Decentralized finance (DeFi) has gained tremendous popularity in recent years, with its promise of providing financial services without intermediaries. Within the DeFi ecosystem, decentralized exchanges (DEXs) have emerged as platforms where users can trade cryptocurrencies directly from their wallets. One such DEX is the 1inch Exchange App, which uses an innovative approach to ensure the best available prices and low slippage for its users.

At the heart of the 1inch Exchange App is the concept of liquidity providers. Liquidity providers are individuals or entities that deposit their digital assets into a liquidity pool, allowing users to make trades on the exchange. By doing so, liquidity providers earn fees in return for providing liquidity to the market.

However, being a liquidity provider on the 1inch Exchange App involves certain risks and responsibilities. For instance, liquidity providers need to ensure that they have sufficient funds to cover any potential losses due to impermanent loss, a phenomenon that occurs when the price of the deposited assets changes significantly. To mitigate this risk, liquidity providers need to carefully assess the market conditions and choose the appropriate assets to deposit.

The role of liquidity providers cannot be overstated in the success of the 1inch Exchange App. They play a crucial role in maintaining the overall liquidity and efficiency of the exchange. Without liquidity providers, the exchange would lack depth in the order book and users would experience significant slippage while trading.

In conclusion, liquidity providers are the backbone of the 1inch Exchange App. They provide the necessary liquidity for users to trade cryptocurrencies seamlessly and at competitive prices. By depositing their assets into the liquidity pool, liquidity providers contribute to the overall success and sustainability of the decentralized exchange ecosystem.

The Importance of Liquidity Providers

Liquidity providers play a crucial role in the functioning of decentralized exchanges like the 1inch Exchange App. They contribute essential liquidity to the various trading pairs available on the platform, ensuring that there are enough tokens available for users to buy or sell at any given time.

Without liquidity providers, the 1inch Exchange App would not be able to offer a seamless trading experience. Liquidity providers provide the necessary depth to the order books, allowing users to execute their trades quickly and at a fair price. This is especially important in volatile markets where prices can change rapidly.

By offering their tokens to the exchange in the form of liquidity, providers are helping to create a more efficient market. They do this by participating in yield farming and earning fees from the transactions that occur on the exchange. In return, they receive rewards in the form of tokens or other incentives, which can help them grow their portfolios.

Additionally, liquidity providers help to stabilize the prices of tokens on decentralized exchanges. When there is a significant buy or sell order, liquidity providers step in to absorb the impact and prevent price slippage. This ensures that users can trade with minimal market impact, providing a smooth experience for all parties involved.

Furthermore, liquidity providers are essential for the growth and adoption of decentralized finance (DeFi). By providing liquidity to exchanges like the 1inch Exchange App, they attract more users to the platform, increasing trading volumes and liquidity pools. This in turn attracts more liquidity providers, creating a positive cycle of growth and adoption.

In conclusion, liquidity providers play a vital role in the success and operation of decentralized exchanges like the 1inch Exchange App. Their contributions provide essential liquidity, stability, and efficiency to the platform, enabling users to trade seamlessly and at fair prices. Their presence is crucial for the growth and adoption of DeFi as a whole, making them integral players in the crypto ecosystem.

Understanding the Role of Liquidity Providers on the 1inch Exchange App

Liquidity providers play a crucial role in the functioning of the decentralized exchange platform, 1inch Exchange App. They are the individuals or entities that supply liquidity to the exchange by depositing their assets into liquidity pools.

1inch Exchange App operates on the principle of decentralized finance (DeFi), where trading is made directly between users and there is no reliance on intermediaries. Liquidity providers enable this by depositing their assets into smart contracts, which are then utilized to facilitate trades on the platform.

How Liquidity Provision Works

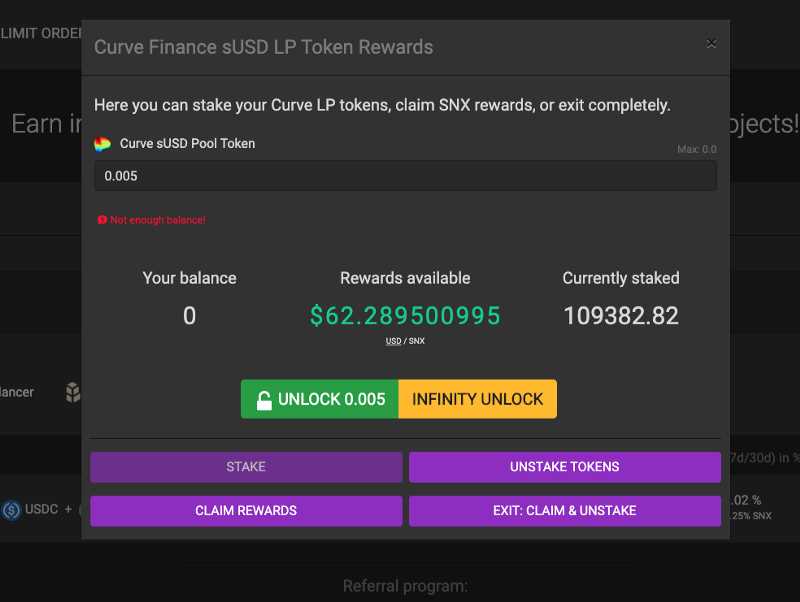

When a liquidity provider deposits their assets into the 1inch Exchange App, they receive liquidity tokens representing their share in the liquidity pool. These tokens can be redeemed by the provider at any time, along with their proportionate share of the fees generated by the trading activity.

The liquidity providers essentially act as market makers on the exchange app, ensuring that there is sufficient liquidity available for traders to execute their trades. By providing assets to the liquidity pools, they help to minimize slippage and maintain competitive prices for the trading pairs.

Risks and Rewards for Liquidity Providers

While liquidity providers play a vital role in the efficient functioning of the exchange, there are risks involved. One of the main risks is impermanent loss, which occurs when the price of the deposited assets changes significantly compared to the time of deposit. This can result in a loss of value for the liquidity provider.

However, liquidity provision also offers potential rewards in the form of fees generated from trading activity. As more users trade on the platform, the fees collected increase, benefiting the liquidity providers proportionately.

Additionally, some platforms, including 1inch Exchange App, offer incentives in the form of yield farming or liquidity mining programs. These programs provide additional rewards to liquidity providers for depositing their assets into specific pools demanded by the platform.

Conclusion

Liquidity providers are essential participants in the 1inch Exchange App ecosystem. By supplying assets to liquidity pools, they enable efficient trading and contribute to the overall liquidity of the platform. However, liquidity provision comes with risks, such as impermanent loss, but can also offer rewards through trading fees and additional incentives offered by the platform.

The Benefits of Liquidity Providers for the 1inch Exchange App

Liquidity providers play a critical role in ensuring the smooth functioning of the 1inch Exchange app. By supplying liquidity to the platform, they enable users to trade assets seamlessly and at competitive prices.

1. Increased Trading Efficiency

Liquidity providers enhance the trading efficiency on the 1inch Exchange app. By offering a pool of assets, they ensure that there are always buyers and sellers available. This reduces the bid-ask spread and minimizes the slippage, allowing users to execute trades quickly and with minimal impact on the asset price.

2. Improved Asset Price Stability

Liquidity providers help maintain price stability on the 1inch Exchange app. By continuously supplying assets to the platform, they prevent sudden price fluctuations that can occur when there is a lack of liquidity. This stability is crucial for traders and investors who rely on accurate and consistent pricing to make informed decisions.

Moreover, liquidity providers contribute to reducing market manipulation by ensuring a fair and transparent trading environment. By offering liquidity, they discourage price manipulation attempts and create a more trustworthy marketplace for users.

3. Lower Transaction Costs

Having a diverse pool of liquidity providers on the 1inch Exchange app leads to lower transaction costs. With more liquidity available, users can execute larger trades without significantly impacting the market price. This reduces the slippage costs and allows traders to enjoy more favorable terms when buying or selling assets.

Conclusion:

Overall, liquidity providers are vital for the success of the 1inch Exchange app. By providing liquidity, they enhance trading efficiency, improve price stability, and lower transaction costs for users. Their role in creating a robust and reliable trading environment cannot be underestimated.

Question-answer:

Who are liquidity providers?

Liquidity providers, sometimes referred to as market makers, are individuals or entities that supply assets to a financial market, ensuring that there is enough liquidity for traders to buy and sell these assets. They do this by placing their assets into a liquidity pool, which is then used to facilitate trades on the platform.

How do liquidity providers benefit from supplying assets on the 1inch Exchange App?

Liquidity providers benefit from supplying assets on the 1inch Exchange App by earning transaction fees and receiving rewards in the form of the platform’s native token, 1inch. They also benefit from the potential price appreciation of the assets they have supplied, as increased trading volume on the platform can lead to increased demand for these assets.