Automated Market Making (AMM) has been one of the most promising innovations in the decentralized finance (DeFi) space. It has revolutionized the way users can trade cryptocurrencies and provided liquidity to various decentralized exchanges. One of the leading platforms in the AMM space is 1inch Swap.

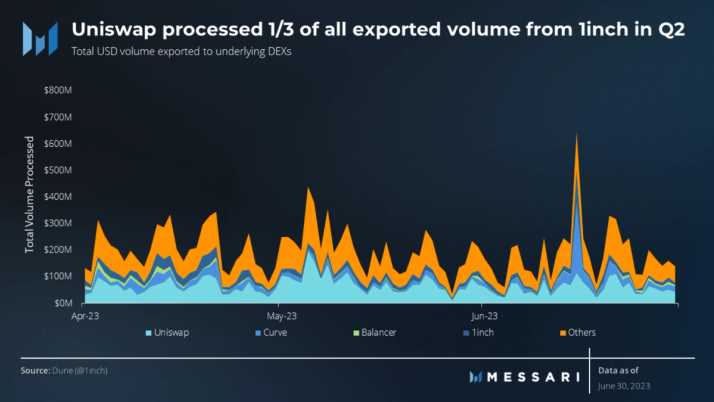

1inch Swap is an efficient and user-friendly decentralized exchange aggregator that sources liquidity from various decentralized exchanges. It uses complex algorithms and smart contract technology to find the best available prices for trades, reducing slippage and maximizing user profits.

What sets 1inch Swap apart from other AMM platforms is its unique approach to routing trades. Instead of relying on a single liquidity source, 1inch Swap splits trades across multiple decentralized exchanges to achieve the best possible outcome. This ensures that users get the most favorable rates and lowest fees.

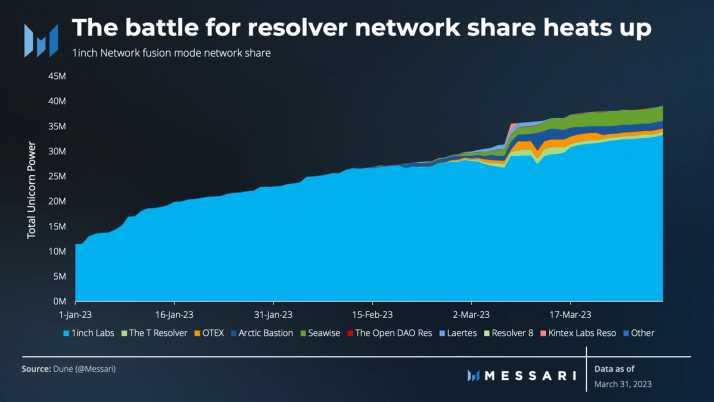

Furthermore, 1inch Swap is powered by the 1inch Liquidity Protocol, which is a decentralized protocol that pools liquidity from various automated market makers. This enables it to tap into a vast pool of liquidity, providing users with deep liquidity for their trades.

With its innovative approach to automated market making and commitment to providing the best trading experience for users, 1inch Swap is poised to become the future of decentralized finance. Its efficient and user-friendly platform, combined with its ability to source liquidity from multiple decentralized exchanges, sets it apart from the competition and makes it a go-to platform for traders and liquidity providers alike.

The Origin of 1inch Swap

1inch Swap is a decentralized exchange aggregator that enables users to access liquidity across multiple decentralized exchanges. Launched in 2020, 1inch Swap has quickly gained popularity and is considered one of the leaders in the automated market making (AMM) space.

The idea behind 1inch Swap was conceived by Sergej Kunz and Anton Bukov, two Russian software developers with a passion for blockchain technology. They recognized that existing decentralized exchanges suffered from fragmented liquidity, high slippage, and high gas fees due to multiple trading platforms.

To solve these issues, Kunz and Bukov created 1inch Swap to aggregate liquidity from different decentralized exchanges and provide users with the best possible trading prices. By splitting and combining orders across different DEXs, 1inch Swap minimizes slippage and maximizes the returns for users.

1inch Swap achieved significant success by attracting a wide user base and executing millions of dollars’ worth of trades. This success was primarily driven by the platform’s advanced algorithms and smart contract automation, which ensure efficient and secure trades.

1inch Swap has also introduced the concept of “gas token”, which allows users to save on gas fees by using tokens that represent the future cost of gas. This innovative feature has gained popularity among traders and has further enhanced the platform’s value proposition.

Looking forward, 1inch Swap aims to continue pushing the boundaries of AMM technology by integrating with other DeFi protocols and expanding its liquidity sources. This ongoing development will further solidify 1inch Swap’s position as a leading player in the decentralized finance ecosystem.

In conclusion, the origin of 1inch Swap can be traced back to the vision of Sergej Kunz and Anton Bukov to create a decentralized exchange aggregator that solves the liquidity and slippage issues faced by existing DEXs. Through their innovative approach and relentless focus on user experience, 1inch Swap has emerged as a trusted and widely used platform in the world of AMM trading.

How Does 1inch Swap Work?

The 1inch Swap is an automated market maker (AMM) that uses smart contracts on the Ethereum blockchain to provide decentralized trading services. It allows users to swap one cryptocurrency for another directly from their wallets, without the need for intermediaries.

When a user initiates a swap on 1inch, the platform searches multiple decentralized exchanges (DEXs) to find the most optimal trading route. It takes into account factors such as the available liquidity, token price, and transaction fees on each DEX to ensure that users get the best possible swap rate.

1inch also aggregates liquidity from various sources, such as liquidity protocols and liquidity pools, to provide users with access to a wide range of tokens and trading pairs. This helps to reduce slippage and improve the overall trading experience.

The platform’s algorithm splits large orders into smaller ones and executes them across multiple DEXs simultaneously to minimize price impact and ensure the best possible execution price. By using this strategy, 1inch maximizes liquidity and minimizes the likelihood of encountering insufficient liquidity on a single DEX.

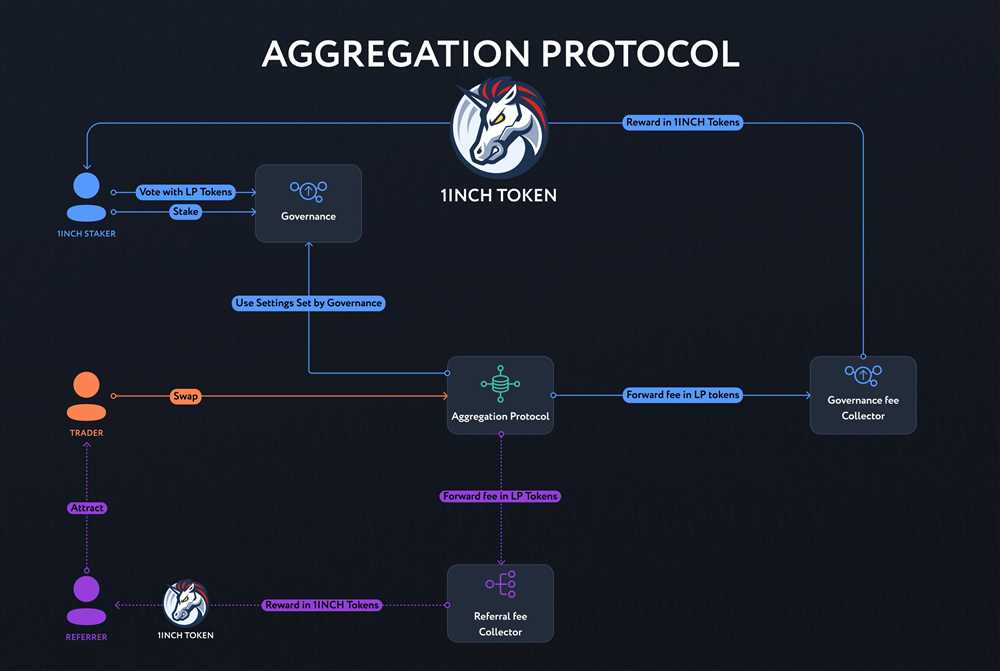

1inch integrates with popular DeFi platforms such as Uniswap, Kyber Network, and Balancer, among others, to provide users with a seamless trading experience. It also enables users to provide liquidity to the platform and earn rewards in the form of token fees and governance tokens.

In summary, 1inch Swap works by leveraging the power of decentralized technology to offer users optimized trades across multiple DEXs. It aggregates liquidity, splits orders, and executes them on the best available routes to provide users with the most efficient and cost-effective trading experience.

The Advantages of 1inch Swap

1inch Swap offers several attractive advantages for users interested in automated market making.

Firstly, 1inch Swap provides users with the ability to access liquidity from a wide range of sources through its aggregation protocol. This means that users can find the best available prices across various decentralized exchanges, saving them both time and money.

Moreover, 1inch Swap offers competitive rates and low fees, making it an affordable option for users looking to swap their assets. The platform also allows users to hold their own private keys, enhancing the security and control of their funds.

Additionally, 1inch Swap is designed to be user-friendly and intuitive, making it easy even for beginners to navigate and use. The platform provides detailed information on swap fees, expected slippage, and routing paths, allowing users to make informed decisions.

Another advantage of 1inch Swap is its commitment to transparency. The platform provides users with access to its smart contract code, enabling them to verify the security and integrity of the system.

Overall, 1inch Swap offers convenience, competitive pricing, security, and transparency, making it an appealing option for automated market making.

The Future of Automated Market Making

Automated market making has revolutionized the way cryptocurrency traders interact with decentralized exchanges. Platforms like 1inch Swap are at the forefront of this evolution, paving the way for a more efficient and seamless trading experience.

With traditional market makers, traders would rely on human intervention to facilitate trades and ensure liquidity. This approach had its limitations, including higher costs and delayed execution times. Automated market making, on the other hand, leverages smart contracts and algorithms to execute trades instantly and efficiently.

1inch Swap, in particular, has gained popularity for its innovative approach to automated market making. By leveraging multiple liquidity sources, the platform seeks to provide users with the best possible prices for their trades. This aggregation of liquidity pools helps minimize slippage and maximize returns for traders.

Improved Efficiency and Lower Costs

The future of automated market making holds immense potential for improved efficiency and lower costs. As technology continues to advance, we can expect further optimization of algorithms and smart contracts, resulting in even faster and more accurate trades.

This increased efficiency translates to lower costs for traders. By reducing the reliance on intermediaries and human intervention, automated market making platforms like 1inch Swap can minimize fees and provide traders with more cost-effective trading options.

Enhanced Liquidity and Market Accessibility

Automated market making platforms have the potential to significantly enhance liquidity in the cryptocurrency market. By aggregating liquidity from various sources, these platforms increase the availability of trading pairs and reduce the risk of illiquid markets.

In addition, automated market making can improve market accessibility, allowing traders to seamlessly trade across multiple decentralized exchanges without the need for multiple wallets or complex processes. This openness and interoperability can unlock new opportunities for traders and further drive the adoption of decentralized finance.

The future of automated market making is promising, with the potential to revolutionize the way we trade cryptocurrencies. Platforms like 1inch Swap are leading the charge, offering users improved efficiency, lower costs, enhanced liquidity, and greater market accessibility. As technology progresses, we can expect automated market making to become even more sophisticated, benefiting traders and the decentralized finance ecosystem as a whole.

Question-answer:

What is 1inch Swap?

1inch Swap is a decentralized exchange aggregator that sources liquidity from various exchanges to provide users with the best possible trading rates. It eliminates the need for users to manually compare prices on different exchanges and executes trades on their behalf.

How does 1inch Swap ensure the best trading rates?

1inch Swap uses an algorithm called Pathfinder to find the most efficient trading path across multiple liquidity sources. It splits the user’s trade across different exchanges and routes it through different pools to minimize slippage and maximize returns. This allows users to get the best possible trading rates.

Can users provide liquidity to 1inch Swap?

Yes, users can provide liquidity to 1inch Swap by depositing their tokens into liquidity pools. In return, they receive pool tokens that represent their share of the pool’s liquidity. By providing liquidity, users can earn trading fees and receive rewards in the form of additional tokens.