How 1inch aggregator facilitates access to decentralized lending and borrowing platforms?

Decentralized lending and borrowing platforms have gained significant popularity in the world of cryptocurrency. These platforms provide users with the ability to lend or borrow digital assets without the need for traditional financial intermediaries. However, accessing different lending and borrowing platforms can be a complex and time-consuming process.

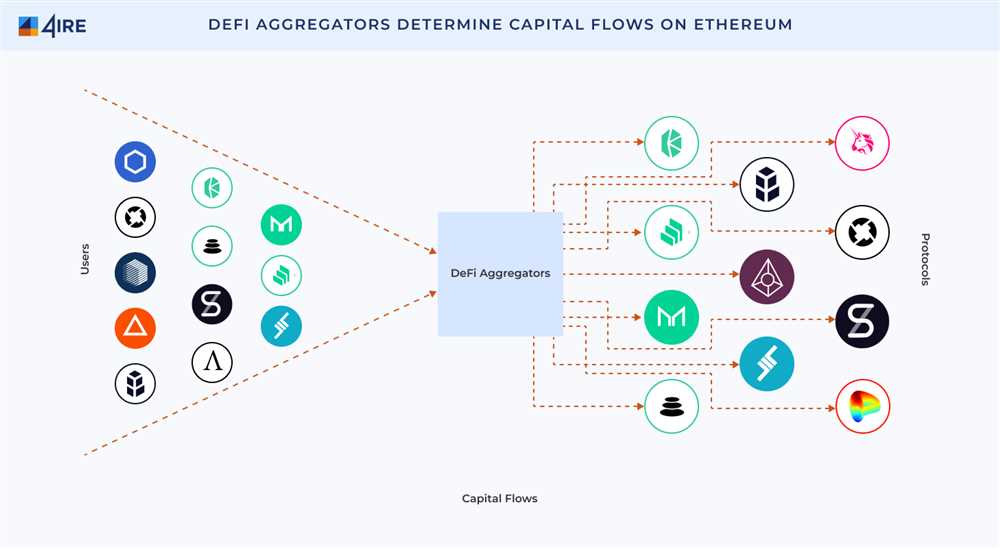

This is where the 1inch aggregator comes into play. 1inch is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges to provide users with the best possible trading rates. In addition to trading, 1inch also allows users to access decentralized lending and borrowing platforms seamlessly.

By leveraging smart contract technology, the 1inch aggregator enables users to interact with multiple lending and borrowing platforms in a unified and simplified manner. Users can easily compare the interest rates, terms, and collateral requirements of different platforms, allowing them to make informed decisions.

The 1inch aggregator also ensures that users obtain the best possible rates when lending or borrowing digital assets. It achieves this by splitting the user’s order across multiple lending and borrowing platforms to maximize returns or minimize costs. This feature is especially useful for users who want to optimize their lending or borrowing strategies.

In conclusion, the 1inch aggregator plays a crucial role in making decentralized lending and borrowing platforms more accessible and efficient for users. It simplifies the process of interacting with multiple platforms, allowing users to compare rates and terms easily. Additionally, it optimizes users’ lending and borrowing strategies by splitting orders across different platforms. With the 1inch aggregator, users can take full advantage of decentralized finance while saving time and effort.

The Importance of 1inch Aggregator in Decentralized Lending and Borrowing Platforms

Decentralized lending and borrowing platforms have revolutionized the way individuals and institutions can access and participate in the global financial system. These platforms eliminate the need for intermediaries, reduce costs, and provide greater transparency, security, and privacy.

One crucial component of these decentralized platforms is the role that 1inch aggregator plays. The 1inch aggregator is an essential tool that allows users to access multiple decentralized lending and borrowing platforms simultaneously. This aggregator combines liquidity from various sources and provides users with the best rates and terms for their lending and borrowing activities.

The 1inch aggregator works by leveraging smart contracts and automated market making systems to search for the most favorable lending and borrowing opportunities across different platforms. It scans the blockchain for the best available rates, taking into account factors such as interest rates, collateral requirements, and platform reputation.

By using the 1inch aggregator, users can save time and effort by obtaining the most favorable rates and terms without the need to manually search and compare different platforms. This aggregator provides a seamless and efficient user experience by aggregating liquidity and executing transactions with minimal slippage.

In addition to the convenience it offers, the 1inch aggregator also plays a crucial role in increasing liquidity in decentralized lending and borrowing platforms. By aggregating liquidity from different platforms, it enables borrowers to access a larger pool of funds, increasing the availability of capital. Similarly, lenders can provide liquidity to multiple platforms using the aggregator, maximizing their earning potential.

Furthermore, the 1inch aggregator contributes to the overall stability and security of decentralized lending and borrowing platforms. By scanning multiple platforms and aggregating liquidity, it reduces the risk of individual platform failures or market manipulations. Users can trust the aggregator to provide reliable and accurate information, ensuring a safe and secure lending and borrowing experience.

In conclusion, the 1inch aggregator plays a vital role in decentralized lending and borrowing platforms. It provides users with a powerful tool to access multiple platforms and obtain the best rates and terms for their lending and borrowing activities. By aggregating liquidity, it increases the availability of capital, enhances platform stability, and contributes to overall market efficiency. As decentralized finance continues to grow, the importance of the 1inch aggregator will only become more significant in the future.

Facilitating Access to DeFi Lending and Borrowing

The emergence of decentralized finance (DeFi) has revolutionized the traditional lending and borrowing landscape. It has allowed users to access financial services without the need for intermediaries, making the process more efficient and transparent.

However, navigating the DeFi space can be overwhelming for users, especially those new to the ecosystem. The 1inch aggregator plays a crucial role in facilitating access to DeFi lending and borrowing platforms, simplifying the process and improving user experience.

1. Aggregating Liquidity

The 1inch aggregator acts as a bridge between different DeFi lending and borrowing platforms, consolidating liquidity from various sources. This means that users can access a wide range of lending and borrowing options through a single platform, without the need to visit multiple websites or applications.

The aggregator analyzes the available options and selects the best ones based on factors such as interest rates, collateral requirements, and platform reputation. This saves users time and effort, as they can make informed decisions and choose the most suitable lending or borrowing option for their needs.

2. Optimizing Trade Execution

In addition to aggregating liquidity, the 1inch aggregator also optimizes trade execution for users. It splits larger transactions into smaller ones across different liquidity sources to ensure the best prices and minimize slippage.

This feature is particularly beneficial for borrowers who need to secure the best borrowing rates and minimize costs. By optimizing trade execution, the aggregator ensures that borrowers can access the most favorable borrowing terms without excessive fees or price volatility.

- Ensuing Security and Transparency

- Expanding Access

- Integration with Wallets

In conclusion, the 1inch aggregator plays a crucial role in facilitating access to DeFi lending and borrowing platforms. By aggregating liquidity, optimizing trade execution, ensuring security and transparency, expanding access, and integrating with wallets, it simplifies the process for users and improves their overall experience in the DeFi ecosystem.

Maximizing Returns through Multiple Platforms

When it comes to accessing decentralized lending and borrowing platforms, 1inch aggregator plays a crucial role. Not only does it provide users with the ability to find the best available rates across various platforms, but it also offers the opportunity to maximize returns through multiple platforms.

By using 1inch aggregator, users can easily compare the interest rates and terms offered by different lending and borrowing platforms. This allows them to make informed decisions and choose the platform that offers the best returns for their specific needs and risk appetite.

Furthermore, 1inch aggregator supports the integration of multiple platforms, allowing users to diversify their investments and spread their risk. By using multiple platforms, users can take advantage of different lending and borrowing options, as well as different interest rates and terms offered by each platform.

By spreading their investments across multiple platforms, users can also minimize the impact of any potential risks or issues that may arise in a single platform. This adds an extra layer of protection to their investments and helps to ensure a more consistent and stable return on investment.

Overall, by utilizing 1inch aggregator and accessing decentralized lending and borrowing platforms, users can maximize their returns by finding the best rates and terms, as well as by diversifying their investments across multiple platforms. This not only helps to optimize their returns but also provides additional security and stability to their investment portfolio.

Ensuring Optimal Pricing and Execution

One of the key roles of the 1inch aggregator in accessing decentralized lending and borrowing platforms is to ensure optimal pricing and execution for users. When users want to lend or borrow assets on these platforms, it’s important to find the best possible rates and execute the transactions in the most efficient way.

The 1inch aggregator achieves this by leveraging smart contract technology and utilizing its integration with multiple decentralized exchanges. By analyzing the available liquidity across these exchanges, it can select the most favorable rates for lending and borrowing. This ensures that users get the best possible terms for their transactions.

In addition to optimizing pricing, the 1inch aggregator also focuses on efficient execution. It does this by splitting transactions into smaller orders and executing them across different exchanges to minimize slippage and maximize the overall outcome for users. By leveraging its integration with multiple exchanges, the aggregator can find the optimal combination of orders that results in the best execution for users.

Furthermore, the 1inch aggregator constantly monitors the market in real-time, adjusting its strategy to reflect changes in liquidity and pricing. This ensures that users always have access to the most up-to-date and competitive rates. The aggregator also takes into account gas fees and network congestion to optimize transaction costs and minimize delays.

Overall, the role of the 1inch aggregator in accessing decentralized lending and borrowing platforms is to ensure that users can access optimal pricing and execution. By leveraging its integration with multiple decentralized exchanges and constantly monitoring the market, the aggregator maximizes the benefits for users and facilitates efficient and cost-effective transactions.

Enhancing User Experience and Security

When it comes to accessing decentralized lending and borrowing platforms, user experience and security are of utmost importance. The 1inch aggregator plays a crucial role in enhancing both aspects for users.

User Experience

1inch offers a seamless and user-friendly interface for interacting with various lending and borrowing platforms. Through its platform, users can easily search and compare different lending and borrowing protocols, enabling them to find the best rates and terms that suit their needs.

Furthermore, 1inch provides a single point of access to multiple platforms, eliminating the need for users to navigate through different interfaces and maintain multiple accounts. This feature significantly enhances the overall user experience by streamlining the process and saving time for individuals who want to participate in decentralized lending and borrowing.

Security

1inch aggregator prioritizes security to ensure the safety of users’ funds and personal information. It achieves this through several measures:

Firstly, 1inch employs smart contract audits and rigorous due diligence processes to evaluate the protocols it integrates with. This helps to identify potential vulnerabilities and reduce the risk of users falling victim to malicious activities or hacks.

Additionally, 1inch employs advanced security protocols, such as multi-signature wallets and withdrawal limits. This adds an extra layer of protection to users’ funds, making it more difficult for unauthorized individuals to gain access to their funds.

Moreover, 1inch utilizes encrypted communication channels to safeguard users’ personal information. This ensures that sensitive data, such as wallet addresses and private keys, remain confidential and inaccessible to unauthorized parties.

By prioritizing user experience and security, the 1inch aggregator creates a trusted and efficient platform for accessing decentralized lending and borrowing protocols.

Question-answer:

What is a decentralized lending and borrowing platform?

A decentralized lending and borrowing platform is a type of financial platform that operates on the blockchain and allows users to lend or borrow digital assets without the need for intermediaries such as banks. The platform uses smart contracts to automate the lending and borrowing process and provides users with increased transparency, security, and control over their assets.

Why are decentralized lending and borrowing platforms becoming popular?

Decentralized lending and borrowing platforms are becoming popular due to several reasons. Firstly, they provide users with increased financial inclusion by allowing them to access loans and earn interest on their assets without the need for a traditional banking system. Secondly, these platforms offer higher interest rates compared to traditional banks, attracting users who are looking for better returns on their investments. Lastly, these platforms operate on the blockchain, ensuring transparency and security for users.

How does 1inch aggregator help in accessing decentralized lending and borrowing platforms?

The 1inch aggregator is a decentralized exchange aggregator that searches various decentralized lending and borrowing platforms to find the best rates and terms for users. It aggregates liquidity from multiple platforms and provides users with a single interface where they can compare and choose the best options for lending or borrowing their digital assets. In this way, the 1inch aggregator simplifies the process of accessing decentralized lending and borrowing platforms.

What are the benefits of using the 1inch aggregator for accessing decentralized lending and borrowing platforms?

Using the 1inch aggregator for accessing decentralized lending and borrowing platforms offers several benefits. Firstly, it saves users time and effort by providing a single interface where they can compare and choose the best options from multiple platforms. This eliminates the need to manually search and analyze different platforms. Secondly, the 1inch aggregator ensures users get the best rates and terms for lending or borrowing their digital assets by aggregating liquidity from various platforms. Lastly, the aggregator enhances the overall user experience by providing a seamless and convenient interface for accessing decentralized lending and borrowing platforms.