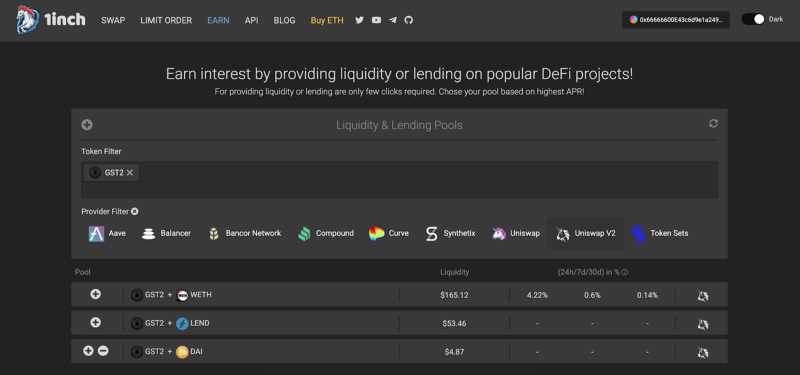

Market making is a crucial function in the 1inch Protocol, ensuring liquidity and efficiency in decentralized exchanges.

1inch Protocol, powered by smart contracts, allows users to access multiple decentralized exchanges through a single interface. This innovative technology leverages market making to optimize trades and provide users with the best possible prices.

Market makers play a vital role in maintaining liquidity by constantly providing buy and sell orders on decentralized exchanges. By doing so, they bridge the gap between buyers and sellers, facilitating smooth transactions and reducing slippage.

The 1inch Protocol incentivizes market makers by rewarding them with fees generated from trades. This creates a mutually beneficial ecosystem where market makers contribute to the efficient functioning of decentralized exchanges and are compensated for their services.

With market making at its core, the 1inch Protocol revolutionizes decentralized trading by offering users a seamless experience, improved liquidity, and access to the best prices across different exchanges.

Benefits of Market Making

Market making plays a crucial role in the 1inch Protocol and offers several benefits for traders and liquidity providers:

- Tight Spreads: Market making helps to maintain tight spreads between buy and sell orders, ensuring that traders can execute their trades at favorable prices.

- Liquidity: By providing liquidity to the market, market makers ensure that there is always sufficient supply and demand for trading assets. This enhances the overall trading experience for all participants.

- Reduced Slippage: Market making helps to reduce slippage, which is the difference between the expected price of a trade and the actual executed price. By ensuring liquidity and tight spreads, market makers minimize the risk of slippage for traders.

- Increased Efficiency: Efficient markets are characterized by reduced transaction costs and improved price discovery. Market making contributes to the overall efficiency of the market by facilitating smooth order execution and enabling fair price formation.

- Stability: Market makers provide stability to the market by continuously providing liquidity and minimizing price fluctuations. This stability attracts more traders and market participants, further enhancing market depth and liquidity.

- Economic Incentives: Market makers are rewarded with trading fees and incentives for their participation in the market. This provides additional income opportunities for liquidity providers and incentivizes them to actively contribute to the market.

In conclusion, market making plays a vital role in the 1inch Protocol by providing several benefits such as tight spreads, liquidity, reduced slippage, increased efficiency, stability, and economic incentives. These benefits contribute to a vibrant and efficient trading ecosystem that benefits all participants.

Market Making Strategies

Market making is an essential component of the 1inch Protocol, as it ensures the liquidity and efficiency of the platform. Market makers play a crucial role in maintaining a balanced order book and facilitating smooth trading on the platform.

Liquidation Strategies

One of the primary strategies employed by market makers is liquidation. Liquidation involves providing liquidity to the market by creating a marketable order book, ensuring that there are enough buy and sell orders to match the demand of traders. Market makers constantly monitor the market and adjust their order book to maintain a fair and competitive pricing for the assets being traded.

Spreading is another technique used by market makers. It involves placing orders at different price levels to maintain a spread, which represents the difference between the bid and ask prices. By spreading their orders across multiple price levels, market makers increase liquidity and minimize slippage for traders.

Risk Management Strategies

Risk management is an integral part of market making strategies. A well-designed risk management framework allows market makers to protect themselves from potential losses and mitigate market risks.

Momentum trading is a popular risk management strategy used by market makers. It involves taking advantage of short-term price movements to generate profits. Market makers closely monitor the market and identify potential price trends, allowing them to make informed trading decisions and maximize their profitability.

In addition to momentum trading, market makers employ various other risk management strategies such as portfolio diversification, hedging, and limit orders to minimize their exposure to market volatility and protect their capital.

Question-answer:

What is 1inch Protocol?

1inch Protocol is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges (DEXs). Using 1inch, users can get the best possible trading rates for their crypto assets.

How does market making work in 1inch Protocol?

Market making in 1inch Protocol involves the creation of liquidity pools on decentralized exchanges. These pools ensure that there is enough liquidity available for users to trade their crypto assets. Market makers provide their assets to these pools and earn fees for their services.