A Comprehensive Guide to Participating in Liquidity Mining on the 1inchswap Platform

Welcome to the 1inchswap’s Liquidity Mining platform, where you can maximize your returns by providing liquidity to various DeFi pools. Liquidity Mining is a great way to grow your digital assets and earn passive income. By participating in Liquidity Mining, you become an essential part of the decentralized finance ecosystem, helping to foster liquidity and the smooth operation of the platform.

What is Liquidity Mining?

Liquidity Mining is the process of depositing your digital assets into liquidity pools and earning rewards for your contribution. By providing liquidity, you enable users to easily trade between different tokens on 1inchswap’s decentralized exchange, ensuring low slippage and enhancing overall trading experience. In return for your contribution, you receive rewards in the form of additional tokens.

How to Participate in Liquidity Mining:

1. Connect your wallet to 1inchswap’s platform.

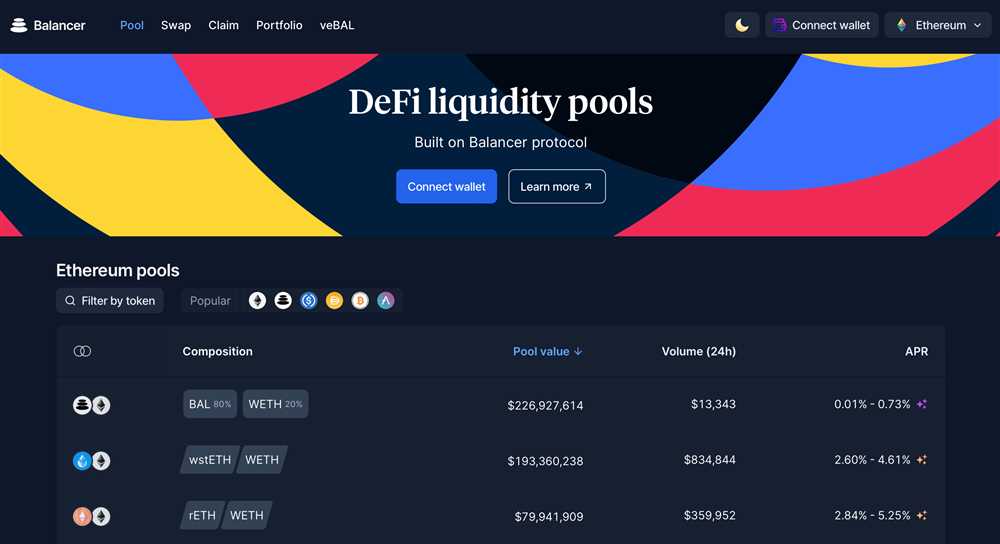

2. Choose the liquidity pool you want to contribute to.

3. Deposit your desired amount of tokens into the pool.

4. Confirm the transaction.

Earn Rewards:

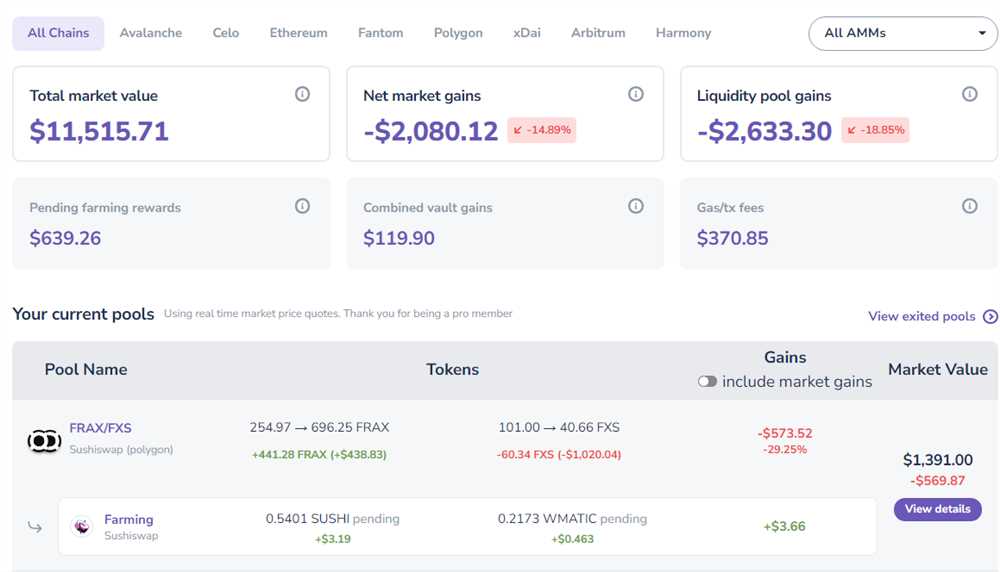

Once you have successfully deposited your tokens into the liquidity pool, you will start earning rewards immediately. The rewards are distributed proportionally based on your share of the total pool liquidity. You can track your earnings and withdraw your rewards at any time.

Note: Remember that Liquidity Mining involves risks, such as impermanent loss and smart contract vulnerabilities. Make sure to do thorough research and understand the risks before participating.

Start your Liquidity Mining journey on 1inchswap’s platform today and harness the power of decentralized finance!

The Basics of Liquidity Mining

Liquidity mining is a process by which users can earn rewards for providing liquidity to a decentralized exchange. In simple terms, liquidity refers to the availability of assets that can be bought or sold on a platform.

How Does Liquidity Mining Work?

Liquidity mining works by incentivizing users to deposit their assets into a liquidity pool. A liquidity pool is a smart contract that holds the funds provided by users. These funds are then used to facilitate trades on the platform.

When a user deposits their assets into a liquidity pool, they receive liquidity tokens in return. These tokens represent their share of the pool. The user can then use these tokens to redeem their share of the assets in the pool at any time.

Now, here’s where liquidity mining comes into play. In addition to receiving liquidity tokens, users also receive governance tokens as rewards for providing liquidity. These governance tokens give users the ability to participate in the decision-making process for the decentralized exchange’s future development.

Why Should You Participate in Liquidity Mining?

Participating in liquidity mining can be highly lucrative. The rewards earned from providing liquidity can be substantial, especially if the token being deposited has a high trading volume.

Furthermore, liquidity mining helps to bootstrap liquidity for newly launched tokens, making it easier for users to buy and sell those tokens. By participating in liquidity mining, users are not only earning rewards but also contributing to the growth and development of the decentralized exchange ecosystem.

It’s important to note that liquidity mining also carries risks. The value of the tokens being provided as liquidity can fluctuate, and there is always a possibility of impermanent loss. However, with proper research and risk management, liquidity mining can be a rewarding endeavor.

What is Liquidity Mining?

Liquidity mining is an innovative concept in the decentralized finance (DeFi) space that allows users to earn rewards by providing liquidity to a liquidity pool.

In traditional financial markets, liquidity refers to the ease and speed with which an asset can be bought or sold without causing significant changes in its price. In the context of decentralized exchanges (DEXs), liquidity is essential for ensuring smooth and efficient trading. However, attracting liquidity to newly launched DEXs can be a challenge.

Liquidity mining addresses this challenge by incentivizing liquidity providers (LPs) to deposit their funds into liquidity pools. LPs can earn rewards in the form of native tokens or other assets by contributing to the liquidity of a specific trading pair. These rewards are typically distributed on a pro-rata basis, meaning that LPs receive a share of the rewards proportional to their contribution to the liquidity pool.

How does Liquidity Mining work on 1inchswap’s Platform?

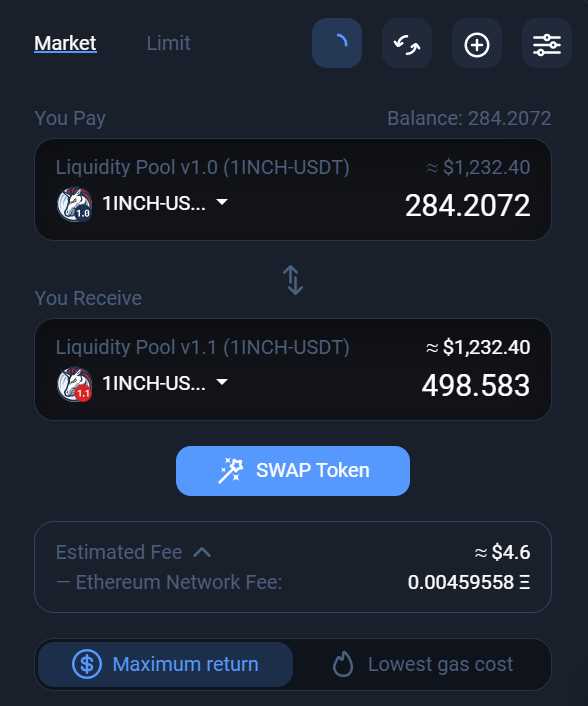

On 1inchswap’s platform, liquidity mining is a straightforward process. LPs can deposit their funds into a liquidity pool by supplying both tokens in the desired trading pair. For example, if you want to provide liquidity for the ETH/DAI trading pair, you need to deposit an equal value of ETH and DAI into the pool.

Once you have deposited your funds, you will receive liquidity pool tokens in return. These pool tokens represent your share of the overall liquidity pool and can be used to withdraw your funds at any time. Additionally, the pool tokens can be staked to earn additional rewards through liquidity mining.

1inchswap’s platform uses a unique algorithm called Mooniswap that maximizes the efficiency of liquidity provision. This algorithm reduces slippage and allows LPs to earn higher trading fees compared to other DEXs, making it an attractive option for liquidity mining.

By participating in liquidity mining on 1inchswap’s platform, you not only earn rewards but also contribute to the overall liquidity and trading experience for other users. It’s a win-win situation that benefits both LPs and traders.

Are you ready to start liquidity mining on 1inchswap’s platform? Join now and unlock the potential of decentralized trading!

Getting Started with 1inchswap

Welcome to 1inchswap, the decentralized exchange platform that allows you to trade tokens with low fees and high liquidity. Whether you are a beginner or an experienced trader, this guide will help you get started with 1inchswap and make the most out of your trading experience.

Create an Account

The first step to get started with 1inchswap is to create an account. Simply click on the “Sign Up” button on the 1inchswap website and follow the instructions to set up your account. Make sure to choose a strong password and enable two-factor authentication for added security.

Connect Your Wallet

Once you have created an account, the next step is to connect your wallet to the 1inchswap platform. 1inchswap supports a variety of wallets, including MetaMask, WalletConnect, and Coinbase Wallet. Choose the wallet of your preference and follow the instructions to connect it to 1inchswap.

After connecting your wallet, you will be able to access your token balances and carry out transactions on the 1inchswap platform.

Start Trading

With your account and wallet set up, you are now ready to start trading on 1inchswap. Simply search for the token you want to trade and select it from the list. You can choose to trade against popular tokens or explore other options based on your preferences.

Before making a trade, make sure to review the token’s price, liquidity, and trading volume. You can also set limits and customize your trading preferences to optimize your trading strategy.

Once you are satisfied with your trade details, click on the “Swap” button to initiate the transaction. Confirm the transaction details in your wallet and wait for the transaction to be processed. Depending on the network congestion, the transaction may take a few seconds to a few minutes to complete.

After the transaction is complete, you will see the updated token balances in your wallet. You can also view your transaction history and monitor your portfolio performance on the 1inchswap platform.

Congratulations! You have successfully started trading on 1inchswap. Remember to stay updated with the latest market trends and always do your own research before making any trading decisions.

Why Choose 1inchswap?

1inchswap is the ultimate decentralized exchange (DEX) platform for liquidity mining. Here are a few reasons why you should choose 1inchswap for all your liquidity mining needs:

1. Advanced Technology: 1inchswap leverages cutting-edge technology to provide the best trading experience. Our smart contract algorithms ensure fast and secure transactions, while our intuitive interface makes it easy for users to navigate the platform.

2. High Liquidity: With 1inchswap, you can access a wide range of liquidity pools, ensuring that you can always find the best rates for your trades. Our platform aggregates liquidity from multiple sources, including major DEXs, to provide you with the highest liquidity possible.

3. Competitive Rewards: As a liquidity provider on 1inchswap, you can earn lucrative rewards in the form of 1INCH tokens. These rewards are distributed based on your contribution to the liquidity pools, and they provide a great way to earn passive income while supporting the decentralized finance ecosystem.

4. Community-driven: At 1inchswap, we believe in the power of community. Our platform allows users to actively participate in the governance and decision-making processes through voting and staking. By choosing 1inchswap, you become part of a vibrant community that drives the future of decentralized finance.

5. Transparent and Secure: Transparency and security are our top priorities at 1inchswap. Our smart contracts are audited by leading security firms, and our platform undergoes regular security tests and upgrades. You can trade with confidence, knowing that your assets are protected.

So why wait? Start liquidity mining on 1inchswap today and take advantage of our advanced technology, high liquidity, competitive rewards, community-driven governance, and transparent security measures. Join the revolution in decentralized finance with 1inchswap!

Maximizing Your Rewards on 1inchswap

Once you have started participating in liquidity mining on 1inchswap’s platform, there are several strategies you can employ to maximize your rewards.

1. Diversify Your Liquidity

One way to increase your rewards is by diversifying the liquidity you provide across multiple pools. By spreading out your funds, you reduce the risk of being exposed to a single asset or market. This allows you to capture more opportunities and earn higher rewards.

2. Monitor Market Trends

Staying informed about the latest market trends and movements is crucial for maximizing your rewards on 1inchswap. By keeping an eye on the market, you can identify potential opportunities to adjust your liquidity strategy and maximize your earnings.

Pro Tip: Use 1inchswap’s advanced analytics tools to track market trends and make informed decisions.

3. Take Advantage of Rewards Multipliers

1inchswap often offers incentives and rewards multipliers for liquidity providers on certain pools. Keep an eye out for these opportunities and adjust your liquidity accordingly to maximize your rewards during these periods.

By following these strategies, you can ensure that you are getting the most out of your liquidity mining efforts on 1inchswap’s platform. Remember to stay informed, diversify your liquidity, and take advantage of any rewards multipliers to maximize your earnings.

Question-answer:

What is liquidity mining?

Liquidity mining is a process where users contribute funds to a liquidity pool on a decentralized exchange platform, such as 1inchswap, and in return, they earn rewards in the form of additional tokens.

How does liquidity mining work on 1inchswap’s platform?

Liquidity mining on 1inchswap’s platform works by users providing liquidity to specific token pairs on the platform. The users contribute their tokens to a liquidity pool and receive LP (liquidity provider) tokens, which represent their share in the pool. These LP tokens can then be staked or used on the platform to earn additional tokens as rewards.