The decentralized finance (DeFi) market has experienced rapid growth in recent years, with new platforms and protocols emerging to meet the demands of users. One such protocol that has gained significant attention is 1inch’s liquidity protocol.

1inch’s liquidity protocol is designed to solve one of the biggest challenges in DeFi – liquidity fragmentation. With hundreds of decentralized exchanges (DEXs) operating on different networks, it can be difficult for users to find the best prices and efficiently trade their assets.

By aggregating liquidity from multiple DEXs, 1inch’s protocol allows users to access the best prices and trade with minimal slippage. This not only ensures better execution of trades but also maximizes the potential returns for users.

Furthermore, 1inch’s liquidity protocol is built on top of Ethereum, making it compatible with a wide range of DeFi applications and smart contracts. This interoperability allows users to seamlessly integrate 1inch into their existing DeFi strategies and leverage its liquidity to optimize their returns.

In addition to its core functionality, 1inch’s protocol also offers various advanced features, such as limit orders and smart contract routing. These features enable users to set specific price targets for their trades and automatically execute them when the desired conditions are met.

Overall, 1inch’s liquidity protocol has the potential to revolutionize the DeFi market by addressing the challenges of liquidity fragmentation and providing users with a seamless trading experience. As the DeFi ecosystem continues to evolve, the importance of efficient and cost-effective trading solutions like 1inch’s protocol will only grow.

The Importance of Liquidity in DeFi

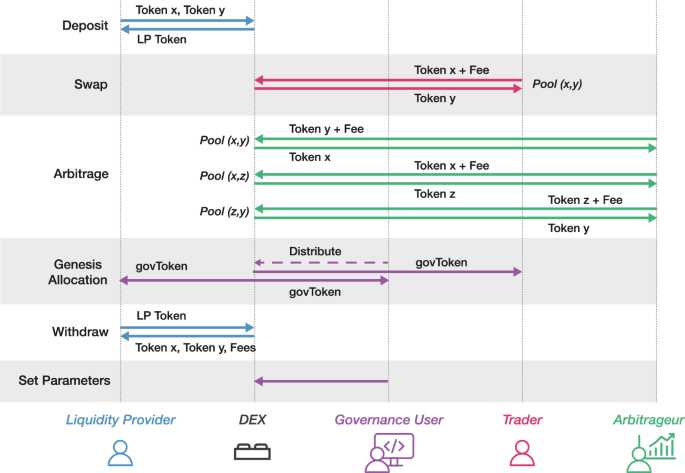

Liquidity plays a crucial role in the decentralized finance (DeFi) ecosystem. It refers to the ease with which an asset can be bought or sold on the market without significantly impacting the asset’s price. In DeFi, liquidity is provided by liquidity providers (LPs), who deposit their assets into liquidity pools.

Enhancing Efficiency

Liquidity is essential for the efficient functioning of DeFi protocols. Without sufficient liquidity, users may experience slippage when trading, which refers to the difference between the expected price of an asset and the actual executed price. High slippage can lead to significant losses for traders and discourage them from participating in the market.

By providing ample liquidity, DeFi protocols like 1inch enable smooth and efficient trading experiences for users. Liquidity providers play a vital role in this process by ensuring that there is enough liquidity in the pools to satisfy the demand from traders.

Facilitating Price Discovery

Liquidity also plays a crucial role in price discovery. In markets with high liquidity, the price of an asset is likely to be more accurate and reflective of its true value. On the other hand, markets with low liquidity can be prone to price manipulation and volatility.

In DeFi, liquidity pools provide a platform for price discovery through the constant trading activity and competition between buyers and sellers. This helps establish a fair market value for assets and enables users to make informed investment decisions.

Encouraging Innovation

Liquidity is essential for fostering innovation in the DeFi space. It provides the foundation for new financial products and services to be built upon. With sufficient liquidity, developers and entrepreneurs can launch new protocols, yield farming strategies, and lending platforms, among other innovations.

1inch’s liquidity protocol plays a significant role in encouraging innovation in DeFi. By seamlessly aggregating liquidity from various sources, such as decentralized exchanges (DEXs) and liquidity pools, 1inch enables users to access the best possible trading opportunities and maximize their returns.

In conclusion, liquidity is of paramount importance in the DeFi ecosystem. It enhances efficiency, facilitates price discovery, and encourages innovation. As the DeFi space continues to grow, the importance of liquidity will only increase, and platforms like 1inch will play a crucial role in unlocking its full potential.

Increasing Market Efficiency and Reducing Slippage

Market efficiency and reducing slippage are two key factors in the success of any decentralized finance (DeFi) platform. These factors determine the effectiveness and profitability of trading on the platform, making them crucial for both traders and liquidity providers.

With 1inch’s liquidity protocol, market efficiency is significantly increased through the aggregation of liquidity from various sources. By accessing multiple decentralized exchanges (DEXs) and liquidity pools, the protocol ensures that traders can always find the best prices for their trades. This eliminates the need for traders to manually check and compare prices on different platforms, saving time and effort.

Reducing slippage is another important aspect of market efficiency. Slippage refers to the difference between the expected price of a trade and the price at which the trade is actually executed. High slippage can result in significant losses for traders, especially when dealing with large transactions.

1inch’s liquidity protocol helps reduce slippage by splitting larger trades into smaller parts and executing them across multiple DEXs. This allows the protocol to access the deepest liquidity pools and ensure that trades are executed at the most favorable prices. By minimizing slippage, traders can maximize their profits and liquidity providers can attract more traders to their pools.

Furthermore, the protocol also takes into account the cost of gas fees when determining the optimal route for a trade. Gas fees are a crucial consideration in decentralized trading, as they can significantly impact the profitability of trades, especially for smaller transactions. By factoring in gas fees, the protocol helps traders optimize their trades and minimize their costs.

In conclusion, 1inch’s liquidity protocol plays a crucial role in increasing market efficiency and reducing slippage in the DeFi space. Through the aggregation of liquidity, splitting trades, and considering gas fees, the protocol ensures that traders can access the best prices and execute trades with minimal slippage. This not only benefits individual traders but also enhances the overall liquidity and attractiveness of the platform for both traders and liquidity providers.

Introducing 1inch’s Liquidity Protocol

The 1inch liquidity protocol is a revolutionary decentralized finance (DeFi) solution that aims to unleash the full potential of liquidity in the cryptocurrency market. Built on the Ethereum blockchain, it provides users with access to an extensive network of decentralized exchanges (DEXs) and liquidity pools, all in one place.

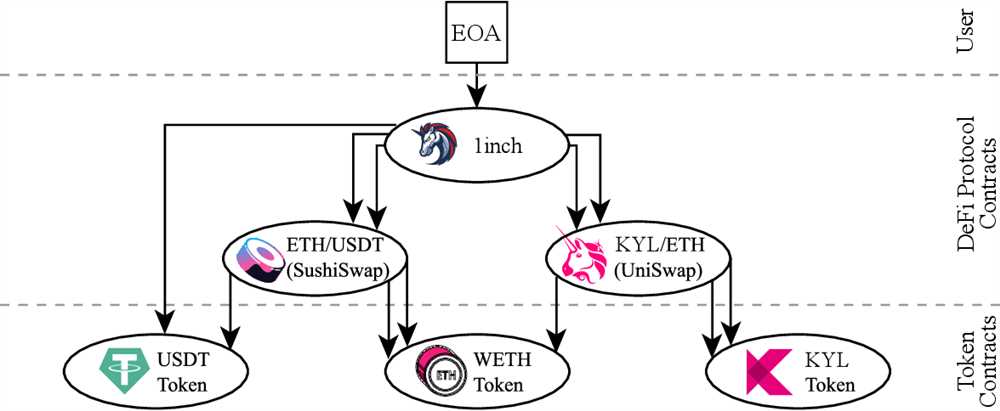

With 1inch’s liquidity protocol, users can swap tokens at the best possible rates, thanks to its powerful smart contract that splits orders across multiple DEXs and aggregates liquidity from various sources. This ensures that users get the most favorable rates and lowest slippage when trading.

One of the key features of the 1inch liquidity protocol is its ability to provide users with access to deep liquidity pools, even for illiquid tokens. By utilizing its algorithmic market maker, the protocol can create and maintain liquidity for tokens that may not have sufficient trading volume on traditional exchanges.

Moreover, the 1inch liquidity protocol is designed to be highly secure and transparent. All transactions are executed on-chain, eliminating the need for intermediaries and ensuring that users have full control over their funds at all times. Additionally, the protocol’s open-source nature allows for independent audits and community involvement, further enhancing its security and trustworthiness.

By leveraging the power of the 1inch liquidity protocol, users can maximize their trading opportunities and easily access a wide range of tokens and DeFi protocols. Whether it’s swapping tokens, providing liquidity to earn yield, or participating in decentralized governance, the 1inch liquidity protocol opens up a world of possibilities in the decentralized finance ecosystem.

In summary, the 1inch liquidity protocol is a game-changer in the DeFi space, offering users a seamless and efficient way to trade and access liquidity in the cryptocurrency market. With its advanced features, security measures, and commitment to decentralization, it is poised to transform the way users interact with decentralized exchanges and participate in the evolving DeFi landscape.

Enhancing Liquidity Mining and Yield Farming

1inch’s liquidity protocol has revolutionized the world of decentralized finance by providing users with seamless access to various liquidity sources. To further enhance the benefits of the protocol, it is crucial to focus on improving liquidity mining and yield farming strategies.

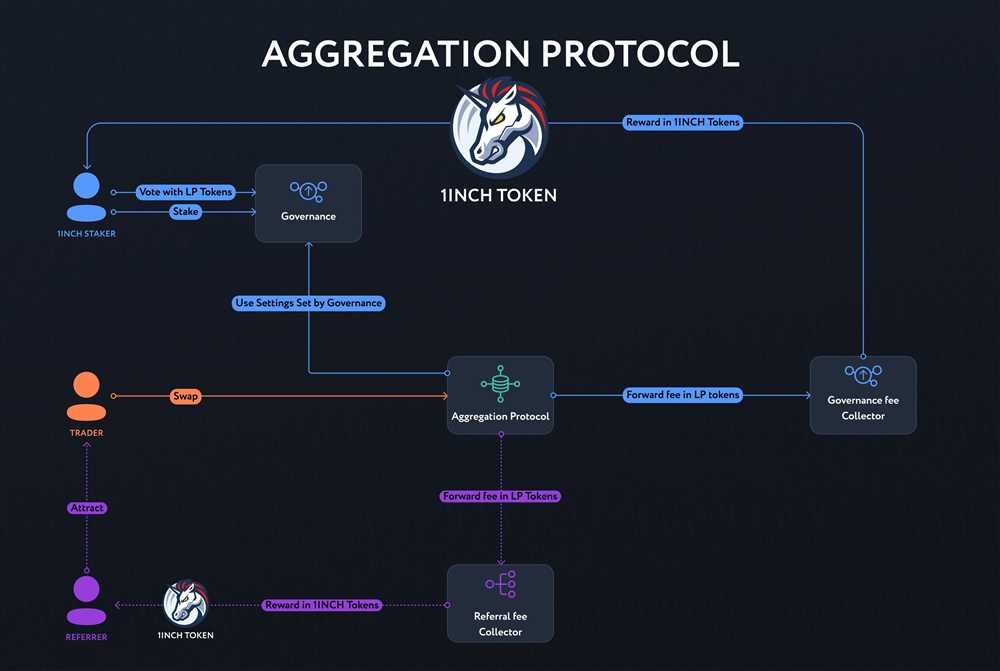

Liquidity mining is a mechanism that incentivizes users to provide liquidity to decentralized exchanges. By enabling users to earn rewards in the form of native tokens, liquidity mining stimulates the growth of liquidity pools and ensures a more vibrant trading environment. 1inch can enhance liquidity mining by introducing innovative mechanisms such as dynamic reward allocation based on factors like pool size and trading volume. This way, participants would have higher incentives to contribute to pools that require additional liquidity, leading to a more efficient allocation of resources.

Another aspect that can be improved is yield farming. Yield farming is a process where users lock their assets in smart contracts to earn rewards in the form of additional tokens. To enhance yield farming with 1inch’s liquidity protocol, it is essential to diversify the available farming options. By introducing new farming strategies and partnerships with other decentralized platforms, users would have more opportunities to maximize their returns on locked assets.

Furthermore, 1inch can collaborate with other projects in the DeFi ecosystem to introduce yield aggregators. Yield aggregators are platforms that automatically move funds between different yield farming opportunities to maximize returns. By integrating with yield aggregators, 1inch can provide users with a seamless experience and ensure that their locked assets are always generating the best possible returns.

Additionally, it is crucial for 1inch to continuously refine its governance mechanisms to allow users to participate and make decisions regarding liquidity mining and yield farming. By establishing a robust governance framework, users can have a say in the allocation of rewards, the introduction of new farming options, and other important aspects of the protocol. This way, the community can actively shape the future of liquidity mining and yield farming with 1inch.

In conclusion, enhancing liquidity mining and yield farming strategies is essential to unlock the full potential of 1inch’s liquidity protocol. By implementing innovative mechanisms, diversifying farming options, collaborating with other projects, and establishing a robust governance framework, 1inch can ensure a thriving ecosystem that provides users with lucrative opportunities and a seamless experience in the world of decentralized finance.

Advantages of 1inch’s Liquidity Protocol in DeFi

The liquidity protocol developed by 1inch has several distinct advantages in the decentralized finance (DeFi) space.

1. Efficient and Optimized Trades

The 1inch liquidity protocol leverages smart contract technology to provide users with the most efficient and optimized trades across different decentralized exchanges (DEXs). By splitting a single trade into multiple smaller trades across various exchanges, the protocol ensures that users get the best possible price for their trades.

2. Aggregation of Liquidity

One of the significant advantages of the 1inch liquidity protocol is its ability to aggregate liquidity from multiple DEXs into a single platform. This aggregation significantly increases the available liquidity, allowing users to execute larger trades with minimal slippage.

3. Low Fees

1inch’s liquidity protocol strives to provide users with the lowest fees possible. By optimizing trade execution and aggregating liquidity, the protocol minimizes the costs associated with trading on different DEXs. This makes it more cost-effective for users to access liquidity and participate in the DeFi ecosystem.

4. Gas Optimization

Gas fees are a significant concern in the Ethereum ecosystem. The 1inch liquidity protocol addresses this issue by optimizing gas usage for trades. By splitting large trades into smaller ones across multiple DEXs, the protocol reduces the overall gas costs for users, making it more affordable to execute trades.

5. Enhanced Security and Transparency

1inch’s liquidity protocol prioritizes security and transparency. All transactions and trades executed on the platform are recorded on the blockchain, providing users with a high level of transparency. Additionally, the protocol undergoes regular audits and security assessments to ensure that it remains secure and reliable for users.

6. Advanced Trading Features

1inch’s liquidity protocol offers advanced trading features that allow users to customize and optimize their trading strategies. These features include limit orders, stop-loss orders, and slippage protection, which provide users with more control over their trades and help mitigate potential risks.

Conclusion

The 1inch liquidity protocol brings several advantages to the DeFi ecosystem. Its efficient and optimized trade execution, liquidity aggregation, low fees, gas optimization, enhanced security, and advanced trading features make it a valuable tool for users looking to maximize their returns and participate in the decentralized finance space.

Question-answer:

What is the 1inch’s liquidity protocol in DeFi?

The 1inch’s liquidity protocol in DeFi is a decentralized financial protocol that allows for efficient and cost-effective trading of digital assets across multiple decentralized exchanges (DEXs). It aggregates liquidity from various sources to provide the best trading rates for users.

How does the 1inch’s liquidity protocol work?

The 1inch’s liquidity protocol works by utilizing smart contract technology to interact with multiple DEXs. When a user wants to make a trade, the protocol splits the trade across different exchanges to find the best available rates. It also takes into account gas costs and slippage to optimize the trading process.

What are the benefits of using 1inch’s liquidity protocol?

Using 1inch’s liquidity protocol offers several benefits. Firstly, it provides users with access to the best available trading rates across multiple DEXs, resulting in cost savings for traders. Additionally, it minimizes slippage and maximizes liquidity by aggregating orders from different sources. Lastly, the protocol is decentralized and transparent, ensuring the security of users’ funds.