Decentralized Finance (DeFi) has emerged as a transformative force in the world of finance, providing users with unprecedented access to financial services and opportunities for wealth creation. One of the key players in this space is 1inch, a decentralized exchange aggregator and liquidity protocol that has been at the forefront of innovation in DeFi.

1inch’s multi-chain strategy is poised to explore new frontiers and unlock countless possibilities for DeFi users. By leveraging the power of multiple blockchains, 1inch aims to provide seamless cross-chain transactions, increase liquidity, and enhance user experience.

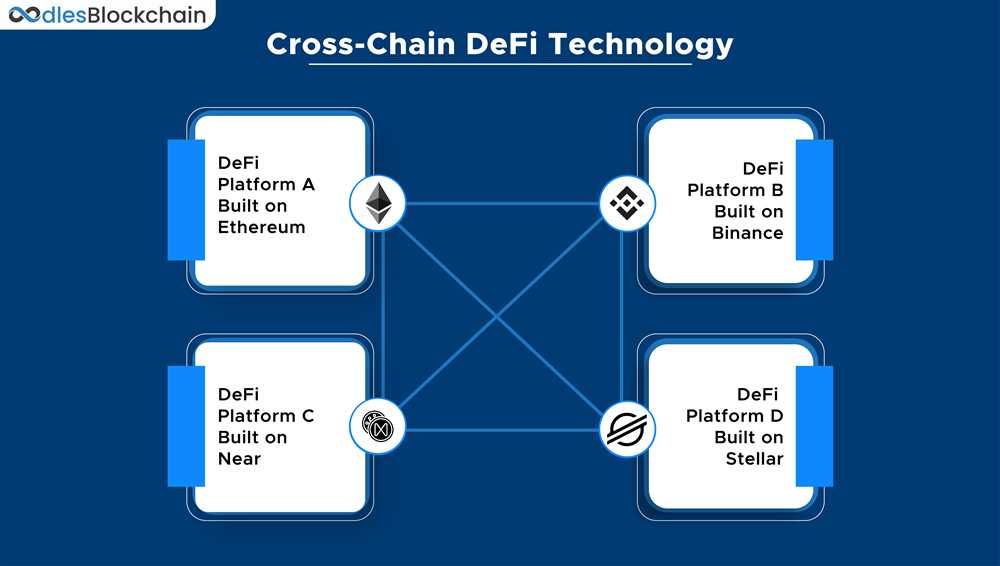

With the rapid growth of the DeFi ecosystem, interoperability has become a pressing challenge. 1inch tackles this challenge head-on by connecting different blockchains and allowing users to seamlessly move assets across protocols. This multi-chain approach not only opens up new opportunities for traders and liquidity providers but also enhances the overall stability and resilience of the DeFi ecosystem.

Furthermore, 1inch’s multi-chain strategy enables users to tap into the unique advantages offered by different blockchains. Whether it’s the scalability of Ethereum, the low fees of Binance Smart Chain, or the privacy features of Polkadot, 1inch aims to provide users with the best of all worlds. By integrating multiple chains, 1inch creates a diverse and flexible DeFi ecosystem that can adapt to changing market conditions and user preferences.

1inch’s Approach to DeFi Expansion

1inch, a leading decentralized exchange aggregator in the DeFi space, is taking a multi-chain approach to expand its services and reach more users. With the rising popularity of alternative blockchain networks and layer 2 solutions, 1inch aims to provide seamless access to DeFi assets and liquidity across different chains.

Identifying Opportunities

1inch recognizes that the future of DeFi lies in interoperability and cross-chain solutions. By connecting different blockchain networks, users can easily access decentralized finance services and assets without being limited to a single platform. 1inch closely monitors the evolving blockchain landscape to identify new opportunities for expansion and integration.

By tracking the development of blockchain protocols and understanding their capabilities, 1inch can strategically decide which networks to integrate with and offer their users enhanced DeFi experiences. This approach allows 1inch to adapt to the changing market demands and stay at the forefront of the industry.

Expanding Integration

1inch has already made significant progress in expanding its integration across different chains. They have successfully integrated with Ethereum, Binance Smart Chain, Polygon, and other popular networks. This enables users to trade on multiple platforms and take advantage of the best prices and liquidity available.

Furthermore, 1inch plans to continue expanding its multi-chain strategy by adding support for additional networks. By doing so, they aim to provide users with even more options when it comes to accessing and utilizing DeFi assets. This approach aligns with their mission to democratize access to decentralized finance and make it accessible to a wider audience.

The Power of Aggregation

1inch’s approach to DeFi expansion is fueled by its powerful aggregation algorithm, which brings together liquidity from various sources to provide users with the best possible prices. By tapping into multiple chains, 1inch ensures that users can access the most competitive rates across different networks.

Moreover, 1inch’s aggregation algorithm takes into account factors such as gas fees and slippage to optimize trade execution and minimize costs for users. This makes trading on 1inch not only seamless but also cost-efficient, enhancing the overall user experience.

In conclusion, 1inch’s multi-chain strategy allows them to stay ahead of the game in the rapidly evolving DeFi landscape. By expanding their integration across different chains and leveraging their powerful aggregation algorithm, 1inch is well-positioned to bring decentralized finance to the masses.

Understanding the Future of DeFi

Decentralized Finance (DeFi) has emerged as one of the most promising and disruptive fields in the blockchain industry. It aims to revolutionize traditional financial systems by replacing intermediaries with smart contracts and providing open, transparent, and permissionless access to financial services.

DeFi applications are built on blockchain networks like Ethereum, which enable the creation of programmable money and decentralized applications (DApps). These applications offer a wide range of financial services such as lending, borrowing, trading, and yield farming.

One of the key features of DeFi is its ability to enable peer-to-peer transactions without the need for a trusted third party. Smart contracts automatically execute transactions based on predefined conditions, eliminating the need for intermediaries like banks or brokers.

This decentralized nature of DeFi also brings several advantages. It reduces the risk of censorship and fraud, as transactions are recorded on a public blockchain and cannot be altered retroactively. It also allows individuals to have complete control over their funds and financial activities.

However, DeFi is still in its early stages, and there are several challenges that need to be addressed for mainstream adoption. Scalability, usability, and security are some of the key areas that require further development and innovation.

1inch’s multi-chain strategy aims to tackle some of these challenges by expanding its platform to multiple blockchain networks. This allows users to access a wider range of DeFi services across different networks, while also benefiting from improved scalability and lower transaction fees.

The future of DeFi is promising, with the potential to disrupt traditional financial systems and empower individuals to have more control over their finances. As the industry continues to evolve and mature, we can expect to see more innovative solutions and widespread adoption of DeFi applications.

Overall, understanding the future of DeFi requires recognizing its potential to transform financial systems, addressing the current challenges, and embracing new technologies and strategies that enable its growth. With the right developments and advancements, DeFi has the power to reshape the way we interact with money and financial services.

Multi-Chain Strategy for DeFi Growth

The emergence of decentralized finance (DeFi) has revolutionized the traditional financial system by offering transparent, secure, and accessible financial services to anyone with an internet connection. As DeFi continues to gain mainstream adoption, scalability and interoperability have become key challenges for the industry.

1inch, a leading decentralized exchange aggregator, has recognized the importance of addressing these challenges and has developed a multi-chain strategy to drive the growth of DeFi. By leveraging multiple blockchain networks, 1inch aims to overcome the scalability limitations of Ethereum and improve the overall user experience.

One of the key components of 1inch’s multi-chain strategy is cross-chain integration. By connecting different blockchain networks, such as Ethereum, Binance Smart Chain, and Polygon, 1inch enables users to access a wider range of DeFi protocols and liquidity pools. This not only increases the options available to users but also fosters greater liquidity and trading volume across different chains.

In addition to cross-chain integration, 1inch also focuses on optimizing transaction costs and speed. By strategically routing transactions through the most cost-effective and efficient blockchain networks, 1inch reduces gas fees and minimizes transaction times. This not only benefits users by making DeFi more affordable and accessible but also promotes the growth of the ecosystem by attracting more participants.

Furthermore, 1inch is actively working on building bridges between different blockchain networks, enabling seamless asset transfers and interoperability. This will allow users to transfer their assets across different chains without the need for complicated and time-consuming processes. Interoperability is crucial for the growth of DeFi, as it ensures that users can access the best opportunities and services, regardless of the blockchain network they are using.

With its multi-chain strategy, 1inch aims to create a decentralized financial ecosystem that is scalable, interoperable, and user-friendly. By addressing the scalability and interoperability challenges of DeFi, 1inch is paving the way for the widespread adoption of decentralized finance and unlocking its full potential.

In conclusion, 1inch’s multi-chain strategy is a game-changer for the DeFi industry. By leveraging the strengths of multiple blockchain networks and addressing key challenges, such as scalability and interoperability, 1inch is driving the growth of DeFi and shaping the future of finance.

Expanding the Reach with Multiple Chains

As the decentralized finance (DeFi) ecosystem continues to grow rapidly, the need for interoperability across different blockchain networks becomes increasingly important. 1inch, a leading decentralized exchange aggregator, recognizes this need and has developed a multi-chain strategy to expand its reach and provide users with access to a wider range of assets and liquidity.

By integrating with multiple chains, such as Ethereum, Binance Smart Chain, and Polygon, 1inch is able to offer its users greater flexibility and choice when it comes to trading and accessing decentralized applications (DApps). This multi-chain approach also helps to mitigate issues such as high gas fees and network congestion, which can often hinder the user experience on a single chain.

One of the key advantages of 1inch’s multi-chain strategy is the ability to tap into different liquidity pools across various chains. This allows users to find the best prices for their trades and ensures that they are getting the most out of their assets. By aggregating liquidity from different sources, 1inch is able to provide users with the best possible trading experience and maximize their returns.

Furthermore, by expanding its reach to multiple chains, 1inch is able to attract a larger user base and tap into new markets. Each chain has its own unique set of users and projects, and by supporting multiple chains, 1inch is able to cater to a diverse range of users and their specific needs.

To facilitate seamless cross-chain transactions, 1inch utilizes its proprietary Pathfinder algorithm, which carefully selects the most efficient route for each trade, taking into account factors such as liquidity and fees. This ensures that users are able to execute their trades quickly and at the best possible prices, regardless of the chain they are using.

| Chain | Advantages |

|---|---|

| Ethereum | High liquidity, large user base, extensive DeFi ecosystem. |

| Binance Smart Chain | Low fees, fast transactions, growing DeFi ecosystem. |

| Polygon | Scalability, low fees, interoperability with Ethereum. |

In conclusion, 1inch’s multi-chain strategy is a testament to the growing importance of interoperability in the DeFi space. By expanding its reach to multiple chains, 1inch is able to provide users with greater flexibility, access to a wider range of assets, and an enhanced trading experience. As the DeFi ecosystem continues to evolve, the ability to seamlessly interact with different chains will become paramount, and 1inch is well-positioned to lead the way in this regard.

Benefits of Being a Multi-Chain Platform

As the decentralized finance (DeFi) space continues to grow and develop, being a multi-chain platform comes with a multitude of benefits. Here are a few advantages of embracing a multi-chain strategy:

1. Enhanced Liquidity

By operating on multiple chains, a platform like 1inch can tap into pools of liquidity across different networks. This allows users to access a wider range of assets and trade with greater ease.

2. Diversified Opportunities

Supporting multiple chains opens up a world of opportunities for users. They can participate in different ecosystems, leverage unique features of each network, and explore a variety of yield farming and staking options.

Moreover, being a multi-chain platform means that users are not limited to a single blockchain’s limitations or scalability issues. They can switch between chains to find the most cost-effective transactions or take advantage of high-yield opportunities.

3. Reduced Fees and Slippage

With multiple chains, users have the flexibility to compare fees and choose the most cost-effective option. They can also analyze slippage and optimize their trading strategies to minimize losses.

Furthermore, by integrating with various chains, a multi-chain platform can distribute user activity across networks, potentially reducing congestion and lowering transaction costs.

4. Enhanced Security and Resilience

A multi-chain platform provides an additional layer of security and resilience. In the event of a network outage or vulnerability, users can quickly switch to another supported chain, ensuring uninterrupted access to their funds and services.

Additionally, when one chain experiences congestion or high gas fees, users can seamlessly shift to another chain to continue their activities without delays or extra expenses.

5. Increased User Base and Adoption

Being a multi-chain platform makes it easier to attract users from different blockchain communities. This leads to a larger user base and increased adoption of the platform. It also encourages cross-chain collaborations and partnerships, further expanding the platform’s reach and impact.

Ultimately, being a multi-chain platform allows for greater flexibility, scalability, and accessibility in the DeFi ecosystem. It opens up a world of opportunities for users and contributes to the growth and development of the decentralized finance space as a whole.

Leveraging Technology for DeFi Success

The future of decentralized finance (DeFi) is bright, attracting a wide range of investors and users who are eager to take advantage of the many benefits it offers. However, to truly unlock the full potential of DeFi, it is crucial to leverage technology effectively.

Automation and Efficiency

One of the key advantages of DeFi is its ability to automate financial processes and remove the need for intermediaries. By leveraging smart contracts and blockchain technology, DeFi platforms can offer fast and efficient transactions, reducing costs and increasing accessibility. This automation not only saves time but also eliminates the potential for human error, ensuring greater accuracy and reliability.

Interoperability and Multi-Chain Approach

Another important aspect of leveraging technology for DeFi success is the ability to achieve interoperability and a multi-chain approach. DeFi platforms like 1inch recognize the importance of connecting different blockchains and enabling seamless transactions across various networks. This allows users to access a wider range of assets and liquidity, increasing the overall efficiency and effectiveness of DeFi protocols.

By leveraging technology to connect different chains, DeFi platforms can also mitigate the risks associated with relying on a single network. This helps to decentralize the financial ecosystem and provides users with more options and flexibility.

Security and Auditing

Security is a paramount concern in the DeFi space, given the value of assets involved. Leveraging technology allows DeFi platforms to implement robust security measures, such as encryption, multi-factor authentication, and cold storage solutions. Additionally, auditing tools and blockchain transparency enable users to verify the integrity of transactions and ensure compliance with regulations.

Overall, leveraging technology is crucial for the success of DeFi. By embracing automation, interoperability, and enhanced security measures, DeFi platforms can provide users with a more efficient, accessible, and secure financial ecosystem.

Question-answer:

What is 1inch’s multi-chain strategy?

1inch’s multi-chain strategy is an approach where they aim to expand their decentralized finance (DeFi) platform to multiple blockchains, allowing users to access various DeFi protocols and services across different networks.

Why is 1inch pursuing a multi-chain strategy?

1inch is pursuing a multi-chain strategy to provide users with more options and opportunities in the DeFi space. By expanding to multiple blockchains, 1inch can tap into different ecosystems and cater to a wider range of users, enhancing the overall accessibility and convenience of their platform.

Which cryptocurrencies can be traded on 1inch’s multi-chain platform?

1inch’s multi-chain platform supports a wide range of cryptocurrencies, including popular ones like Bitcoin, Ethereum, and Binance Coin, as well as numerous other tokens from various blockchain networks.

How does 1inch ensure the security of its multi-chain platform?

1inch implements various security measures, including audits and rigorous testing of smart contracts, to ensure the security of its multi-chain platform. They also collaborate with top security firms to identify and address any potential vulnerabilities in their system.

What are the benefits of using 1inch’s multi-chain platform?

Using 1inch’s multi-chain platform offers several benefits. Users gain access to a broader range of DeFi protocols and services across multiple blockchains, allowing for greater liquidity and opportunities for trading and yield farming. Additionally, 1inch’s aggregation and optimization algorithms help users find the best prices and minimize slippage, leading to improved trading efficiency.