1inch is a decentralized exchange (DEX) protocol that has gained significant traction in the cryptocurrency industry. What sets 1inch apart from other DEX protocols is its unique approach to optimizing decentralized trading.

One of the key features that makes 1inch stand out is its pathfinder algorithm. This algorithm is designed to find the most efficient paths for executing trades across multiple liquidity sources. By analyzing the liquidity pools, 1inch is able to provide users with the best possible prices and minimize slippage.

Another aspect that sets 1inch apart is its aggregation protocol. With this protocol, 1inch is able to split a trade across multiple DEXs to ensure that users get the best possible price. This allows users to access deeper liquidity and avoid trading restrictions that may exist on a single DEX.

Furthermore, 1inch offers liquidity mining as an incentive for users to provide liquidity to the protocol. By staking their tokens, users can earn rewards in the form of additional tokens. This helps to bootstrap liquidity and ensure that the protocol has sufficient trading volume.

In addition to its technological innovations, 1inch is also known for its commitment to security and transparency. The team behind 1inch regularly conducts security audits and openly shares the results with the community. This helps to build trust and ensure that users can trade with confidence.

In conclusion, 1inch sets itself apart from other DEX protocols through its pathfinder algorithm, aggregation protocol, liquidity mining program, and commitment to security and transparency. These features have contributed to its rapid growth and popularity in the cryptocurrency industry.

Understanding Decentralized Exchange (DEX) Protocols

A decentralized exchange (DEX) protocol is a blockchain-based platform that enables the trading of digital assets directly between users, without the need for intermediaries or centralized control. Unlike traditional centralized exchanges, which rely on a trusted third party to facilitate trades, DEX protocols utilize smart contracts and decentralized networks to ensure transparency, security, and user ownership.

DEX protocols eliminate the need for users to trust a centralized exchange with their funds, as assets are held in user-controlled wallets, rather than being deposited into custodial accounts. This not only reduces the risk of theft or loss, but also grants users full control over their assets, allowing them to make trades on their own terms.

Key Features of DEX Protocols

1. Decentralization: DEX protocols operate on a decentralized network of nodes, ensuring that no single entity has control over the platform or user funds. This decentralized architecture promotes trustlessness and censorship resistance.

2. Non-custodial: Unlike centralized exchanges that require users to deposit their funds into custodial accounts, DEX protocols enable users to trade directly from their wallets. This puts users in control of their assets and reduces the risk of hacking or mismanagement by the exchange.

3. Interoperability: DEX protocols aim to be compatible with multiple blockchains, allowing users to trade a wide range of digital assets across different networks. This enables greater flexibility and liquidity for traders.

The 1inch Protocol Difference

1inch Protocol sets itself apart from other DEX protocols by offering users the best possible trading rates across multiple decentralized exchanges. Through its innovative aggregation and routing technology, 1inch Protocol scans multiple liquidity sources to find the most favorable rates for trades.

Furthermore, 1inch Protocol is built on top of the Ethereum blockchain and is compatible with various other blockchains, enhancing interoperability and expanding the range of tradable assets.

Overall, understanding DEX protocols is crucial for individuals who wish to take advantage of decentralized finance and trade digital assets in a secure, transparent, and user-centric manner.

What Sets 1inch Apart

When it comes to decentralized exchange (DEX) protocols, 1inch stands out from the competition in several key ways.

1. Aggregation

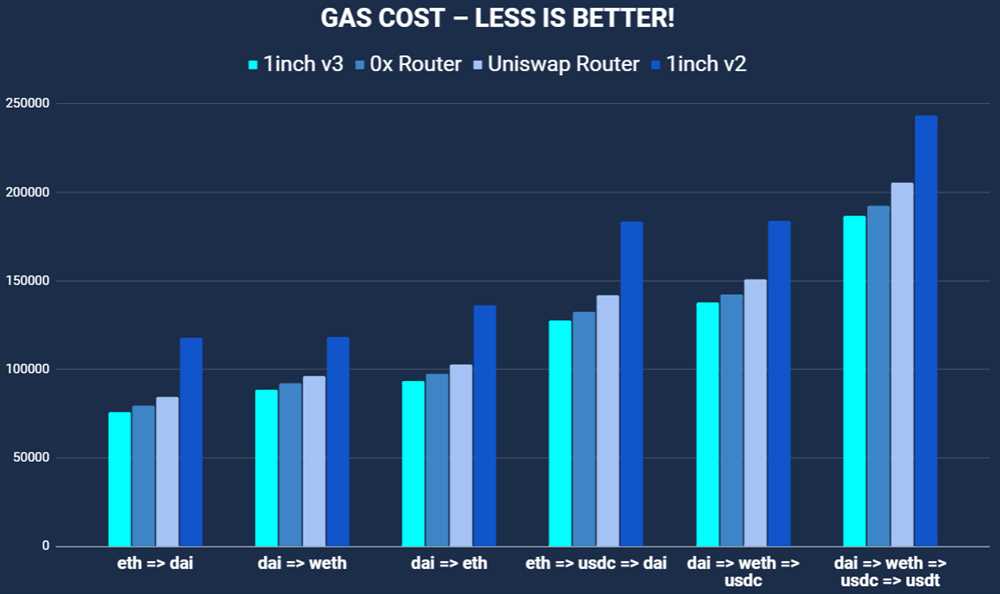

One of the main features that sets 1inch apart is its aggregation functionality. Instead of relying on a single liquidity source, 1inch aggregates liquidity from multiple DEXs, allowing users to get the best possible prices for their trades. This not only improves the efficiency of trades but also helps users save on gas fees.

2. Optimized Routing

1inch also utilizes an optimized routing algorithm to ensure that trades are executed in the most cost-effective manner possible. By analyzing the liquidity available on various DEXs and taking into account factors such as gas costs, slippage, and trading volume, 1inch is able to route trades through the most optimal path, resulting in better prices and lower fees for users.

Moreover, 1inch continuously monitors the market and adjusts its routing strategies in real-time, ensuring that users always get the best possible outcomes.

These unique features make 1inch a top choice for traders looking for the best prices, efficiency, and cost savings in the decentralized exchange space.

In conclusion, 1inch distinguishes itself from other DEX protocols through its aggregation functionality and optimized routing algorithm. By aggregating liquidity from multiple sources and utilizing advanced routing strategies, 1inch is able to provide users with better prices, improved efficiency, and cost savings.

Key Features of 1inch Exchange Protocol

The 1inch Exchange Protocol stands out from other DEX protocols with its unique features and capabilities:

- Aggregation of Liquidity: The 1inch Exchange Protocol aggregates liquidity from various decentralized exchanges, enabling users to access the best available prices and execute trades with minimal slippage.

- Optimized Gas Fees: The protocol optimizes gas fees by splitting the user’s trade across multiple DEXs, resulting in lower transaction costs and improved trading efficiency.

- Intelligent Routing: 1inch uses an intelligent routing algorithm that selects the most efficient paths for trades, balancing factors such as liquidity, fees, and slippage to ensure users get the best possible trading experience.

- Multi-Chain Support: The protocol supports multiple blockchains, including Ethereum, Binance Smart Chain, and Polygon, allowing users to access liquidity on different networks and trade their assets seamlessly.

- Trade History Tracking: 1inch provides users with a complete trade history, allowing them to track their previous transactions and gain valuable insights into their trading activity.

- Security and Reliability: The protocol prioritizes security and reliability, implementing robust smart contract audits and partnering with reputable wallets and infrastructure providers to ensure the safety of user funds.

- Governance and Tokenomics: The 1inch Exchange Protocol is governed by the 1INCH token holders, who can participate in the decision-making process and earn rewards for their contribution to the network.

- Developer-Friendly Environment: 1inch offers a developer-friendly environment with comprehensive documentation, open-source libraries, and APIs, making it easier for developers to integrate with the protocol and build on top of it.

These key features set the 1inch Exchange Protocol apart from other DEX protocols, providing users with a powerful and efficient platform for decentralized trading.

Question-answer:

What is 1inch?

1inch is a DEX aggregator that connects multiple decentralized exchanges into one platform, allowing users to find the best possible trading rates and execute trades across different liquidity sources.

How does 1inch differ from other DEX protocols?

1inch stands out from other DEX protocols because of its unique algorithm that splits trades across multiple DEXes to ensure users get the best possible rates. It also offers lower gas fees and provides on-chain liquidity for various tokens, which contributes to its popularity among DeFi users.

Are there any benefits of using 1inch?

Yes, there are several benefits of using 1inch. Firstly, it offers the best possible rates for trades by splitting them across different decentralized exchanges. Secondly, it provides on-chain liquidity for various tokens, making it easier for users to trade their assets. Lastly, it has lower gas fees compared to other DEX protocols, which can save users money when executing trades.

Is 1inch safe to use?

Yes, 1inch is considered to be a safe DEX aggregator. It has undergone extensive audits by reputable firms, such as ConsenSys Diligence and CertiK, to ensure the security of its smart contracts. Additionally, 1inch has implemented several security measures, such as a bug bounty program and a partnership with Hacken, to further enhance the safety of its platform.