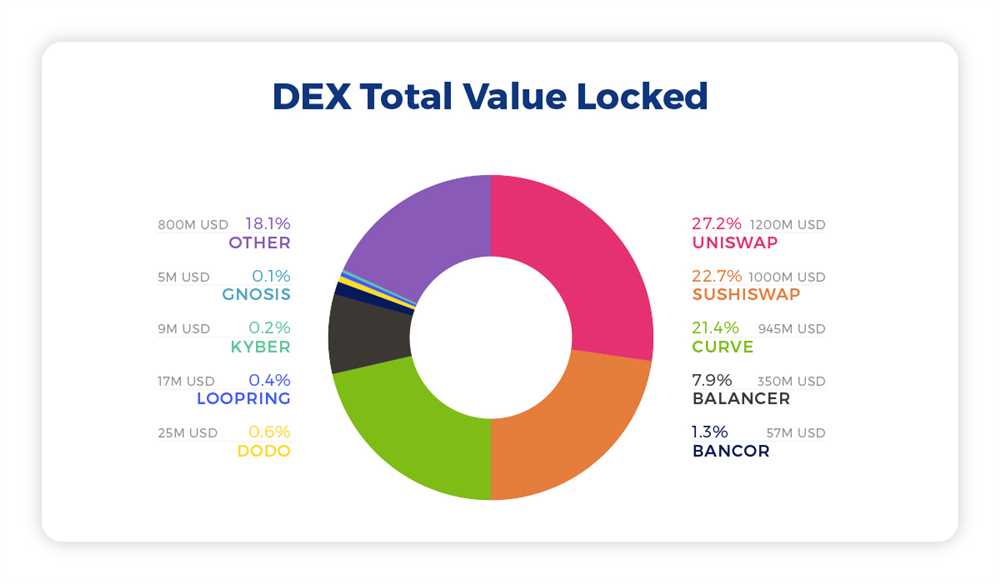

Decentralized finance (DeFi) has gained massive popularity in recent years, and decentralized exchanges (DEXs) have played a crucial role in this ecosystem. Among the top DEXs, 1inchswap and Uniswap have emerged as major players, offering unique features and attracting significant user attention.

1inchswap is a decentralized exchange aggregator that enables users to find the most optimal trading routes across various DEXs. It leverages smart contract technology and sophisticated algorithms to split trades across multiple liquidity protocols, ensuring users get the best possible rates. With its user-friendly interface and seamless integration with popular wallets, 1inchswap has quickly become a preferred choice for traders seeking efficient and cost-effective trades.

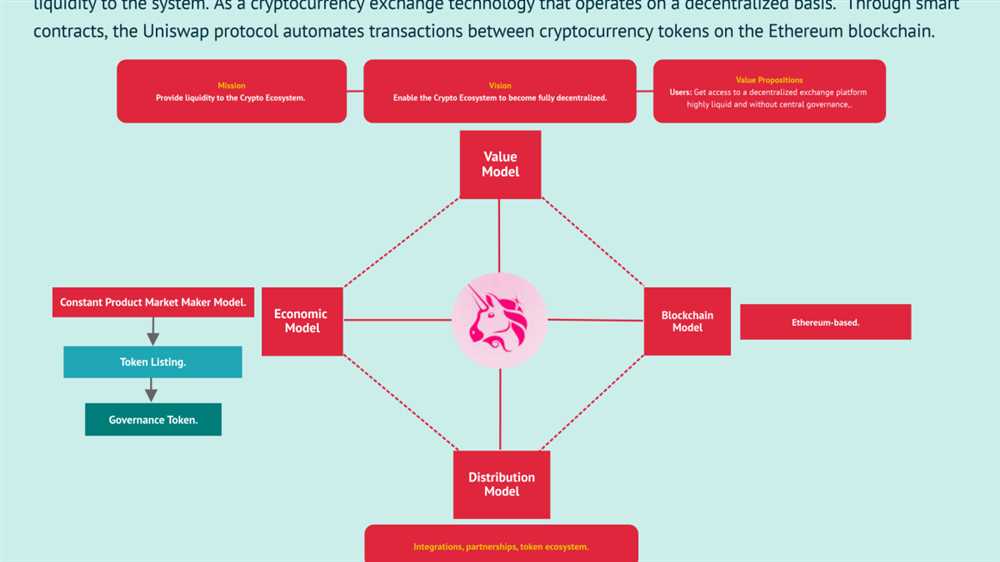

On the other hand, Uniswap is one of the pioneers of decentralized exchanges and has played a crucial role in the growth of the DeFi space. Built on Ethereum, Uniswap employs an automated market-making (AMM) mechanism, allowing users to trade directly from their wallets. It utilizes liquidity pools and smart contracts to facilitate peer-to-peer trading without the need for traditional intermediaries. Uniswap’s simplicity and ability to support a wide range of tokens have made it a go-to platform for many DeFi enthusiasts.

While both 1inchswap and Uniswap operate in the realm of decentralized trading, there are key differences between the two. 1inchswap’s focus on optimizing trades through multiple DEXs sets it apart from Uniswap’s simplicity and direct wallet-to-wallet trading. Additionally, 1inchswap’s algorithmic routing system allows traders to access the best prices across different liquidity sources, providing a competitive edge.

When it comes to liquidity, Uniswap has a larger pool of available tokens due to its early entry into the market. However, 1inchswap has been rapidly expanding its list of supported DEXs, ensuring its users can access a wide range of tokens. This increased liquidity options make 1inchswap an attractive choice for traders looking to explore different DEXs and maximize their trading opportunities.

In conclusion, both 1inchswap and Uniswap have made significant contributions to the decentralized finance ecosystem. While 1inchswap offers advanced trading optimization and access to multiple liquidity sources, Uniswap excels in simplicity and wider token availability. Ultimately, the choice between the two depends on individual preferences and trading strategies. Regardless of the chosen platform, it is evident that decentralized exchanges have revolutionized the way we trade cryptocurrencies and are here to stay.

Main Features of 1inchswap

1inchswap is a decentralized exchange (DEX) platform that offers several unique features that set it apart from other DEXs. Here are some of the main features of 1inchswap:

- Aggregation of Liquidity: 1inchswap uses an algorithm to aggregate liquidity from various decentralized exchanges, allowing users to find the best prices and swap tokens more efficiently.

- Low Slippage: By aggregating liquidity, 1inchswap aims to minimize slippage, which is the difference between the expected and the actual price of tokens when swapping.

- Gas Efficiency: 1inchswap utilizes the Ethereum network and employs various strategies to reduce gas fees, making transactions more cost-effective for users.

- Flexible Gas Fees: Users can choose between different gas fee options based on their preference for transaction speed and cost.

- Security: 1inchswap prioritizes the security of users’ funds by using audited smart contracts and integrating with reputable wallets.

These features make 1inchswap an attractive option for users looking for a decentralized exchange that provides efficient swaps, low slippage, and cost-effective transactions. It is worth noting that some of these features may be subject to change as the platform continues to evolve and adapt to the needs of its users.

Main Features of Uniswap

Uniswap is a decentralized exchange (DEX) built on the Ethereum blockchain. It has gained significant popularity due to its unique features and benefits. Here are some of the main features of Uniswap:

| Features | Description |

|---|---|

| Liquidity Pools | Uniswap allows users to contribute liquidity to trading pairs by depositing an equal value of both tokens. Liquidity providers earn fees on trades made using their liquidity. |

| Automatic Market Maker (AMM) | Uniswap uses an automated market maker algorithm, which eliminates the need for traditional order books. Instead, trades are executed against liquidity pools with predefined algorithms. |

| No Listing Requirements | Anyone can create a trading pair on Uniswap without any listing requirements. This allows for a wide range of tokens to be traded on the platform, including new and small-cap tokens. |

| No Central Authority | Uniswap is decentralized, meaning it operates without a central authority. All transactions are executed through smart contracts on the Ethereum blockchain, providing transparency and security. |

| Permissionless | Uniswap does not require users to go through a registration or KYC process. Anyone with an Ethereum wallet can participate and trade on the platform. |

| Low Fees | Uniswap charges a 0.3% fee on trades, which is distributed to liquidity providers. Compared to traditional centralized exchanges, Uniswap’s fees are typically lower. |

| Decentralized Governance | Uniswap has a decentralized governance system that allows token holders to participate in the decision-making process. This ensures that the community has a say in the platform’s development and direction. |

These are just some of the main features that make Uniswap an attractive option for decentralized trading. Its innovative approach to liquidity provision and decentralized governance have made it a popular choice among cryptocurrency enthusiasts and traders.

Advantages of 1inchswap over Uniswap

When comparing 1inchswap and Uniswap, it becomes clear that 1inchswap has several advantages that make it a strong competitor in the decentralized exchange space.

Improved Liquidity: 1inchswap utilizes a unique aggregation algorithm that allows it to source liquidity from multiple decentralized exchanges. This ensures that users get the best possible prices and improved liquidity compared to Uniswap.

Lower Fees: One of the significant advantages of 1inchswap is its lower fees compared to Uniswap. By utilizing its aggregation technology, 1inchswap can find the most cost-effective routing options, resulting in lower transaction fees for users.

Reduced Slippage: Slippage can be a significant issue when trading on decentralized exchanges. However, 1inchswap’s aggregation algorithm helps to mitigate this problem by dynamically splitting orders across various liquidity sources. This reduces slippage and improves the overall trading experience.

Access to Multiple Networks: While Uniswap primarily operates on the Ethereum network, 1inchswap supports multiple networks, including Ethereum, Binance Smart Chain, and Polygon. This provides users with more options and flexibility when it comes to choosing which network they want to trade on.

Advanced Features: 1inchswap offers several advanced features that are not available on Uniswap. These include limit orders, gas fee refunds, and protocol fees redistribution to users. These features provide additional functionality and incentives for users to choose 1inchswap over Uniswap.

Community Governance: 1inchswap is built on the 1inch Protocol, which allows users to participate in the decision-making process through community governance. This gives users a voice in the development and evolution of the platform, ensuring that their needs and preferences are taken into account.

In conclusion, 1inchswap offers several advantages over Uniswap, including improved liquidity, lower fees, reduced slippage, access to multiple networks, advanced features, and community governance. These features make 1inchswap a compelling choice for users looking for a decentralized exchange that offers a superior trading experience.

Advantages of Uniswap over 1inchswap

While both 1inchswap and Uniswap are popular decentralized exchanges, Uniswap comes with several advantages over 1inchswap. These advantages include:

1. Simplicity and User-Friendliness

Uniswap is known for its simplicity and user-friendly interface. It provides a seamless user experience with a clean and intuitive design. Users can easily navigate through the platform and execute trades without encountering any complications. On the other hand, 1inchswap may be a bit overwhelming for new users due to its complex interface and additional features.

2. Liquidity and Depth of Market

Uniswap has a significantly higher liquidity compared to 1inchswap. As one of the first decentralized exchanges, it has attracted a large number of users, resulting in a deeper and more liquid market. This means that traders on Uniswap can execute larger trades without significantly impacting the price. On the other hand, 1inchswap may experience liquidity gaps and slippage, especially for less popular tokens.

3. Protocol Governance

Uniswap has a decentralized governance model that allows users to vote on proposals and decisions related to the platform. This gives users a voice in shaping the future of Uniswap and ensures that the platform remains decentralized. 1inchswap, on the other hand, does not currently have a governance system in place, giving Uniswap an advantage in terms of community involvement and decision-making.

4. Brand Recognition and Trust

Uniswap is one of the most well-known and trusted decentralized exchanges in the cryptocurrency space. It has been around since 2018 and has gained a strong reputation for its reliability and security. This brand recognition and trust give Uniswap an advantage over 1inchswap, which is a relatively newer platform in comparison.

In conclusion, while both 1inchswap and Uniswap offer decentralized exchange services, Uniswap has several advantages in terms of simplicity, liquidity, protocol governance, and brand recognition. These factors make Uniswap a preferred choice for many traders and users in the decentralized finance ecosystem.

| Advantages of Uniswap | Advantages of 1inchswap |

|---|---|

| Simplicity and user-friendliness | Aggregation of liquidity from multiple sources |

| Liquidity and depth of market | Lower transaction fees |

| Protocol governance | Integration with other DeFi platforms |

| Brand recognition and trust | Access to unique liquidity pools |

Question-answer:

What is the difference between 1inchswap and Uniswap?

1inchswap and Uniswap are both decentralized exchanges that allow users to trade cryptocurrencies directly from their wallets. However, there are several key differences between the two platforms. Firstly, 1inchswap is a multi-chain decentralized exchange that operates on various blockchains, while Uniswap is primarily built on the Ethereum blockchain. Additionally, 1inchswap utilizes a unique aggregation algorithm that sources liquidity from multiple exchanges to find the best prices for users, whereas Uniswap relies on its own liquidity pools. Finally, 1inchswap offers a feature called “Gas Tokenization,” which allows users to pay lower gas fees, while Uniswap does not have this functionality.

Which platform has lower fees, 1inchswap or Uniswap?

In terms of fees, 1inchswap has a unique feature called “Gas Tokenization” that can help users save on gas fees. Gas Tokenization allows users to convert high gas fees into lower-priced tokens called CHI tokens. This feature can significantly reduce transaction costs for frequent traders. On the other hand, Uniswap does not have a similar feature, so users will have to pay the regular gas fees. Therefore, 1inchswap generally offers lower fees compared to Uniswap.

Is it possible to trade on both 1inchswap and Uniswap simultaneously?

Yes, it is possible to trade on both 1inchswap and Uniswap simultaneously. Since both platforms are decentralized exchanges, users can connect their wallets to both platforms and execute trades as they see fit. However, it’s important to note that each platform operates independently, so the liquidity and prices may vary between the two. Additionally, it’s worth considering the gas fees associated with each trade, as they can add up if trading on multiple platforms simultaneously.