Tips and Strategies for Minimizing Gas Fees in 1inch Staking: Understanding the Impact on Costs

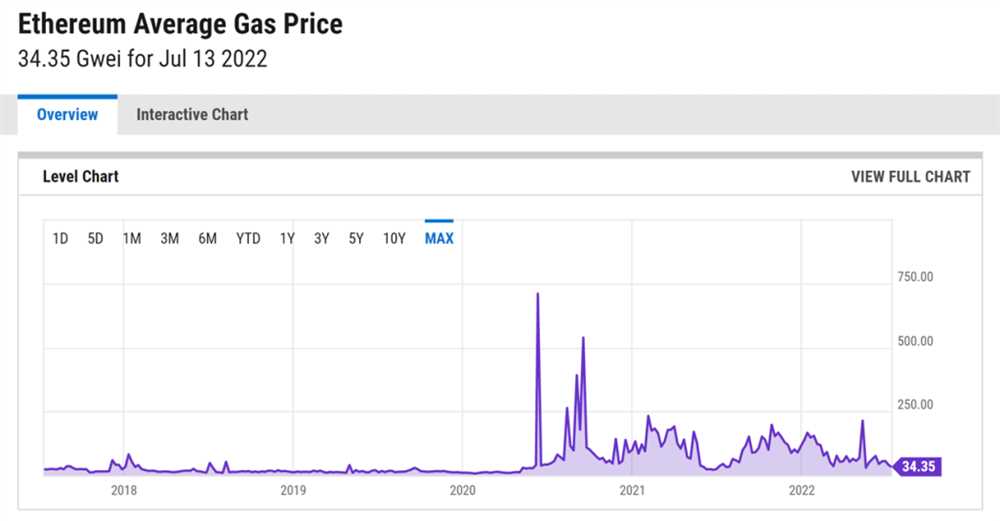

Gas fees have become a hot topic in the world of cryptocurrency, and they can have a significant impact on the profitability of staking on the 1inch platform. Gas fees are the transaction fees required to conduct transactions on the Ethereum network, and they can vary greatly depending on network congestion and other factors.

For 1inch stakers, high gas fees can eat into their earnings and make the process less profitable. However, there are several tips and strategies that can help minimize these costs and maximize profits. One of the most effective ways to reduce gas fees is to carefully choose the timing of your transactions. Gas fees tend to be lower during periods of lower network congestion, so keep an eye on the Ethereum network and try to conduct your transactions during off-peak hours.

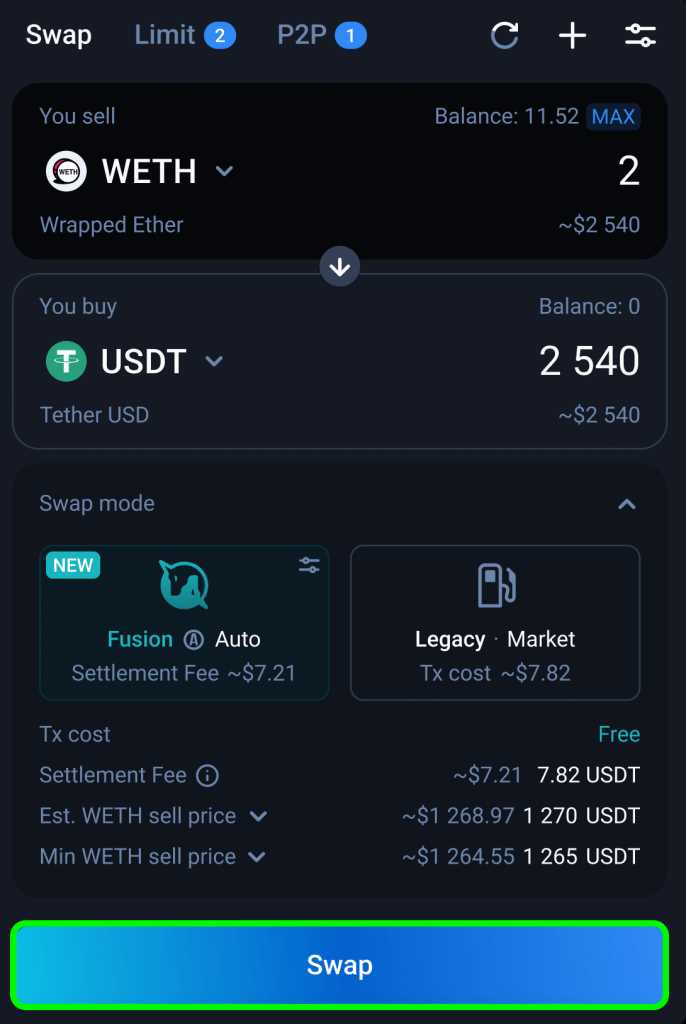

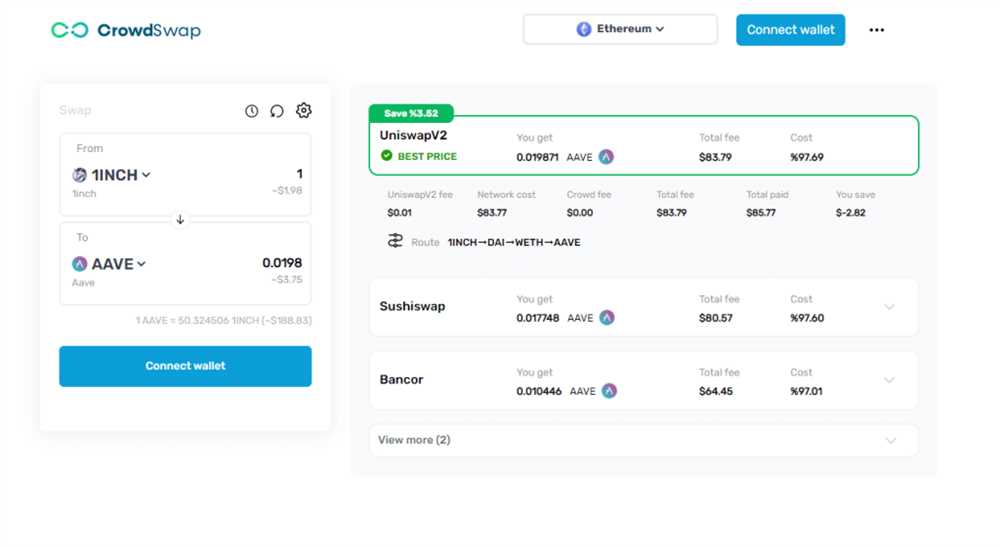

Another strategy is to use gas optimization tools such as gas limit and gas price calculators. These tools can help you estimate the gas required for your transactions and determine the optimal gas price to use, ensuring that you are not overpaying for fees. Additionally, consider using decentralized exchanges with lower gas fees or exploring layer 2 solutions that offer cheaper and faster transactions.

Lastly, it’s important to keep an eye on the gas fees market and stay updated on the latest developments. Gas fees can fluctuate greatly, and being aware of these changes can help you make informed decisions and minimize costs. By staying proactive and implementing these tips, you can mitigate the impact of gas fees on your 1inch staking activities and maximize your profits.

The Cost-Saving Strategies for 1inch Staking amidst Rising Gas Fees

As gas fees on the Ethereum network continue to rise, it is becoming increasingly important for 1inch stakers to find ways to minimize costs. Here are some cost-saving strategies that you can implement:

1. Choose the right time to stake

Gas fees tend to fluctuate throughout the day due to network congestion. By monitoring the gas fees on the Ethereum network, you can identify periods of lower fees and choose to stake your 1inch tokens during those times. This can significantly reduce the cost of your staking transactions.

2. Opt for batch staking

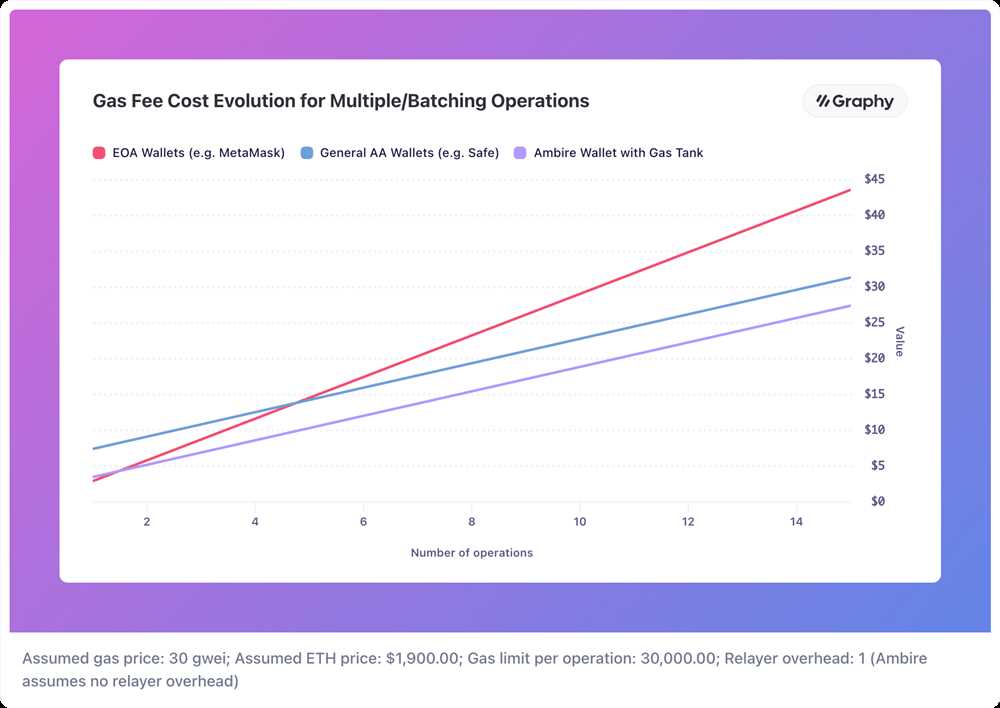

Instead of staking your 1inch tokens individually, consider batching multiple staking transactions together. By combining multiple transactions into a single transaction, you can save on gas fees as you only pay the fee once. This is especially useful if you have a large number of tokens to stake.

Additionally, batch staking can help you optimize your gas usage by reducing the number of interactions with the Ethereum network. This can further reduce the overall cost of your staking.

3. Leverage layer 2 solutions

Gas Fees: Understanding the Impact on 1inch Staking

Gas Fees: Understanding the Impact on 1inch Staking

Gas fees play a crucial role in the process of staking on the 1inch platform. For those unfamiliar, gas fees refer to the cost of executing transactions on the Ethereum network. It is important to understand the impact of gas fees, as they can significantly affect the profitability and overall experience of staking on 1inch.

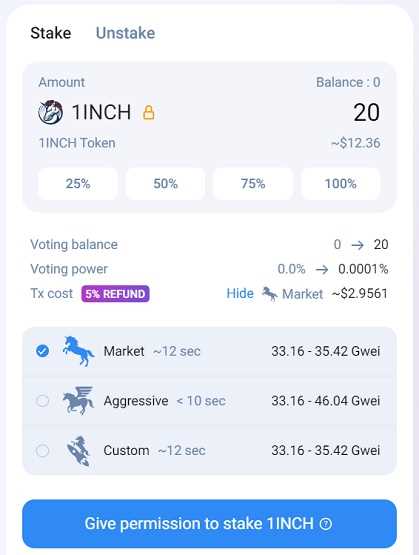

When staking on 1inch, users are required to pay gas fees for various actions, such as depositing funds, claiming rewards, and withdrawing stakes. The amount of gas fees depends on several factors, including the current state of the Ethereum network and the complexity of the transaction.

High gas fees can negatively impact the profitability of staking, as they eat into the rewards earned from the staked assets. Therefore, it is essential for users to consider strategies for minimizing gas fees and optimizing their staking experience.

One way to minimize gas fees is to carefully choose the timing of transactions. Gas fees tend to be lower during periods of low network congestion, such as during off-peak hours. Monitoring gas fee trends and planning transactions accordingly can help reduce costs.

Another strategy is to use gas fee optimization tools. These tools analyze the current state of the Ethereum network and suggest gas fee values that are more likely to be accepted by miners. By setting the gas fee at an optimal value, users can save on unnecessary costs.

Furthermore, it is important to consider the trade-offs between gas fees and transaction speed. Higher gas fees often correspond to faster transaction processing times, while lower gas fees may result in slower confirmation times. Users should find the right balance based on their individual needs and priorities.

| Tip | Explanation |

|---|---|

| 1 | Monitor gas fee trends and plan transactions during periods of low network congestion. |

| 2 | Use gas fee optimization tools to set the gas fee at an optimal value and save costs. |

| 3 | Consider the trade-offs between gas fees and transaction speed, finding the right balance. |

In conclusion, gas fees have a significant impact on 1inch staking, affecting profitability and user experience. By understanding the factors influencing gas fees and implementing strategies to minimize costs, users can optimize their staking experience and maximize their rewards.

Smart Contract Optimization: Techniques for Reducing Gas Costs

Gas fees can be a significant cost for users interacting with smart contracts on the Ethereum network. Fortunately, there are several techniques that can be employed to reduce these gas costs and improve overall efficiency.

1. Minimize storage usage: Storing data on the Ethereum blockchain is expensive, so it’s important to only store what is absolutely necessary. Consider using smaller data types and optimizing storage structures to reduce gas costs.

2. Optimize code execution: Smart contract code should be designed to minimize the number of computational steps required. This includes avoiding unnecessary loops or expensive operations, and finding more efficient algorithms for performing tasks.

3. Use gas-efficient libraries: Take advantage of existing libraries and contracts that have been specifically designed to be gas-efficient. These libraries often provide optimized implementations of common functions and can greatly reduce gas usage.

4. Batch transactions: If multiple interactions with a smart contract are needed, consider batching these transactions together. This can help reduce the total gas cost by eliminating the need to pay for multiple transaction fees.

5. Gas price optimization: Keep an eye on gas prices and choose the right time to make transactions. Gas prices can fluctuate significantly, so monitoring the network and making transactions during periods of lower gas prices can result in significant savings.

6. Off-chain computations: Consider moving certain computations off-chain to reduce the amount of work that needs to be done on the Ethereum network. Off-chain computations can be performed using trusted oracles, which can greatly reduce gas costs.

7. Contract architecture optimization: Carefully consider the overall architecture of your smart contract system. Breaking large contracts into smaller, modular contracts can help reduce gas costs by allowing for more targeted interactions and more optimized code.

8. Gas token usage: Gas tokens, such as the CHI token, can be used to pre-purchase gas at lower prices and then use it later to pay for transactions. This can help mitigate the impact of high gas fees and reduce overall costs.

By employing these smart contract optimization techniques, users can significantly reduce gas costs and improve the efficiency of their interactions with the Ethereum network.

Timing is Everything: Strategies for Minimizing Gas Fees

Gas fees are an important factor to consider when staking on 1inch, as they can significantly impact your overall profits. However, there are strategies you can employ to minimize these costs and maximize your returns. One such strategy is to carefully time your staking transactions.

Gas fees on the Ethereum network are known to fluctuate throughout the day based on demand. By monitoring gas prices and choosing to stake during periods of lower fees, you can save a substantial amount of money. This requires staying up to date with current gas prices and monitoring the market closely.

Another timing strategy is to take advantage of periods of lower network congestion. Gas fees tend to spike during times of high activity on the Ethereum network, such as when a popular DeFi project launches or during periods of high market volatility. By staking during times of lower network congestion, you can avoid the surge in gas fees and reduce your overall costs.

Furthermore, it is important to consider the specific timing of your staking transactions within a block. Ethereum transactions are grouped into blocks, and the order in which they are processed within a block can impact the gas fees you pay. It is advisable to choose a gas price that ensures your transaction will be included in the next block, but not at a significantly higher cost. This requires careful consideration and adjustment of your gas price based on the current network conditions.

In summary, timing is everything when it comes to minimizing gas fees when staking on 1inch. By monitoring gas prices, choosing periods of lower network congestion, and carefully timing your transactions within a block, you can effectively reduce your overall costs and maximize your staking profits. Stay informed, be strategic, and optimize your gas fee strategy for success.

Navigating the Gas Fee Landscape: Choosing the Right Time to Stake

Gas fees can have a significant impact on the profitability of staking on 1inch. By understanding the gas fee landscape and choosing the right time to stake, users can minimize costs and maximize their earnings. Here are some tips for navigating the gas fee landscape:

- Monitor gas prices: Gas fees can fluctuate significantly depending on network congestion and demand. To make the most informed decision, users should regularly monitor gas prices and identify periods of lower fees.

- Utilize gas fee trackers: Gas fee trackers provide real-time information on gas prices, helping users identify the optimal time to stake. By using these trackers, users can avoid high fees and choose a time when gas prices are reasonable.

- Consider off-peak hours: Gas fees tend to be lower during off-peak hours when network activity is lower. Users can take advantage of these periods to stake their tokens and minimize costs.

- Batch transactions: Rather than staking tokens individually, users can consider batching their transactions. By combining multiple staking actions into a single transaction, users can reduce gas fees and save on costs.

- Optimize gas settings: Choosing the right gas settings can also help minimize costs. Users can experiment with different gas limits and gas prices to find the balance between transaction speed and cost-effectiveness.

By following these tips, users can navigate the gas fee landscape and choose the right time to stake on 1inch. With careful planning and monitoring, users can significantly reduce gas fees and maximize their staking rewards.

Question-answer:

What are gas fees and how do they affect 1inch staking?

Gas fees are the fees required to perform transactions on the Ethereum network. When staking on 1inch, gas fees can significantly impact the overall cost of the staking process. Higher gas fees can make staking less profitable.

How can I minimize the gas fees when staking on 1inch?

There are several tips to minimize gas fees when staking on 1inch. One tip is to choose the right time to perform the staking transaction when the network is less congested. Another tip is to use gas optimization tools to minimize the gas usage for the transaction. Additionally, using a wallet with a gas fee customization feature can also help adjust the gas fees according to your preferences.

What are gas optimization tools and how do they work?

Gas optimization tools are software tools that help analyze and optimize the gas usage of a transaction. These tools analyze the smart contract code and provide suggestions to reduce the gas fees. They can help remove unnecessary operations, optimize storage usage, and improve overall efficiency in order to reduce the transaction costs.

Are there any alternative staking platforms with lower gas fees?

Yes, there are alternative staking platforms with lower gas fees. Some platforms operate on different blockchains, such as Binance Smart Chain or Polygon, which generally have lower transaction costs compared to Ethereum. Additionally, newer or less popular platforms might also have lower gas fees due to less congestion on their networks. It’s worth considering these alternatives if gas fees are a concern.