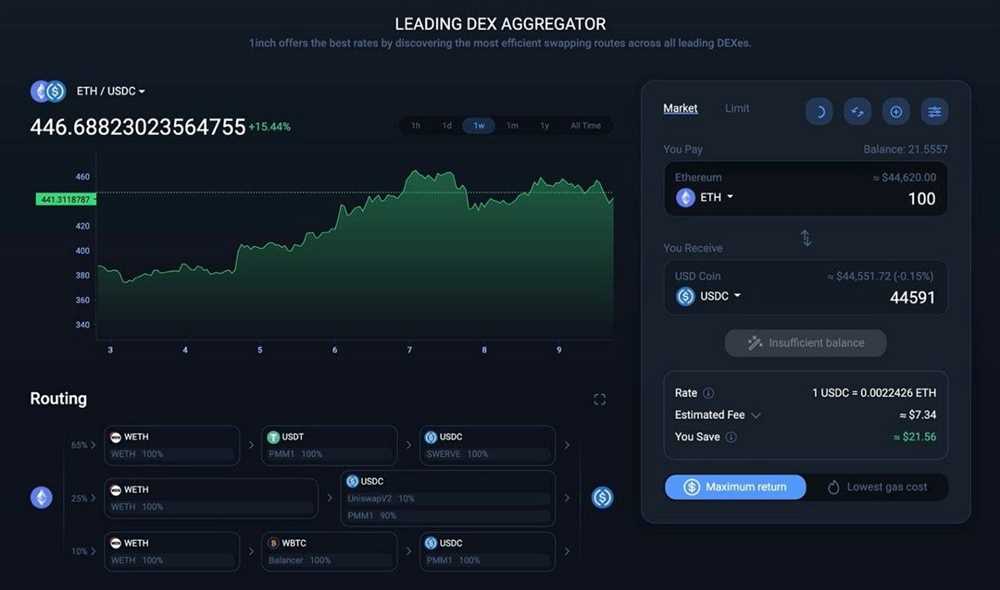

1inch is a popular decentralized exchange (DEX) aggregator that allows users to find the best prices for various cryptocurrencies across multiple DEXs. The platform aims to provide users with the most cost-effective and efficient way to trade digital assets by aggregating liquidity from various decentralized exchanges.

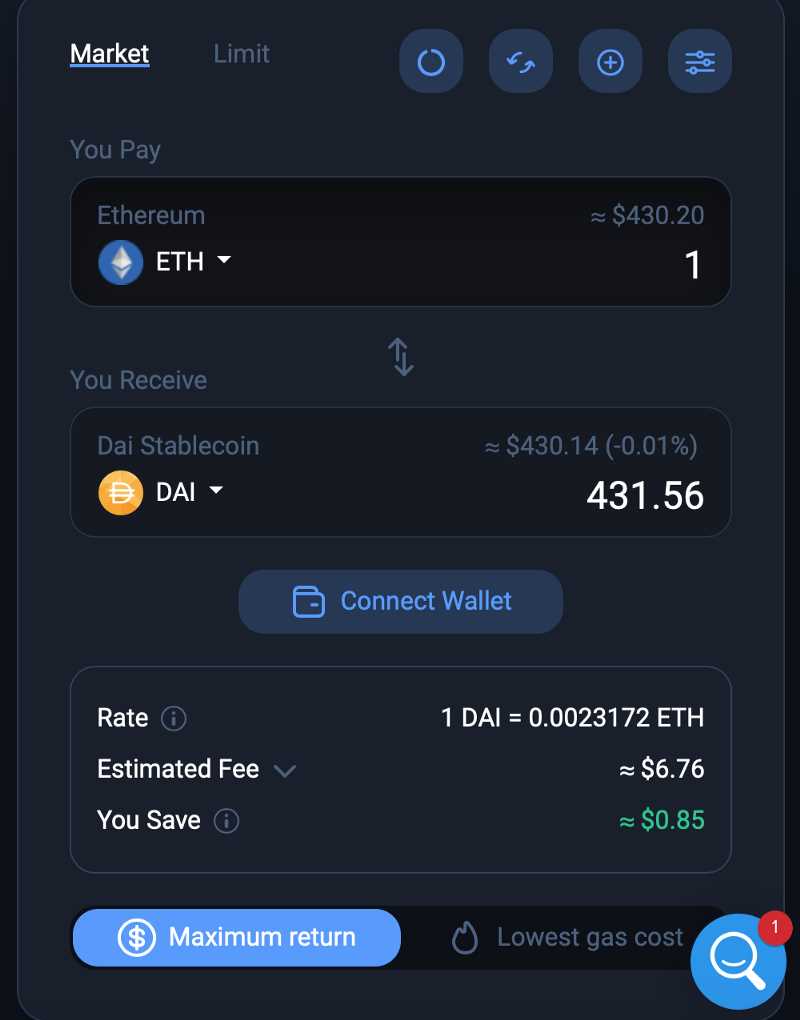

Before buying 1inch cryptocurrency, it is important to understand the basics of how the platform works. 1inch uses an algorithm called Pathfinder, which splits the user’s trade across different liquidity sources to get the best possible price. This means that users can potentially save on fees and get better prices compared to trading on a single exchange.

In addition to its aggregation service, 1inch also offers a variety of other features, such as liquidity mining and staking. By participating in these programs, users can earn rewards in the form of 1inch tokens, which can then be used for various purposes within the platform.

However, it is essential to note that investing in cryptocurrency always carries risks. The price of 1inch token can be volatile, and its value may fluctuate significantly over time. It is important to conduct thorough research and consider factors such as market trends and project developments before making any investment decisions.

In conclusion, 1inch cryptocurrency offers a unique approach to decentralized trading by aggregating liquidity from various DEXs. Before buying 1inch tokens, it is crucial to understand the platform’s mechanisms and consider the risks associated with cryptocurrency investments.

inch cryptocurrency: Things to consider before purchasing

Before purchasing 1inch cryptocurrency, there are several important factors that you should consider:

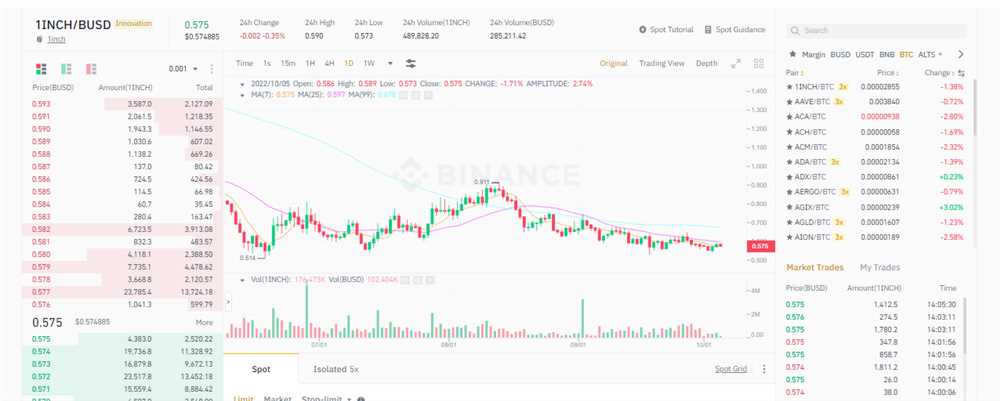

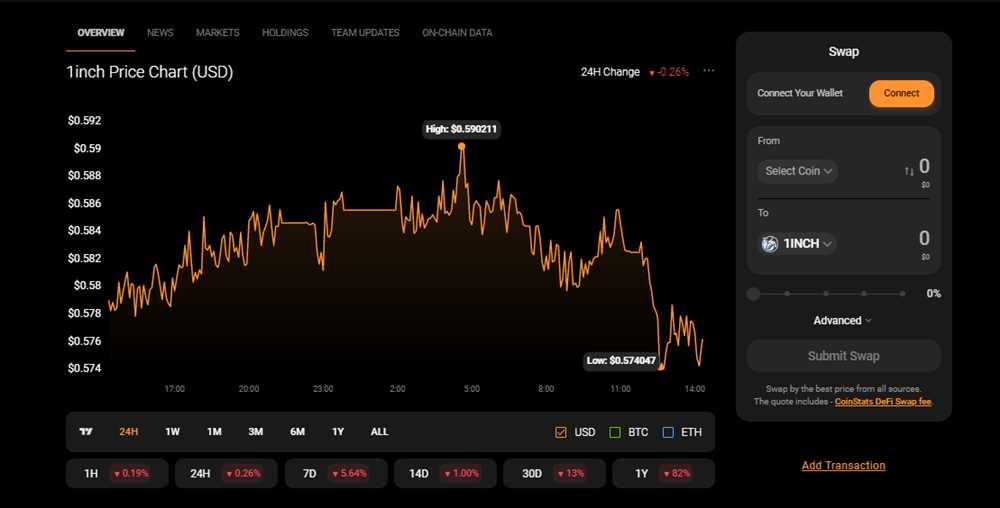

1. Market Analysis: Conduct thorough market research and analysis to understand the current trends and potential future growth of the 1inch cryptocurrency. Look into factors such as market capitalization, trading volume, and price history. This will help you make an informed decision about whether or not to invest in 1inch.

2. Team and Technology: Evaluate the team behind the 1inch project and the technology they have developed. Look for a strong and experienced team with a track record of successful projects. Additionally, assess the technological capabilities of the cryptocurrency, such as its scalability and security features.

3. Use Case and Adoption: Consider the use case and potential adoption of the 1inch cryptocurrency. Evaluate whether the project solves a real-world problem and if there is a demand for its services. Additionally, analyze the current and potential future partnerships and collaborations that could drive adoption.

4. Risk Assessment: Assess the risks associated with investing in 1inch cryptocurrency. Cryptocurrency investments are inherently volatile, and the 1inch market is no exception. Consider factors like regulatory uncertainty, competition, and market fluctuations. It’s crucial to only invest what you can afford to lose.

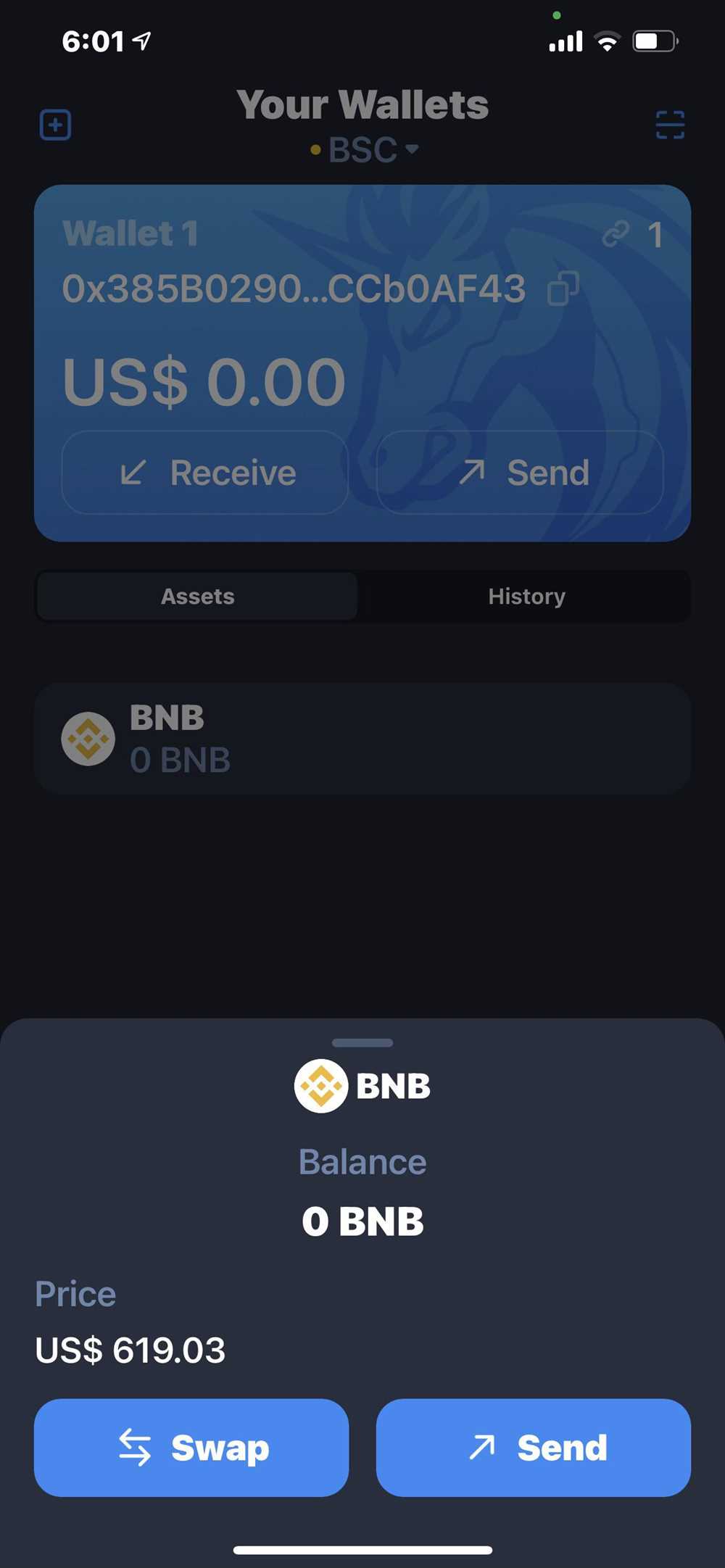

5. Wallet and Security: Choose a secure wallet to store your 1inch cryptocurrency. Look for wallets that offer features like two-factor authentication and cold storage options. It’s essential to protect your investment from theft or hacking.

6. Diversification: Consider diversifying your cryptocurrency portfolio by investing in a variety of projects and assets. This can help mitigate risk and maximize potential returns. Don’t put all your eggs in one basket, and carefully consider the allocation of your investment capital.

By considering these factors, you can make a more informed decision about whether or not to purchase 1inch cryptocurrency. Remember to always do your own research and consult with a financial advisor before making any investment decisions.

Benefits of 1inch cryptocurrency

1inch cryptocurrency has several benefits that make it an attractive investment option. Here are some of the key advantages:

| 1. Decentralization | 1inch is a decentralized cryptocurrency that operates on the Ethereum blockchain. This means that it is not controlled by any central authority or government, making it resistant to censorship and manipulation. |

| 2. Liquidity aggregation | 1inch platform uses an innovative algorithm that allows users to find the most efficient routes for trading their digital assets across multiple decentralized exchanges. This helps to maximize liquidity and reduce slippage. |

| 3. Low fees | Transactions on the 1inch platform are executed using the 1inch token, which helps to significantly reduce transaction fees compared to traditional centralized exchanges. |

| 4. Yield farming | 1inch token holders can participate in yield farming programs on the platform, allowing them to earn additional tokens as a reward for providing liquidity to the protocol. |

| 5. Governance rights | By holding 1inch tokens, users have the ability to participate in the governance of the 1inch platform, including voting on proposals and changes to the protocol. |

| 6. Security | 1inch platform prioritizes the security of its users’ funds by utilizing secure smart contracts and undergoing regular audits by reputable security firms. |

| 7. User-friendly interface | The 1inch platform is designed with a user-friendly interface, making it easy for both beginners and experienced traders to navigate and execute transactions. |

These benefits make 1inch cryptocurrency a promising option for those looking to invest in a decentralized and efficient trading platform.

Risks associated with investing in 1inch cryptocurrency

While investing in 1inch cryptocurrency can potentially bring high returns, it is important to be aware of the risks involved in this type of investment. Here are some of the main risks you should consider before buying 1inch cryptocurrency:

1. Volatility

Like most cryptocurrencies, 1inch is highly volatile, meaning its price can experience significant fluctuations in a short period of time. This volatility can make it difficult to predict the value of your investment and can result in substantial losses.

2. Market and Regulatory Risks

The cryptocurrency market is still relatively young and is not regulated in the same way as traditional financial markets. This lack of regulation can expose investors to various risks, including market manipulation, fraudulent activities, and security breaches. Additionally, the regulatory landscape for cryptocurrencies is constantly evolving, and new regulations or restrictions could impact the value and usage of 1inch.

3. Liquidity Risks

While 1inch is listed on several major cryptocurrency exchanges, its liquidity can still be affected by market conditions and trading volumes. As such, it may be difficult to buy or sell 1inch at a desired price, especially during times of high market volatility.

| Pros | Cons |

|---|---|

| Opportunity for high returns | High volatility |

| Decentralized finance (DeFi) potential | Market and regulatory risks |

| Rapidly growing ecosystem | Liquidity risks |

It is crucial to carefully consider these risks and conduct thorough research before making any investment decisions regarding 1inch cryptocurrency. Diversifying your investment portfolio and consulting with a financial advisor can also help minimize potential risks.

Factors to evaluate before buying 1inch cryptocurrency

Before investing in 1inch cryptocurrency, it is important to consider several key factors that can help you make an informed decision. These factors include:

- Market Trends: Analyze the current market trends and the performance of 1inch cryptocurrency. Look for signs of growth and stability to determine if it is a good investment option.

- Technology: Assess the technology behind 1inch and its potential for future development. Consider factors such as scalability, security, and the team’s ability to innovate.

- Competition: Evaluate the competition in the decentralized exchange (DEX) market. Consider how 1inch compares to other similar platforms and assess its competitive advantages.

- Token Utility: Understand the utility of the 1inch token within the 1inch ecosystem. Consider how the token is used and its potential for value appreciation.

- Team and Partnerships: Research the background and expertise of the 1inch team. Look for partnerships and collaborations that can potentially enhance the project’s credibility and success.

- Regulatory Environment: Stay informed about the regulations and legal landscape surrounding cryptocurrencies and decentralized exchanges. Consider how these factors may impact the future of 1inch.

- Risk and Reward: Assess the potential risks and rewards associated with investing in 1inch cryptocurrency. Consider factors such as volatility, liquidity, and the potential for high returns.

- Community and Adoption: Examine the community support and adoption of 1inch cryptocurrency. Look for community engagement, active development, and a growing user base.

- Financials: Evaluate the financial health of the 1inch project and its funding sources. Consider factors such as revenue streams, funding rounds, and token distribution.

By carefully evaluating these factors, you can make a more informed decision about whether or not to invest in 1inch cryptocurrency. Remember, cryptocurrency investments are inherently risky and it is important to conduct thorough research and seek professional advice before making any investment decisions.

Future growth potential of 1inch cryptocurrency

As with any cryptocurrency, it is important to consider the future growth potential of 1inch before making an investment. While no one can predict the future with certainty, there are several factors that suggest positive growth for 1inch.

User Adoption:

One of the key indicators of a cryptocurrency’s future growth potential is the level of user adoption. 1inch has gained significant popularity due to its innovative decentralized exchange aggregator. With its user-friendly interface and competitive fees, more and more traders are choosing 1inch as their preferred platform. This increasing user adoption is a positive sign for the future growth of 1inch.

Ongoing Development:

Another factor to consider is the ongoing development of the 1inch platform. The team behind 1inch is dedicated to continuously improving and expanding the platform’s capabilities. They regularly release new features and upgrades, ensuring that the platform remains competitive and attractive to users. This commitment to development suggests a positive outlook for the future growth of 1inch.

Furthermore, the team behind 1inch actively engages with the community and listens to user feedback. This collaborative approach ensures that the platform evolves according to the needs and preferences of its users. By prioritizing user satisfaction and responding to market demands, 1inch positions itself for future growth in the cryptocurrency market.

Overall, while no investment is without its risks, the future growth potential of 1inch cryptocurrency appears promising. Its growing user adoption and commitment to ongoing development indicate that the platform is well-positioned for continued success in the cryptocurrency market.

Question-answer:

What is 1inch cryptocurrency?

1inch cryptocurrency is the native token of the 1inch decentralized exchange (DEX) platform. It serves as a utility token within the platform, providing various benefits and incentives to users.

How can I buy 1inch cryptocurrency?

You can buy 1inch cryptocurrency on several popular cryptocurrency exchanges, such as Binance, Coinbase, and Kraken. Simply create an account on one of these exchanges, deposit funds, and search for the 1inch cryptocurrency to make a purchase.

What are the potential risks of buying 1inch cryptocurrency?

Like any investment, buying 1inch cryptocurrency comes with its own set of risks. Some potential risks include price volatility, regulatory changes, and the possibility of technology glitches or security breaches on the 1inch platform. It’s important to do thorough research and consider these risks before making a purchase.

Are there any alternatives to 1inch cryptocurrency?

Yes, there are several alternatives to 1inch cryptocurrency. Some popular decentralized exchange platforms include Uniswap, SushiSwap, and PancakeSwap. Each of these platforms has its own native token, which can be used for similar purposes as the 1inch token.