Decentralized Finance (DeFi) has taken the world by storm, offering users unprecedented financial opportunities and freedom. Within the DeFi ecosystem, decentralized exchanges (DEXs) play a pivotal role, allowing users to trade cryptocurrencies in a truly peer-to-peer manner. Two prominent players in this space, 1inch and SushiSwap, have emerged as major contenders in the battle for dominance in DeFi.

1inch is a decentralized exchange aggregator that leverages smart contracts to provide users with the best possible trading rates across various DEXs. By splitting trades across multiple platforms, 1inch ensures that users always get the most favorable rates, effectively minimizing slippage and maximizing their returns. With its user-friendly interface and advanced algorithm, 1inch has quickly gained popularity among DeFi enthusiasts.

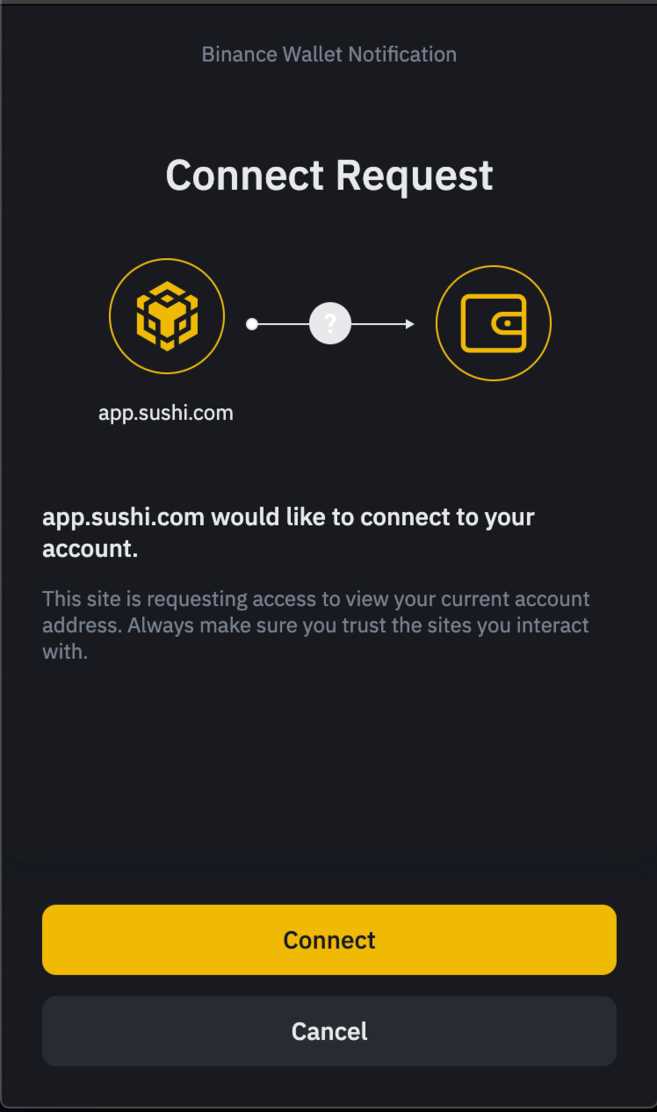

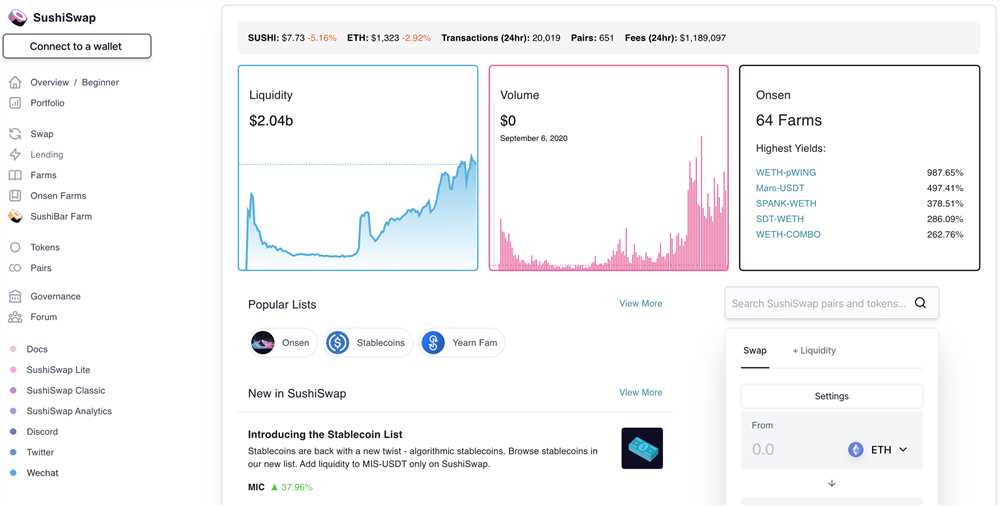

SushiSwap, on the other hand, is an automated market maker (AMM) built on the Ethereum blockchain. It allows users to trade ERC-20 tokens directly from their wallets, without the need for an intermediary. SushiSwap also incorporates yield farming, allowing users to earn governance tokens (SUSHI) by providing liquidity to the platform. SushiSwap’s innovative features and strong community support have made it a force to be reckoned with in the DeFi landscape.

The battle between 1inch and SushiSwap for dominance in DeFi is not just about providing the best trading experience, but also about capturing a larger share of the DeFi market. Both platforms are constantly innovating and introducing new features to attract users and improve their overall offerings. While 1inch focuses on optimizing trading rates and minimizing slippage, SushiSwap places a strong emphasis on yield farming and community governance.

As the DeFi space continues to evolve, the competition between 1inch and SushiSwap will only intensify. Users can expect to see new features, partnerships, and collaborations from both platforms as they strive to stay ahead of the curve. Ultimately, the battle for dominance in DeFi is not just about the success of 1inch or SushiSwap, but about the growth and maturation of the entire DeFi ecosystem.

1inch vs SushiSwap: Who Will Reign Supreme in DeFi?

The battle for dominance in the decentralized finance (DeFi) space is heating up between 1inch and Sushiswap. Both platforms have gained considerable traction and have emerged as major players in the DeFi ecosystem.

1inch is an aggregator that sources liquidity from various decentralized exchanges (DEXs) to provide users with the best possible trading rates. On the other hand, SushiSwap is a decentralized exchange that aims to enhance the functionality of Uniswap by offering additional features and incentives to its users.

While both platforms have their unique advantages and features, the question of who will reign supreme in DeFi remains unanswered. 1inch has gained a reputation for its efficient and innovative approach to trading, while SushiSwap has garnered attention for its integration of yield farming and other innovative DeFi features.

At the moment, 1inch has a larger market share and a strong user base. Its intuitive interface and advanced trading capabilities have attracted many DeFi enthusiasts. However, SushiSwap has been gaining ground rapidly and has consistently introduced new features and partnerships to expand its ecosystem.

Ultimately, the answer to who will reign supreme in DeFi might depend on several factors. These factors could include the ability of each platform to innovate and adapt to the changing needs of the DeFi community, the strength of their partnerships, and the overall user experience they provide.

As the battle between 1inch and SushiSwap continues to unfold, it is clear that both platforms have their loyal supporters and are committed to revolutionizing the DeFi landscape. Only time will tell which platform will emerge as the ultimate champion and reign supreme in DeFi.

Comparing 1inch and SushiSwap

1inch and SushiSwap are two prominent decentralized exchanges (DEXes) operating in the decentralized finance (DeFi) space. While both platforms offer similar services, they have some key differences that set them apart from each other. In this article, we will compare 1inch and SushiSwap in terms of their features, tokenomics, and community support.

Features

1inch is known for its innovative and efficient approach to liquidity aggregation. It sources liquidity from various DEXes and liquidity pools to provide users with the best possible trading rates. It also offers limit orders and other advanced trading features to cater to the needs of experienced traders.

SushiSwap, on the other hand, started as a fork of Uniswap but has since developed its own set of unique features. One of its standout features is the SushiBar, which allows users to earn additional rewards by staking their SUSHI tokens. It also offers yield farming and other DeFi services, making it a comprehensive platform for DeFi enthusiasts.

Tokenomics

1inch has its native utility token, 1INCH, which is used for governance and to access premium features on the platform. The total supply of 1INCH is limited to 1.5 billion tokens. The token is distributed among users through airdrops, liquidity mining, and other community initiatives.

SushiSwap has its native token, SUSHI, which serves as the platform’s governance token and also rewards users for their participation in the network. The total supply of SUSHI is capped at 250 million tokens, with a portion of it allocated to the community treasury.

Community Support

Both 1inch and SushiSwap have vibrant and active communities supporting their platforms. They have strong social media presence, active developer communities, and engage with their users through various channels. Both platforms are also supported by reputable venture capital firms and have secured partnerships with other DeFi projects.

| 1inch | SushiSwap | |

|---|---|---|

| Features | Liquidity aggregation, advanced trading features | SushiBar, yield farming, DeFi services |

| Tokenomics | 1INCH, limited to 1.5 billion tokens | SUSHI, capped at 250 million tokens |

| Community Support | Active community, strong social media presence | Vibrant community, partnerships with other DeFi projects |

While 1inch and SushiSwap have their own unique features and tokenomics, they are both contributing to the growth and development of the DeFi ecosystem. Users can choose between the two platforms based on their specific needs and preferences.

The Battle for Dominance in DeFi

1inch and SushiSwap have emerged as the two major players in the decentralized finance (DeFi) space, each vying for dominance in this rapidly growing sector.

1inch, a decentralized exchange aggregator, allows users to find the best prices for their trades across multiple liquidity sources. With its intuitive user interface and efficient trading mechanisms, 1inch has garnered a strong following in the DeFi community.

SushiSwap, on the other hand, is an automated market maker (AMM) that aims to provide users with the best possible liquidity and trading experience. It has gained popularity by offering innovative features such as yield farming and staking incentives.

Both platforms offer unique value propositions and have attracted a significant user base. However, as the competition heats up, the battle for dominance is intensifying.

One of the key factors that will determine the winner in this battle is the ability to provide the best user experience. 1inch has built a reputation for its intuitive and user-friendly interface, making it easy for both experienced traders and newcomers to navigate the platform.

SushiSwap, on the other hand, has focused on building a robust ecosystem with a wide range of features. Its integration of yield farming and staking options has attracted a loyal community that actively participates in the platform’s governance.

Another important factor in this battle is the adoption of new technologies and partnerships. Both platforms have been quick to integrate with other DeFi protocols and form strategic partnerships to expand their offerings.

Additionally, the ability to provide competitive fees and efficient trading mechanisms will play a crucial role in determining the dominant player in DeFi. Users are increasingly seeking cost-effective and seamless trading experiences, and the platform that can cater to these demands will have a significant advantage.

Ultimately, the battle for dominance in DeFi will be won by the platform that can consistently provide the best user experience, innovative features, and cost-effective trading mechanisms. As the competition between 1inch and SushiSwap intensifies, the DeFi community awaits to see who will emerge as the ultimate victor.

Question-answer:

What is 1inch?

1inch is a decentralized exchange aggregator that sources liquidity from various exchanges to provide users with the best possible trading rates.

What is SushiSwap?

SushiSwap is a decentralized exchange built on the Ethereum blockchain that allows users to trade ERC-20 tokens and earn rewards through liquidity provision.

How do 1inch and SushiSwap differ?

While both 1inch and SushiSwap are decentralized exchanges, 1inch focuses on aggregating liquidity from various exchanges, while SushiSwap offers users the ability to provide liquidity and earn rewards through yield farming.

Which exchange offers better trading rates, 1inch or SushiSwap?

1inch is designed to offer users the best possible trading rates by sourcing liquidity from multiple exchanges, whereas SushiSwap’s rates are determined by the liquidity available on its own platform.

Can you earn rewards by providing liquidity on 1inch?

No, 1inch does not currently offer a liquidity provision program for users to earn rewards. This is a key difference compared to SushiSwap, which incentivizes liquidity provision through its SUSHI token rewards.