If you’re looking to optimize your trading strategy and maximize your profits, using 1inch limit orders on Arbitrum can be an excellent option. The 1inch platform allows users to access multiple decentralized exchanges and liquidity sources, ensuring the best possible prices for their trades. With the recent launch of Arbitrum, a Layer 2 scaling solution for Ethereum, the speed and cost-efficiency of your trades are greatly enhanced.

Limit orders are a popular tool in trading that allow you to set specific conditions for buying or selling an asset. Instead of executing the trade immediately at the market price, you can set a target price at which you want to buy or sell. When the market reaches your target price, the trade is executed automatically. This can be particularly useful when the market is volatile or when you want to take advantage of price fluctuations.

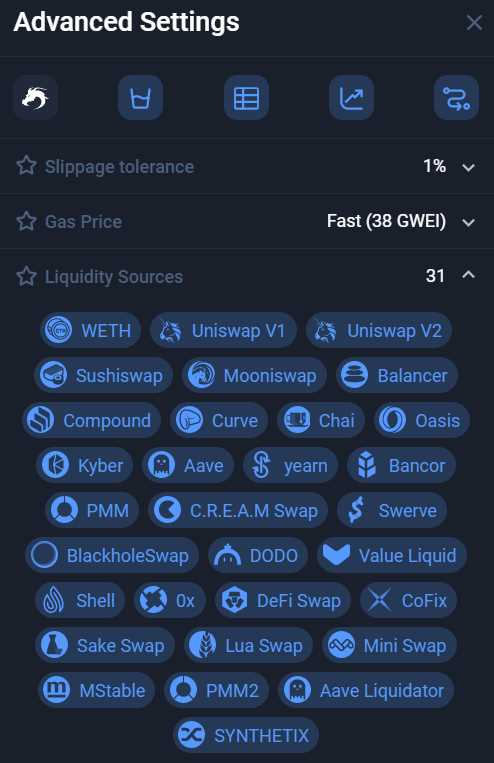

1inch brings the power of limit orders to the decentralized finance (DeFi) space, allowing you to execute trades across multiple platforms with a single transaction. This not only saves time and gas fees but also gives you access to the best prices available in the market. By using 1inch limit orders on Arbitrum, you can benefit from the fast and cost-effective transactions offered by Layer 2 solutions without compromising on accuracy and precision in your trades.

With this guide, we will walk you through the step-by-step process of using 1inch limit orders on Arbitrum. Whether you’re a beginner in DeFi or an experienced trader, you’ll find valuable insights and instructions to help you optimize your trading strategy and make the most of your investments. Let’s dive in and unlock the full potential of 1inch limit orders on Arbitrum!

Understanding 1inch Limit Orders

1inch Limit Orders provide traders with a powerful tool to execute trades with precision on the Arbitrum network. By leveraging limit orders, users can set specific price conditions for their trades, allowing them to enter or exit positions at predefined levels.

A limit order is a type of order placed by a trader to buy or sell an asset at a specified price or better. It is different from a market order, where the asset is bought or sold at the current market price. With 1inch Limit Orders, traders have more control over their trades and can potentially achieve better execution prices.

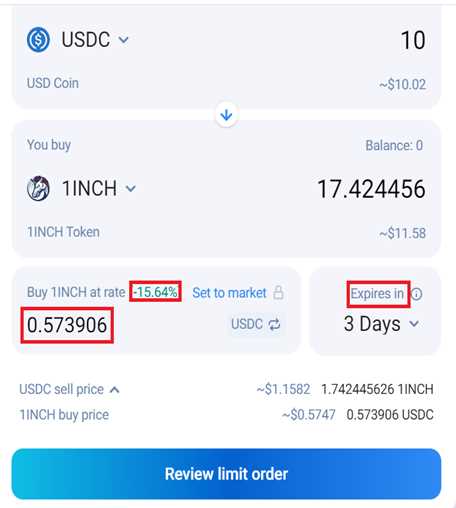

When placing a 1inch Limit Order, traders need to specify the token pair they want to trade, the amount of tokens they want to trade, and the price at which they want to execute the trade. The price can be set either as a fixed amount or as a percentage deviation from the current market price.

1inch Limit Orders also provide additional features to enhance trading flexibility. Traders can choose to enable partial fills, meaning that if the entire order cannot be filled at the specified price, a partial fill will still be executed. Traders can also set an expiration time for the order, after which it will be automatically cancelled if not executed.

Once a 1inch Limit Order is placed, it is added to the order book and will be executed if the specified price conditions are met. If the conditions are not met, the order will remain open until it is cancelled by the trader or the expiration time is reached.

The order book for 1inch Limit Orders on Arbitrum is highly liquid, with a wide range of token pairs available for trading. Traders can take advantage of this liquidity to find the best possible prices for their trades and optimize their trading strategies.

| Advantages of 1inch Limit Orders: |

|---|

| 1. Precise execution: Traders can set specific price conditions for their trades, ensuring they enter or exit positions at desired levels. |

| 2. Enhanced control: Traders have more control over their trades compared to market orders, potentially achieving better execution prices. |

| 3. Flexibility: Traders can enable partial fills and set expiration times for their orders, enhancing their trading strategies. |

| 4. Wide availability: The order book for 1inch Limit Orders on Arbitrum is highly liquid, providing traders with ample trading opportunities. |

Overall, 1inch Limit Orders on Arbitrum offer traders a comprehensive and efficient trading solution, empowering them to execute trades with precision and optimize their trading strategies.

Benefits of using 1inch Limit Orders

1inch Limit Orders offer several benefits that make them a valuable tool for accurate trading on Arbitrum. Here are some of the key advantages:

1. Enhanced Precision

1inch Limit Orders allow traders to specify the exact price at which they want to buy or sell a token. This eliminates the need to constantly monitor the market and manually execute trades, providing enhanced precision and reducing the risk of slippage.

2. Automated Execution

Once a 1inch Limit Order is set, the trade is automatically executed when the market reaches the specified price. This feature removes the need for constant monitoring and manual intervention, allowing traders to save time and trade more efficiently.

3. Increased Efficiency

By utilizing 1inch Limit Orders, traders can take advantage of opportunities and execute trades even when they are not actively monitoring the market. This increases efficiency and enables traders to participate in trading activities around the clock.

Overall, 1inch Limit Orders on Arbitrum offer traders a way to execute trades with enhanced precision, automate the trading process, and increase overall efficiency. It is a powerful tool for those looking to optimize their trading strategies and manage their assets effectively.

How to use 1inch Limit Orders on Arbitrum

1inch Limit Orders on Arbitrum provide users with a convenient way to execute trades with accuracy and efficiency. By utilizing the 1inch platform, traders can take advantage of the lower fees and faster transaction times offered by Arbitrum. Below, we will guide you through the process of using 1inch Limit Orders on Arbitrum.

| Step | Instructions |

|---|---|

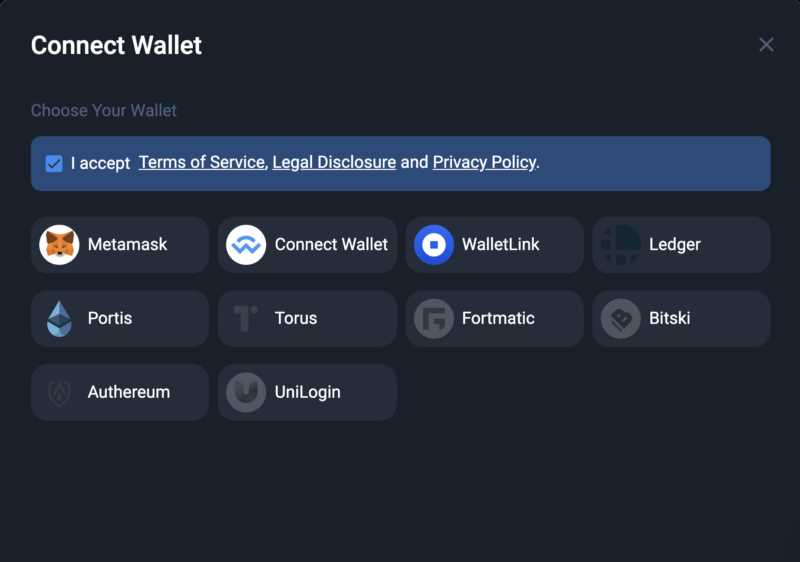

| 1 | Visit the 1inch website and connect your wallet to the platform. Make sure you are connected to the Arbitrum network. |

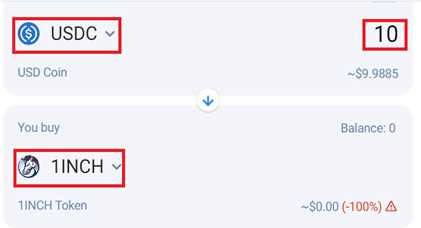

| 2 | Enter the details of your desired trade, including the token pair, the amount you want to trade, and the limit order price. |

| 3 | Review the estimated gas fee for executing the trade. Keep in mind that Arbitrum generally offers lower fees compared to other Ethereum-based networks. |

| 4 | Set the expiration time for your limit order. This determines how long your order will be active on the market. |

| 5 | Once you have reviewed and confirmed all the details, click on the “Submit” button to place your limit order. |

| 6 | Wait for the order to be executed. You can track the status of your limit order on the 1inch platform. |

| 7 | If your limit order is successfully executed, the tokens will be transferred to your wallet address. |

| 8 | If your limit order is not executed within the specified expiration time, it will be automatically canceled, and your funds will be returned to your wallet. |

Using 1inch Limit Orders on Arbitrum is a powerful tool for traders looking to optimize their trading experience. By following the above steps, you can take advantage of the precise execution and cost-effectiveness offered by the 1inch platform on the Arbitrum network. Happy trading!

Tips for accurate trading with 1inch Limit Orders

1. Understand the concept of limit orders:

Before getting started with 1inch limit orders on Arbitrum, make sure you have a good understanding of the concept of limit orders. Limit orders allow you to set a specific price at which you want to buy or sell a certain cryptocurrency. This can help you get better prices and avoid unpredictable market movements.

2. Research and analyze:

Prior to placing a limit order, it’s crucial to conduct thorough research and analysis. Understand the market trends, check the latest news, and analyze technical indicators. This will help you make more accurate predictions and increase your chances of executing successful limit orders.

3. Set realistic price targets:

When placing a limit order, be sure to set realistic price targets. Setting overly ambitious targets may result in your order not getting filled, while setting overly conservative targets may lead to missed opportunities. Find a balance and set targets based on your research and analysis.

4. Utilize stop-loss orders:

In order to manage risk and protect your investments, consider utilizing stop-loss orders alongside your limit orders. Stop-loss orders allow you to automatically sell a cryptocurrency when its price reaches a certain level, preventing further losses. This can be especially useful in volatile markets.

5. Keep an eye on the market:

While limit orders can help reduce the need for constant monitoring, it’s still important to keep an eye on the market. Pay attention to any significant price movements or news that could impact your limit orders. This will allow you to make necessary adjustments or cancel orders if needed.

6. Start with small amounts:

If you’re new to trading with limit orders, it’s advisable to start with small amounts. This will help you gain experience and understand the dynamics of limit order trading without risking a significant amount of capital. As you become more comfortable and confident, you can gradually increase your investment amounts.

7. Use a reliable platform:

When trading with 1inch limit orders on Arbitrum, it’s important to choose a reliable trading platform. Ensure that the platform has a good reputation, offers competitive pricing, and provides efficient order execution. This will help you trade with confidence and minimize any potential issues or delays.

In conclusion

By following these tips, you can enhance your accuracy when trading with 1inch limit orders on Arbitrum. Remember to thoroughly research and analyze the market, set realistic price targets, utilize stop-loss orders, monitor the market, start with small amounts, and use a reliable platform. These practices will contribute to your success as a limit order trader.

Question-answer:

What is Arbitrum and how does it relate to 1inch limit orders?

Arbitrum is a layer 2 scaling solution for Ethereum that aims to improve transaction throughput and reduce fees. 1inch limit orders can be executed on Arbitrum for faster and cheaper trading.

How do 1inch limit orders work?

1inch limit orders allow users to set a maximum price at which they are willing to buy or a minimum price at which they are willing to sell a certain asset. Once the price reaches the specified level, the order is executed automatically.

What are the benefits of using 1inch limit orders on Arbitrum?

Using 1inch limit orders on Arbitrum offers several advantages. First, it allows for faster trading with reduced transaction times. Second, it reduces fees as transactions on Arbitrum are generally cheaper than on the Ethereum mainnet. Lastly, it provides access to a wider range of trading opportunities due to increased liquidity and availability of assets on Arbitrum.

How can I set up a 1inch limit order on Arbitrum?

To set up a 1inch limit order on Arbitrum, you first need to connect your wallet to the 1inch platform. Then, select the token pair you wish to trade and specify the desired price and quantity. Once the order details are filled, click on the “Create Limit Order” button to submit the order to Arbitrum for execution.

Is there any risk associated with using 1inch limit orders on Arbitrum?

While using 1inch limit orders on Arbitrum can offer benefits, there are some risks to consider. Market volatility can result in the price quickly surpassing the specified limit, causing the order to be executed at a different price than intended. Additionally, the layer 2 solution itself may have its own technical issues or security vulnerabilities. It is always important to conduct thorough research and exercise caution when using any trading platform.