Slippage is a term commonly used in the cryptocurrency trading world, referring to the difference between the expected price of a trade and the actual executed price. It is a phenomenon that can occur when trading large volumes of digital assets, particularly in decentralized exchanges (DEXs).

When a trader submits an order to a DEX, the trade is executed by interacting with various liquidity sources. However, due to the dynamic nature of the market and the time it takes to execute the trade, the price can change, resulting in slippage. Slippage can lead to unfavorable trade outcomes, as the trader may end up buying or selling at a different price than anticipated.

1inch is a decentralized exchange aggregator that is designed to minimize slippage and optimize trades for users. It achieves this by splitting a large trade across multiple DEXs and liquidity sources, thus increasing the chances of finding the best available price. Through its algorithm, 1inch analyzes the liquidity depths and prices on different platforms in real-time, providing users with the most efficient trading options.

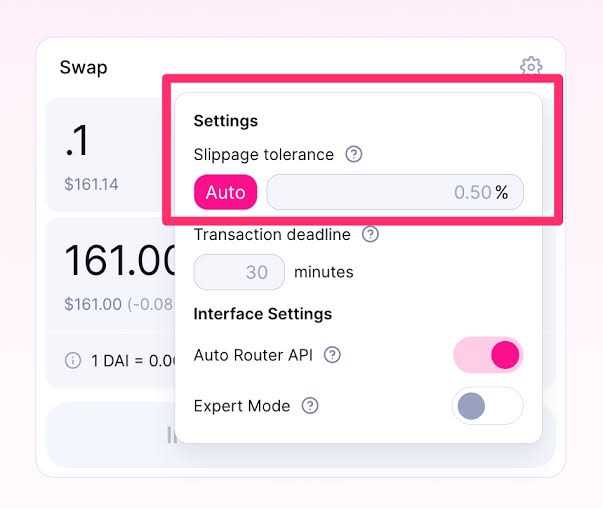

In addition to optimizing trades, 1inch also minimizes the impact of slippage by utilizing specific techniques. One such technique is called “virtual aggregation,” which involves executing a trade in smaller parts across different platforms in order to reduce the slippage impact. This approach allows 1inch to access the best liquidity pools for each trade, maximizing the chances of obtaining the desired price.

Overall, understanding slippage and its impact on trading is crucial for any cryptocurrency trader. By using platforms like 1inch that offer advanced algorithms and techniques to minimize slippage, traders can increase their chances of achieving the desired trade outcomes and maximizing their profits.

What is Slippage and How it Affects Your Trades on 1inch?

Slippage is a common occurrence in trading that refers to the difference between the expected price of a trade and the actual price at which the trade is executed. It is often caused by factors such as market volatility, low liquidity, and delays in transaction confirmation. Slippage can work both in favor of the trader or against them, resulting in either a better or worse price than initially anticipated.

When trading on 1inch, slippage can have a significant impact on the outcome of a trade. If the slippage is positive, it means that the trader can potentially get a better price than expected. However, if the slippage is negative, it can result in the trader paying a higher price than anticipated.

How does slippage affect trades on 1inch?

Slippage can affect trades on 1inch in multiple ways:

1. Price Impact: Slippage can influence the price impact of a trade. High slippage can result in a significant price impact, which means that the execution price will diverge further from the market price. This can be especially problematic for large trades as it can lead to substantial losses or missed opportunities.

2. Trading Costs: Slippage can also increase the trading costs on 1inch. When a trade is executed at a higher price than expected, the trader ends up paying more in transaction fees and other associated costs. This can erode the profitability of the trade, particularly for frequent traders or those making large transactions.

3. Risk Management: Slippage is also a risk factor that traders need to consider when using 1inch. Unexpected slippage can make it harder to manage risk effectively, as it can result in trades being executed at unfavorable prices. Traders need to account for slippage when setting their stop-loss or take-profit levels to avoid unexpected losses or missed profit opportunities.

How does 1inch minimize slippage?

1inch is a decentralized exchange aggregator that aims to minimize slippage for its users. It achieves this by splitting trades across multiple liquidity sources, including both decentralized and centralized exchanges. By doing so, 1inch can tap into a broader pool of liquidity, reducing the impact of slippage.

Additionally, 1inch’s Pathfinder algorithm optimizes the trading route taken by each transaction to further minimize slippage. This algorithm analyzes the available liquidity sources and selects the most efficient path for the trade, considering factors such as price, gas fees, and slippage. This helps ensure that trades on 1inch are executed at the best possible price, mitigating the impact of slippage on users.

In conclusion, slippage is an important consideration for traders on 1inch as it can significantly affect the outcome of their trades. However, 1inch employs various strategies to minimize slippage and provide its users with the best trading experience possible.

Understanding the Concept of Slippage

Slippage is a common occurrence in decentralized exchanges (DEXs) and refers to the difference between the expected price of a trade and the price at which the trade is actually executed. It happens because the price of a token can change rapidly in the time it takes for a transaction to be confirmed on the blockchain.

Slippage can have a significant impact on the efficiency and profitability of trades. If the slippage is high, it means that traders may end up paying more or receiving less than they expected for their tokens.

There are several factors that can contribute to slippage, including market volatility, liquidity, and order size. When the market is highly volatile, the prices can change rapidly, leading to larger slippage. Low liquidity can also cause slippage, as there may not be enough buy or sell orders to match a trader’s desired price.

1inch is a decentralized exchange aggregator that aims to minimize slippage by splitting a trade across multiple DEXs and liquidity sources. By spreading the trade across different platforms, 1inch can find the best available prices and reduce the impact of slippage.

Additionally, 1inch utilizes an algorithm that calculates the optimal distribution of a trade across different liquidity sources, taking into account parameters like gas fees, token prices, and liquidity depth. This algorithm helps to ensure that traders can get the most favorable execution price for their trades.

Overall, understanding the concept of slippage is crucial for traders in the decentralized finance (DeFi) space, as it can significantly affect the outcome of their trades. By utilizing platforms like 1inch, traders can minimize slippage and improve their trading strategies.

The Risks and Challenges of Slippage in Trading

Slippage is a common occurrence in trading and refers to the difference between the expected price of a trade and the actual price at which the trade is executed. It can occur in any financial market, including stocks, cryptocurrencies, and forex.

One of the main risks of slippage is that it can result in unexpected losses for traders. When slippage occurs, it means that the trade is not executed at the desired price, which can lead to a worse fill price than anticipated. This can be especially problematic for traders who rely on precise entry and exit points for their trading strategies.

Another challenge of slippage is that it can impact the overall profitability of a trading strategy. Even if a trader correctly predicts the direction of a trade, slippage can eat into potential profits and reduce overall returns. This is particularly true for high-frequency traders who rely on executing large volumes of trades quickly.

Slippage can also be affected by market volatility. During periods of high volatility, such as news events or market shocks, the liquidity in the market can dry up, leading to wider spreads and increased slippage. This can make it even more challenging for traders to execute trades at their desired prices.

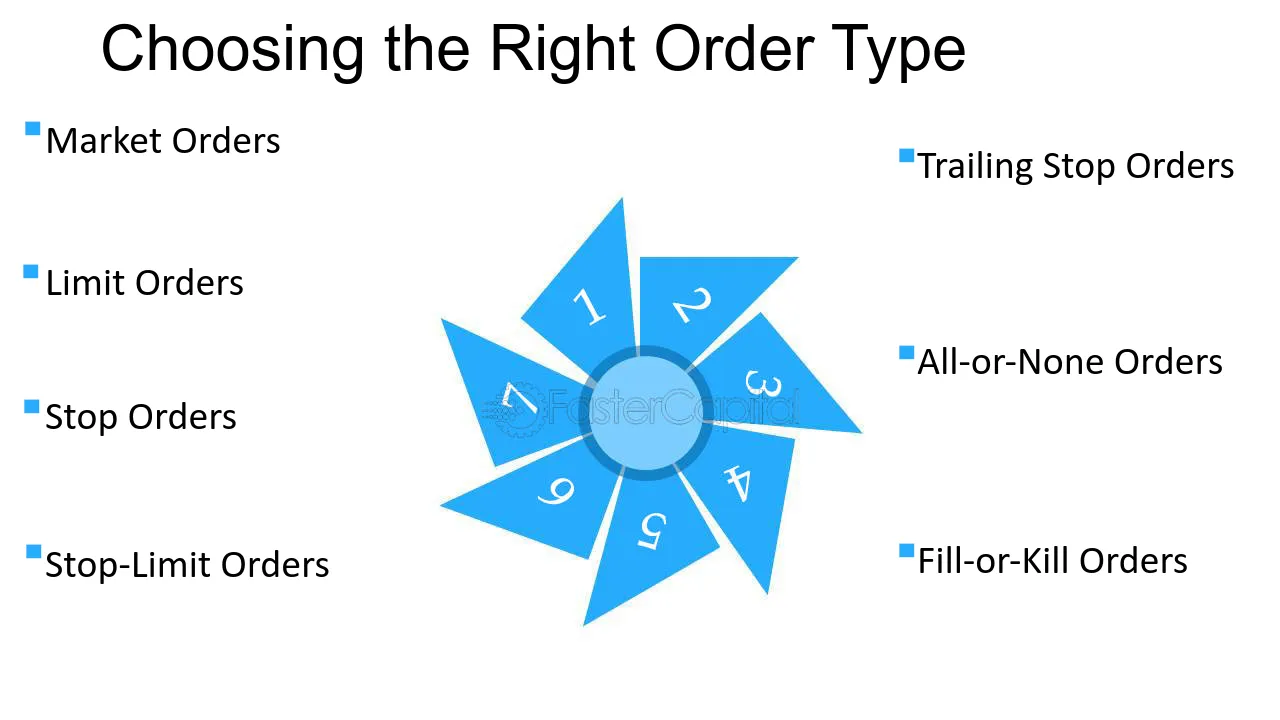

To address these risks and challenges, platforms like 1inch have developed innovative solutions to minimize slippage. By aggregating liquidity from various sources, 1inch is able to offer traders the best possible prices while reducing the likelihood of slippage. Additionally, advanced algorithms and smart order routing systems help ensure that trades are executed as efficiently as possible, further minimizing slippage for traders.

Overall, understanding the risks and challenges of slippage is crucial for traders. By being aware of potential slippage risks and utilizing platforms that prioritize minimizing slippage, traders can improve their overall trading experience and potentially increase their profitability.

How 1inch Minimizes Slippage for Traders

When trading on decentralized exchanges (DEXs), slippage can be a major concern for traders. Slippage occurs when the execution price of a trade differs from the expected price. This can happen due to the dynamic nature of the market and the time it takes for transactions to be processed on the blockchain.

1inch is a decentralized exchange aggregator that aims to minimize slippage for traders. By integrating various DEXs and liquidity sources, 1inch is able to provide the best possible execution price for each trade. Here’s how 1inch achieves this:

Smart Contract Routing

1inch uses smart contract routing to split large orders across multiple DEXs. This helps to reduce slippage by ensuring that each trade is executed at the best available price. The smart contracts analyze the liquidity and depth of each DEX and choose the most optimal route for the trade.

DEX Aggregation

1inch aggregates liquidity from multiple DEXs, including Uniswap, SushiSwap, Balancer, and more. This allows traders to access a wider pool of liquidity and ensures that they get the best possible price for their trades. By comparing the prices across different DEXs, 1inch selects the one with the lowest slippage.

| Features of 1inch Minimizing Slippage: |

|---|

| Advanced algorithms that analyze liquidity and optimize trade execution |

| Real-time price comparison across multiple DEXs to find the best rates |

| Smart contract routing to split large orders and reduce slippage |

| Integration with various DEXs and liquidity sources for maximum availability |

By using 1inch, traders can minimize the impact of slippage on their trades and ensure that they get the best possible price. The platform’s efficient routing and aggregation mechanisms help to optimize trade execution and provide a seamless trading experience on decentralized exchanges.

Question-answer:

What is slippage in cryptocurrency trading?

Slippage refers to the difference between the expected price of a trade and the price at which the trade is actually executed. It usually occurs in situations where there is high volatility and low liquidity in the market.

How does slippage affect trading?

Slippage can have a significant impact on trading, especially for large orders. It can result in traders paying more or receiving less than they anticipated, which can reduce their overall profits or increase their losses.

How does 1inch minimize slippage?

1inch is a decentralized exchange aggregator that sources liquidity from various exchanges. It uses a smart contract to split the order into smaller parts and execute them at the best available prices across different exchanges. This helps to minimize slippage and obtain the most favorable outcome for traders.