USDT, or Tether, is a stablecoin that is pegged to the value of the US dollar. It is widely used in the cryptocurrency market as a means of preserving value and providing stability amidst the volatility of other cryptocurrencies. 1inch, on the other hand, is a decentralized exchange aggregator that allows users to find the best prices across various decentralized exchanges.

With the growing popularity of stablecoins and decentralized exchanges, it is important to analyze the historical performance of USDT trading on platforms like 1inch. By understanding the trends and patterns of USDT trading on 1inch, traders and investors can make more informed decisions and optimize their trading strategies.

One key aspect to consider when analyzing the historical performance of USDT trading on 1inch is liquidity. Liquidity refers to the ease with which an asset can be bought or sold without causing a significant change in its price. Higher liquidity generally leads to lower trading costs and a smoother trading experience. By looking at the volume and depth of the USDT trading pairs on 1inch over time, we can assess the liquidity levels and identify any notable trends or changes.

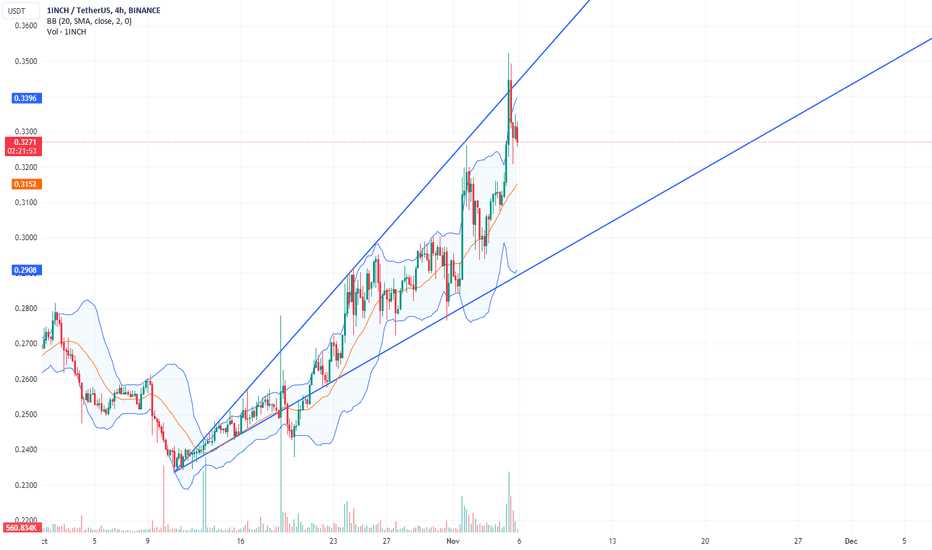

Another important factor to consider is the price volatility of USDT on 1inch. While USDT is designed to maintain a stable value, it is not immune to market forces and may experience temporary fluctuations. Analyzing the historical price movements of USDT on 1inch can provide insights into the stability of the token and its performance relative to other cryptocurrencies.

Overview of USDT trading on 1inch

USDT, also known as Tether, is a popular stablecoin in the crypto market that is pegged to the value of the US dollar. On the 1inch decentralized exchange platform, USDT is one of the most traded cryptocurrencies. In this overview, we will analyze the historical performance of USDT trading on 1inch.

Trading Volume and Liquidity

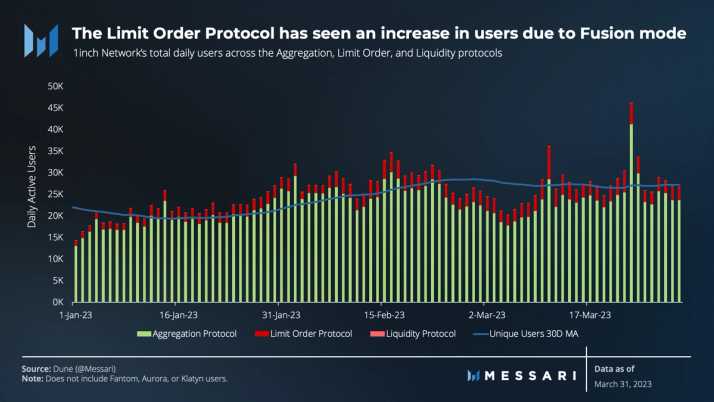

USDT has consistently maintained high trading volume on the 1inch platform, indicating its popularity among traders. The liquidity of USDT on 1inch has also been robust, ensuring easy and efficient trading. Traders can easily buy and sell USDT without experiencing slippage or delays due to the ample liquidity.

Competitive Pricing

Due to the high liquidity and intense competition among market makers on 1inch, users can enjoy competitive pricing when trading USDT. This means that users can obtain USDT at favorable prices, maximizing their potential gains.

- High trading volume

- Ample liquidity

- Competitive pricing

These factors combine to make USDT trading on 1inch a popular choice for both retail and institutional traders looking for a stablecoin with reliable performance and excellent trading conditions.

Historical performance of USDT trading on 1inch

USDT, also known as Tether, has become one of the most popular stablecoins in the cryptocurrency market. Its value is pegged to the US dollar, making it a reliable digital asset for traders and investors. In this article, we will analyze the historical performance of USDT trading on the decentralized exchange 1inch.

What is 1inch?

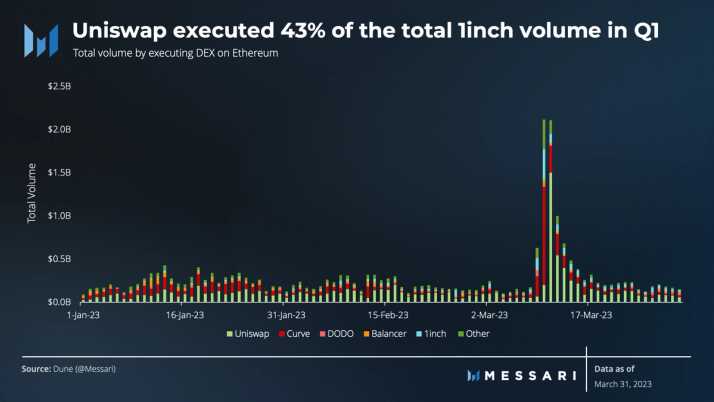

1inch is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges (DEXs) to offer users the best possible trading rates. It combines liquidity from platforms such as Uniswap, Sushiswap, and Kyber Network, among others, to provide users with optimal results.

Historical Performance

The historical performance of USDT trading on 1inch has been quite impressive. Since its launch, 1inch has constantly been improving its platform to provide users with a seamless trading experience. This has resulted in a significant increase in trading volume for USDT, further establishing it as a reliable stablecoin.

One of the key factors contributing to the success of USDT trading on 1inch is its integration with various decentralized exchanges. By sourcing liquidity from multiple platforms, 1inch ensures that users get access to the best possible rates, minimizing slippage and maximizing their trading profits.

Additionally, 1inch offers users advanced trading features such as limit orders and gas optimization. These features allow traders to set specific price targets and automate their trades, making it easier to execute trading strategies effectively. USDT traders on 1inch can take advantage of these features to optimize their trading performance.

Furthermore, the decentralized nature of 1inch ensures that users have full control over their assets. They do not need to trust a centralized exchange with their funds, reducing the risk of theft or hacks. The transparency and security offered by 1inch make it an attractive platform for USDT traders.

In conclusion, the historical performance of USDT trading on 1inch has been impressive due to its integration with multiple decentralized exchanges, advanced trading features, and the security offered by the platform. As the cryptocurrency market continues to grow, it is expected that USDT trading on 1inch will continue to thrive, providing traders with a reliable and efficient trading experience.

Analytical approach to evaluating USDT trading on 1inch

When it comes to analyzing the historical performance of USDT trading on 1inch, several factors should be taken into account. By leveraging quantitative data and analytical tools, we can gain valuable insights into the trading activity and patterns on this decentralized exchange.

Data collection

The first step in our analytical approach is to collect the relevant data. This includes obtaining historical trading data for USDT on 1inch, such as trading volume, price fluctuations, and liquidity. Additionally, we may gather data on trading pairs involving USDT, as well as the trading activity of specific addresses.

Data analysis

Once the data has been collected, we can proceed with the analysis. This typically involves applying statistical techniques and data visualization methods to identify patterns and trends. We may assess the relationship between USDT trading volume and price movements, as well as analyze the impact of specific events or market conditions on trading activity.

- Quantitative analysis: By crunching the numbers, we can calculate various metrics, such as average daily trading volume, price volatility, and liquidity ratios, to get a better understanding of the market dynamics.

- Technical analysis: Utilizing technical indicators and chart patterns, we can identify potential entry and exit points for traders. This can help us gauge the effectiveness of different trading strategies and assess the overall performance of USDT trading on 1inch.

- Market sentiment analysis: By analyzing social media sentiment and market news, we can gain insights into the overall sentiment towards USDT trading on 1inch. This information can be used to assess the market sentiment and its potential impact on trading activity.

Visualization and interpretation

After analyzing the data, it is important to visualize the findings in a clear and concise manner. This can be achieved through the use of charts, graphs, and other visual representations. By presenting the data in an easily digestible format, we can effectively communicate the insights gained from the analysis.

Finally, the interpretation of the results should be done in the context of the broader cryptocurrency market and the specific characteristics of USDT trading on 1inch. This helps to provide a comprehensive understanding of the performance and trends observed, allowing traders and investors to make more informed decisions.

Question-answer:

What is USDT?

USDT, or Tether, is a stablecoin that is pegged to the US dollar. It is a widely used cryptocurrency that aims to maintain a 1:1 ratio with the US dollar, providing stability and liquidity for traders and investors.

How does 1inch analyze the historical performance of USDT trading?

1inch analyzes the historical performance of USDT trading by monitoring the price, volume, and liquidity of USDT on various exchanges. They gather data from multiple sources and use advanced algorithms to analyze and visualize the data, allowing users to make informed trading decisions.

What are some key findings from the analysis of USDT trading on 1inch?

The analysis of USDT trading on 1inch revealed several key findings. Firstly, there was a significant increase in trading volume, indicating a growing interest in USDT. Secondly, the liquidity of USDT remained stable throughout the analyzed period, indicating a strong market for the stablecoin. Finally, the price of USDT showed minimal fluctuations, demonstrating its stability as a stablecoin.