The Significance of Liquidity Providers in Enabling the Success of the 1inch Network

In the competitive world of decentralized finance (DeFi), liquidity is crucial for the success of any protocol. Liquidity providers play a vital role in ensuring a smooth and efficient operation of platforms like 1inch Network.

What is 1inch Network?

1inch Network is a decentralized exchange aggregator that sources liquidity from various exchanges to provide users with the best possible trading rates. By leveraging the power of multiple liquidity sources, 1inch Network minimizes slippage and optimizes trading for its users.

Why are Liquidity Providers Important?

Liquidity providers contribute to the success of 1inch Network by supplying the necessary tokens to ensure smooth trading and allow users to execute their transactions at competitive prices. By providing liquidity, these individuals or entities help maintain a healthy trading ecosystem.

The Benefits of Being a Liquidity Provider

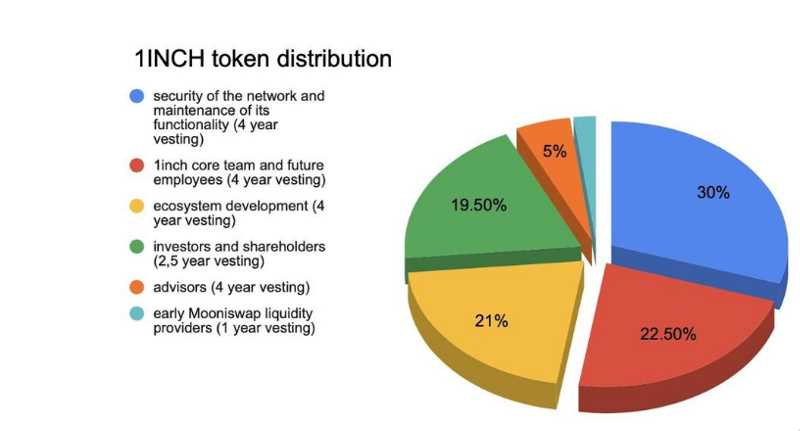

Being a liquidity provider on 1inch Network offers numerous benefits. Firstly, it allows individuals to earn passive income through the fees generated from their provided liquidity. Secondly, liquidity providers can participate in the governance and decision-making processes of the network.

How to Become a Liquidity Provider on 1inch Network

Becoming a liquidity provider on 1inch Network is a straightforward process. Simply connect your digital wallet to 1inch Network’s platform and deposit your preferred tokens into the liquidity pool of your choice. By doing so, your tokens will be utilized by the network to facilitate trades and generate fees.

Join the ranks of liquidity providers on 1inch Network and contribute to the success of decentralized finance!

The Importance of Liquidity Providers

Liquidity providers play a crucial role in the success of the 1inch Network. Their presence ensures that there is a sufficient amount of assets available for trading, which in turn leads to a more efficient and liquid market.

One of the main benefits of liquidity providers is that they help to reduce price slippage. When there are more assets available for trading, buyers and sellers can easily find a match, resulting in lower spreads and better execution prices.

Liquidity providers also contribute to the overall stability of the market. By continuously providing liquidity, they help to prevent sudden market movements or extreme price fluctuations. This stability is crucial for traders and investors who rely on consistent and reliable prices.

Market Depth and Order Book

Liquidity providers are responsible for creating market depth. Market depth refers to the volume of buy and sell orders at different price levels. When there is a high level of market depth, it indicates that there is a sufficient amount of assets available for trading, which attracts more traders and investors to the platform.

Additionally, liquidity providers contribute to the building of an order book. An order book contains all the buy and sell orders for a particular asset. It helps traders to determine the best entry and exit points by providing them with information about the demand and supply levels at different price points.

Ensuring Efficient Price Discovery

Liquidity providers also play a critical role in ensuring efficient price discovery. Price discovery refers to the process of determining the fair market value of an asset based on the supply and demand dynamics. When there are more liquidity providers, it leads to more accurate and transparent price discovery, allowing traders to make informed decisions.

Furthermore, liquidity providers contribute to the overall growth and adoption of the 1inch Network. By providing liquidity, they attract more traders and investors to the platform, which increases trading volumes and market activity. This, in turn, creates a positive feedback loop, leading to increased liquidity and a more robust ecosystem.

In conclusion, liquidity providers are essential for the success of the 1inch Network. They contribute to the efficiency, stability, and growth of the platform by providing sufficient liquidity, reducing price slippage, creating market depth, ensuring efficient price discovery, and attracting more participants to the market.

Why Liquidity Providers are Essential

Liquidity providers play a crucial role in the success of the 1inch Network. They are the backbone of the decentralized finance (DeFi) ecosystem, ensuring that users have access to sufficient liquidity to make trades and transactions.

1. Market Efficiency

Liquidity providers improve market efficiency by adding depth and volume to the market. By providing ample liquidity, they narrow the bid-ask spread, reducing the cost of trading for users. This allows traders to make transactions at better prices and encourages market participants to engage more actively.

2. Price Stability

With liquidity providers actively offering tokens for trading, price volatility is reduced. Market fluctuations become less extreme as liquidity is readily available, preventing sudden price swings. This price stability is essential for traders and users who require predictable and reliable prices to make informed decisions.

Additionally, liquidity providers contribute to the overall stability of the network. Their continuous presence in providing liquidity prevents potential market manipulations and ensures a fair and transparent marketplace.

In conclusion, liquidity providers are essential to the success of the 1inch Network. They promote market efficiency, reduce price volatility, and contribute to the stability of the overall network. Without liquidity providers, the decentralized finance ecosystem would face significant challenges in providing seamless and efficient trading experiences for users.

The Role of Liquidity Providers in the 1inch Network

Liquidity providers play a crucial role in the success of the 1inch Network. As decentralized exchanges (DEXs) continue to gain popularity, the need for efficient and reliable liquidity has become paramount. Liquidity providers step in to meet this demand by supplying assets to the 1inch Network, allowing users to easily trade between different tokens.

One of the main advantages of liquidity providers in the 1inch Network is their ability to earn passive income. By providing liquidity, providers can earn fees generated from trading activity on the platform. These fees are distributed among the liquidity providers in proportion to their contribution, incentivizing them to supply assets and maintain sufficient liquidity.

In addition to earning fees, liquidity providers also play a crucial role in reducing slippage and improving market efficiency. The 1inch Network aggregates liquidity from various DEXs, allowing users to find the best prices for their trades. By supplying liquidity across multiple platforms, providers help to bridge liquidity gaps and ensure that users can execute trades at the most favorable rates.

Furthermore, liquidity providers contribute to the overall stability of the 1inch Network. By maintaining a sufficient supply of assets, they help to prevent price volatility and ensure that trades can be executed without significant price impact. This is especially important for larger trades, where slippage can significantly affect the final execution price.

The role of liquidity providers in the 1inch Network is crucial for the success and growth of the platform. By providing liquidity, earning fees, reducing slippage, and maintaining stability, they create a vibrant and efficient trading ecosystem for users. As the popularity of decentralized finance continues to rise, the role of liquidity providers will only become more important in ensuring the smooth and seamless operation of the 1inch Network.

Question-answer:

What is the role of liquidity providers in the success of the 1inch Network?

Liquidity providers play a crucial role in the success of the 1inch Network by supplying the necessary funds for trading on the platform. They ensure that there is enough liquidity in the market, allowing users to easily exchange their assets without encountering any slippage.

How do liquidity providers benefit from participating in the 1inch Network?

Liquidity providers benefit from participating in the 1inch Network by earning fees for providing liquidity to the platform. They receive a share of the trading fees generated by the transactions that take place using the liquidity they have supplied. This can be a lucrative source of passive income for liquidity providers.

What are some risks associated with being a liquidity provider on the 1inch Network?

While being a liquidity provider on the 1inch Network can be profitable, there are also risks involved. One major risk is impermanent loss, which occurs when the value of the supplied assets changes relative to each other. Additionally, there is always the risk of smart contract vulnerabilities or hacks, which could result in the loss of funds.

How can I become a liquidity provider on the 1inch Network?

To become a liquidity provider on the 1inch Network, you will need to connect your wallet to the platform and deposit your desired assets into the liquidity pool of your choice. Once your assets are in the pool, you will start earning fees for providing liquidity. It’s important to do thorough research and consider the risks before becoming a liquidity provider.

What are some strategies for maximizing returns as a liquidity provider on the 1inch Network?

There are several strategies for maximizing returns as a liquidity provider on the 1inch Network. One approach is to provide liquidity to pools that have high trading volumes and fees. Another strategy is to use automated market maker (AMM) protocols, which can help mitigate impermanent loss. It’s important to regularly assess and rebalance your liquidity in order to adapt to changing market conditions.