Understanding the Significance of Market Capitalization in Evaluating the Value of 1inch Coin

Discover the Power of Market Cap

Are you looking for a promising investment opportunity? Look no further!

Introducing 1inch Coin – the rising star in the world of cryptocurrency.

With its innovative technology and unique value proposition, 1inch Coin is poised to revolutionize the way we think about decentralized exchanges.

But how can you assess the value of 1inch Coin?

One key metric that investors should consider is the market capitalization, or market cap, of the coin.

Why is market cap important?

Market cap represents the total value of a cryptocurrency, taking into account both the price and the circulating supply of coins.

This metric can give investors valuable insights into the potential growth and stability of a coin.

So, what does this mean for 1inch Coin?

As one of the fastest-growing coins in the market, 1inch Coin has a market cap that is steadily increasing.

Investing in 1inch Coin means you can be part of a dynamic and rapidly expanding community, while also enjoying potential profits.

Don’t miss out on this exciting opportunity!

Join the 1inch Coin movement and discover the power of market cap in assessing its value proposition.

Understanding the Value Proposition

When considering the value proposition of 1inch Coin, it is important to understand the role of market capitalization (market cap) and how it can help assess the potential worth of a cryptocurrency.

What is Market Capitalization?

Market capitalization refers to the total value of a company or cryptocurrency. It is calculated by multiplying the current price of a single coin or token by the total supply in circulation. Market cap is often used as an indicator of the size and significance of a cryptocurrency within the market.

The Significance of Market Cap

Market cap provides insight into the overall market confidence and investment interest in a particular cryptocurrency. A higher market cap generally indicates a larger and more established project, with a potentially higher level of trust and liquidity.

While market cap can be a useful metric for understanding the overall value of a cryptocurrency, it should not be the sole factor in assessing its potential worth. Other factors, such as the project’s technology, team, partnerships, and adoption, should also be considered.

1inch Coin has seen significant growth in its market cap, reflecting investor confidence and interest in the project. As the decentralized finance (DeFi) industry continues to evolve and gain traction, 1inch Coin’s value proposition becomes more compelling.

The Value Proposition of 1inch Coin

1inch Coin aims to provide users with the best possible trading experience in the decentralized finance space. By aggregating liquidity from various decentralized exchanges (DEXs), 1inch enables users to find the most efficient trading routes and secure the best prices for their trades. This innovative approach offers users unparalleled access to liquidity and competitive rates.

Additionally, 1inch Coin offers token holders governance rights within the 1inch ecosystem. This allows token holders to actively participate in the decision-making processes and shape the future development of the platform.

The combination of efficient trading and governance rights makes 1inch Coin an attractive investment opportunity. As the DeFi industry continues to grow and innovate, 1inch Coin’s unique value proposition positions it well for long-term success.

The Role of Market Cap

Market cap, short for market capitalization, is a key metric that investors and traders use to assess the value proposition of a cryptocurrency like 1inch Coin. Market cap represents the total value of a cryptocurrency, calculated by multiplying its current price by the total supply of coins in circulation.

Market cap is an important factor in evaluating the potential of a cryptocurrency investment. It provides an indication of the size and popularity of a particular coin within the crypto market. Generally, cryptocurrencies with larger market caps are considered more established, stable, and potentially less risky.

Market cap can be seen as a measure of the market’s confidence and trust in a cryptocurrency. It can reflect the level of adoption, demand, and overall interest in a coin. A high market cap suggests that a cryptocurrency has gained significant attention and recognition from investors, which may indicate a higher likelihood of its long-term success.

However, market cap should not be the sole factor considered when evaluating the value proposition of a cryptocurrency. Other factors such as the project’s technology, team, partnerships, roadmap, and overall market conditions should also be taken into account.

1inch Coin is a prominent cryptocurrency with a noteworthy market cap. It has gained popularity due to its innovative decentralized exchange aggregator platform, which allows users to find the most efficient trading routes across various decentralized exchanges. As the market cap of 1inch Coin continues to grow, it solidifies its position as a valuable and promising investment option within the crypto market.

In conclusion, market cap plays a crucial role in assessing the value proposition of 1inch Coin and other cryptocurrencies. It provides insights into the market’s perception of a cryptocurrency’s potential and can serve as a helpful tool for investors and traders when making investment decisions.

Evaluating Market Cap

The market capitalization, or market cap, of a cryptocurrency is a crucial metric used to assess its value proposition. Market cap is calculated by multiplying the total supply of coins by the current market price per coin. It provides investors with a snapshot of the cryptocurrency’s total value in the market.

When evaluating market cap, it is important to consider both the absolute value and the relative value. The absolute market cap gives a sense of the cryptocurrency’s overall worth, while the relative market cap compares it to other cryptocurrencies in the market.

Absolute Market Cap

The absolute market cap of a cryptocurrency reflects its total value, essentially indicating its position in the crypto market. Coins with a high absolute market cap are generally considered more established and stable, as they have a larger user base and wider adoption. This can provide investors with confidence in the cryptocurrency’s long-term potential.

However, a high absolute market cap does not guarantee a good investment opportunity. It is essential to analyze other factors such as the cryptocurrency’s technology, team, and market demand before making investment decisions. A high absolute market cap could also indicate that the cryptocurrency is overvalued, making it a riskier investment.

Relative Market Cap

The relative market cap compares the market cap of a cryptocurrency to other cryptocurrencies in the market. It helps investors understand the cryptocurrency’s position in the competitive landscape. A cryptocurrency with a high relative market cap compared to its peers suggests that it is outperforming other cryptocurrencies in terms of market value.

However, evaluating relative market cap should not be the sole factor in making investment decisions. It is crucial to consider other fundamental and technical aspects of the cryptocurrency, such as its underlying technology, team, community support, and future growth potential.

In conclusion, market cap is an important metric for evaluating the value proposition of a cryptocurrency. However, it should be used in conjunction with other factors to make informed investment decisions. Understanding both the absolute and relative market cap can provide investors with a comprehensive analysis of the cryptocurrency’s potential and its position in the market.

Factors Influencing Market Cap

There are several factors that influence the market capitalization (market cap) of a cryptocurrency such as 1inch Coin. Understanding these factors is crucial for assessing the value proposition of a digital asset. The following are some key factors that can influence the market cap:

1. Supply and Circulation: The total supply of a cryptocurrency and the amount of it that is in circulation greatly affect its market cap. Generally, a higher supply or a higher percentage of the supply being in circulation tends to result in a higher market cap.

2. Adoption and Usage: The level of adoption and usage of a cryptocurrency plays a significant role in determining its market cap. If a digital asset is widely adopted and extensively used for various transactions, it is likely to have a higher market cap compared to a less adopted or used cryptocurrency.

3. Price and Trading Volume: The price and trading volume of a cryptocurrency also influence its market cap. A higher price and trading volume generally indicate higher demand for the digital asset, which can result in an increased market cap.

4. Utility and Functionality: The utility and functionality of a cryptocurrency can impact its market cap. If a digital asset offers unique features or serves a specific purpose that is valued by users, it may attract more investors and contribute to a higher market cap.

5. Market Sentiment and Investor Confidence: Market sentiment and investor confidence are crucial factors in determining the market cap of a cryptocurrency. Positive sentiment and high investor confidence can drive the demand for a digital asset, leading to an increase in its market cap.

It is important to note that these factors are interconnected and can influence each other. A comprehensive analysis of these factors is necessary to evaluate the value proposition and potential growth of 1inch Coin or any other cryptocurrency.

Supply and Demand Dynamics

Supply and demand dynamics play a crucial role in determining the value proposition of 1inch Coin. Understanding how supply and demand interact can provide valuable insights for investors and traders looking to assess the potential of this cryptocurrency.

The supply of 1inch Coin refers to the total number of coins that are currently in circulation or available for trading. This includes coins held by individuals, liquidity pools, and the development team. The total supply of 1inch Coin is finite and predetermined, which means that no additional coins can be created beyond the established cap.

On the other hand, demand for 1inch Coin represents the desire and willingness of investors and traders to acquire and hold the cryptocurrency. Factors such as the technology behind the coin, its utility, market sentiment, and overall market conditions can influence the demand for 1inch Coin.

When the demand for 1inch Coin exceeds its current supply, the price tends to increase due to limited availability. Conversely, when the supply exceeds the demand, the price may decrease as sellers look to offload their holdings.

The interplay between supply and demand creates a dynamic market environment for 1inch Coin. Understanding the factors that influence supply and demand can help investors make informed decisions and assess the value proposition of this cryptocurrency.

Factors such as partnerships, adoption by major exchanges, regulatory developments, and market trends can all influence the supply and demand dynamics of 1inch Coin. Additionally, factors that affect the overall cryptocurrency market, such as investor sentiment, technological advancements, and macroeconomic conditions, can also impact the supply and demand dynamics of 1inch Coin.

By closely monitoring the supply and demand dynamics of 1inch Coin, investors and traders can gain insights into the potential future value of the cryptocurrency. This understanding can guide investment strategies and help investors make informed decisions based on market conditions and trends.

Analyzing the 1inch Coin

The 1inch coin has gained significant attention in the cryptocurrency market due to its innovative approach and unique value proposition. In this section, we will dive into the various factors that make the 1inch coin an interesting investment option.

1. Market Cap: Market capitalization is an important metric to assess the value of a cryptocurrency. The market cap of the 1inch coin demonstrates its popularity and adoption in the market. As of [current date], the 1inch coin has a market cap of [market cap value], making it one of the top cryptocurrencies in the market.

2. Liquidity: Liquidity is crucial for any cryptocurrency project to succeed. The 1inch coin has a robust liquidity ecosystem, which ensures that users can easily buy and sell the coin without significant price slippage.

3. Decentralized Exchange (DEX) Aggregation: One of the key features of the 1inch coin is its integration with decentralized exchanges (DEXs). By aggregating liquidity from multiple DEXs, the 1inch coin provides users with the best possible trading experience, ensuring competitive pricing and minimal slippage.

4. Governance and Protocol Upgrades: The 1inch coin holders have the ability to participate in the governance of the 1inch protocol. This means that coin holders can propose and vote on protocol upgrades, ensuring the community’s active involvement in the project’s development and decision-making processes.

5. Team and Community: The success of any cryptocurrency project relies heavily on the team and the community backing it. The 1inch coin benefits from a talented team of developers, experienced advisors, and a vibrant community of supporters who actively contribute to the project’s growth and success.

In conclusion, the 1inch coin offers a compelling value proposition for investors and cryptocurrency enthusiasts. Its strong market cap, liquidity, integration with decentralized exchanges, governance features, and active community make it an attractive investment option in the ever-evolving crypto market.

Question-answer:

What is market cap and why is it important for assessing the value of 1inch Coin?

Market cap, or market capitalization, is a measure of the total value of a cryptocurrency. It is calculated by multiplying the current price of the coin by the total supply. Market cap is important for assessing the value of 1inch Coin because it gives investors an idea of the coin’s size and popularity in the market. A higher market cap generally indicates a more established and valuable coin, while a lower market cap may suggest a riskier investment.

How does the market cap of 1inch Coin compare to other cryptocurrencies?

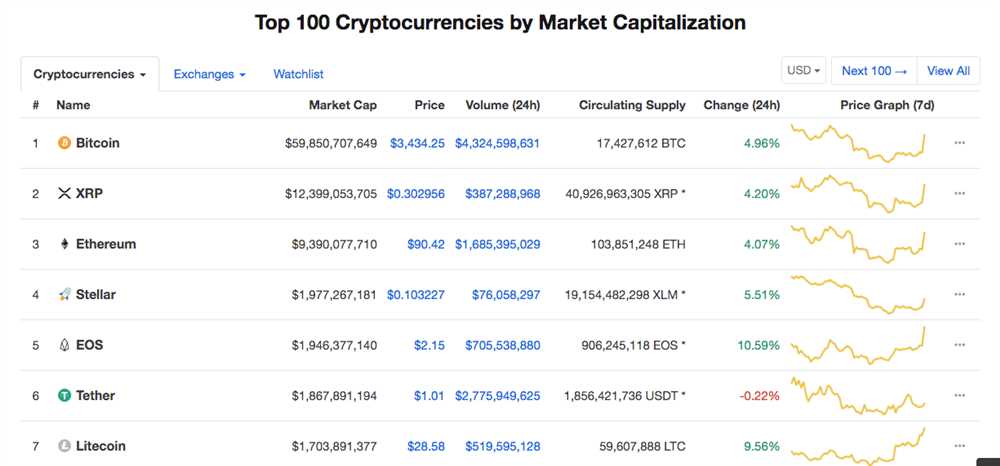

The market cap of 1inch Coin can vary over time, as it is influenced by factors such as price fluctuations and the circulating supply of the coin. It is important to compare the market cap of 1inch Coin to other cryptocurrencies in order to gain perspective on its value. While 1inch Coin may have a relatively smaller market cap compared to well-known cryptocurrencies like Bitcoin or Ethereum, it is still considered a significant player in the market and has the potential for growth.

Is the market cap of 1inch Coin a reliable indicator of its value?

While market cap can provide some insight into the value of a cryptocurrency like 1inch Coin, it should not be the sole factor considered when assessing its worth. Other factors, such as the team behind the project, the technology, and the overall market conditions, should also be taken into account. Market cap can be influenced by external factors and can fluctuate, so it is important to conduct thorough research before making any investment decisions.

What are some potential risks associated with investing in a cryptocurrency with a smaller market cap like 1inch Coin?

Investing in a cryptocurrency with a smaller market cap, like 1inch Coin, can carry certain risks. These risks can include higher price volatility, lower liquidity, and a higher potential for manipulation. Smaller market cap coins may also face challenges in gaining widespread adoption and attracting institutional investors. However, investing in a smaller market cap coin can also present opportunities for greater returns if the project is successful and gains traction in the market.

How can the market cap of 1inch Coin change over time?

The market cap of 1inch Coin can change over time due to factors such as price movements and changes in the circulating supply of the coin. If the price of 1inch Coin increases, the market cap will also increase. However, if the circulating supply increases significantly, it can dilute the market cap and potentially decrease its overall value. It is important to closely monitor these factors and stay updated on the latest developments in order to assess the potential changes in the market cap of 1inch Coin.