Understanding the Potential Risks Associated with Impermanent Loss while Staking on 1inch

With the rise of decentralized finance (DeFi), more and more investors are exploring opportunities to earn passive income through staking their tokens. One popular platform for staking is 1inch, a decentralized exchange aggregator that allows users to swap and stake their tokens. While staking can be a lucrative strategy, it’s important for investors to be aware of the risks involved, especially when it comes to impermanent loss.

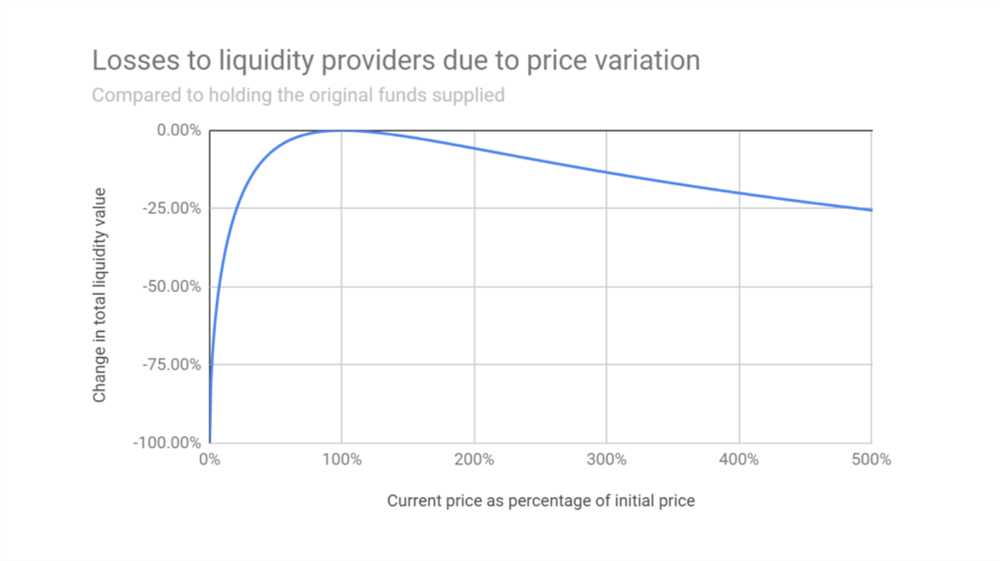

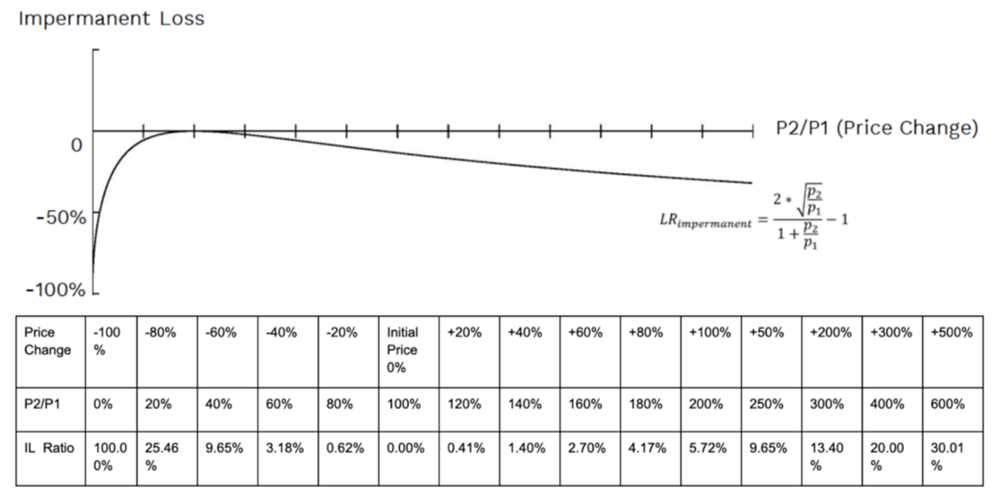

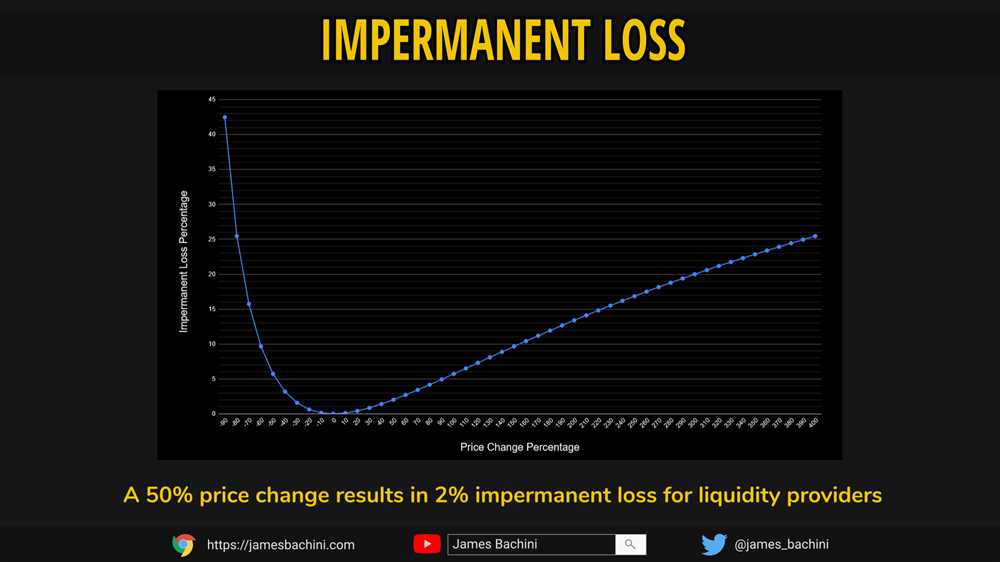

Impermanent loss occurs when the value of the tokens in a liquidity pool diverges from the value of the same tokens held individually. This can happen when the price of one token in the pool increases or decreases significantly compared to its initial value. As a result, when liquidity providers withdraw their tokens from the pool, they may receive fewer tokens than they initially deposited.

One of the main factors that contribute to impermanent loss is volatility. In the highly volatile crypto market, token prices can fluctuate rapidly, leading to potential losses for liquidity providers. Additionally, the higher the trading volume and liquidity in a pool, the lower the risk of impermanent loss. Therefore, investors must carefully consider the liquidity of the pool they plan to stake their tokens in.

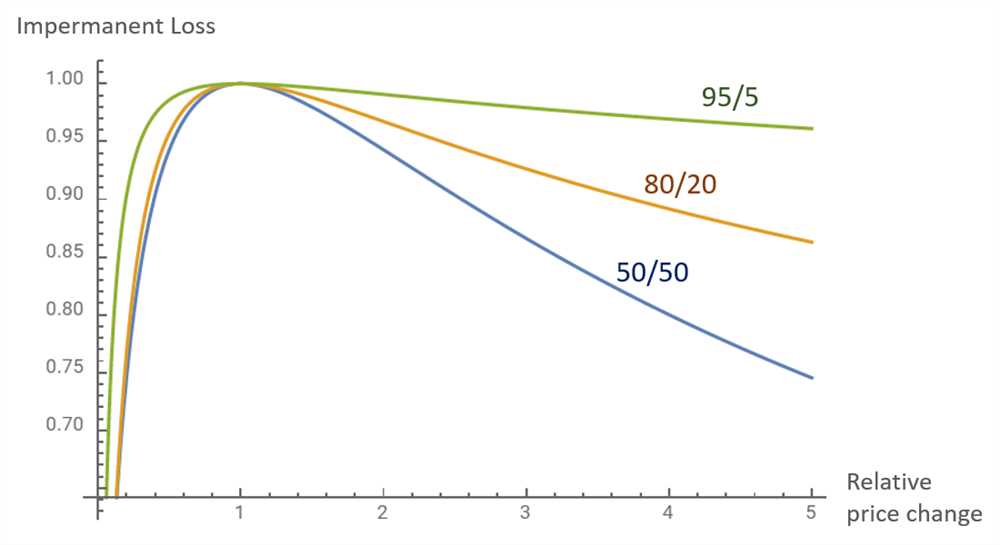

Another factor that can amplify impermanent loss is the ratio of the tokens in the pool. If the ratio between the two tokens is not balanced, the potential for losses increases. For example, if the ratio is heavily skewed towards one token and its price decreases, liquidity providers may suffer significant losses when they withdraw their funds. This highlights the importance of diversification and choosing pools with well-balanced token ratios.

In conclusion, while staking can be a profitable strategy, investors should be aware of the risks involved, particularly impermanent loss. By understanding the factors that contribute to impermanent loss and carefully choosing the pools they stake their tokens in, investors can minimize their exposure to potential losses and make more informed investment decisions.

The Risks of Impermanent Loss

Impermanent loss is a concept that all liquidity providers should be familiar with. When providing liquidity to a decentralized exchange like 1inch, there is always a risk of impermanent loss occurring. This risk arises due to the volatility of the assets being provided as liquidity.

Impermanent loss occurs when the price of the provided assets changes while they are locked in a liquidity pool. If the price of one asset increases significantly compared to the other, liquidity providers may experience a loss when they withdraw their funds.

Understanding Impermanent Loss

To understand impermanent loss, let’s consider an example. Imagine you provide liquidity by depositing equal amounts of ETH and DAI into a liquidity pool. The price of ETH increases while your assets are locked in the pool. When you decide to withdraw your assets, you will receive less ETH and more DAI compared to your initial deposit. This loss in value is known as impermanent loss.

It’s important to note that impermanent loss is “impermanent” because it only becomes realized if you decide to withdraw your funds. If the price of the assets returns to their initial value, the loss disappears. However, if the price difference remains, the loss becomes permanent.

Minimizing Impermanent Loss

While impermanent loss cannot be completely avoided, there are strategies to minimize its impact. One approach is to carefully choose the assets you provide as liquidity. Ideally, you want to provide assets that have a similar price movement to minimize the risk of significant price differences.

Another strategy is to consider the fee rewards from providing liquidity. If the rewards from fees outweigh the potential impermanent loss, it may still be profitable to provide liquidity.

Additionally, regularly monitoring the liquidity pool and rebalancing your assets can help minimize impermanent loss. By adjusting your asset ratio based on the current market conditions, you can capitalize on price movements and minimize losses.

However, it’s important to remember that impermanent loss is an inherent risk of providing liquidity, and it should be carefully considered before entering any liquidity pool. It’s crucial to do thorough research, assess the market conditions, and evaluate the potential risks and rewards before becoming a liquidity provider.

Understanding Impermanent Loss

Impermanent loss is a concept that often arises in the context of liquidity provision and yield farming. It refers to the potential loss of value that liquidity providers may experience when providing liquidity to a decentralized exchange or automated market maker.

When a liquidity provider deposits their funds into a liquidity pool, they typically deposit equal values of two tokens, such as ETH and a different ERC-20 token. The liquidity provider receives pool tokens in return, which represent their share of the liquidity pool. These pool tokens can then be used to withdraw the liquidity provider’s share of the total value in the pool.

However, impermanent loss can occur if the value of one of the tokens in the pool fluctuates significantly compared to the other token. This happens because liquidity providers always provide both tokens in equal values, regardless of their current market prices. If the value of one token increases, liquidity providers may end up receiving more of that token when they withdraw from the pool, leading to a loss in value compared to holding onto their tokens.

It is important to note that impermanent loss is temporary in nature and only materializes when liquidity providers decide to withdraw their funds from the pool. If they choose to keep their funds in the pool for an extended period, they may still benefit from the trading fees generated by the pool and any potential price changes.

Furthermore, impermanent loss is more pronounced when the volatility between the two tokens in the pool increases. Liquidity providers should be aware of this risk and weigh it against the potential rewards from providing liquidity. It is also important to diversify one’s liquidity provision across different pools and platforms to mitigate the impact of impermanent loss.

In summary, impermanent loss is the potential loss of value that liquidity providers may experience when providing liquidity to a decentralized exchange. It arises from the fluctuation in the value of tokens in the pool and can be mitigated by diversifying one’s liquidity provision and understanding the risks involved.

The Impact of Impermanent Loss on 1inch Staking

Impermanent loss is a phenomenon that can significantly affect the profitability of liquidity providers on decentralized exchanges. While staking on 1inch can be a lucrative way to earn passive income, it is essential to understand the potential risks associated with impermanent loss.

When you provide liquidity to the 1inch decentralized exchange, your funds are used to facilitate trades between different tokens. As the market prices of these tokens fluctuate, the value of your liquidity pool tokens may also change. This is where impermanent loss comes into play.

Impermanent loss occurs when the value of the tokens in the liquidity pool diverges from the value of the same tokens when held individually. This can happen due to price volatility and the way liquidity pools work. When the value of one token in the pool increases, the liquidity provider’s share of that token decreases, resulting in a loss.

The impact of impermanent loss on 1inch staking can be significant. If the value of one token in the liquidity pool increases significantly, the liquidity provider may experience a loss compared to holding the tokens individually. This loss is called “impermanent” because it can be reversed if the market conditions change.

Minimizing Impermanent Loss on 1inch

While impermanent loss is an inherent risk of liquidity provision, there are strategies that liquidity providers can employ to minimize its impact.

- Diversify your liquidity across different pools and tokens. By spreading your funds across various liquidity pools, you can minimize the risk of a significant loss in one particular pool.

- Consider the volatility of the tokens you are providing liquidity for. Tokens with high volatility are more likely to experience impermanent loss, so it’s crucial to assess the risks before staking.

- Regularly monitor your liquidity pools and adjust them based on market conditions. If you notice significant changes in the value of the tokens in the pool, consider rebalancing your liquidity to minimize loss.

It is also important to remember that impermanent loss is just one factor that affects the profitability of staking on 1inch. Factors such as transaction fees, trading volume, and incentives can also impact your overall earnings as a liquidity provider.

By understanding and managing the risks associated with impermanent loss, liquidity providers can make informed decisions and maximize their potential earnings on 1inch staking.

Strategies to Mitigate Impermanent Loss

Impermanent loss is a common risk faced by liquidity providers in decentralized exchanges like the 1inch platform. However, there are several strategies that can be employed to mitigate this risk and maximize returns:

1. Diversify the Investment: One way to mitigate impermanent loss is to diversify the investment across multiple liquidity pools. By spreading the investment across different assets and pools, the impact of impermanent loss can be minimized. This strategy helps in reducing the exposure to a single asset’s volatility, thereby reducing the chances of a significant loss.

2. Monitor the Market: Keeping a close eye on the market is crucial for liquidity providers. By monitoring the price movements of the assets in the pool, providers can make informed decisions about when to enter or exit a pool. This allows providers to avoid entering a pool when there is a high likelihood of impermanent loss due to a sudden price swing.

3. Use Stablecoins: Another strategy to mitigate impermanent loss is to provide liquidity using stablecoins. Stablecoins are pegged to a stable asset like the US dollar, which means their value remains relatively stable. By using stablecoins, liquidity providers can avoid the volatility of other assets and minimize the chances of impermanent loss.

4. Consider the Fees: It is essential to consider the fees associated with providing liquidity on the platform. Higher fees can eat into the potential returns and increase the risk of impermanent loss. By carefully evaluating the fees and comparing them across different pools, liquidity providers can choose pools with lower fees, thereby reducing the impact of impermanent loss.

5. Stay Informed: The cryptocurrency market is highly dynamic and often subject to sudden changes. Staying informed about the latest market trends, news, and developments is crucial for liquidity providers. By staying updated, providers can anticipate potential market movements and make proactive decisions to mitigate impermanent loss.

6. Determine an Exit Strategy: Having a well-defined exit strategy is essential to minimize impermanent loss. Providers should set a predetermined threshold for when they will exit a pool, based on factors like the liquidity pool’s performance, market conditions, and other external factors. By having a clear exit strategy, liquidity providers can limit their exposure to impermanent loss and protect their investments.

Overall, impermanent loss can pose significant risks to liquidity providers, but by employing these strategies, providers can mitigate the impact and maximize their returns.

Question-answer:

What is impermanent loss in 1inch staking?

Impermanent loss is a phenomenon that occurs when providing liquidity in decentralized exchanges like 1inch. It refers to the potential loss of value that liquidity providers may experience due to the volatility of the traded assets. When the price of the assets in the liquidity pool changes significantly, the value of the provided liquidity may decrease, resulting in impermanent loss.

How does impermanent loss occur in 1inch staking?

In 1inch staking, impermanent loss occurs when the price of the assets in the liquidity pool changes. When a liquidity provider deposits assets into the pool, they receive liquidity pool tokens proportional to their share of the pool. If the price of one asset increases significantly compared to the other, the liquidity provider may experience impermanent loss when withdrawing their liquidity, as the value of the assets in the pool may have changed during their time of staking.

Can impermanent loss be avoided in 1inch staking?

Impermanent loss cannot be completely avoided in 1inch staking or any other decentralized exchange. However, there are strategies that liquidity providers can utilize to mitigate the impact of impermanent loss, such as providing liquidity for assets with a more stable price correlation, choosing pools with lower volatility, and carefully monitoring market conditions.

What are the risks of impermanent loss in 1inch staking?

The risks of impermanent loss in 1inch staking include potential financial loss for liquidity providers if the price of the assets in the liquidity pool fluctuates significantly. Liquidity providers may end up with a lower value of assets when withdrawing their liquidity compared to the initial deposit. This risk is inherent to providing liquidity in decentralized exchanges like 1inch and should be carefully considered before staking.