Welcome to the world of decentralized finance (DeFi)! If you’re looking to venture into the exciting world of crypto investments, it’s essential to understand the potential of platforms like 1inch. With its innovative approach to liquidity and decentralized trading, 1inch has quickly risen to prominence as a leading player in the DeFi space.

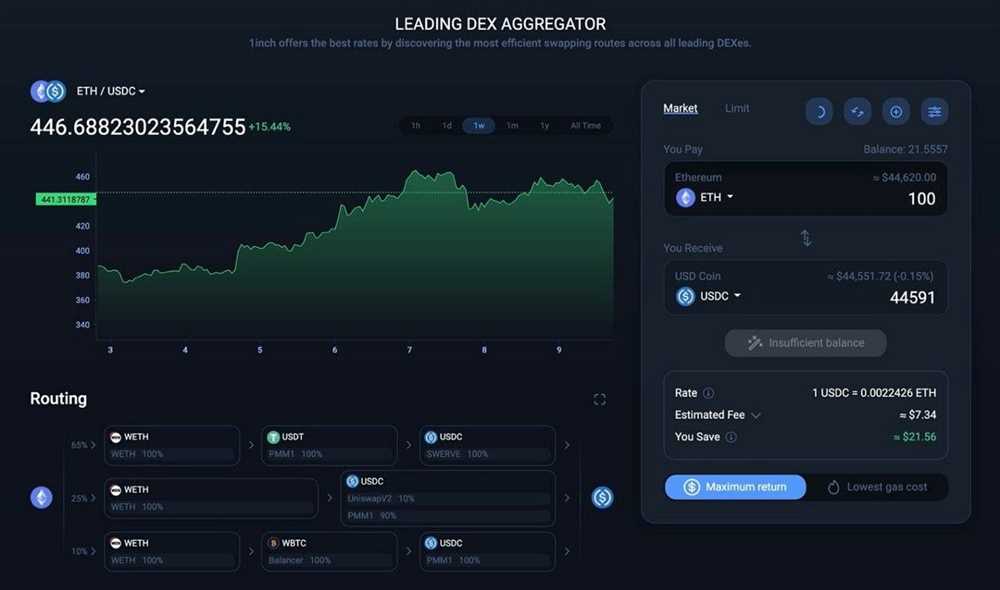

1inch is a decentralized exchange aggregator that sources liquidity from various exchanges to ensure users get the best possible rates for their trades. This unique feature allows investors to access a wide range of decentralized exchanges through a single convenient interface. Whether you’re a beginner or an experienced trader, 1inch offers a user-friendly experience that maximizes your investment potential.

One of the key reasons why 1inch has gained so much popularity is its ability to provide the best possible prices for trades. By leveraging smart contract technology and advanced algorithms, 1inch scans multiple exchanges to find the most favorable rates for users. This not only saves investors time and effort but also ensures they get the most out of their investments.

But 1inch is not just about trading. It also offers a range of additional features and services that can help you unlock even greater potential. From yield farming and staking to liquidity provision and governance, 1inch provides a comprehensive suite of tools to help users make the most of their investments. Whether you’re looking to earn passive income or actively participate in decentralized governance, 1inch has something for everyone.

So, if you’re ready to explore the exciting world of DeFi and take your investments to the next level, it’s time to dive into the potential of 1inch. In this beginner’s guide, we’ll walk you through everything you need to know to get started on your journey to financial freedom. From understanding the basics of decentralized finance to learning how to navigate the 1inch platform, we’ll equip you with the knowledge and tools you need to make informed investment decisions. Let’s unlock the potential of 1inch together!

1inch: Maximizing Your Potential Through Investing

Investing in 1inch can be a strategic move to unlock your potential in the ever-growing decentralized finance (DeFi) market. With its innovative features and wide range of services, 1inch offers investors a unique opportunity to maximize their returns and stay ahead in this competitive space.

Understanding 1inch

1inch is a decentralized exchange (DEX) aggregator that connects multiple DEXes into one platform, giving users access to the best possible prices and liquidity. By integrating different DEXes, 1inch minimizes slippage and maximizes returns for investors.

Investing in 1inch

When investing in 1inch, it’s important to conduct thorough research on the project and understand its fundamentals. Take the time to study the team behind 1inch, their vision, and the technology they are using. This will give you confidence in your investment decision and help you make informed choices.

One of the key advantages of investing in 1inch is its potential for growth. As more users enter the DeFi market and demand for DEXes increases, the value of 1inch could rise significantly. This makes it an attractive long-term investment for those who believe in the future of DeFi.

Additionally, 1inch offers various incentives to its users, such as liquidity mining programs and staking rewards. By participating in these programs, investors can earn additional tokens and maximize their potential returns.

However, like any investment, investing in 1inch comes with risks. The DeFi market can be highly volatile, and the value of cryptocurrencies can fluctuate rapidly. It’s important to set realistic expectations and diversify your investment portfolio to manage these risks effectively.

In conclusion, investing in 1inch has the potential to unlock significant returns in the DeFi market. By understanding the fundamentals of the project, conducting thorough research, and managing risks effectively, investors can maximize their potential and stay ahead in this rapidly evolving space.

Understanding the Power of 1inch

1inch is a decentralized exchange aggregator that allows users to find the best prices on various decentralized exchanges (DEXs) and execute trades all in one place. By connecting to multiple DEXs, 1inch is able to provide users with access to a wide range of liquidity pools and ensure they get the most favorable rates when trading.

One of the key advantages of using 1inch is its ability to split a single trade across multiple DEXs, which is known as “DEX aggregation”. This feature helps users to avoid liquidity issues and slippage by automatically routing their trades through the most liquid and cost-effective pools. By doing so, users can maximize their trading efficiency and minimize trading costs.

In addition to DEX aggregation, 1inch also offers various other features that enhance the overall trading experience. These include gas optimization, where trades are routed through the most cost-effective chains to minimize transaction fees, as well as “Chi Gas Token”, which further reduces gas costs by utilizing gas tokens.

Another notable feature of 1inch is its “Limit Orders” functionality, which allows users to set their desired price for a trade and wait for the market to reach that price before the trade is executed. This provides users with more control over their trades and helps them take advantage of market fluctuations.

Overall, the power of 1inch lies in its ability to provide users with access to the best prices and liquidity across multiple DEXs, while also offering advanced features to optimize trading efficiency and reduce costs. Whether you are a beginner or an experienced investor, 1inch is a valuable tool in the decentralized finance (DeFi) space that can help unlock the full potential of your investments.

Getting Started: How to Invest in 1inch

Investing in 1inch can be an exciting opportunity to participate in the growing decentralized finance (DeFi) ecosystem. If you want to get started with investing in 1inch, follow these steps:

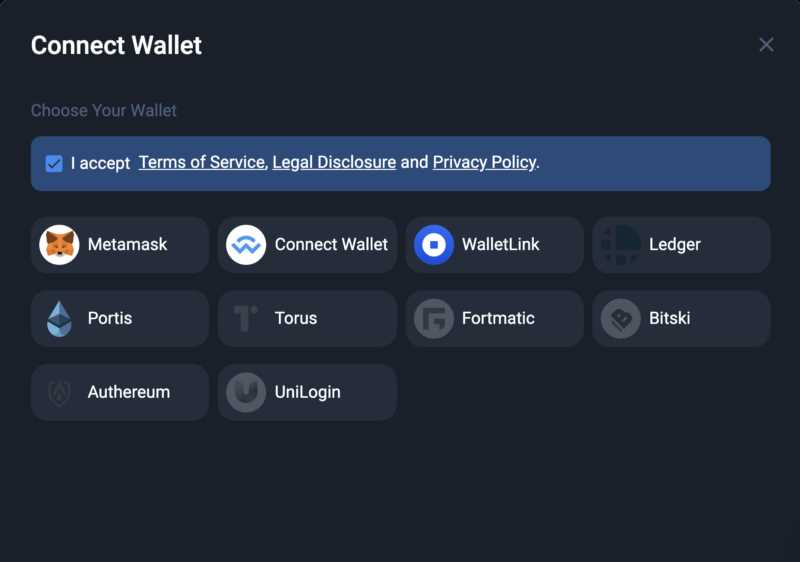

Step 1: Set up a Wallet

The first thing you’ll need is a digital wallet that supports Ethereum and its tokens. The most popular options include MetaMask, Trust Wallet, and MyEtherWallet. Choose the wallet that best suits your needs and set it up by following the instructions provided by the wallet provider.

Step 2: Get some Ethereum (ETH)

In order to invest in 1inch, you’ll need to have some Ethereum (ETH) available in your wallet. You can acquire ETH by purchasing it from a cryptocurrency exchange or by converting other cryptocurrencies into ETH.

Step 3: Connect your Wallet to 1inch

Once you have a wallet with some ETH, you’ll need to connect it to the 1inch platform. Visit the official 1inch website (1inch.exchange) and connect your wallet by clicking on the “Connect Wallet” button. Follow the prompts to connect your wallet to the platform.

Step 4: Deposit Ethereum (ETH) into your Wallet

Before you can start investing in 1inch, you’ll need to deposit some Ethereum (ETH) into your wallet on the 1inch platform. Click on the “Deposit” button and follow the instructions to deposit ETH into your wallet.

Step 5: Choose your Investment Strategy

Now that you have Ethereum in your wallet on the 1inch platform, you can start investing in 1inch. Decide on your investment strategy – whether you want to trade 1inch tokens, provide liquidity to the platform, or stake your tokens for rewards. Make sure to do thorough research and consider your risk tolerance before making any investment decisions.

Step 6: Start Investing in 1inch

Now that you have everything set up, it’s time to start investing in 1inch. Navigate to the “Trade” or “Invest” section on the 1inch platform to explore available investment options. Follow the instructions provided by the platform to execute your investment transactions.

Step 7: Monitor and Manage Your Investments

Once you’ve made your investments, it’s important to regularly monitor and manage your portfolio. Keep track of your investments and adjust your strategy as needed based on market conditions and your own investment goals.

Remember, investing in 1inch and other cryptocurrencies involves risks, and it’s important to only invest what you can afford to lose. Stay informed, do your own research, and consider seeking advice from a financial professional before making any investment decisions.

Strategies for Success: Maximizing Returns with 1inch

Investing in 1inch can be a lucrative endeavor, but it’s essential to have a well-thought-out strategy in place to maximize your returns. Here are some strategies to consider:

- Diversify Your Portfolio: Instead of investing all your funds into 1inch, consider spreading your investment across multiple projects. This diversification can help mitigate risk and improve the overall performance of your portfolio.

- Keep an Eye on Market Trends: Stay informed about the latest market trends and developments in the cryptocurrency industry. By keeping track of the market, you can make informed decisions about when to buy or sell your 1inch tokens.

- Set Realistic Goals: Define your investment goals and establish a clear plan to achieve them. Whether your goal is to make a certain percentage return or to accumulate a specific amount of 1inch tokens, having a clear objective will help you stay focused and make better investment decisions.

- Take Advantage of Yield Farming: 1inch offers yield farming opportunities that allow you to earn additional tokens by providing liquidity to the platform. By participating in yield farming, you can maximize your returns and potentially earn a passive income from your 1inch investment.

- Utilize Risk Management Tools: To minimize the impact of potential losses, consider using risk management tools such as stop-loss orders or trailing stops. These tools can automatically sell your 1inch tokens if the price falls below a certain threshold, limiting your losses and protecting your investment.

Remember, investing in 1inch or any cryptocurrency carries inherent risks. It’s important to thoroughly research and understand the project, its tokenomics, and the market conditions before making any investment decisions. With a solid strategy and careful planning, you can maximize your returns and unlock the full potential of your 1inch investment.

Navigating the 1inch Ecosystem: Exploring Additional Investment Opportunities

As an investor, understanding the different opportunities within the 1inch ecosystem can help you make informed decisions and maximize your investment potential. While 1inch initially gained popularity as a decentralized exchange aggregator, the platform has since expanded its offerings and grown into a multifaceted ecosystem.

1. Liquidity Pool Providers

One of the ways you can participate in the 1inch ecosystem is by becoming a liquidity pool provider. By supplying liquidity to various pools, you can earn fees and rewards in return. There are several popular liquidity pools on 1inch, such as those supporting Ethereum and other popular tokens. Carefully research the available pools and their associated risks before deciding to become a liquidity pool provider.

2. Yield Farming

Another investment opportunity within the 1inch ecosystem is yield farming. Yield farming involves staking your tokens in specific protocols to earn additional tokens as rewards. 1inch provides yield farming opportunities through its farming pools, where you can leverage your assets to earn higher yields. Keep in mind that yield farming carries its own risks, so it’s crucial to do your due diligence and understand the potential rewards and risks involved.

3. Governance and Voting Rights

As a token holder, you may also have the opportunity to participate in the governance of the 1inch ecosystem. This means you can have a say in important decisions that can impact the future of the platform. Additionally, by holding 1inch tokens, you may be eligible to vote on proposals and earn rewards for your participation. Participating in governance and voting can provide an extra layer of engagement and potentially increase your influence in the ecosystem.

It’s important to note that additional investment opportunities within the 1inch ecosystem may emerge as the platform continues to evolve. Keeping an eye on the latest developments and announcements from 1inch can help you stay informed and identify new investment prospects.

Remember, investing in the cryptocurrency market carries inherent risks and it’s important to do your own research, assess your risk tolerance, and make investment decisions based on your own financial situation.

Question-answer:

What is 1inch and how does it work?

1inch is a decentralized exchange aggregator that helps users find the best trading prices across multiple exchanges. It does this by splitting up a user’s trade into multiple parts and routing them through different decentralized exchanges to achieve the best possible price. It takes advantage of liquidity pools and smart contract technology to facilitate these trades.

How can beginners invest in 1inch?

Beginners can invest in 1inch by first obtaining the necessary cryptocurrency, such as Ethereum, and then using a decentralized exchange or a centralized exchange that supports 1inch to buy 1inch tokens. They can then store these tokens in a compatible wallet and participate in the 1inch network by staking their tokens or providing liquidity to the platform.

What are the benefits of investing in 1inch?

Investing in 1inch can offer several benefits. Firstly, it allows investors to participate in the growth and success of a decentralized exchange aggregator that has gained popularity in the decentralized finance space. Secondly, investors can potentially earn passive income by staking their 1inch tokens or providing liquidity to the platform. Thirdly, investing in 1inch can be a way to diversify one’s investment portfolio and potentially earn higher returns compared to traditional investments.

What are the risks of investing in 1inch?

As with any investment, there are risks associated with investing in 1inch. One of the main risks is the volatility of the cryptocurrency market, which can lead to fluctuations in the value of 1inch tokens. Additionally, investing in a decentralized project like 1inch comes with the risk of smart contract vulnerabilities and potential hacking attacks. It is important for investors to do their own research, understand the risks involved, and only invest what they can afford to lose.