1inch Swap has emerged as one of the most innovative decentralized trading platforms in the cryptocurrency industry. With its cutting-edge technology and advanced algorithms, 1inch Swap has revolutionized the way users can trade crypto assets across multiple platforms.

But what makes 1inch Swap so unique?

Unlike traditional exchanges, 1inch Swap utilizes smart contract technology to pool liquidity from various decentralized exchanges (DEXs) and execute trades at the best available prices. This means that users can take advantage of the best prices and lowest slippage without the need to manually search for the most favorable trading opportunities.

So, how does the technology behind 1inch Swap actually work?

1inch Swap aggregates liquidity from various DEXs through its innovative Pathfinder algorithm, which analyzes prices, liquidity, and trading volumes across multiple platforms in real-time. By splitting and routing trades across different liquidity sources, 1inch Swap ensures that users get the most optimal rates for their transactions.

In addition to its smart routing algorithm, 1inch Swap also incorporates Chi Gas Token to optimize gas fees for users.

The Chi Gas Token allows users to save on transaction costs by minimizing the impact of high gas prices on Ethereum. By leveraging the Chi Gas Token, 1inch Swap is able to reduce gas costs for its users when executing trades on the Ethereum network.

In conclusion, 1inch Swap combines sophisticated technology, advanced algorithms, and innovative solutions to provide users with the best possible trading experience.

Whether you’re a seasoned trader or just starting out in the world of cryptocurrencies, 1inch Swap offers a reliable and efficient solution for executing trades at the best available prices. With its emphasis on liquidity and gas optimization, 1inch Swap is poised to continue disrupting the decentralized trading landscape.

Overview of 1inch Swap

1inch Swap is a decentralized exchange aggregator that allows users to find the best prices for their token swaps across multiple protocols. It was developed by a team of experienced blockchain engineers and launched in 2020.

The main goal of 1inch Swap is to provide users with the most efficient and cost-effective way to trade tokens. By aggregating liquidity from various decentralized exchanges, 1inch Swap is able to find the best available prices for token swaps, reducing slippage and maximizing user returns.

1inch Swap works by splitting a user’s token swap across multiple decentralized exchanges to find the lowest possible price. This is done through an automated market maker (AMM) algorithm that takes into account factors such as liquidity, trading volume, and fees. The algorithm continuously monitors the market and updates the swap route in real-time to ensure optimal results.

1inch Swap supports a wide range of tokens and protocols, including Ethereum, Binance Smart Chain, and Polygon. Users can easily connect their wallets to the 1inch platform and start swapping tokens with just a few clicks.

In addition to its swapping capabilities, 1inch also offers other key features such as limit orders, liquidity provision, and governance. These features provide additional flexibility and options for users looking to optimize their trading strategies.

Overall, 1inch Swap is a powerful tool for decentralized trading that provides users with the best prices and lowest slippage for their token swaps. Its automated market maker algorithm and wide range of supported tokens make it a popular choice among traders in the DeFi space.

Decentralized Exchanges

Decentralized exchanges (DEXs) are a type of cryptocurrency exchange that operates on a decentralized network. Unlike traditional exchanges, DEXs do not rely on a central authority to facilitate transactions. Instead, they use smart contracts and blockchain technology to enable peer-to-peer trading.

One of the main advantages of decentralized exchanges is that they provide users with full control over their funds. Since there is no central authority involved, users do not need to deposit their funds into the exchange. Instead, they can trade directly from their personal wallets, which reduces the risk of theft or hacking.

DEXs also offer greater privacy compared to centralized exchanges. Users do not need to go through a KYC (Know Your Customer) process or disclose their personal information to start trading. This decentralized nature makes DEXs more attractive to users who value privacy and security.

Another benefit of decentralized exchanges is that they are often more resistant to censorship and regulation. Since there is no central authority to be targeted or shut down, DEXs can continue to operate even in jurisdictions with strict regulations. This resilience makes DEXs a reliable option for users who are concerned about government interference.

However, it is important to note that decentralized exchanges also have some limitations. Due to the reliance on blockchain technology, DEXs can sometimes suffer from slower transaction speeds and higher fees compared to centralized exchanges. Additionally, the lack of a central authority means that there may be less liquidity on DEXs, resulting in less trading options and potentially higher slippage.

Overall, decentralized exchanges play a crucial role in the cryptocurrency ecosystem by offering users a secure and private way to trade digital assets. As blockchain technology continues to advance, DEXs are likely to become even more efficient and user-friendly, making them a viable alternative to centralized exchanges.

How 1inch Swap Works

1inch Swap is an advanced decentralized exchange aggregator that allows users to find the most efficient and cost-effective routes for trading tokens across various liquidity sources.

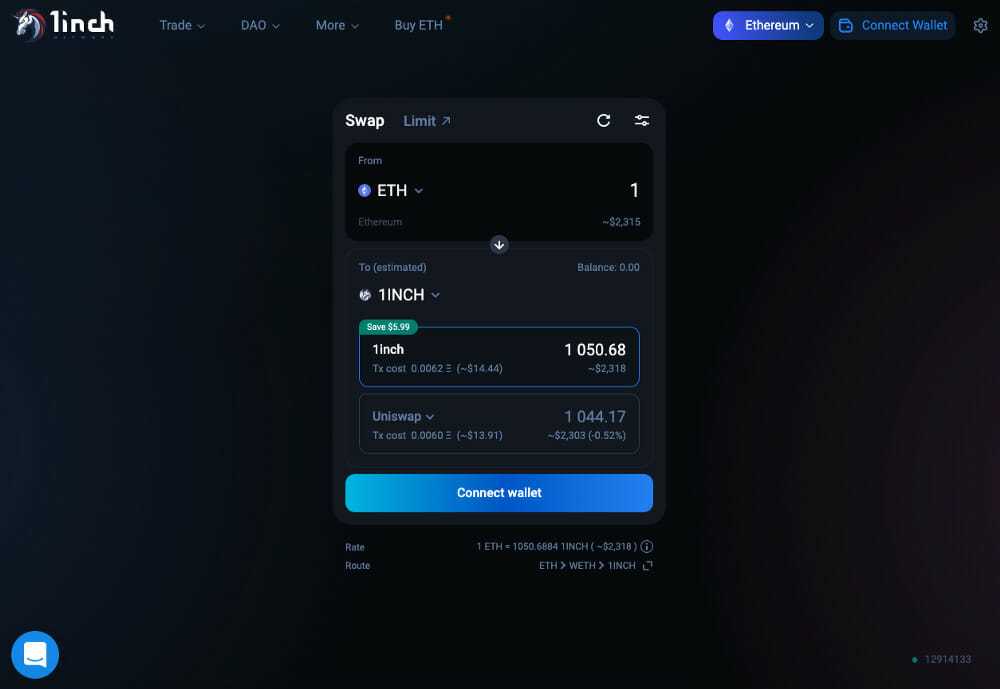

The underlying technology behind 1inch Swap works by splitting users’ trade orders across multiple decentralized exchanges to ensure the best possible execution price. This process is known as “splitting” and it maximizes the liquidity and reduces slippage for users.

When a user wants to make a trade on 1inch Swap, the protocol’s smart contract analyzes the liquidity pools on different decentralized exchanges in real-time. It identifies the most favorable prices and routes for the trade and divides the user’s order across multiple exchanges accordingly.

This splitting mechanism is made possible through the use of Pathfinder, a proprietary algorithm developed by 1inch. Pathfinder calculates the optimal route for each trade by considering factors such as gas costs, exchange fees, and overall liquidity.

1inch Swap also utilizes the Chi Gastoken, which allows users to save on gas fees by bundling multiple transactions together into a single transaction. This further optimizes the trade execution process and reduces costs for users.

Another important feature of 1inch Swap is its “smart order routing” capability. This means that the protocol automatically selects the best exchange(s) to execute a trade based on the available liquidity and prices at any given moment. It ensures that users always get the best possible trade execution, even when liquidity is fragmented across different exchanges.

In conclusion, 1inch Swap utilizes advanced algorithms, smart order routing, and splitting mechanisms to enable users to find the most efficient and cost-effective routes for trading tokens. By leveraging multiple decentralized exchanges and optimizing trade execution, 1inch Swap maximizes liquidity and minimizes slippage for its users.

Aggregation Technology

1inch Swap utilizes aggregation technology to provide users with the best prices across multiple decentralized exchanges (DEXs). Aggregation technology works by splitting a user’s trade into multiple smaller trades and executing them across different DEXs to find the most efficient route.

When a user wants to make a trade on 1inch Swap, the platform scans multiple DEXs to find the best prices. It takes into account factors such as liquidity, fees, and slippage to determine the most optimal route for the trade. This means that users are able to get the best possible prices for their trades without having to manually compare prices on different exchanges.

Aggregation technology also helps to minimize slippage, which is the difference between the expected price of a trade and the actual executed price. By splitting a trade into smaller parts and executing them across multiple DEXs, 1inch Swap is able to minimize the impact on the market and ensure that users get the best price possible.

Furthermore, aggregation technology allows users to access liquidity from multiple DEXs, which can sometimes be fragmented across different platforms. This means that users can access a larger pool of liquidity, increasing the likelihood of getting their trades executed quickly and efficiently.

Overall, aggregation technology is a crucial component of 1inch Swap’s functionality. It enables users to get the best prices for their trades, minimize slippage, and access liquidity across multiple DEXs. By leveraging aggregation technology, 1inch Swap provides users with a seamless and efficient trading experience in the decentralized finance (DeFi) space.

The Role of 1inch’s Aggregation Technology

1inch’s aggregation technology plays a crucial role in its ability to provide users with the best possible rates and liquidity for their trades. The platform uses a unique combination of algorithms, smart contracts, and decentralized exchange protocols to aggregate liquidity from various sources.

By utilizing multiple liquidity sources, including both centralized and decentralized exchanges, 1inch is able to find the most optimal trading route for its users. This helps ensure that users get the best rates and can minimize slippage and other trading costs.

1inch’s aggregation technology also allows for the splitting of large orders across multiple exchanges, which helps to further improve liquidity and reduce the impact of large trades on the market. By splitting orders, 1inch is able to access deeper pools of liquidity and improve the overall trading experience for its users.

In addition to finding the best rates and liquidity, 1inch’s aggregation technology also helps to protect users from risks such as front-running and price manipulation. By sourcing liquidity from multiple exchanges and executing trades in a decentralized manner, 1inch is able to minimize the potential for these types of market distortions.

Overall, 1inch’s aggregation technology is a key component of its mission to provide users with the best possible trading experience. By leveraging innovative algorithms and decentralized protocols, 1inch is able to offer users access to the most competitive rates, deep liquidity, and protection against market manipulation.

Benefits and Future Developments

1inch Swap offers a number of benefits for users, making it a popular choice in the decentralized finance (DeFi) space. Some of the key benefits include:

- Low Slippage: 1inch Swap uses advanced algorithms to minimize slippage, ensuring that users get the best possible price when swapping tokens.

- Competitive Fees: The platform offers competitive fees compared to other DeFi exchanges, making it cost-effective for users.

- High Liquidity: 1inch Swap aggregates liquidity from various DEXs, ensuring high liquidity for a wide range of tokens.

- Wide Token Support: The platform supports a wide range of tokens, allowing users to swap between different assets easily.

- Gas Efficiency: 1inch Swap optimizes gas usage, reducing transaction costs for users.

In terms of future developments, 1inch Swap is constantly working on improving its technology and adding new features. Some of the key areas of focus include:

- Protocol Upgrades: The team behind 1inch Swap is continuously working on upgrading the protocol to enhance its efficiency and scalability.

- Improved User Experience: The platform aims to provide users with a seamless and intuitive experience when using 1inch Swap.

- Integration with Other DeFi Platforms: 1inch Swap plans to integrate with other DeFi platforms to provide users with more options and opportunities for yield generation.

- Enhanced Security Measures: The team is committed to implementing robust security measures to protect users’ funds and ensure the safety of transactions.

- Expansion to Other Blockchains: 1inch Swap is exploring the possibility of expanding its services to other blockchains to reach a wider user base.

With these ongoing developments, 1inch Swap aims to remain at the forefront of the DeFi industry and provide users with an efficient and user-friendly platform for swapping tokens.

Question-answer:

How does 1inch Swap work?

1inch Swap is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges. It uses smart contract technology to split a user’s trade across multiple DEXs to achieve the best possible price and minimize slippage.

What are the benefits of using 1inch Swap?

Using 1inch Swap allows users to access the best prices and deep liquidity in the decentralized market. It also saves users time and gas fees by automatically splitting trades across different DEXs to get the best price.

How does 1inch Wallet protect user funds?

1inch Wallet is a non-custodial wallet that allows users to have full control and ownership of their funds. It uses smart contract technology to securely store and manage user assets. Private keys are never exposed to the internet, ensuring maximum security.

What are the risks associated with using 1inch Swap?

While 1inch Swap is designed to provide the best prices and minimize slippage, there are still risks involved in using decentralized exchanges. These include smart contract bugs, impermanent loss, and potential hacks. It’s important for users to understand and assess these risks before using the platform.